Transcatheter Aortic Valve Replacement Market

Transcatheter Aortic Valve Replacement Market - Global Industry Assessment & Forecast

Segments Covered

By Implantation Procedure Transfemoral, Transapical, Transaortic

By Material Stainless Steel, Nitinol, Cobalt Chromium, Other Materials

By Mechanism Balloon-Expanding Valve, Self-Expanding Valve

By End-Use Hospitals, Ambulatory Surgical Centers, Other End-Uses

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 6.5 Billion | |

| USD 11.85 Billion | |

| 6.9% | |

| Europe | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

The global Transcatheter Aortic Valve Replacement Market is valued at USD 6.5 Billion in 2023 and is projected to reach a value of USD 11.85 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 6.9% between 2024 and 2032. The market is driven by the growing incidence of aortic valve stenosis (AS), a shift toward minimally invasive surgeries, and the aging population. Cardiovascular Business Magazine reports that 92,000 TAVR valves were implanted in the U.S. in 2023.

Key Highlights

- Based on the Implantation Procedure, the Transfemoral category accounted for significant market share of 52.5% in 2023

- In 2023, by Material, Nitinol dominated the market with significant market share of 35.4%

- Mechanism segment dominated the market with market share of 55.4% in 2023

- In 2023, by End Use, Hospitals dominated with market share of 89.5%

- North America dominated the market with 39.3% market share in 2023

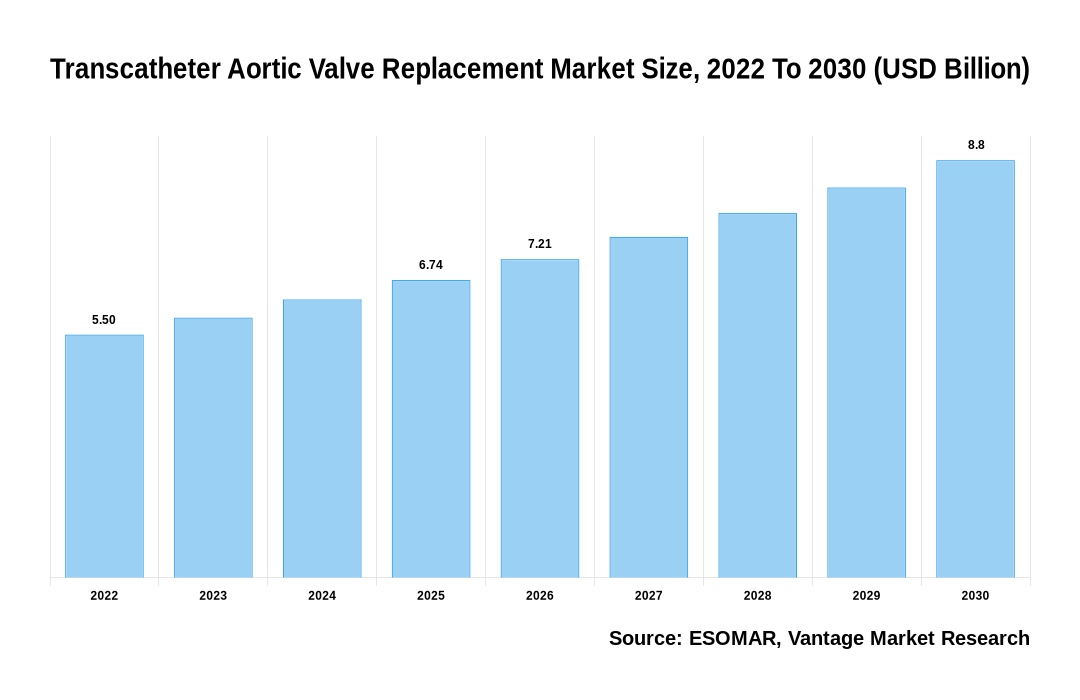

Transcatheter Aortic Valve Replacement Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Transcatheter Aortic Valve Replacement Market

Implantation Procedure Overview

The Implantation Procedure segment is divided into Transfemoral, Transapical, Transaortic. The Transfemoral segment held the dominant share in 2023, accounting for significant market share of 52.5%.

Transfemoral valve insertion, performed through the femoral artery, offers a less invasive option compared to traditional open-heart surgery. Technological innovations, better procedural outcomes, and broader patient eligibility are driving the increased use of transfemoral TAVR procedures. Consequently, this segment is expected to grow further, meeting the rising demand for minimally invasive treatments for aortic valve stenosis.

Mechanism Overview

The Mechanism segment is divided into Balloon-expandable and Self-expandable. In 2023, the Balloon-expandable segment held largest share of 55.4% in the Transcatheter Aortic Valve Replacement market.

Balloon-expandable valves are the most commonly used in TAVR procedures. Their fixed, intra-annular design and lower stent frame profile allow for easier coronary access. Additionally, their more precise delivery system, compared to self-expanding valves, enables better implantation in patients with challenging vascular anatomies, such as a horizontal aorta (aortic angulation >60°). The segment's growth is further driven by new product releases. For example, in September 2022, Edwards Lifesciences gained FDA approval for its Sapien 3 valve, made from materials intended to support future heart valve implants.

Regional Overview

In 2023, the North America captured 39.3% of the revenue share.

The North America Transcatheter Aortic Valve Replacement market is driven by a robust healthcare infrastructure and rising cases of aortic stenosis (AS) and aortic regurgitation. As these conditions increase, the market is expected to grow throughout the forecast period. According to StatPearls (April 2022), the prevalence of aortic regurgitation in the U.S. ranges from 4.9% to 10.0%, with men (13.0%) more affected than women (8.5%).

The U.S. Transcatheter Aortic Valve Replacement market is set to expand, with companies like Edwards Lifesciences, Medtronic, and Boston Scientific driving growth through product innovation, FDA approvals, and partnerships. For example, in June 2022, Medline launched its TAVR drape, designed to streamline procedures and enhance perioperative care. These advancements continue to improve outcomes and increase access to minimally invasive treatments.

The Europe region is anticipated to grow at the highest CAGR during the forecast period, driven by an increasing number of procedures, economic factors, regulatory changes, and product launches. In October 2021, JenaValve Technology released its Trilogy heart valve system in Europe, receiving CE Mark approval for aortic stenosis (AS), offering dual-disease treatment options for European clinicians.

In the UK, research and clinical trials are shaping the Transcatheter Aortic Valve Replacement market. For instance, the UK-TAVI trial in September 2022 evaluated outcomes of TAVR and surgical aortic valve replacement (SAVR) in patients over 70 with moderate surgical risk, helping define TAVR's role in clinical practice.

Germany's Transcatheter Aortic Valve Replacement market is expected to grow, driven by innovations in valve design and delivery systems. These technological advancements enhance procedural success and expand access to minimally invasive treatments, shaping the future of TAVR in the country's healthcare system.

The Asia Pacific region is anticipated to grow at a significant rate. The region's enormous potential is shown by the extrapolation of western prevalence data, indicating that between 250,000 and 300,000 Indian patients with aortic stenosis could benefit from TAVR.

In China, TAVR improvements are increasing with innovative valve technologies. For instance, Peijia Medical introduced its first- and second-generation TAVR devices in 2021 following regulatory clearance. With these advancements, more patients are becoming eligible for minimally invasive therapies for severe aortic valve diseases.

Japan's Transcatheter Aortic Valve Replacement market is also set for rapid growth, driven by advanced heart valve device designs and delivery systems that enhance outcomes for patients with severe aortic valve conditions. This technological progress is essential in addressing the increasing demand for minimally invasive cardiovascular procedures in Japan's aging population.

Based on the provided market data, Vantage Market Research offers customizations in the reports to meet the specific needs of clients.

Key Trends

- Minimally invasive preference: TAVR procedures are favored because they allow patients to avoid the risks and long recovery times associated with traditional open-heart surgery

- Expanded indications: Initially, TAVR was only approved for high-risk patients who couldn't undergo open surgery, but its success has led to approval for use in intermediate- and low-risk groups

- Technological advancements: Newer-generation valves are designed with enhanced durability and flexibility, making the implantation process smoother and reducing complications. Advanced delivery systems improve accuracy and control during the procedure, leading to better patient outcomes and fewer re-interventions

- Positive clinical outcomes: Studies and clinical trials continue to provide long-term data showing high success rates and patient survival following TAVR. This growing body of evidence reinforces the procedure's reliability and effectiveness, encouraging wider adoption by healthcare professionals

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Technological advancements in TAVR procedures play a pivotal role in driving market growth

Innovations in valve design, imaging techniques, and catheter technology have enhanced the safety, effectiveness, and accessibility of TAVR. For example, in January 2023, Abbott announced FDA approval for its latest TAVR system, Navitor, for high-risk aortic stenosis patients. Imaging techniques, like CT scans and 3D echocardiograms, increase accuracy and lower risk of complications. Catheter technological advancements have also resulted in smaller, more flexible devices, which further reduces invasiveness. These developments expand eligibility and enhance patient outcomes, making TAVR a practical choice for a larger group of patients.

The rising global geriatric population is a major factor driving the growth of the Transcatheter Aortic Valve Replacement market

Cardiovascular diseases such as aortic valve stenosis, which frequently necessitates TAVR procedures, are more common in older adults. According to WHO, the number of people over 60 will nearly treble to 2.1 billion by 2050. The demand for medical treatments for age-related conditions like aortic stenosis will increase as a result of this demographic transition. Since elderly patients are frequently high-risk for traditional surgery, the minimally invasive TAVR procedure offers a safer alternative.

High cost of TAVR procedures restraints the market growth

TAVR is an expensive procedure, often limiting access for patients in countries with underfunded healthcare systems or without comprehensive insurance coverage. It is less affordable for a larger population due to the high cost of the devices and the advanced technologies required.

Competitive Landscape

The Transcatheter Aortic Valve Replacement market is characterized by intense rivalry among key players such as Medtronic, Edwards Lifesciences, Boston Scientific, and Abbott, who dominate the global market. These companies focus on innovation, clinical trials, and expanding their product portfolios to maintain leadership. Technological advancements, such as minimally invasive techniques, improved valve designs, and next-generation devices, are driving competition. Additionally, regulatory approvals, strategic partnerships, and acquisitions further intensify market dynamics. With the growing aging population and increasing incidence of aortic stenosis, the TAVR market is expected to expand, attracting more entrants and intensifying the competitive environment.

The key players in the global Transcatheter Aortic Valve Replacement market include - Medtronic plc, Abbott Laboratories Inc., Boston Scientific Corporation, Meril Life Sciences Pvt. Ltd. Inc., Edwards Lifesciences Corporation, St. Jude Medical, Inc., JenaValve Technology Inc., Bracco SpA, Transcatheter Technologies GmbH. among others.

Recent Market Developments

FDA Approves Medtronic's Evolut FX+ TAVR System for Severe Aortic Stenosis Treatment

- In March 2024, Medtronic plc announced that its Evolut FX+ transcatheter aortic valve replacement (TAVR) system received approval from the U.S. Food and Drug Administration (FDA) for treating symptomatic severe aortic stenosis. The Evolut FX+ system builds on the valve performance of its predecessor while improving coronary access

egnite, Inc. and JenaValve Technology Announce Strategic Partnership to Improve Aortic Regurgitation Care

- In June 2023, egnite, Inc., a cardiovascular-focused digital health company, partnered with JenaValve Technology, Inc., a TAVR system developer. Their collaboration aims to enhance the understanding of patient outcomes for aortic regurgitation (AR)

Eisenhower Health Named First U.S. Edwards Benchmark Program Case Observation Site for TAVR Procedures

- In January 2024, Eisenhower Health became the first U.S. hospital designated as an Edwards Benchmark Program Case Observation Site for TAVR procedures in patients with aortic stenosis

The global Transcatheter Aortic Valve Replacement market can be categorized as Implantation Procedure, Material, Mechanism, End Use and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Implantation Procedure

By Material

By Mechanism

By End-Use

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Transcatheter Aortic Valve Replacement in terms of revenue?

-

The global Transcatheter Aortic Valve Replacement valued at USD 6.5 Billion in 2023 and is expected to reach USD 11.85 Billion in 2032 growing at a CAGR of 6.9%.

Which are the prominent players in the market?

-

The prominent players in the market are Medtronic plc, Abbott Laboratories Inc., Boston Scientific Corporation, Meril Life Sciences Pvt. Ltd. Inc., Edwards Lifesciences Corporation, St. Jude Medical, Inc., JenaValve Technology Inc., Bracco SpA, Transcatheter Technologies GmbH..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 6.9% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Transcatheter Aortic Valve Replacement include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Transcatheter Aortic Valve Replacement in 2023.

Vantage Market

Research | 28-Apr-2023

Vantage Market

Research | 28-Apr-2023