Water Based Resins Market

Water Based Resins Market - Global Industry Assessment & Forecast

Segments Covered

By Type Acrylic, Epoxy, Polyurethane, Alkyd, Polyester, Vinyl, Other Types

By Application Paints & Coatings, Adhesives & Sealants, Inks, Other Applications

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 52.6 Billion | |

| USD 84.85 Billion | |

| 5.45% | |

| North America | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

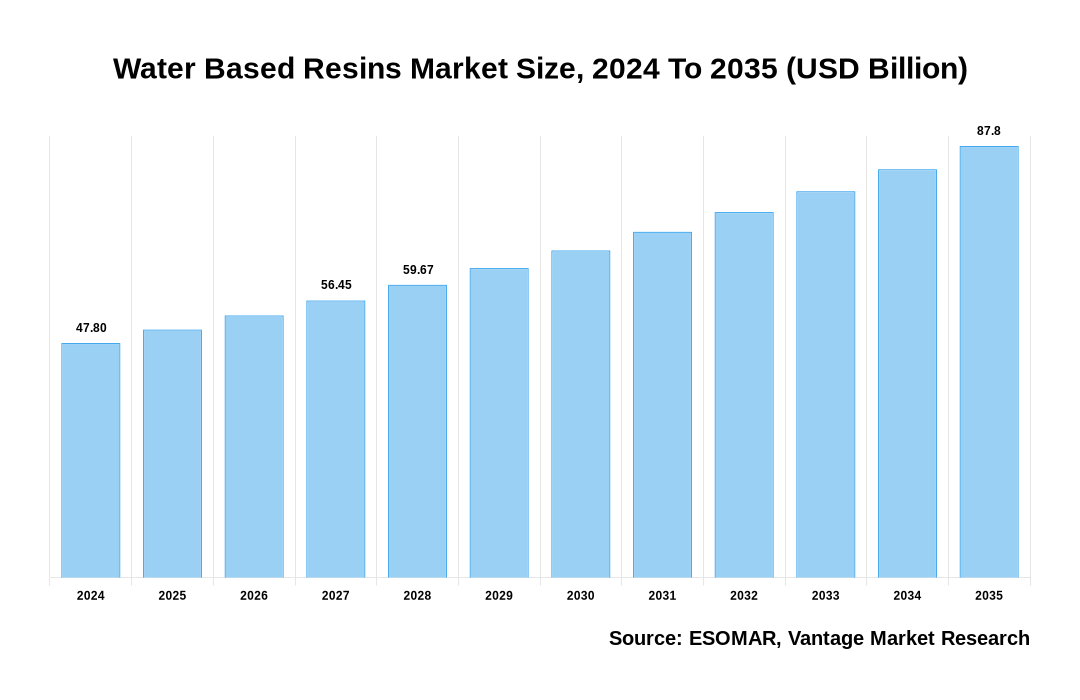

The global Water Based Resins Market is valued at USD 52.6 Billion in 2023 and is projected to reach a value of USD 84.85 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 5.45% between 2024 and 2032.

Key Highlights

- In 2023, Asia Pacific led the market, capturing 42.2% market share due to the rapid industrialization, growing construction activities, and increasing demand for eco-friendly products in the region

- The North America region is expected to grow at significant CAGR projected throughout the forecast period

- By Type, Acrylic dominated the market in 2023 with significant market share because of its superior adhesion, durability, and widespread use in various applications like coatings and adhesives

- In 2023, by Application, the Paints & Coatings segment dominated with a market share of 40.3% due to the rising demand for water-based, low-VOC, and environmentally friendly coatings in the construction and automotive industries

Water Based Resins Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Water Based Resins Market

Regional Overview

Asia Pacific Dominated Sales with a 42.2% share in 2023.Asia Pacific's substantial share is driven by the region's fast industrialization, extensive building activity, and increased focus on environmentally friendly and sustainable products. As a result of its advantages for the environment and the government's support of low-VOC products, countries like China, India, and Japan have been leading the way in increasing demand for water-based resins.

The growing use of water-based resins in a variety of industries, including as packaging, paints and coatings, adhesives, sealants, and inks, building, and automobiles, is another factor contributing to the Asia Pacific region's growth. The market has grown significantly as a result of the region's growing manufacturing base, growing emphasis on lowering carbon footprints, and strict adherence to environmental rules. Asia Pacific is anticipated to hold the top position as long as there is a growing need for environmentally friendly technology and sustainable solutions.

Application Overview

In 2023, the Paints & Coatings segment dominated the market with the largest share of 40.3%. The Water Based Resins market, segmented by the End Use Industry, includes Paints & Coatings, Adhesives & Sealants, Inks, Other Applications.

Paints & Coatings segment dominance is attributed to the widespread use of water-based resins in various coatings applications due to their environmental benefits and regulatory advantages. The rise of this class has been largely attributed to the growing demand in the commercial, industrial, and residential sectors for low-VOC and eco-friendly coatings.

Increased emphasis on sustainable building practices, renovation projects, and infrastructure development are some of the other factors propelling the Paints & Coatings segment's growth. Water-based resins are the preferred option for coatings applications due to their superior performance and lower environmental impact. As industries continue to prioritize green technologies and comply with stringent environmental regulations, the Paints & Coatings segment is expected to maintain its leading position and continue driving market growth.

The demand for epoxy resin in paints and coatings applications is robust due to its exceptional qualities, including superior adhesion, chemical resistance, and durability. Because epoxy resin provides long-lasting protection against wear, corrosion, and environmental conditions, its demand in paints and coatings is increasing. The demand for epoxy resin will continue to be high due to the requirement for long-lasting coatings that improve surfaces' sustainability and longevity.

Top Trends

- Sustainability and Green Chemistry: There is a growing trend towards developing and utilizing bio-based water resins derived from renewable sources. This aligns with the broader push for sustainable materials and green chemistry, as companies strive to reduce their carbon footprint and environmental impact.

- Increased Adoption in Industrial Coatings: The industrial coatings sector is increasingly adopting water-based resins due to their lower VOC emissions and improved safety profiles. This trend is particularly strong in automotive, construction, and general industrial applications where environmental regulations are stringent.

- Advancements in Resin Technology: Continuous innovations in resin formulations are enhancing the performance characteristics of water-based resins, such as improved adhesion, faster drying times, and greater durability. These advancements are helping water-based resins compete more effectively with traditional solvent-based products in various high-performance applications.

Premium Insights

Waterborne acrylic resin is an eco-friendly compound widely utilized in paints, industrial coatings, ships, bridges, and locomotives. Often termed a thermosetting resin, it has been modified for application in a various industry. Its practical applications are greatly impacted by its thermal properties, which include flame retardancy and thermal-oxidative stability.

The Water Based Resins market is driven by the increasing global emphasis on environmental sustainability and regulatory compliance. Water-based resins are becoming the preferred choice in a various industry, including paints and coatings, adhesives, and inks, because they significantly reduce VOC emissions and pollutants in the environment. The need for eco-friendly products and rising consumer awareness are also driving this change, in addition to legislative demands. Businesses are using water-based resins more frequently in order to follow these trends and promote environmental practices, which will improve their brand image.

The continuous technological developments that have enhanced the functionality and acceptability of water-based resins are another driver. Water-based resins are now more competitive in terms of performance thanks to advancements brought about by ongoing research and development. This has increased their use in high-performance applications in the packaging, construction, and automotive industries. The market is expected to rise steadily as more sectors come to understand the advantages of water-based resins, such as their compatibility with innovative materials and manufacturing techniques.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

The growing awareness of environmental sustainability and the tightening of regulations on volatile organic compounds (VOCs) are driving the shift towards environmentally friendly products in various industries

Because of their favorable environmental characteristics, water-based resins are progressively replacing solvent-based resins in applications like adhesives, coatings, paints, and inks. In the past, solvent-based resins were frequently utilized because to their high volatile organic compound (VOC) concentration. Nonetheless, their use has decreased as a result of tighter laws designed to lower VOC emissions. VOCs are dangerous chemicals that can harm human health and the environment. Examples of these substances are formaldehyde and benzene. The US, the UK, and Germany are just some of the nations that have enacted strict legislation governing VOC emissions. For instance, the US Environmental Protection Agency (EPA) limits VOCs in indoor coatings to 380 grams per liter. Because China plays a major role in the paint and coatings sector, rules require the use of water-based resin coatings in many applications to reduce VOC emissions. In the same way, automobile refinishes and decorative paints are subject to VOC regulations enforced by the European Parliament. Regulatory bodies such as the Biocidal Products Regulation (BPR), EU Ecolabel, British Coatings Federation (BC), Toxic Substances Control Act (TSCA), Clean Air Act (CAA), ASTM International, and REACH have established standards for VOC limits in paints and coatings. Water-based resins are replacing high-VOC solvent-based resins, which is leading to innovation and reshaping the market as manufacturers create goods that satisfy environmental rules without compromising quality or performance.

Despite their environmental benefits, water-based resins often face challenges related to cost and performance

These resins typically have higher production costs due to the need for specialized raw materials and complex manufacturing processes. Water-based resins may also be less durable, dry more slowly, and have less adhesion than solvent-based resins, which can restrict their use in high-performance situations. These elements may discourage certain industries, especially those where performance is a top priority, from completely switching to water-based substitutes.

As technology advances, water-based resins are finding new applications in various emerging industries

Water-based resins are being studied by the electronics and automotive industries for use in coatings, adhesives, and other materials that need to have a lower environmental impact without compromising performance. Additionally, the growing focus on sustainable packaging and the development of bio-based water resins present significant opportunities for market expansion. As these applications mature, they are expected to drive further growth and innovation within the water-based resins market.

Competitive Landscape

The Water Based Resins market is characterized by the presence of several key players, including major chemical companies and specialized resin manufacturers, competing on factors such as product innovation, environmental sustainability, and pricing. In order to comply with strict environmental rules and the growing demand from consumers for sustainable products, these companies are concentrating more and more on creating high-performance, environmentally friendly resins. These companies frequently use strategic alliances, mergers and acquisitions, and production capacity expansion as means of fortifying their market positions. The competition in this market is further heightened by technological developments and the increasing use of water-based resins in a variety of industries, including coatings, adhesives, and inks.

The key players in the global Water Based Resins market include - Dow, BASF SE, Lubrizol Corporation, Covestro AG, Westlake Corporation, Arkema, ADEKA CORPORATION, Olin Corporation, DIC Corporation, Allnex GMBH among others.

Recent Market Developments

Covestro AG Launches New Waterborne and UV Resins for Industrial Coating Applications

- In February 2024, Covestro AG introduced a new series of high-performance resins, Waterborne and Waterborne UV, specifically designed for industrial coating applications in sectors such as wood furniture, cabinetry, and building products

Westlake Debuts Azures Product Line at European Coatings Show

- In March 2023, Westlake unveiled its Azures product line at the European Coatings Show in Nuremberg, Germany. This new line from Westlake Epoxy includes epoxy resins, modifiers, and curing agents free from SVHC- and CMR-labelled components, offering eco-friendly alternatives for coatings, civil engineering, and adhesives while maintaining high-performance standards

Arkema Introduces Incellion Waterborne Acrylic Solutions for EV and ESS Batteries

- In April 2023, Arkema launched the Incellion range of sustainable waterborne acrylic solutions for high-capacity anodes, cathode primers, and ceramic-coated separators used in electric vehicle (EV) and energy storage system (ESS) batteries. Marketed under the INCELLION brand, these products feature acrylic-based binders, dispersants, and rheology modifiers designed to improve battery performance

Arkema Expands Waterborne Resin Capabilities with Acquisition of Polimeros Especiales

- In 2022, Arkema, a specialty chemicals company, completed the acquisition of Polimeros Especiales, a leading Mexican producer of high-performance waterborne resins. This acquisition enhances Arkema's capabilities in solvent-free solutions and strengthens its presence in the rapidly growing Mexican market

The global Water Based Resins market can be categorized as Type, Application, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Application

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 22-Aug-2024

Vantage Market

Research | 22-Aug-2024

FAQ

Frequently Asked Question

What is the global demand for Water Based Resins in terms of revenue?

-

The global Water Based Resins valued at USD 52.6 Billion in 2023 and is expected to reach USD 84.85 Billion in 2032 growing at a CAGR of 5.45%.

Which are the prominent players in the market?

-

The prominent players in the market are Dow, BASF SE, Lubrizol Corporation, Covestro AG, Westlake Corporation, Arkema, ADEKA CORPORATION, Olin Corporation, DIC Corporation, Allnex GMBH.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 5.45% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Water Based Resins include

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Water Based Resins in 2023.