Surgical Equipments Market

Surgical Equipments Market - Global Industry Assessment & Forecast

Segments Covered

By Products Surgical Sutures & Staplers, Handheld Surgical Equipment, Electrosurgical Devices, Other Surgical Equipment

By Categories Reusable Surgical Equipment, Disposable Surgical Equipment

By Applications Neurosurgery, Plastic & Reconstructive Surgeries, Wound Closure, Urology, Obstetrics & Gynecology, Thoracic Surgery, Microvascular, Cardiovascular, Orthopedic Surgery, Laparoscopy, Ophthalmic Applications, Veterinary Applications, Dental Applications, Other Applications

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 14.1 Billion | |

| USD 28.30 Billion | |

| 9.1% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Premium Insights

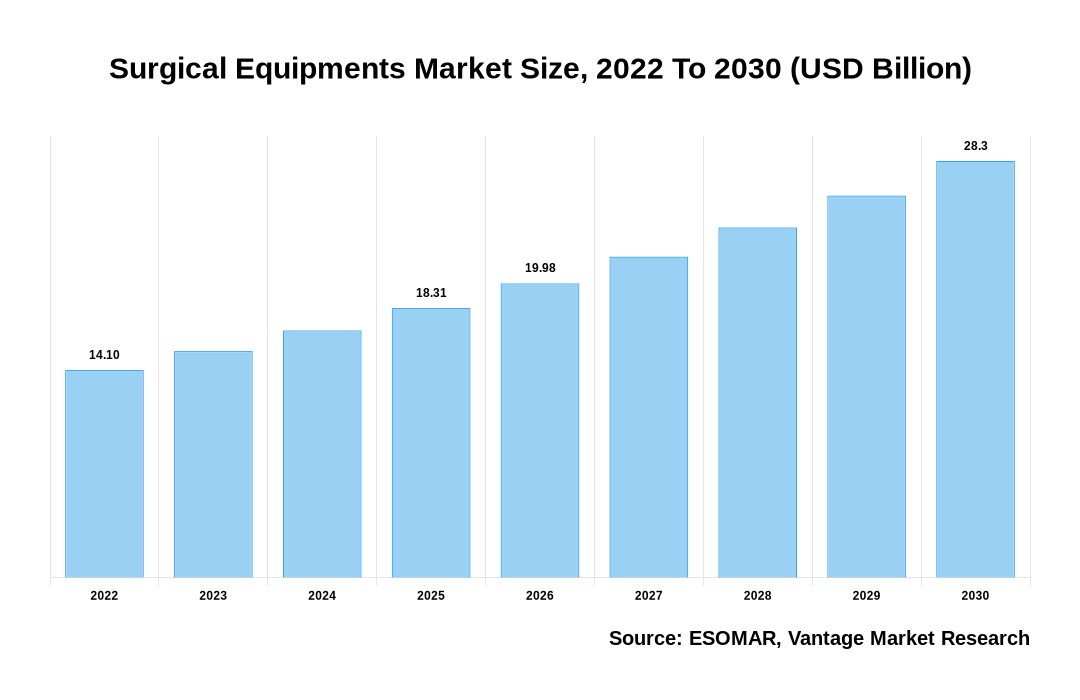

The global Surgical Equipments Market is valued at USD 14.1 Billion in 2022 and is projected to reach a value of USD 28.30 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 9.1% over the forecast period.

Surgical Equipments are tools or devices used to perform specific actions or carry out desired effects during a surgery or operation. These can include modifying biological tissue or providing access for viewing. The global Surgical Equipments market is expected to grow significantly during the forecast period owing to the rising geriatric population, the incidence of lifestyle disorders requiring constant surgeries, and growing healthcare costs. Additionally, studies have indicated a large number of unmet surgical needs. Furthermore, rising technological advancements in minimally invasive surgeries reduced hospital stay post-surgery, and an increased number of ambulatory surgical centers will fuel the growth of the Surgical Equipments market during the forecast period.

The increasing geriatric population is a key factor that will contribute to the market's growth. Individuals over 60 years are at a constant risk of developing disorders that might require constant surgeries compared to the younger population. According to the United Nations, there were more than 382 million people older than 60 years and above across the globe in 2017. This population is expected to increase to 2.1 billion by 2050. Rising awareness regarding non-invasive procedures combined with a cost-effective nature will likely contribute to the Surgical Equipments market during the forecast. According to the Centers for Disease Control and Prevention, increased hip replacements among people 45 and above was more than 310,000 in 2019.

Technological advancements within surgery pieces of equipment combined with rising investments by prominent manufacturers will provide ample growth opportunities for the Surgical Equipments market during the forecast period. Increased government initiatives for developing advanced healthcare infrastructure and favorable policies attract numerous FDIs in developed regions. Rising injuries such as sports injuries, road accident injuries, and increasing cardiac surgeries will further contribute to the global Surgical Equipments market during the forecast period. According to the World Health Organization, more than 32% of global deaths were linked to cardiovascular diseases in 2019. Additionally, according to the Orthopedic Journal of Sports Medicine, athletes in China showed a higher rate of injuries than American athletes. This tendency is expected to contribute to the market growth in China at an exponential rate.

Surgical Equipments Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Surgical Equipments Market

Cancellations of non-invasive surgeries during the COVID-19 pandemic created a backlog as the pandemic rolled on. These cancellations made a backlog that must be cleared after the COVID-19 disruption will account for a sudden growth of the global Surgical Equipments market. For instance, in April 2022, the Victorian government announced that they were investing more than USD 1.5 billion to address the growing number of elective surgery waitlists as part of a catch-up scheme that will increase the surgical capacity for one quarter. The COVID catchup plan is expected to increase capacity to 125% in 2020, with more than 400,000 surgeries planned over the next year.

Economic Insights

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

The likelihood of a US recession was essentially zero from September 2020 to March 2022, the initial phase of the global pandemic. The likelihood of a recession fell to 30% and 50% in April and May, respectively. This increased the possibility of a US economic downturn. Various recession models also forecast when an economic downturn will end. According to these projections, the short supply will be reduced by 70% before recessions end. As the protracted crisis between Russia and Ukraine began to play out in early 2022, the global economy began accelerating its growth. This protracted battle has significantly reduced the chances of a stable expanding state.

Top Market Trends

1. Rising Requirement of Surgeries: According to an article published by the "Estimation of the National Surgical Needs in India by Enumerating the Surgical Procedures in an Urban Community Under Universal Health Coverage", an estimated 5,000 surgeries will be required to meet the current surgical burden of diseases of 100,000 people in low- and middle-income countries. As per the source, the reported rate of surgeries vary from 295 in low and middle-income countries to 23,000 in high-income countries (HCIs).

2. Increasing Variation in Surgeries: As per the Organization for Economic Cooperation and Development (OCED), the number of cataract surgical procedures reported in 2020 in Turkey was 393,901. While the number of hip replacement surgeries in Italy in 2020 were, 84,647 and caesarean section procedures were approximately 114,601. These surgeries are expected to increase during the forecast period, fuelling the growth of Surgical Equipments market.

3. Technological Advancements: Various technological advancements are constantly taking place in the market. This gives rise to a diverse product portfolio among the dominant players that can deal with numerous complications and requirements. For instance, in March 2022, the British Deputy High Commission in Chennai, announced the unveiling of Freehand Robot. This is the first of its kind in laparoscopic Surgical Equipments.

4. Rising Health Insurance Coverage to Propel Growth: The growing amount of health insurance is gaining importance among developing economies, especially in India. Studies have indicated more than 15% of the total population in India is covered by government health insurance companies, while 2% is covered by private health insurance. Several private entities are entering the market, providing hospitals to provide cashless treatment to consumers. These factors are expected to increase the number of surgeries in India, fuelling the growth of the Surgical Equipments market in India.

Market Segmentation

The global Surgical Equipments market can be categorized on the following: Product, Category, Application, and Regions. Based on product, the market can be categorized into surgical sutures & staplers, handheld Surgical Equipments, electrosurgical devices, and other Surgical Equipments. By category, the market can be segmented across reusable Surgical Equipments and disposable Surgical Equipments. By application, the market can be fragmented across neurosurgery, plastic & reconstructive surgeries, wound closure, urology, obstetrics & gynecology, thoracic surgery, microvascular, cardiovascular, orthopedic surgery, laparoscopy, ophthalmic application, veterinary application, dental application, and others. Likewise, based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Product

Surgical Sutures & Staplers to Account for Largest Market Share Owing to Rising Utilization in Wound Closure Procedures

The surgical sutures and staplers’ segment is expected to dominate the Surgical Equipments market during the forecast period in terms of growth and sales. Factors such as increased adoption rate of sutures and staplers in wound closure procedures combined with rapid healing after usage is expected to contribute to the segmental growth. Additionally, a lower risk of infection combined with various technological advancements is expected to fuel the growth of surgical sutures and staplers. Various government initiatives are further adding to the segmental value. For instance, in June 2021, Ethicon Inc., announced that the National Institute for Health and Excellence (NICE) would issue new medical technological guidance for using sutures developed by the company in surgeries within the National Health Service. Handheld Surgical Equipments will grow with the fastest growing CAGR during the forecast period owing to an inclination towards disposable instruments.

Based on Category

Reusable Surgical Instruments to Occupy Largest Market Share While Disposable Equipment to Grow with the Fastest Growing CAGR

Reusable surgical instruments will dominate the global Surgical Equipments market in terms of sales and revenue. Factors such as rising surgeries post-pandemic are expected to contribute towards the segmental growth. The increased flow of patients in hospitals and specialty clinics combined with rising demand for aesthetic procedures is expected to widen the growth of reusable Surgical Equipments. The disposable Surgical Equipments will grow with the fastest growing CAGR during the forecast period owing to an ongoing trend of reducing cross-contamination and its cost-effectiveness.

Based on Application

Obstetrics & Gynecology to Dominate Market Owing to Rising Number of Birth

The obstetrics & gynecology segment is expected to account for the largest market share in the global Surgical Equipments industry. Factors such as rising number of childbirths during the forecast period is expected to contribute to the segmental growth. The rising prevalence of complications during procedures and increasing variations of women reproductive organ disorders, will give rise to the number of gynecology procedures performed. Studies have indicated a growing number of caesarean deliveries during the forecast period, which will contribute to the obstetrics & gynecology segment. The plastic and reconstructive surgeries will grow with the fastest growing CAGR during the forecast period owing to rising disposable income, technological advancements, and growing demand for improving appearance and aesthetic appeal.

Based on Region

North America to Fuel Largest Market Share Owing to the Presence of a Well-Established Healthcare System

The global Surgical Equipments market is expected to be dominated by the region of North America in terms of revenue and sales. Increasing healthcare expenditure and a well-established healthcare system will contribute to regional growth. The region is also home to numerous prominent manufacturers, primarily in the United States. Rising demand for minimally invasive surgeries and increasing consumer awareness will add to the North American Surgical Equipments market. Also, an ongoing prevalence of chronic diseases and a growing senior population will contribute to the market growth.

Asia Pacific will grow with the fastest growing CAGR during the forecast period owing to rising disposable income from emerging countries such as India, China, and Japan combined with an increasing number of plastic and reconstructive surgeries. Additionally, the increasing geriatric population in the region will lead to a rise in the number of orthopedic and cardiovascular procedures, fuelling the growth of the Asia Pacific Surgical Equipments market.

Competitive Landscape

The global Surgical Equipments market is extremely competitive due to the presence of numerous players. These players constantly innovate their product portfolios due to intense competition and rapid technological advancements. Additionally, these companies focus heavily on their research and development to include a broader range of products. Various strategies such as investments, partnerships, and mergers & acquisitions supplement the fragmented market growth.

The key players in the global Surgical Equipments market include - B. Braun SE (Germany), Boston Scientific Corporation (U.S.), CONMED Corporation (U.S.), Entrhal Medical GmbH (Germany), Fuhrmann GmbH (Germany), Smith & Nephew (U.K.), Zimmer Biomet (U.S.), Stryker (U.S.), Alcon Vision LLC (U.S.), Aspen Surgical (U.S.), Medtronic (Ireland), Ethicon Inc. (U.S.), BD (U.S.), KLS Martin Group (U.S.), MEDICON eG (Germany), KARL STORZ (Germany), Olympus Corporation (Japan), Erbe Elektromedizin GmbH (Germany), Integra LifeSciences (U.S.), Getinge AB (Sweden) among others.

Recent Market Developments:

· June 2022: Xenco Medical announced expanding their Ambulatory Surgical Center surgical device portfolio through the United States Food and Drug Administration clearance and launch of their Multilevel Cervikit. The product is a single-use cervical spine technology that includes a comprehensive suite of implants and single-use instruments for 2,3, and 4-level anterior cervical spine procedures.

· June 2022: Ethicon, a part of Johnson and Johnson MedTech, announced that they were launching the ECHELON 3000 Stapler in the United States. This digital device can provide surgeons with simple, one-handed powdered articulations for addressing a variety of unique requirements of their patients.

Segmentation of the Global Surgical Equipments Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Products

By Categories

By Applications

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Surgical Equipments in terms of revenue?

-

The global Surgical Equipments valued at USD 14.1 Billion in 2022 and is expected to reach USD 28.30 Billion in 2030 growing at a CAGR of 9.1%.

Which are the prominent players in the market?

-

The prominent players in the market are B. Braun SE (Germany), Boston Scientific Corporation (U.S.), CONMED Corporation (U.S.), Entrhal Medical GmbH (Germany), Fuhrmann GmbH (Germany), Smith & Nephew (U.K.), Zimmer Biomet (U.S.), Stryker (U.S.), Alcon Vision LLC (U.S.), Aspen Surgical (U.S.), Medtronic (Ireland), Ethicon Inc. (U.S.), BD (U.S.), KLS Martin Group (U.S.), MEDICON eG (Germany), KARL STORZ (Germany), Olympus Corporation (Japan), Erbe Elektromedizin GmbH (Germany), Integra LifeSciences (U.S.), Getinge AB (Sweden).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 9.1% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Surgical Equipments include

- Large pool of geriatric population and related rise in chronic diseases

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Surgical Equipments in 2022.

Vantage Market

Research | 31-Mar-2023

Vantage Market

Research | 31-Mar-2023