U.S. and Europe Insulin Infusion Pump and Accessories Market

U.S. and Europe Insulin Infusion Pump and Accessories Market - Global Industry Assessment & Forecast

Segments Covered

By Type Traditional Insulin Pumps, Patch Insulin Pumps

By Accessories Infusion sets, Insulin reservoirs/cartridges, Infusion set insertion devices, Other Accessories

By Features Basic Insulin Pumps, Advanced Insulin Pumps

By End User Hospitals, Clinics, Homecare, Others

By Region United States, Europe

Snapshot

| 2023 | |

| 2024 - 2030 | |

| 2018 - 2022 | |

| USD 3321.0 Million | |

| USD 7498.7 Million | |

| 12.3% | |

| 618.9 Thousand Units | |

| 1284.2 Thousand Units | |

| 11.0% | |

| NA | |

| Europe |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

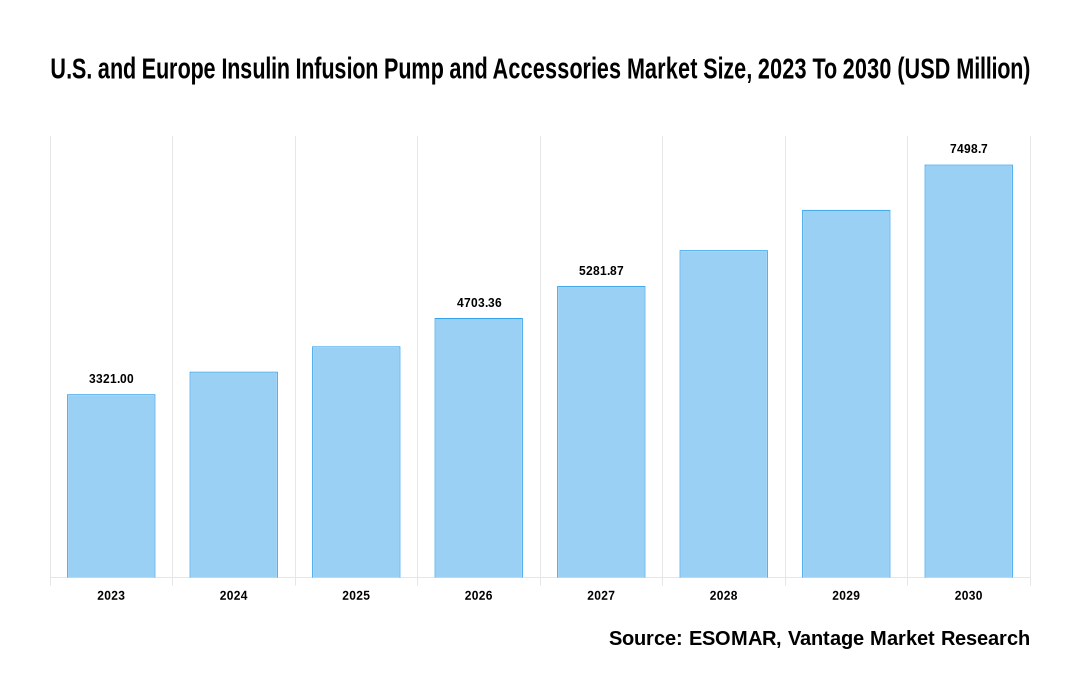

The U.S. and Europe Insulin Infusion Pump and Accessories Market is valued at USD 3321.0 Million in 2023 and is projected to reach a value of USD 7498.7 Million by 2032 at a CAGR (Compound Annual Growth Rate) of 12.3% between 2024 and 2032.

Key Highlights of U.S. and Europe Insulin Infusion Pump and Accessories Market

- In 2023, the Traditional Insulin pumps U.S. and Europe Insulin Infusion Pump and Accessories Category dominated the market with around 80.2% share.

- The Infusion sets segment significantly contributed to the market’s expansion, constituting over 38.1% of the overall revenue share in 2023

- The Advanced Insulin pumps segment significantly contributed to the market’s expansion, constituting over 60.7% of the overall revenue share in 2023

- The Hospitals segment significantly contributed to the market’s expansion, constituting over 41.6% of the overall revenue share in 2023

- Rapid innovation in medical equipment, communication, and data analytics. Insulin pumps have become smaller and easier to operate due to developments in sensor technology, wireless communication, and downsizing.

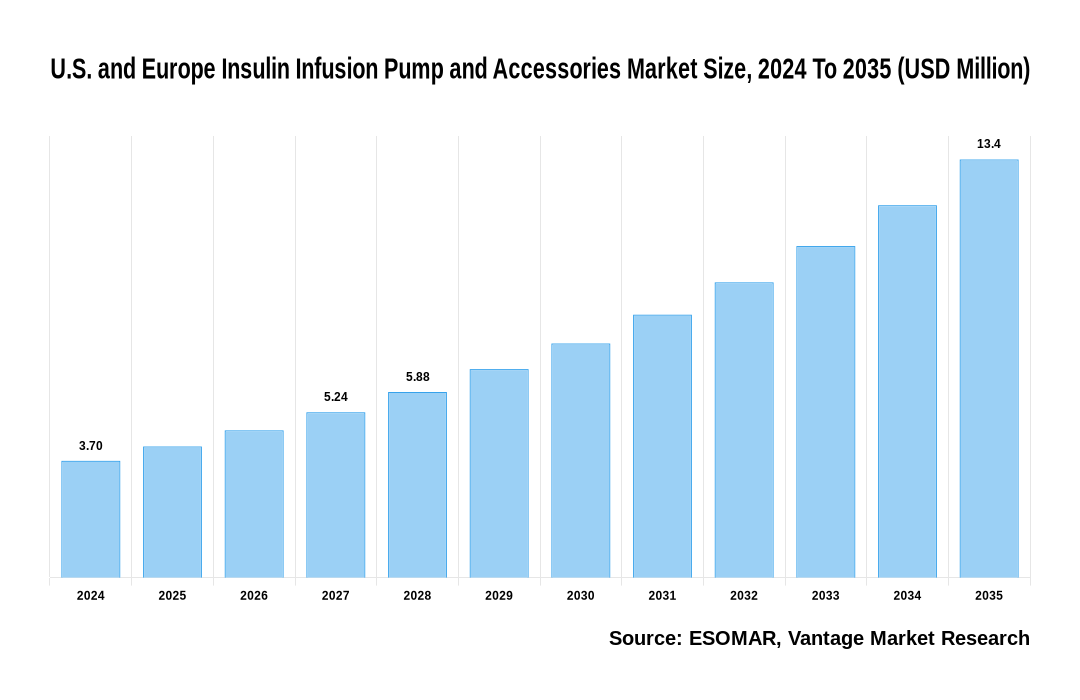

U.S. and Europe Insulin Infusion Pump and Accessories Market Size, 2023 To 2030 (USD Million)

AI (GPT) is here !!! Ask questions about U.S. and Europe Insulin Infusion Pump and Accessories Market

U.S. and Europe Insulin Infusion Pump and Accessories Market Overview

The category with the fastest CAGR in the insulin infusion pump and accessories market in the United States and Europe is insulin reservoirs/cartridges. Their crucial function mostly explains this predilection in the continuous administration of insulin. Insulin reservoirs provide a reliable and seamless delivery system by storing the insulin that is gradually pumped into the user's body. Because of their design, the risk of under- or overdose is reduced. infusion set insertion tools make it easier to install infusion sets, reducing discomfort for the user and associated consequences. The popularity of these devices has been fueled by rising demand for simple and efficient diabetes care options. The innovation and user-friendliness offered by the infusion set insertion devices considerably contribute to their quick market expansion as people seek out increasingly easy and reliable methods for insulin infusion.

The Advanced Insulin Pump is the most well-liked product in the booming insulin infusion pump and accessories market in the United States and Europe. Due to their superior features and functions, these pumps were picked. Continuous glucose monitoring (CGM) integration and advanced dosage algorithms are features of cutting-edge insulin pumps. With the help of these features, users may better understand their blood sugar levels and obtain more precise insulin delivery, which improves their ability to manage their diabetes. In the US and Europe, homecare is the most substantial category for the utilization of products in the insulin infusion pump and accessories market. This preference stems from a need for comfortable, convenient, and individualized diabetes control. People can manage their insulin infusion at home, fostering a sense of autonomy and lowering the number of times they need to attend a hospital or clinic.

The U.S. and Europe Insulin Infusion Pump and Accessories market can be categorized as Types, accessories, Features, End Users.

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Accessories

By Features

By End User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

U.S. and Europe Insulin Infusion Pump and Accessories Market: Types Overview

In 2023, the Traditional insulin pumps dominated the market with a 80.2% share and a market CAGR of 12.0% in the forecast period. The Types segment is separated into traditional insulin pumps and patch insulin pumps. The demand for insulin infusion pumps and accessories is significantly fueled by the rising prevalence of diabetes in the US and Europe. The demand for efficient glucose management solutions like insulin pumps increases as the number of people with diabetes rises, fueling the market growth. Although older insulin pumps only provide the bare minimum of capability, modern insulin infusion devices now have more overall capabilities. More people use these devices to better control their diabetes thanks to improved features like touchscreen user interfaces, Bluetooth connectivity, and CGM system integration. Insulin pumps are increasingly being used because of their capacity to provide insulin dosages without requiring several injections during the day, improving the quality of life for people with diabetes. Market expansion has been spurred by increasing patient and healthcare professionals' knowledge of the advantages of insulin pumps. As older people desire greater control over their health, this demographic trend promotes demand for diabetes care options, including insulin pumps and accessories. Collaborations between producers of medical equipment, pharmaceutical firms, and healthcare organizations have improved distribution systems and raised knowledge of the various types of insulin pumps available.

U.S. and Europe Insulin Infusion Pump and Accessories Market: Accessories Overview

In 2023, the Infusion sets dominated the market with a 38.1% share and a market CAGR of 12.5% in the forecast period. The Accessories segment is categorized into Infusion sets, Insulin reservoirs /cartridges, infusion sets insertion devices, and other accessories. The constant and precise administration of insulin from the pump to the diabetic person is made possible by an infusion set, a crucial part of insulin infusion pumps and accessories. The adoption of insulin infusion pumps and accessories like infusion sets has been fueled by the rising demand for effective and efficient insulin delivery systems caused by the rising prevalence of diabetes. The development of infusion set technology has also been crucial to the market's expansion. To improve the comfort and convenience of these sets, manufacturers are constantly coming up with new ideas. Many people choose insulin pumps as their preferred method of administering insulin due to features including painless insertion, lessened skin trauma, and wear-time extensions. Better glucose control due to this customizability lowers the risk of complications from poorly controlled diabetes. As more patients and healthcare professionals become aware of these advantages, there is an increasing demand for insulin infusion pumps and their accessories, such as infusion sets.

U.S. and Europe Insulin Infusion Pump and Accessories Market: Features Overview

In 2023, the Advanced insulin pumps dominated the market with a 60.7% share and a market CAGR of 13.5% in the forecast period. The Features segment is categorized into Basic insulin pumps and advanced insulin pumps. Advanced insulin pumps are technologically advanced medical equipment used to give insulin to people with diabetes precisely and effectively. Advanced insulin pumps are becoming more and more popular as a result of their user-friendly interfaces and adaptable options, which give people a personalized and efficient way to administer insulin and regulate their blood sugar levels. In the insulin infusion pump and accessories market in the United States and Europe, Basic Insulin Pumps are the most often used product. This dramatic recovery is intriguingly driven by the increased need for straightforward, user -friendly diabetic care options. Due to their superior features and functions, these pumps were picked. Continuous glucose monitoring (CGM) integration and advanced dosage algorithms are features of cutting-edge insulin pumps. With the help of these features, users may better understand their blood sugar levels and obtain more precise insulin delivery, which improves their ability to manage their diabetes.

U.S. and Europe Insulin Infusion Pump and Accessories Market: End Users Overview

In 2023, the Hospitals dominated the market with a 41.6% share and a market CAGR of 12.0% in the forecast period. The End Users segment is categorized into Hospitals, Clinics, Home care, and Others. The insulin infusion pump and accessories market in the US and Europe is expanding due to the crucial role hospitals play in using these products. These medical facilities use these devices to manage insulin administration to individuals with diabetes efficiently. This long-term illness affects blood sugar levels. Insulin Infusion Pump and Accessories are widely used in hospitals for various purposes, including meeting urgent medical demands and fostering market growth. These devices have features like networking choices and continuous glucose monitoring, enabling remote monitoring and real-time tracking of data. Hospitals are intrigued by these cutting-edge features because they let medical personnel customize insulin therapy to each patient's needs, enhancing overall patient care. Hospitals are also encouraged to invest in technology that enhances patient outcomes and lower long-term healthcare costs due to the change to value-based healthcare models.

Key Trends

- The convenience of integration with other diabetes management tools, such as continuous glucose monitors, contributes to the rapid growth of traditional insulin pumps, making them a market-competitive alternative.

- Innovative insulin devices include continuous glucose monitoring (CGM) integration and sophisticated dosing algorithms. These features enable users to have a more thorough comprehension of their glucose levels and to receive more precise insulin delivery, resulting in enhanced diabetes management.

- Increasing demand for user -friendly and effective diabetes management solutions has driven the adoption of these devices. As individuals pursue increasingly convenient and dependable methods for insulin infusion, the innovation and user-friendliness offered by the infusion set insertion devices significantly contribute to their rapid market expansion.

Premium Insights

The market for insulin infusion pumps and accessories in the US and Europe has undergone remarkable technological advancement. The delivery and monitoring of insulin have radically transformed due to this advancement in diabetes care. Innovative solutions that improve patient outcomes, raise the quality of life, and provide people with diabetes more control over their diabetes management have been created due to the fusion of cutting-edge medical knowledge and cutting-edge technology. For instance, In November 2022, In the US, Medtronic released a new infusion set for insulin pumps. Similarly, In April 2023, The Medtronic MiniMedTM 780G System, the first insulin pump in the world featuring meal detection technology and 5-minute auto-corrections, has received FDA approval.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

The rising incidence of diabetes and the demand for cutting-edge, practical treatment choices are two major factors propelling the market for insulin infusion pumps and accessories in the US and Europe. Globally, the prevalence of diabetes, a long-term metabolic condition marked by increased blood glucose levels, has skyrocketed. there is a critical need for novel treatments that support people in efficiently managing their diabetes while preserving their quality of life. The market for insulin infusion pumps and accessories is expanding significantly due to the increased incidence of type 1 and type 2 diabetes. Fast-moving developments in medical technology have produced increasingly advanced and feature-rich insulin infusion pumps. These pumps feature cutting-edge algorithms, touchscreen user interfaces, and connectivity possibilities, which make them simpler to operate and provide more flexibility for managing diabetes. the market for insulin infusion pumps and accessories is expanding in the US and Europe due to the rising prevalence of diabetes, technological developments, and a focus on patient -centric care. The aging population, increased healthcare awareness, favorable reimbursement policies, and ongoing research and development initiatives are a few factors that contribute to the growth of this market. The demand for insulin infusion pumps and accessories is anticipated to increase as healthcare systems and people prioritize good diabetes control.

Higher manufacturing expenses brought on by this sophistication are frequently passed on to customers. An insulin infusion pump can be expensive initially, especially for those without extensive insurance or financial resources. The cost of accessories and consumables such as infusion sets, reservoirs, adhesive patches, and sensors for integrated continuous glucose monitoring is continuing in addition to the cost of the pump itself. Over time, these costs could increase and raise the overall cost of utilizing insulin infusion pumps. the difficulty in making insulin infusion pumps and accessories affordable in the US and Europe represents a substantial barrier. High upfront acquisition costs, ongoing consumable costs, erratic insurance coverage, out-of-pocket charges, problems with reimbursement, and maintenance/upgrades exacerbate this dilemma. The cost landscape is influenced by several variables, including the expenses associated with technology development, the level of market rivalry, the complexity of regulatory requirements, research and development investments, the need for customization, and aspects of the healthcare system.

Competitive Landscape

The US and European Insulin Infusion Pump and Accessories Market providers' negotiating position significantly impacts the industry's competitive environment. The Major players of U.S. and Europe Insulin Infusion pump and accessories market are Insulet Corporation, Medtronic, Ypsomed AG, Roche Diabetes care limited, Tandem Diabetes Care Inc., SOOIL Developments Co. Ltd., Mannakind Corporation, A. Menarini Diagnostics s.r.l., Wuxi Apex Medical Co. Ltd., ICU Medical Inc. For Instance, In November 2022, MannKind Corporation Announces Agreement to Buy Zealand Pharma's V-Go Insulin Delivery Device.

Recent Developments

- In April 2023, Omnipod GOTM, a first-ofits- kind basal-only insulin pod, has been FDA-cleared by Insulet, further simplifying life for those with type 2 diabetes.

- In July 2022, The Tandem Mobi insulin pump has received FDA approval from Tandem Diabetes Care.

FAQ

Frequently Asked Question

What is the global demand for U.S. and Europe Insulin Infusion Pump and Accessories in terms of revenue?

-

The global U.S. and Europe Insulin Infusion Pump and Accessories valued at USD 3321.0 Million in 2023 and is expected to reach USD 7498.7 Million in 2030 growing at a CAGR of 12.3%.

Which are the prominent players in the market?

-

The prominent players in the market are Insulet Corporation, Medtronic, Ypsomed AG, Roche Diabetes care limited, Tandem Diabetes Care Inc., SOOIL Developments Co. Ltd., Mannakind Corporation, A. Menarini Diagnostics s.r.l., Wuxi Apex Medical Co. Ltd., ICU Medical Inc.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 12.3% between 2024 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the U.S. and Europe Insulin Infusion Pump and Accessories include

- Increasing prevalence of diabetes

Which region accounted for the largest share in the market?

-

Europe was the leading regional segment of the U.S. and Europe Insulin Infusion Pump and Accessories in 2023.