UV Stabilizers Market

UV Stabilizers Market - Global Industry Assessment & Forecast

Segments Covered

By Type HALS, UV Absorbers, Quenchers

By Application Packaging, Automotive, Building & Construction, Agricultural Films, Adhesives & Sealants, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 1.42 Billion | |

| USD 2.33 Billion | |

| 5.65% | |

| North America | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

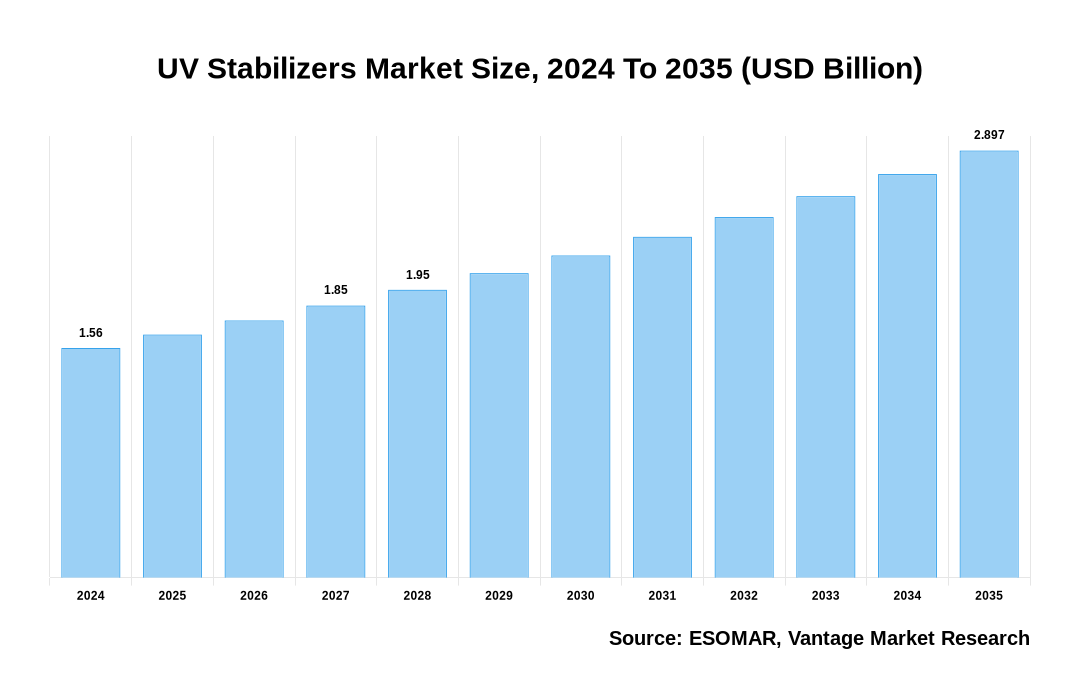

The global UV Stabilizers Market is valued at USD 1.42 Billion in 2023 and is projected to reach a value of USD 2.33 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 5.65% between 2024 and 2032.

Key Highlights

- In 2023, Asia Pacific led the market, capturing 45.3% market share due to the region's booming industrial sector, rapid urbanization, and increasing demand for high-performance plastics in various end-use industries such as automotive, construction, and packaging

- The North America region is expected to grow at significant CAGR projected throughout the forecast period

- By Type, HALS dominated the market in 2023 with a market share of 67.8% because of its superior effectiveness in extending the lifespan of polymers exposed to UV radiation

- Among various Application, the Packaging segment accounted for the largest market share of 47.5% in 2023 owing to the rising demand for UV-stabilized plastic packaging materials that protect products from degradation and ensure extended shelf life

UV Stabilizers Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about UV Stabilizers Market

Regional Overview

Asia Pacific Dominated Sales with a 45.3% share in 2023. Asia Pacific’s dominance can be attributed to several factors, including the region's burgeoning industrial sector, rapid urbanization, and infrastructure development. Asia Pacific has a strong manufacturing base that helps businesses effectively meet the demands of a wide range of industries. In order to provide innovative UV stabilizer solutions that are suited to local needs, manufacturers seen in sectors including packaging, construction, and automobiles in nations like South Korea, China, and India have been increasing their manufacturing capacity and making R&D investments.

Following the epidemic, China's automobile industry saw significant expansion, with production rising to 27.02 million units in 2022 with 3.4% rise. Furthermore, according to China's Ministry of Industry and Information Technology, the country's car output is expected to exceed 35 million units by 2025, solidifying China's lead in the global auto industry.

South Korea stands as a significant market for adhesives and sealants, primarily propelled by the burgeoning woodworking and joinery sectors. The escalating demand for furniture further amplifies the need for adhesives, fostering overall industry growth. Notably, the electronics industry is also witnessing a surge in adhesive usage, with manufacturers expanding their operations to meet rising demands. For instance, Henkel Korea completed its Songdo Plant within the Songdo High-Tech Industrial Cluster in Incheon in August 2022, positioning it as the Asia-Pacific production hub for high-impact electronics solutions within the Adhesive Technologies business unit.

In India, the food packaging industry is witnessing a sharp uptick, driven by the urbanization trend and the subsequent rise in food services. The country consumed 38.28 billion food and beverage packages annually in 2022, a figure expected to 58.53 billion by 2026, with an 11% growth rate projected in beverage packaging. This surge in food packaging activities is anticipated to bolster the demand for UV stabilizers in India over the coming years.

End Use Industry Overview

In 2023, the Packaging segment dominated the market with the largest share of 47.5%. The UV Stabilizers market, segmented by the Application, includes Packaging, Automotive, Building & Construction, Agricultural Films, Adhesives & Sealants, Others.

UV stabilizers are essential components of packaging in various industries such as food and beverage, pharmaceuticals, cosmetics, and consumer goods. The need for UV stabilizers is mostly driven by the food and beverage industries. Food products must be protected from harmful UV radiation, which can cause nutrient deterioration and spoiling, using UV stabilizers. Through the mitigation of these detrimental effects, UV stabilizers help to extend the shelf life of packaged foods by preventing the growth of dangerous bacteria and microbes and preserving the freshness of food products. UV stabilizers are essential for creating strong packaging materials that can withstand exposure to UV light, especially in light of the growing need for environmentally friendly packaging options. This trend is expected to continue as customers choose more environmentally friendly packaging options, which will drive significant growth and profitability for businesses that specialize in packaging-grade stabilizers in the near future.

UV stabilizers are widely used in the pharmaceutical packaging and cosmetic packaging because they maintain the efficacy and aesthetic appeal of packaged products, which is crucial given the importance placed on product stability and safety in these fields.

The packaging segment is expected to maintain its dominance in the market, driven by ongoing advancements in packaging materials and technologies. UV stabilizer demand is expected to stay strong as long as industries keep innovating and introducing new packaging formats to meet changing consumer preferences and sustainability aims. Additionally, the development of environmentally friendly packaging options as well as the growing focus on branding and product uniqueness are probably going to drive the packaging industry's growth.

Top Trends

- There is a growing trend towards eco-friendly and sustainable stabilizer solutions for UV stabilizers. As environmental concerns rise and regulatory pressures mount, manufacturers are focusing on developing UV stabilizers that have minimal environmental impact. These eco-friendly stabilizers are designed to be non-toxic, biodegradable, and compliant with stringent environmental regulations

- Technological advancements are another major trend shaping the market. Continuous R&D efforts are leading to the creation of more efficient and robust stabilizers. Innovations in nanotechnology and material science are enabling the development of UV stabilizers with enhanced performance characteristics, such as greater UV absorption capacity, improved thermal stability, and longer-lasting protection. These advancements are particularly beneficial for high-performance applications in industries like automotive, aerospace, and electronics, where materials are subjected to extreme environmental conditions

- There is a growing trend towards the development and use of multi-functional UV stabilizers that offer comprehensive protection against various environmental factors. These stabilizers not only provide UV protection but also enhance thermal stability, prevent oxidation, and improve mechanical properties. Multi-functional stabilizers are particularly advantageous in applications where materials are exposed to multiple stressors simultaneously, such as in outdoor furniture, agricultural films, and automotive parts

Premium Insights

The UV Stabilizers market is driven by various factors such as the increasing demand for UV stabilizers in the building and construction sector. Worldwide urbanization and infrastructure development are occurring at a rapid pace, which is increasing demand for strong, long-lasting building materials that can resist exposure to sunlight and adverse weather. By shielding composite materials, polymers, and coatings against UV radiation-induced deterioration, UV stabilizers can prolong the life of these materials and preserve their structural integrity.

The COVID-19 pandemic had a negative impact on the market, mainly because it caused plants and manufacturing facilities to close in reaction to lockdowns and limitations. Significant challenges for market operations were generated by these closures in addition to supply chain and transportation network interruptions. However, the sector started to rebound by 2023, which raised demand for the market that was being tracked constantly.

The market is being further fueled by manufacturers' investments in research and development to create revolutionary stabilizers with improved performance features. These qualities include improved UV absorption capacity, thermal stability, and compatibility with various polymers. Additionally, the development of green UV stabilizers which offer premium value to environmentally sensitive customers and industries—is being fueled by the focus on sustainability and eco-friendliness.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

The building and construction industry is a significant driver for the UV Stabilizers market due to its increasing reliance on materials that require protection from ultraviolet (UV) radiation

UV stabilizers are essential in building and construction sector as they help prevent the degradation of construction materials such as plastics, coatings, and composite materials that are commonly used in building exteriors and interiors. These materials are exposed to harsh environmental conditions, including prolonged sunlight, which can lead to photodegradation, discoloration, and loss of mechanical properties. By incorporating UV stabilizers, manufacturers can enhance the durability and lifespan of these materials, ensuring they maintain their structural integrity and aesthetic appeal over time. As global construction activities surge, particularly in rapidly urbanizing regions and developing countries, the demand for UV stabilizers is expected to rise. Infrastructure development, residential housing projects, and commercial buildings are all expanding, creating a robust market for materials that incorporate UV protection.

The market faces significant restraints due to stringent government regulations aimed at environmental and human health protection

Stringent government regulations often restrict the use of certain chemicals and additives deemed hazardous or harmful, which can include specific types of UV stabilizers. Compliance with such regulations requires manufacturers to conduct extensive testing, obtain certifications, and possibly reformulate their products to meet safety standards. This process can be time-consuming and costly, potentially slowing down innovation and product development in the market. As governments worldwide continue to tighten environmental policies and standards, manufacturers must remain agile and adaptive to comply with new requirements. This regulatory landscape can deter smaller companies from entering the market due to the high compliance costs and complexity.

The agricultural films industry presents a significant growth opportunity for UV stabilizers

Agricultural films, such as greenhouse covers, mulch films, and silage wraps, are extensively used to improve crop productivity and protect crops from environmental stressors. These films are often exposed to intense sunlight, making UV stabilization crucial to prevent photodegradation, maintain film integrity, and extend their service life. As the agricultural sector increasingly adopts these films to enhance crop yields and efficiency, the demand for effective UV stabilizers that can protect against UV radiation and other environmental factors is set to rise. Moreover, advancements in agricultural practices and the rising global focus on food security drive the adoption of high-quality agricultural films. Farmers and agricultural businesses are investing in innovative solutions to optimize crop protection and maximize output. UV stabilizers play a pivotal role in ensuring these films perform effectively under prolonged exposure to sunlight.

Competitive Landscape

The UV Stabilizers market is characterized by the presence of several key players striving for market share and dominance with leading players in the includes BASF SE, Clariant AG, Songwon Industrial Co., Ltd., Solvay S.A., and ALTANA AG, among others. These organizations provide a wide variety of UV stabilizer products to fulfill the needs of the automotive, packaging, construction, agricultural, and electronics industries, among others. Furthermore, they focus on research and development endeavors to create state-of-the-art UV stabilizer formulations that showcase superior performance attributes like increased UV absorption, thermal stability, and compatibility with various polymers. Moreover, the market for UV Stabilizers is becoming more competitive as a result of new competitors coming into the market and the growth of niche market. Partnerships and cooperation between end users and UV stabilizer producers also help to improve market penetration and provide customized solutions.

The key players in the global UV Stabilizers market include - Solvay S.A., Songwon Industrial Co., Ltd., Addivant, Altana AG, Mayzo Inc., Akcros Chemicals Ltd., Everlight Chemical Industrial Corporation, Chemtura Corporation, Everspring Chemical Co., Ltd., BASF SE, Clariant AG, Evonik Industries AG, Cytec Industries Inc. among others.

Recent Market Developments

Songwon Unveils Advanced Polymer Additives at NPE 2024

- In April 2024, Songwon Industrial Co. Ltd. a prominent global player in specialty chemicals and polymer stabilizers, is showcasing its cutting-edge additives for the plastics industry at the National Plastics Exhibition (NPE) 2024. Visitors can visit Booth S11203 to explore Songwon's extensive range of high-performance additives designed to safeguard polymers and end-products from the deteriorating impacts of high temperatures and solar radiation

Solvay Launches Innovative UV-C Stabilizer Range for Hygiene Applications

- In July 2022, Solvay unveiled an innovative UV-C stabilizer range designed to address the specific needs of demanding hygiene applications combating COVID and hospital-acquired infections. Utilizing the UV-C spectrum (200-280 nm), these stabilizers were developed to treat polyolefin surfaces, marking a significant breakthrough in the industry. This pioneering stabilizing technique effectively mitigates the risks of polyolefin degradation, discoloration, and microcrack formation induced by frequent exposure to UV-C radiation, offering enhanced protection and durability

BASE Expands HALS Production Capacity to Meet Growing Demand

- In March 2022, BASE disclosed plans for expanding production capacity for hindered amine light stabilizers (HALS) at its facilities in Pontecchio Marconi, Italy, and Lampertheim, Germany. This expansion initiative forms a crucial part of BASE's strategic investment plan aimed at meeting the escalating demand for light stabilizers in durable plastics applications. By bolstering HALS production, BASE strengthens supply chain resilience, ensuring uninterrupted access to key additives for its global clientele, thus reinforcing its commitment to meeting evolving market needs

SONGWON Launches New Additives: SONGSORB 1164 and SONGNOX 9228 for Diverse Applications

- In October 2022, SONGWON introduced two new products, SONGSORB 1164 and SONGNOX 9228, tailored to meet diverse customer requirements across agriculture, packaging, construction, and home & personal care applications

SONGWON Expands Partnership with Bodo Möller Chemie GmbH for Sub-Saharan African Market

- In January 2022, SONGWON Industrial Co., Ltd., announced an extension of its partnership with Bodo Möller Chemie GmbH, appointing the latter as a distributor of SONGWON's PVC additives in the Sub-Saharan African region. This strategic collaboration aims to enhance market reach and customer accessibility for SONGWON's specialized additives, catering to the growing demand in the region's polymer industry

Clariant Introduces AddWorks AGC 970: A Light Stabilizer Solution for Agricultural Films

- In October 2022, Clariant unveiled AddWorks AGC 970 in the same month, a novel light stabilizer solution designed to enhance the durability of polyethylene agricultural films, particularly in the mulch segment. This innovative solution enables film converters to prolong the service life of their products by improving UV resistance and resistance to high levels of agrochemicals, thus addressing critical performance challenges in the agricultural industry

The global UV Stabilizers market can be categorized as Type, Application and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Application

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 22-Aug-2024

Vantage Market

Research | 22-Aug-2024

FAQ

Frequently Asked Question

What is the global demand for UV Stabilizers in terms of revenue?

-

The global UV Stabilizers valued at USD 1.42 Billion in 2023 and is expected to reach USD 2.33 Billion in 2032 growing at a CAGR of 5.65%.

Which are the prominent players in the market?

-

The prominent players in the market are Solvay S.A., Songwon Industrial Co., Ltd., Addivant, Altana AG, Mayzo Inc., Akcros Chemicals Ltd., Everlight Chemical Industrial Corporation, Chemtura Corporation, Everspring Chemical Co., Ltd., BASF SE, Clariant AG, Evonik Industries AG, Cytec Industries Inc..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 5.65% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the UV Stabilizers include

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the UV Stabilizers in 2023.