Turbocharger Market

Turbocharger Market - Global Industry Assessment & Forecast

Segments Covered

By Vehicle Type Passenger Car, LCV, HCV, Agricultural Machinery, Construction Machinery

By Technology Wastegate Technology, Variable-geometry Technology, Twin Turbo Technology

By Fuel Type Gasoline, Diesel

By Sales Channel OEM, Aftermarket

By Actuators Hydraulic, Pneumatic, Electric

By Region North America, Europe, Asia Pacific, Latin America, Middle East adn Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 31.7 Billion | |

| USD 61.1 Billion | |

| 7.56 % | |

| Europe | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

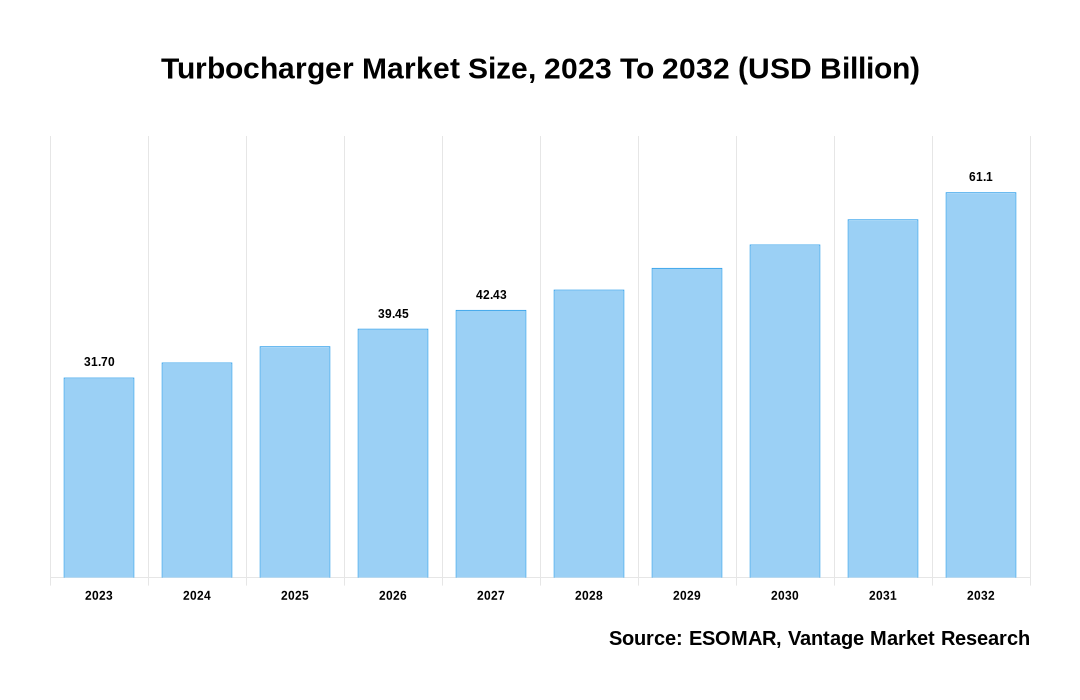

The Global Turbocharger Market is valued at USD 31.7 Billion in 2023 and is projected to reach a value of USD 61.1 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 7.56 % between 2024 and 2030.

Key highlights of Turbocharger Market

- Asia Pacific dominated the market in 2023, obtaining the largest revenue share of 46.9%.

- The Diesel segment dominated the Turbocharger market with the largest market share of 67.6% in 2023.

- The Passenger cars segment dominated the Turbocharger market with the largest market share of 48.7% in 2023.

- The Original Equipment Manufacturer (OEM’s) segment dominated the Turbocharger market with the largest market share of 51.9% in 2023.

- The Electric segment dominated the Turbocharger market with the largest market share of 57.9% in 2023.

- The Variable geometry technology segment dominated the Turbocharger market with the largest market share of 54.1% in 2023.

- As the automotive industry shifts towards electric and hybrid vehicles, electric turbochargers, also known as e-boosting technology, offer numerous advantages and open new possibilities for engine optimization.

- Government regulations worldwide also emphasize the importance of fuel efficiency, imposing strict emission standards and fuel economy targets.

Turbocharger Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Turbocharger Market

Turbocharger Market: Regional Overview

Asia Pacific Dominated Sales with a 46.9% share in 2023. The Asia-Pacific region is a significant player in the global turbocharger market, both as a consumer and a manufacturer. The region has a large automotive industry and a growing demand for turbocharger technology driven by factors such as increasing vehicle production, improving fuel efficiency, and meeting stricter emission regulations. Countries such as China, Japan, South Korea, and India are key contributors to the Asia-Pacific turbocharger market. Japanese automakers such as Toyota, Honda, Nissan, and Subaru have extensively incorporated turbochargers in their vehicles to enhance engine performance, fuel efficiency, and reduce emissions. Turbocharger are widely used in various vehicle segments, including passenger cars, sports cars, and commercial vehicles.

China Turbocharger Market Overview

The Turbocharger market in China, with a valuation of USD 4,449.2 Million in 2023, is projected to reach around USD 6,485.8 Million by 2030. This forecast indicates a substantial Compound Annual Growth Rate (CAGR) of 6.48% from 2024 to 2030. China is a major player in the global turbocharger market, both as a consumer and a manufacturer. As the world's largest automotive market, China has a robust demand for Turbocharger technology driven by factors such as increasing vehicle production, improving engine performance, and meeting stricter emission regulations. Chinese automakers, including Geely, Great Wall Motors, Chery, and BYD, extensively utilize turbocharger technology in their vehicles. Turbochargers are widely adopted in passenger cars, commercial vehicles, and even in electric vehicles with hybrid powertrains to enhance power output and improve fuel efficiency.

Turbocharger Market: Fuel Type Overview

In 2023, the Diesel segment dominated the market, with the largest share accounting for 67.6% of the overall market. The Turbocharger market, segmented by the Fuel Type, includes Gasoline and Diesel. Turbochargers have long been a standard feature in diesel engines. Due to the inherent characteristics of diesel engines, which include higher compression ratios and a lean-burning process, turbochargers are essential to optimize their performance. Turbocharging allows diesel engines to generate higher power outputs, improve torque, and achieve better fuel efficiency. Turbocharged diesel engines are widely used in commercial vehicles, including trucks, buses, and heavy machinery. Furthermore, Gasoline is fastest growth segment of the market. Turbocharger are increasingly used in gasoline engines to enhance power and improve fuel efficiency. By compressing the incoming air, turbochargers increase the amount of air available for combustion, allowing for more fuel to be burned, resulting in increased power output. This enables automakers to downsize engines while maintaining or even improving performance. Turbocharged gasoline engines are commonly found in passenger cars, sports cars, and high performance vehicles.

Turbocharger Market: Vehicle Type Overview

In 2023, the Passenger cars segment dominated the market, with the largest share accounting for 48.7% of the overall market. The Turbocharger market, segmented by the Vehicle Type, includes Passenger cars, LCV, HCV, Agriculture machinery, Construction machinery. Passenger cars segment includes turbochargers used in vehicles designed for personal use, such as sedans, hatchbacks, SUVs, and sports cars. Turbocharging is employed to improve engine performance, increase power output, and enhance fuel efficiency in passenger cars. For instance, in May 2023, BorgWarner announced that it has entered into a global agreement to supply its advanced eTurbo to a major European OEM for use in a high-voltage hybrid passenger car. BorgWarner's advanced electric boosting technology provides significant engine efficiency and performance benefits while also enabling the automotive manufacturer to meet increasingly strict emissions regulations.

Turbocharger Market: Sales Channel Overview

In 2023, the Original Equipment Manufacturer (OEMs) segment dominated the market, with the largest share accounting for 51.9% of the overall market. The Turbocharger market, segmented by the Sales Channel, includes Original Equipment manufacturer and Aftermarket. OEM sales channel refers to the direct supply of turbochargers from manufacturers to vehicle manufacturers. Turbocharger are integrated into engines during the original production of vehicles by the OEMs. Turbocharger manufacturers work closely with vehicle manufacturers to design and develop turbochargers that meet specific performance, efficiency, and packaging requirements. OEM sales channel is the primary channel for turbocharger supply in the initial equipment installation in new vehicles. Furthermore, Aftermarket segment is fastest growing segment of market. Aftermarket sales channel involves the supply of turbochargers for vehicles already in use. Aftermarket turbochargers are supplied as replacements for worn-out or damaged turbochargers in existing vehicles. They are sold through various channels, including authorized dealerships, independent retailers, online platforms, and specialized automotive parts stores.

Turbocharger Market: Actuator Overview

In 2023, the Electric segment dominated the market, with the largest share accounting for 57.9% of the overall market. The Turbocharger market, segmented by the Actuator, includes Hydraulic, Pneumatic, and Electric. Electric actuators are a newer and increasingly popular type of actuator in the turbocharger market. They utilize electric motors or solenoids to control the wastegate or variable geometry mechanism. Electric actuators offer precise and rapid response, allowing for more accurate control of the Turbocharger operation. They are commonly used in advanced engine management systems and are found in a range of vehicle types, including passenger cars and hybrid vehicles. Electric actuators are well-suited for these vehicles as they provide precise control, high responsiveness, and compatibility with electric powertrains.

Turbocharger Market: Technology Overview

In 2023, the Variable geometry technology segment dominated the market, with the largest share accounting for 54.1% of the overall market. The Turbocharger market, segmented by the Technology, includes Wastage technology, Variable geometry technology, and Twin turbo technology. Variable geometry technology, also known as variable nozzle turbine (VNT) or variable turbine geometry (VTG), employs adjustable vanes in the turbine housing. These vanes can change their angle to optimize the exhaust gas flow, controlling the speed and pressure of the turbine. Variable geometry turbochargers (VGT) provide precise control over the turbine geometry, allowing for improved engine response, reduced turbo lag, and increased efficiency across a wide range of engine speeds. VGT technology is commonly used in passenger cars, commercial vehicles, and high-performance applications.

Key Trends

- In 2023, the diesel category dominate the market and is projected to witness significant growth in the coming years.

- In 2023, the electric had a major share. Moreover, electric category to witness the fastest growth over the forecast period.

- In 2023, Asia Pacific category had a major share in the market.

Premium Insights

The global Turbocharger market is projected to witness a substantial growth. This is majorly due to the increase in demand for technogically advanced products. As COVID-19 waves hit the countries worldwide, the demand for turbocharger is expected to witness susbtantial growth in the long run. The major companies are continously investing heavily to enhance the production which is projected to enhance the global market growth over the coming years. The development of global competition, technology, and advertising industry have made maintenance, pricing and promotion strategies for the product more complicated. Concerning these challenges, the importance of the marketing channel, as a strategic tool, has rapidly grown.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Growing demand for fuel efficiency

Turbochargers enable automakers to downsize engines without sacrificing power output. By compressing the incoming air, Turbocharger increase the air density in the combustion chamber, allowing for more efficient combustion. This downsizing approach reduces internal friction and pumping losses, improving fuel economy. With rising fuel prices and increasing awareness of carbon emissions, consumers are actively seeking vehicles that offer better fuel efficiency. Turbocharged engines provide an appealing option as they balance performance and fuel economy. Government regulations worldwide also emphasize the importance of fuel efficiency, imposing strict emission standards and fuel economy targets. Automakers are turning to turbocharging technology to meet these requirements and avoid penalties. Turbochargers help reduce CO2 emissions by optimizing combustion efficiency and enabling downsizing strategies. The growth of hybrid and electric vehicles further boosts the demand for fuel -efficient vehicles. Turbocharging plays a role in hybrid powertrains, where it assists in boosting the power output of smaller, more fuel-efficient engines. In electric vehicles, Turbocharger can be utilized to optimize range-extending engines, ensuring efficient operation when the electric battery is depleted.

Stringent emission regulation

As governments worldwide aim to reduce vehicle emissions and combat environmental concerns, turbocharging technology has become crucial in meeting these strict regulations. Automakers can downsize engines with Turbocharger while maintaining or enhancing power output. This downsizing allows for improved fuel efficiency and reduced emissions without sacrificing performance. By compressing the intake air and increasing the oxygen supply to the engine, turbochargers enable more efficient combustion, resulting in lower fuel consumption and reduced greenhouse gas emissions. Emission regulations, such as the Euro standards in Europe, the EPA regulations in the United States, and similar regulations in other regions, set specific limits on pollutants like nitrogen oxides (NOx) and particulate matter (PM). Turbochargers are vital in reducing these pollutants by optimizing engine efficiency and improving combustion. They enable automakers to meet emission limits and avoid penalties or non-compliance issues.

Furthermore, Turbocharger support integrating advanced emission control systems, such as exhaust gas recirculation (EGR) and selective catalytic reduction (SCR). These systems reduce harmful emissions by recirculating exhaust gases or treating them with catalysts. Turbochargers enhance the efficiency and effectiveness of these emission control technologies. The global push for electric and hybrid vehicles also benefits the turbocharger market. Turbocharging is employed in hybrid powertrains to provide additional power and boost the efficiency of smaller combustion engines.

Competitive Landscape

The global Turbocharger market is a competitive and fragmented market due to the high presence of players in the market. Only a few companies account for a major market share, and hence, the degree of competition among the suppliers is high as the players in the market are active at global, regional, and country level. Also, the increasing rivalry between the players to obtain the majority of the market share for global has played a major role in intensifying the level of competition. The key companies in the global market are majorly focusing on partnerships and collaborations, mergers and acqusitions, and new product launch. The major Key Players are HONEYWELL INTERNATIONAL INC., BORGWARNER INC., IHI CORPORATION, CUMMINS INC., BOSCH MAHLE TURBO SYSTEMS GMBH & CO., EATON CORPORATION PLC, WEIFANG FUYUAN TURBOCHARGERS CO. LTD., MITSUBISHI HEAVY INDUSTRIES, CONTINENTAL AG, PRECISION TURBO & ENGINE, TURBO DYNAMICS LTD., ABB, ROTOMASTER INTERNATIONAL.

Recent Developments

- In November 2022, Announced a new partnership with a major American mining company to supply turbochargers for its fleet of heavy-duty trucks.

- In November 2022, Launched a new line of turbochargers for heavy-duty vehicles that are designed to improve fuel efficiency and reduce emissions.

- In October 2022, Launched a new line of turbochargers for heavy-duty vehicles that are designed to improve fuel efficiency and reduce emissions.

- In July 2022, Launched a new line of turbochargers for passenger cars that are designed to improve performance and fuel efficiency.

The global Turbocharger market can be categorized as Fuel Type, Vehicle Type, Sales Channel, Actuator, Technology and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Vehicle Type

By Technology

By Fuel Type

By Sales Channel

By Actuators

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Turbocharger in terms of revenue?

-

The global Turbocharger valued at USD 31.7 Billion in 2023 and is expected to reach USD 61.1 Billion in 2032 growing at a CAGR of 7.56 %.

Which are the prominent players in the market?

-

The prominent players in the market are HONEYWELL INTERNATIONAL INC., BORGWARNER INC., IHI CORPORATION, CUMMINS INC., BOSCH MAHLE TURBO SYSTEMS GMBH & CO., EATON CORPORATION PLC, WEIFANG FUYUAN TURBOCHARGERS CO. LTD., MITSUBISHI HEAVY INDUSTRIES, CONTINENTAL AG, PRECISION TURBO & ENGINE, TURBO DYNAMICS LTD., ABB, ROTOMASTER INTERNATIONAL..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 7.56 % between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Turbocharger include

- Growing demand for fuel efficiency

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Turbocharger in 2023.

Vantage Market

Research | 14-Apr-2022

Vantage Market

Research | 14-Apr-2022