U.S. Vascular Closure Devices Market

U.S. Vascular Closure Devices Market - Global Industry Assessment & Forecast

Segments Covered

By Type Passive Approximators, Active Approximators, External Hemostatic Devices

By Access Femoral Access, Radial Access

By Procedure Interventional Cardiology, Interventional Radiology/Vascular Surgery

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 599.97 Million | |

| USD 1013.5 Million | |

| 6.2% | |

| XX | |

| XX |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

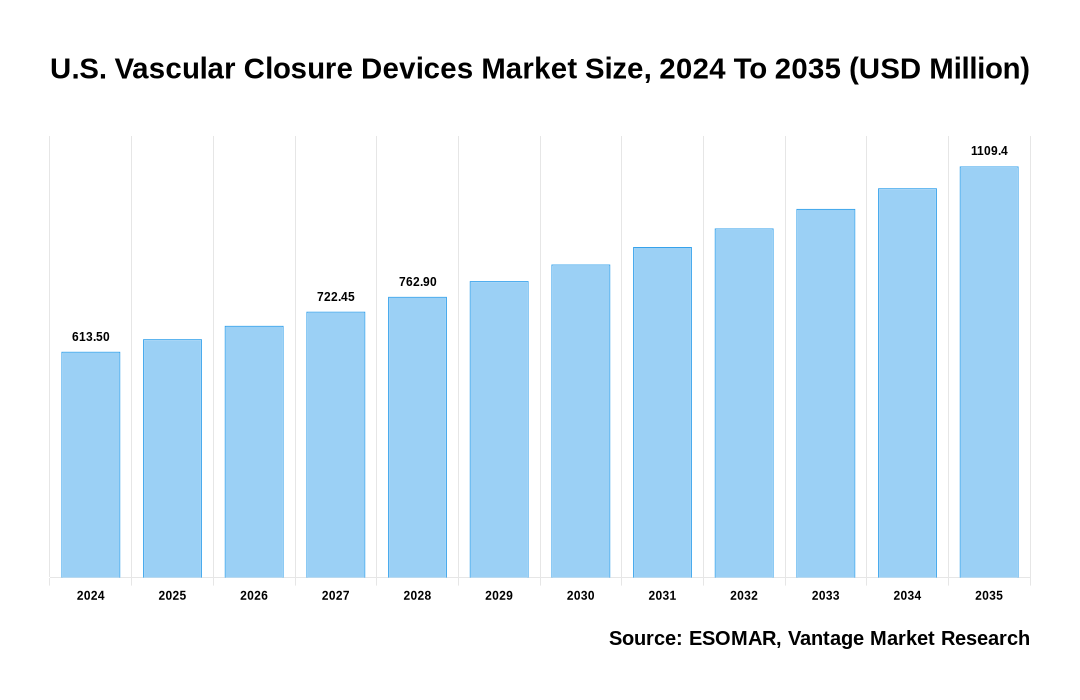

The global U.S. Vascular Closure Devices Market is valued at USD 599.97 Million in 2023 and is projected to reach a value of USD 1013.5 Million by 2032 at a CAGR (Compound Annual Growth Rate) of 6.2% between 2024 and 2032. The market is driven by rising prevalence of chronic diseases, advancements in minimally invasive techniques.

Key Highlights

- By Type, the Active approximators is dominated the market with 59.4% market share in 2023

- Based on Access, the Femoral Access is dominated the market with 71.1% market share

- Based on Procedure, the Interventional cardiology is dominated the market with 79.9% market share

- Key trends include increasing use of absorbable closure devices, technological advancements, demand for minimally invasive procedures, and outpatient cardiovascular interventions

U.S. Vascular Closure Devices Market Size, 2023 To 2032 (USD Million)

AI (GPT) is here !!! Ask questions about U.S. Vascular Closure Devices Market

The U.S. U.S. Vascular Closure Devices market is driven by growing demand for quicker patient recovery post-angiographic procedures, technological advancements, and a growing emphasis on minimally invasive procedures. Furthermore, the aging population in the U.S. significantly impacts the market, as older patients are more likely to undergo interventional procedures requiring effective vascular closure solutions. For instance, according to ACL, in the United States, there were 57.8 million people 65 and over in 2022. More than one in six Americans, or 17.3% of the population, were represented by them. Companies invest heavily in R&D to stay competitive and address the evolving needs of healthcare providers. Additionally, regulatory approvals and adherence to stringent guidelines are vital for market entry and product success.

Type Overview

The Type Segment is divided into Passive approximators, Active approximators, and External hemostatic devices. The Active approximators held the dominant share in 2023, accounting for significant market share of 59.4%.

The Active approximators primarily includes suture -based and clip-based devices, each leveraging distinct methodologies to ensure effective closure and hemostasis. Suture-based devices offer excellent dependability and versatility to different clinical settings by using automated or manual suturing techniques to secure the vascular puncture site. Furthermore, clip-based systems provide a rapid and effective way to accomplish closure by approximating the vessel walls using mechanical clips.

Access Overview

The Access Segment is divided into Femoral Access and Radial Access. The Femoral Access held the dominant share in 2023, accounting for significant market share of 71.1%.

The market for femoral access VCDs is robust, with leading companies like Terumo Corporation and Medtronic driving innovation. For instance, Medtronic’s Angio-Seal product is a prominent player in this space, offering advanced hemostatic technology that addresses common complications associated with femoral access, such as hematoma and prolonged recovery. Recent advancements focus on reducing the size of closure devices and improving ease of deployment, which aligns with the broader trend towards minimally invasive procedures.

Procedure Overview

The Access Segment is divided into Interventional cardiology and Interventional radiology/Vascular surgery. The Interventional cardiology held the dominant share in 2023, accounting for significant market share of 79.9%.

Interventional cardiology is a significant segment driven by the high prevalence of cardiovascular diseases and the growing demand for minimally invasive procedures. Interventional cardiology procedures, such as percutaneous coronary interventions (PCI), frequently require vascular closure solutions to ensure effective hemostasis and reduce post -procedural complications. The demand for VCDs in interventional cardiology is fueled by the need to manage arterial access sites and prevent complications such as bleeding and hematoma formation.

Key Trends

- Surge in technological advancements: The development of bioresorbable materials, which naturally dissolve in the body after completing the closure, has gained substantial traction. These materials eliminate the need for a secondary procedure to remove the device, reducing the risk of infection and long-term complications

- Rising prevalence of cardiovascular diseases (cvds): As the number of cardiovascular interventions, such as angiography and angioplasty, continues to rise, the demand for vascular closure devices will grow proportionately

- Growing focus on outpatient settings and same -day discharge: The drive toward cost -efficiency, improved patient experiences, and value-based care has led to a growing trend of conducting cardiovascular procedures in outpatient settings, such as ambulatory surgical centers (ASCs)

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Increasing Prevalence of Cardiovascular Diseases

As heart disease remains the leading cause of mortality in the U.S., with approximately 696,000 deaths reported annually according to the Centers for Disease Control and Prevention (CDC), the necessity for effective and reliable vascular closure solutions has never been more critical. This high incidence of cardiovascular conditions results in a substantial volume of diagnostic and interventional procedures, which in turn drives the need for advanced VCDs. The device is designed to achieve hemostasis quickly and effectively, reducing the risk of post-procedural bleeding and allowing for faster patient mobilization. Similarly, the Perclose ProGlide Suture-Mediated Closure System by Abbott is widely utilized in both diagnostic and interventional cardiology for its ability to offer secure closure with minimal discomfort and quick recovery.

Innovation In Device Design and Materials

The continuous advancement in materials science and engineering is paving the way for more effective and patient-friendly VCDs, addressing some of the limitations associated with traditional devices. Bioresorbable VCDs are designed to dissolve naturally within the body over time, eliminating the need for device retrieval and minimizing the risk of long -term complications such as infection or vessel injury. For example, the FDA-approved Myna Vascular Closure Device utilizes a bioresorbable plug that provides rapid hemostasis and gradually absorbs into the body, offering a safer and more convenient option compared to traditional metal-based devices. This advancement not only reduces patient discomfort but also enhances overall procedural outcomes.

Competitive Landscape

The U.S. Vascular Closure Devices market is characterized by dynamic and evolving environment with several key players and their ongoing advancement. Major Players are Terumo corporation, Abbott vascular, cardinal health, Cardiva Medical Inc., Medtronic Plc, COOK, Merit Medical Systems Inc., C.R. bard Inc, Essential Medical Inc, Other Companies. These companies focus on innovations, product launches, and strategic mergers or acquisitions to strengthen their market positions. Smaller, specialized companies are also entering the market, offering niche or cost-effective solutions. Increasing regulatory approvals and continuous R&D investments in advanced vascular closure technologies play a significant role in shaping competition.

Recent Market Developments

Medtronic plc announced a strategic partnership with Merit Medical Systems

- In June 2024, Medtronic plc announced a strategic partnership with Merit Medical Systems Inc. This collaboration aims to leverage Medtronic’s extensive healthcare technology expertise and Merit Medical’s innovative medical devices to enhance patient care. By combining resources, the partnership will drive advancements in vascular closure devices, expanding their capabilities and improving clinical outcomes. This synergy is expected to accelerate the development of new, more effective closure solutions, enhance product offerings, and strengthen market position, ultimately benefiting patients and healthcare providers globally

Abbott’s acquisition of Cardiovascular Systems Inc

- In April 2023, Abbott’s acquisition of Cardiovascular Systems, Inc., as announced on April 27, 2023, marks a significant expansion of its vascular portfolio. This strategic move integrates new technologies designed to treat artery diseases, enhancing Abbott’s ability to address complex vascular conditions. By incorporating Cardiovascular Systems’ innovations, Abbott aims to offer a broader range of solutions for arterial diseases, including advanced stenting and plaque removal technologies. This expansion underscores Abbott’s commitment to improving patient care through innovative, comprehensive vascular treatments

The global U.S. Vascular Closure Devices market can be categorized as Type, Access, Disorder and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Access

By Procedure

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for U.S. Vascular Closure Devices in terms of revenue?

-

The global U.S. Vascular Closure Devices valued at USD 599.97 Million in 2023 and is expected to reach USD 1013.5 Million in 2032 growing at a CAGR of 6.2%.

Which are the prominent players in the market?

-

The prominent players in the market are Terumo corporation, Abbott vascular, cardinal health, Cardiva Medical Inc., Medtronic Plc, COOK, Merit Medical Systems Inc., C.R. bard Inc, Essential Medical Inc.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 6.2% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the U.S. Vascular Closure Devices include

Which region accounted for the largest share in the market?

-

XX was the leading regional segment of the U.S. Vascular Closure Devices in 2023.