Takaful Insurance Market

Takaful Insurance Market - Global Industry Assessment & Forecast

Segments Covered

By Distribution Channel Agents & Brokers, Banks, Direct Response, Other Channels

By Type Family Takaful, General Takaful

By Application Personal, Commercial

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 28.50 Billion | |

| USD 81.30 Billion | |

| 14.00% | |

| Asia Pacific | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Market Synopsis:

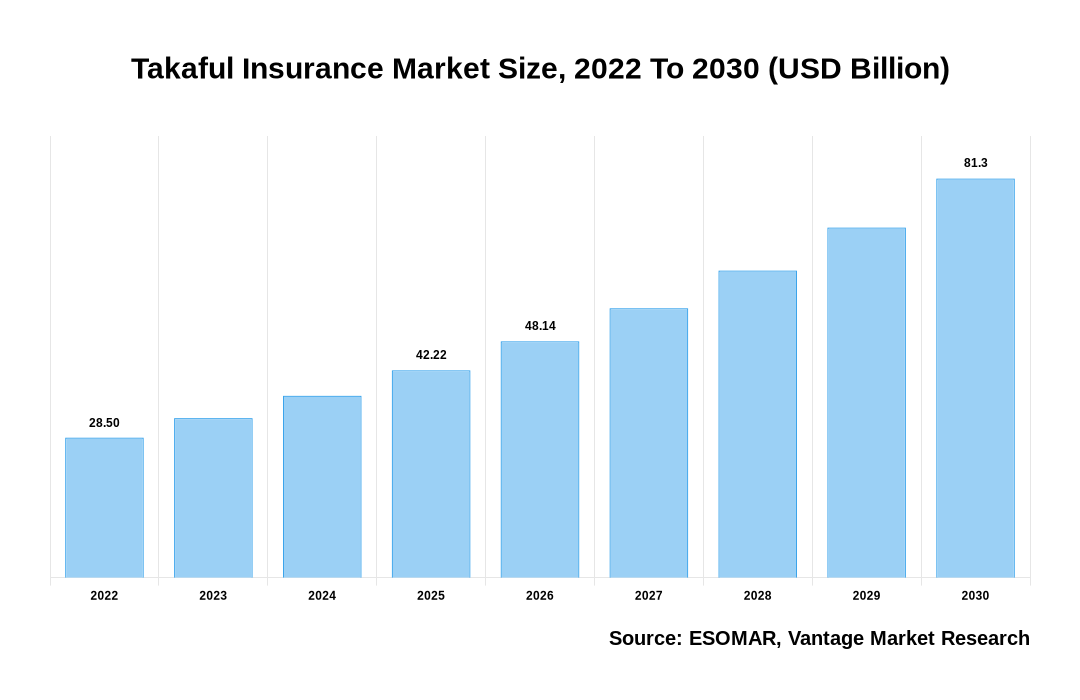

The Global Takaful Insurance Market was valued at USD 28.50 Billion in 2022 and is expected to reach a value of USD 81.30 Billion by 2030. The Global Market is anticipated to grow to exhibit a Compound Annual Growth Rate (CAGR) of 14.00% over the forecast period.

Takaful Insurance Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Takaful Insurance Market

Takaful Insurance is a sharia-compliant insurance system in which members pool their resources to support one another in the event of a loss, damage, or theft. The goal of Takaful Insurance is for people to work together, live in harmony, and protect one another from unforeseen events. Takaful policyholders make regular monetary contributions supervised and managed by a Takaful Management firm. Nonetheless, the excess money invested is used to make investments that assist policyholders achieve a more significant profit. Takaful Insurance is an insurance system based on the Islamic concepts of mutual help and giving, in which policyholders agree to guarantee each other and contribute to a pool or collective fund rather than pay premiums.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

A pool of collected donations creates the Takaful fund, and each participant's contribution is determined by the type of coverage necessary and their specific circumstances. A Takaful contract, like a traditional insurance policy, outlines the kind of risk and coverage period. A Takaful Insurance operator manages and administers the Takaful fund on behalf of the participants, collecting a fee to cover costs. Moreover, expanded knowledge of Takaful Insurance in both Muslim and non-Muslim countries has increased market penetration by providing better services than traditional insurance, which is a primary driving force behind market expansion.

Furthermore, the distribution of surplus funds among members in the event of no claims and the deployment of technology in the Takaful Insurance Market are two elements driving the market forward. However, lack of standardization due to differences in countries' willingness to amend Takaful Insurance rules, as well as a lack of awareness of the coverage included in Takaful Insurance policies, is some of the primary challenges impeding the Takaful Insurance Market's growth. In addition, Government actions, on the other hand, that assist the development of Takaful Insurance by making it easier for new companies to enter the market would enable new players to offer more innovative solutions to consumers. However, advancements in insurance technologies such as blockchain, predictive analysis, artificial intelligence, and others are likely to significantly improve the Takaful Insurance business in the following years.

Market Segmentation:

The Takaful Insurance Market is segmented based on Distribution Channel, Type, Application, and Region. Based on Distribution Channel, the market is further sub-segmented as Agents & Brokers, Banks, Direct Response, and Other Channels. Moreover, based on the Type segment, the market is sub-segmented as Family Takaful and General Takaful. Finally, based on the Application category, the market is sub-categorized as Personal and Commercial.

Based on Distribution Channel:

Based on the segment Distribution Channel, the Agents & Brokers sub-segment is expected to maintain its lead in the market during the projected period. This lead is attributed to independent Brokers & Agents leveraging many websites and online selling platforms, which has become a prominent trend in the market, as demand for tailored and personalized Takaful Insurance coverage grows. On the other hand, the direct response segment is predicted to develop significantly throughout the projection period, owing to increasing client preferences for acquiring Takaful Insurance directly and a growing number of benefits of direct sales, such as comparatively low production costs and others.

Based on Type:

Based on the Type segment, the Family Takaful sub-segment is expected to lead the market. Family Takaful is like traditional life insurance; it provides financial protection for you and your family, allowing you to live a better life free of financial worries. Investment-linked family takaful plans will enable you to increase your investment returns while still providing coverage and benefits to you and your dependents.

Asia Pacific Region to Stand Firm on its Leading Position in the Takaful Insurance Market

Asia Pacific is accounted to grow at the fastest Compound Annual Growth Rate (CAGR) during the forecast period. The rise is linked to increased awareness of Takaful Insurance benefits, which recent political and tragic events have fueled. Furthermore, demographic effects such as an expanding population base, a significant foreign workforce, and rising life expectancy are projected to impact Takaful Insurance demand positively. The region is expected to grow significantly during the forecast period, owing to increasing digitization in various Asian countries and the adoption of advanced technology by Takaful Insurance service providers to increase sales and market value, propelling the market in this region forward.

Competitive Landscape:

The key players in the Global Takaful Insurance Market include- Abu Dhabi National Takaful Co., Allianz, AMAN Insurance, Islamic Insurance, Prudential BSN Takaful Berhad, Qatar Islamic Insurance, SALAMA Islamic Arab Insurance Company, Syarikat Takaful Brunei Darussalam, Takaful International, Zurich Malaysia and others.

Segmentation of the Global Takaful Insurance Market:

| Parameter | Details |

|---|---|

| Segments Covered |

By Distribution Channel

By Type

By Application

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Takaful Insurance in terms of revenue?

-

The global Takaful Insurance valued at USD 28.50 Billion in 2022 and is expected to reach USD 81.30 Billion in 2030 growing at a CAGR of 14.00%.

Which are the prominent players in the market?

-

The prominent players in the market are Abu Dhabi National Takaful Co., Allianz, AMAN Insurance, Islamic Insurance, Prudential BSN Takaful Berhad, Qatar Islamic Insurance, SALAMA Islamic Arab Insurance Company, Syarikat Takaful Brunei Darussalam, Takaful International, Zurich Malaysia.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 14.00% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Takaful Insurance include

- Growth in demand of takaful insurance across Muslim majority countries

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Takaful Insurance in 2022.

Vantage Market

Research | 04-Jul-2022

Vantage Market

Research | 04-Jul-2022