Uninterruptible Power Supply (UPS) Market

Uninterruptible Power Supply (UPS) Market - Global Industry Assessment & Forecast

Segments Covered

By Capacity Less than 10 kVA, 10-100 kVA, Above 100 kVA

By Type Standby UPS System, Online UPS System, Line-interactive UPS System

By Application Data Centers, Telecommunications, Healthcare (Hospitals & Clinics etc.), Industrial, Other Applications

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 10.6 Billion | |

| USD 15.1 Billion | |

| 4.6% | |

| Asia Pacific | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

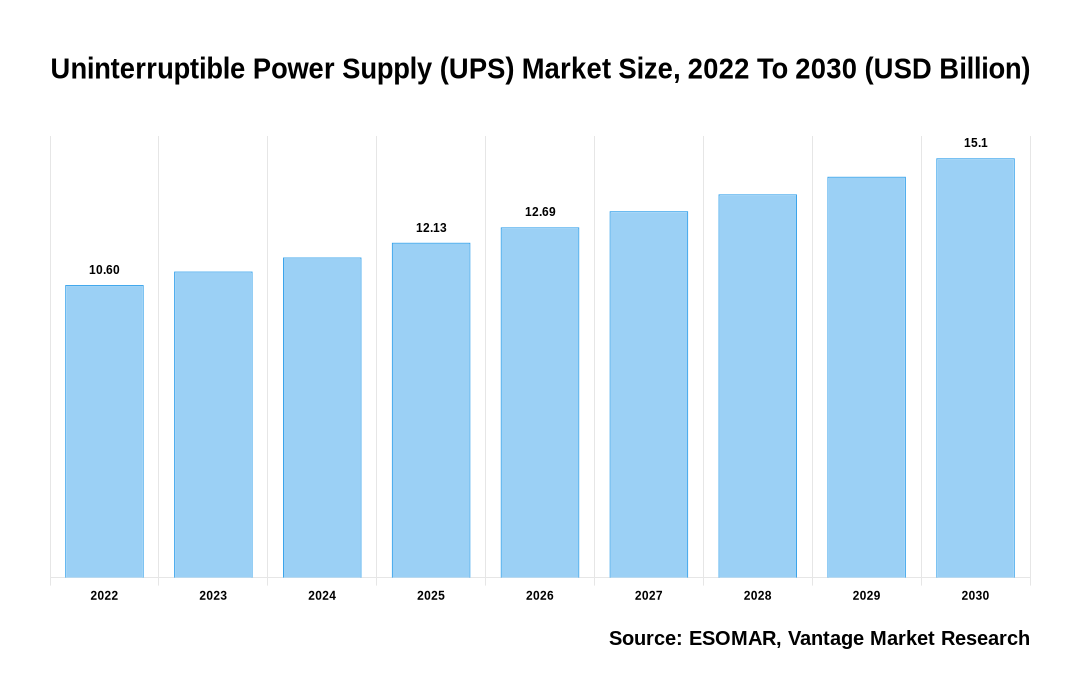

The global Uninterruptible Power Supply (UPS) Market is valued at USD 10.6 Billion in 2022 and is projected to reach a value of USD 15.1 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 4.6% between 2023 and 2030.

Premium Insights

An Uninterruptible Power Supply (UPS) is a battery backup system that provides continuous power to electric equipment in the event of a power outage or voltage drop. It offers a safe means to shut down computers, reducing data loss and repair expenses. Uninterruptible Power Supply (UPS)s are commonly used with desktop computers to prevent data loss in the event of power outages and voltage fluctuations, which can shorten the life of the hardware and circuits inside. For power backup, Uninterruptible Power Supply (UPS)s are widely used in small offices, hospitals, electric point-of-sale terminals, and telecommunications centers. A single massive Uninterruptible Power Supply (UPS) can be a single point of failure in large commercial environments where security is crucial, confusing numerous other systems. Multiple smaller Uninterruptible Power Supply (UPS) modules and batteries can be integrated to provide redundant power protection equivalent to one large Uninterruptible Power Supply (UPS) to accommodate more good reliability.

Uninterruptible Power Supply (UPS) Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Uninterruptible Power Supply (UPS) Market

- The demand for alcohol in the Uninterruptible Power Supply (UPS) market will notably increase its expansion during the projection period from 2023 to 2030.

- The standby Uninterruptible Power Supply (UPS) system segment to dominate the type, capturing the largest market share globally throughout the forecast period 2023 to 2030.

- In 2022, the Asia Pacific region had the greatest market share, with 40.6%, and is likely to continue to dominate the market during the projection period.

- The Asia Pacific Uninterruptible Power Supply (UPS) market is expected to grow rapidly between 2023 and 2030.

Top Market Trends

- The ongoing development of infrastructure around the world has an impact on the global market for uninterruptible power supplies. Developed countries are increasingly investing in the development of smart cities, which are largely reliant on uninterrupted power supply, which is expected to have an impact on market growth. Industry improvements, such as the replacement of lead-acid batteries with lithium-ion batteries to address the issues given by higher working temperatures and rapid charging capacities, have an impact on the overall market value of uninterruptible power supplies.

- Flywheel is a cutting-edge technology that was created to supply power sources in tough conditions for the manufacturing and oil and gas industries. The technique provides excellent power efficiency to safeguard equipment from persistent voltage fluctuations and clean power sources while minimizing environmental impact.

- Furthermore, the fourth industrial revolution has grown dramatically in recent years. Incorporating cutting-edge technologies, such as IoT, cloud computing and analytics, AI, and machine learning, into manufacturing facilities and operations is revolutionizing manufacturing processes. As a result of the factors above, the UPS market is expected to grow throughout the forecast period.

- Nonetheless, technological advancements in Uninterruptible Power Supply (UPS) battery systems, such as new Li-ion batteries with high operating temperatures, are expected to aid traditional data centers greatly. As a result, over the forecast period, Uninterruptible Power Supply (UPS) systems, which can be used as a backup if the power grid fails, are expected to offer growth opportunities for the Uninterruptible Power Supply (UPS) market.

- Increasing data center investments have emerged as a significant driver of the worldwide data center Uninterruptible Power Supply (UPS) (Uninterruptible Power Supply (UPS)) market. Demand for data storage, processing, and management has increased as organizations across industries continue to grow their digital operations and services, forcing significant investments in data center infrastructure. The convergence of rising data center investments and the need for dependable power has positioned the global UPS industry as a critical enabler of seamless digital operations.

- Digitalization has affected businesses in every industry. This has led to a reliance on electronic devices to collect and retrieve data for corporate processes. This increases reliance on a consistent and steady power supply. Enterprises cannot run business processes without a power source. Although Uninterruptible Power Supply (UPS) systems are in high demand in the IT sector, many industrial processes have recently embraced microprocessors and PC-based systems that are susceptible to power outages. A few seconds of power outage can impair industrial processes and result in significant financial losses. As a result, most industries across sectors have begun to employ improved Uninterruptible Power Supply (UPS) and modular Uninterruptible Power Supply (UPS) systems.

Report Coverage & Deliverables

Get Access Now

Economic Insights

Businesses and organizations may reduce capital expenditures, including investments in backup power systems such as Uninterruptible Power Supply (UPS) units, during economic downturns or recessions. This may result in a decrease in demand for Uninterruptible Power Supply (UPS) products and services. Organizations frequently allot money for IT infrastructure and important systems. Economic challenges may drive them to prioritize other sectors over Uninterruptible Power Supply (UPS) investments, which will influence market growth. Uninterruptible Power Supply (UPS) systems and components are frequently manufactured and exchanged on a global scale. Currency exchange rate fluctuations can alter the cost of imported or exported Uninterruptible Power Supply (UPS) items, affecting market price and affordability.

Market Segmentation

The Global Uninterruptible Power Supply (UPS) Market is categorized into the segments as mentioned below:

The global Uninterruptible Power Supply (UPS) market can be categorized into Capacity, Type, Application, Region. The Uninterruptible Power Supply (UPS) market can be categorized into Less than 10 kVA, 10-100 kVA, Above 100 kVA based on Capacity. The Uninterruptible Power Supply (UPS) market can be categorized into Standby UPS System, Online UPS System, Line-interactive UPS System based on Type. The Uninterruptible Power Supply (UPS) market can be categorized into Data Centers, Telecommunications, Healthcare (Hospitals & Clinics etc.), Industrial, Other Applications based on Application. The Uninterruptible Power Supply (UPS) market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East & Africa based on Region.

Based on Type

Standby Uninterruptible Power Supply (UPS) System to Lead Market Share Due to the Demand For Consumer Electronics

In 2022, the standby Uninterruptible Power Supply (UPS) segment will dominate the global market for Uninterruptible Power Supply (UPS). The expanding global demand for consumer electronics is one of the key drivers for standby Uninterruptible Power Supply (UPS) systems vs. other Uninterruptible Power Supply (UPS) systems, as the standby Uninterruptible Power Supply (UPS) system is the most desired alternative for consumer electronics because it is the most cost-effective solution for devices with low power consumption. According to the International Data Center (IDC), global desktop shipments totaled 17.98 million units in the fourth quarter of 2022, compared to 23.37 million in the previous year's fourth quarter. Desktop personal computers face competition from mobile devices such as laptops and desktops, resulting in a drop in overall sales; however, this is likely to increase in the future as more professionals work from home. Similarly, demand for game consoles is likely to rise during the projection period, driven by a jump in demand for home entertainment caused by the coronavirus pandemic. A backup power supply (Uninterruptible Power Supply (UPS)) is required for game consoles, especially in places with poor power quality, because unsafe quantities of energy can damage the machine.

Based on Application

Industrial Segment Expects to Dominate the Growing Power Cut

In 2022, the Industrial segment will dominate the Uninterruptible Power Supply (UPS) market. Uninterruptible Power Supply (UPS) are used in a range of industrial applications, including nuclear power facilities, oil rigs, petrochemical plants, the food and beverage industry, pharmaceutical factories, and so on. The Uninterruptible Power Supply (UPS) is a critical support system for assuring the continuous operation of industrial-quality infrastructure. Furthermore, in the event of a momentary power outage, the industrial-grade Uninterruptible Power Supply (UPS) can keep the vital infrastructure running until the mains power supply is restored. In the event of a major power outage, the Uninterruptible Power Supply (UPS) may power the critical infrastructure component until a backup power source, such as generators, can be connected.

Based on Region

Asia Pacific To Dominate Global Sales Due to Increase in the Number of Small and Medium-Sized Outsourcing Firms

In 2022, the Asia Pacific region emerged as the dominant player in the Uninterruptible Power Supply (UPS) market. The lack of adequate grid infrastructure in the region drives the regional market, resulting in frequent power outages and voltage variations. Regional market growth is being driven by an increase in the number of small and medium-sized outsourcing firms, as well as an increase in the number of small-scale data centers. Furthermore, the widespread usage of electronic devices and appliances such as mobile phones, laptop computers, smart TVs, and air conditioners increases the requirement for backup power to prevent appliance damage. The COVID-19 outbreak has pushed governments in the region to construct advanced equipment, such as ventilators, which has increased the need for efficient Uninterruptible Power Supply (UPS) to prevent equipment failure during power outages.

The North American Uninterruptible Power Supply (UPS) market is expected to expand dramatically. The increasing need for Uninterruptible Power Supply (UPS) in end-user applications such as industrial systems, point-of-sale equipment, telephone systems, laboratories, healthcare, small business offices, and internet service providers, among others, presents considerable market growth prospects. Furthermore, the rapid growth of hyperscale data centers in North America is pushing the Uninterruptible Power Supply (UPS) industry. These data centers want a significant quantity of electricity for numerous data-intensive tasks, raising the regional demand for uninterruptible power supplies (Uninterruptible Power Supply (UPS)). The swift introduction of new and cutting-edge technologies, the presence of the majority of key marketplace giants, a well-established IT infrastructure, a growing number of construction projects, a growing number of data centers, and other major factors are expected to contribute to the region's Uninterruptible Power Supply (UPS) market growth over the forecast period.

Competitive Landscape

The global Keyword market is highly competitive, with numerous important competitors working in the industry. Riello Elettronica SpA, Emerson Electric Co., EATON Corporation PLC, Delta Electronics Inc., ABB Ltd, Hitachi Ltd, Mitsubishi Electric Corporation, General Electric Company, Schneider Electric SE, Cyber Power Systems Inc., and Aspex Inc. are among the market's key players. These businesses are focusing on research and development in order to create innovative and sustainable products. Furthermore, strategic alliances, mergers, and acquisitions are common in the industry as organizations seek to extend their product offerings and market presence.

The key players in the global Uninterruptible Power Supply (UPS) market include - Riello Elettronica SPA (Italy), EATON Corporation PLC (Ireland), Emerson Electric Co. (U.S.), Delta Electronics Inc. (Taiwan), ABB Ltd. (Switzerland), Schneider Electric SE (France), Hitachi Ltd. (Japan), Mitsubishi Electric Corporation (Japan), General Electric Company (U.S.), Cyber Power Systems Inc. (Taiwan), Aspex Inc. (U.S.) among others.

Recent Market Developments

- In July 2022, Schneider Electric updated its EcoStruxure Service Plan for 10-40 kVA Three-Phase Uninterruptible Power Supply (UPS) devices. The EcoStruxure Service Plan integrated traditional onsite services with digital capabilities backed by the IoT-enabled EcoStruxure architecture, and customers received 24/7 remote and onsite knowledge and support.

- In February 2022, Mitsubishi Electric Corporation announced the acquisition of Computer Protection Technology, Inc. (CPT), in order to develop its Uninterruptible Power Supply (UPS) business in North America. With this transaction, MEPPI and CPT were intended to improve their respective company structures in order to deliver highly reliable and professional one-stop services for Uninterruptible Power Supply (UPS) systems in the North American market, from installation to maintenance.

- In October 2022, Su-vastika introduced a three-phase Uninterruptible Power Supply (UPS) system based on lithium batteries that can be used as a replacement for polluting diesel generators (DGs) in a variety of settings, including schools, hospitals, residential and commercial buildings, and shopping malls.

Segmentation of the Global Uninterruptible Power Supply (UPS) Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Capacity

By Type

By Application

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Uninterruptible Power Supply (UPS) in terms of revenue?

-

The global Uninterruptible Power Supply (UPS) valued at USD 10.6 Billion in 2022 and is expected to reach USD 15.1 Billion in 2030 growing at a CAGR of 4.6%.

Which are the prominent players in the market?

-

The prominent players in the market are Riello Elettronica SPA (Italy), EATON Corporation PLC (Ireland), Emerson Electric Co. (U.S.), Delta Electronics Inc. (Taiwan), ABB Ltd. (Switzerland), Schneider Electric SE (France), Hitachi Ltd. (Japan), Mitsubishi Electric Corporation (Japan), General Electric Company (U.S.), Cyber Power Systems Inc. (Taiwan), Aspex Inc. (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 4.6% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Uninterruptible Power Supply (UPS) include

- Growing Number of Data Centers

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Uninterruptible Power Supply (UPS) in 2022.

Vantage Market

Research | 21-Feb-2024

Vantage Market

Research | 21-Feb-2024