Surgical Drill Market

Surgical Drill Market - Global Industry Assessment & Forecast

Segments Covered

By Product Instrument, Accessories

By Application Orthopedic Surgeries, Dental Surgeries, ENT Surgeries, Others

By End Use Hospitals & Clinics, Ambulatory Surgical Centers, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 1.3 Billion | |

| USD 2.13 Billion | |

| 5.7% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

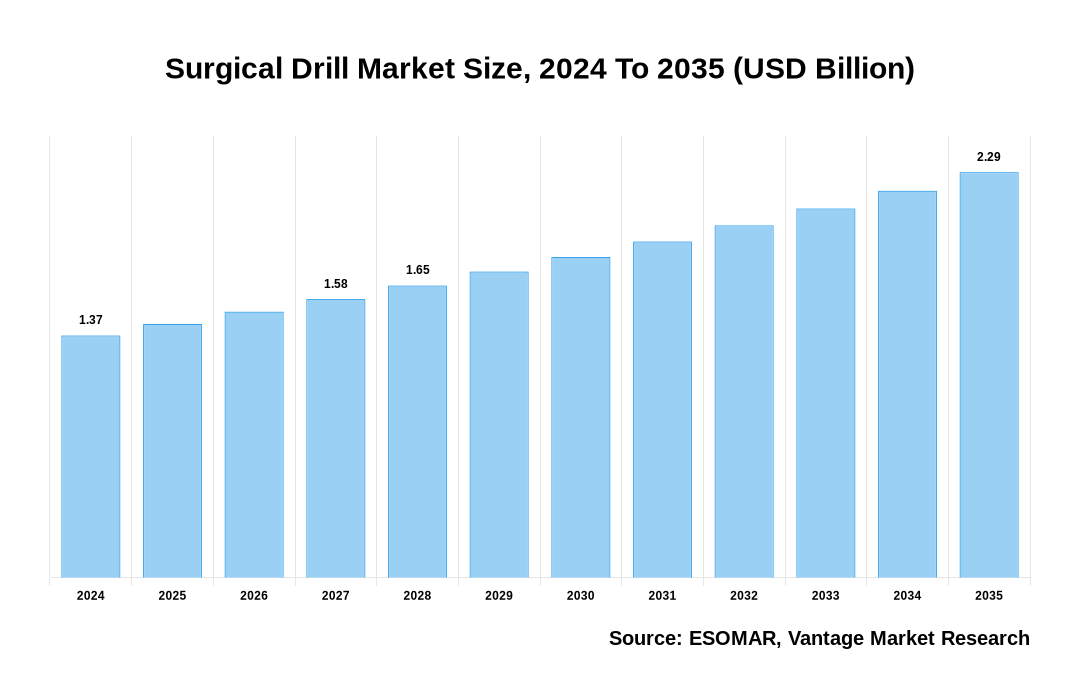

The global Surgical Drill Market is valued at USD 1.3 Billion in 2023 and is projected to reach a value of USD 2.13 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 5.7% between 2024 and 2032.

Key Highlights

- In 2023, North America led the market, capturing 37.5% market share due to the high incidence of orthopedic conditions, the prevalence of advanced healthcare infrastructure, and the rising number of surgical procedures, particularly in the U.S. and Canada

- The Asia Pacific region is expected to grow at significant CAGR projected throughout the forecast period

- By Product, Instrument dominated the market in 2023 with a market share of 63.2% because of the growing demand for precision surgical tools, advancements in drill technology, and the widespread use of surgical drills across various medical procedures

- Among various Application, the Orthopedic Surgeries segment accounted for the largest market share of 45.02% in 2023 owing to the increasing number of joint replacement surgeries, the aging population, and the rising prevalence of musculoskeletal disorders

- In 2023, by End Use, Hospitals & Clinics segment dominated with the market share of 50.1% due to the higher frequency of complex surgeries performed in these settings, the availability of skilled surgeons, and the adoption of cutting-edge surgical technologies in hospitals and clinics

Surgical Drill Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Surgical Drill Market

Regional Overview

North America Dominated Sales with a 37.5% share in 2023. This dominance is largely attributed to the region's advanced healthcare infrastructure, high adoption rate of innovative medical technologies, and the increasing prevalence of chronic conditions requiring surgical interventions. The US in particular plays a key role because of its well-established medical device sector, significant pool of highly skilled healthcare workers, and strong emphasis on healthcare spending. Furthermore, a high rate of surgical procedures and the existence of major market players support North America's dominant position in the industry.

The aging population in North America is another factor driving the market, as they are more susceptible to conditions including neurological diseases and orthopedic disorders that frequently require surgery. In addition, the region benefits from ongoing efforts to improve surgical outcomes through research and development as well as favorable reimbursement regulations.

The increased frequency of road accidents and the expanding demand for orthopedic operations are the main causes of this dominance. Moreover, strategic alliances and product approvals among major industry participants are driving up demand for surgical drills in the area. For instance, the Canadian Institute for Health Information (CIHI) reported that during 2023-2022, 117,000 hip and knee replacement surgeries were performed in Canada.

Application Overview

In 2023, the Orthopedic Surgeries segment dominated the market with the largest share of 45.02%. The Surgical Drill market, segmented by the Application, includes Orthopedic Surgeries, Dental Surgeries, ENT Surgeries, Others.

The rising incidence of orthopedic problems such fractures, arthritis, and joint replacement surgeries is the main cause of the dominance of orthopedic surgeries. The market share of this category has been greatly boosted by the use of improved surgical drills, which are driven by the need for accuracy and efficiency in orthopedic treatments.

The aging population and rising cases of sports injuries have also fueled the growth of the orthopedic surgeries segment. As the need for minimally invasive procedures continues to grow, surgical drills are becoming essential tools in orthopedic surgeries, further solidifying this segment's leading position.

The dominance is primarily due to the rising incidence of orthopedic disorders globally, leading to a higher number of patients requiring surgical interventions. For instance, according to research, the global incidence rate of knee arthritis was 203 per 10,000 individuals, with the total number of knee arthroplasty procedures expected to increase by 85.0%, reaching 1.26 million by 2030.

Top Trends

- Rising Demand for Minimally Invasive Surgery: There is a growing preference for minimally invasive surgical procedures, which require specialized surgical drills that are smaller, more precise, and capable of operating in confined spaces. This trend is driving innovation in the design and functionality of surgical drills, leading to the development of more sophisticated and versatile tools

- Advances in Battery-Powered Surgical Drills: Battery-powered surgical drills are gaining traction due to their portability, ease of use, and ability to operate without the constraints of power cords. These drills are particularly valuable in settings where mobility and ease of access are crucial, such as in emergency surgeries or in field hospitals

- Emphasis on Sterilization and Infection Control: With the growing concern over healthcare-associated infections (HAIs), there is a heightened emphasis on the sterilization of surgical drills. Businesses are developing drills with parts that can survive numerous sterilization cycles without sacrificing functionality or safety, making them easier to clean

Premium Insights

The Surgical Drill market is driven primarily by the increasing prevalence of chronic diseases and the rising number of surgical procedures worldwide. Joint replacements, spinal surgeries, and cranial treatments are among the orthopedic, dental, and neurological disorders that are more common as the world's population ages and demand for surgical interventions. Surgical drills are vital instruments in these procedures because they offer the accuracy and effectiveness required for positive outcomes. The need for surgical drills has also increased as a result of developments in minimally invasive surgical techniques, which frequently call for specialized, high-performance drilling equipment to shorten recovery times for patients and enhance surgical outcomes.

Technological innovation is another significant driver of the Surgical Drill market. Surgeons are using surgical drills more frequently as a result of next-generation models with characteristics including greater power-to-weight ratios, enhanced safety mechanisms, and improved ergonomics. Furthermore, the need for more advanced and adaptable drilling equipment is being driven by the integration of robotics and computer-assisted surgery. In addition to increasing surgical accuracy, these developments are also lowering the possibility of problems, which improves patient outcomes and gives medical professionals more confidence while utilizing these cutting-edge instruments.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

The increasing prevalence of various medical conditions, such as orthopedic disorders, dental issues, and neurological ailments, is leading to a rise in the number of surgical procedures performed globally

This surge in surgeries directly boosts the demand for surgical drills, which are essential tools in many of these procedures. As populations age and lifestyle-related health issues become more common, the frequency of surgeries, including joint replacements, spinal surgeries, and dental and Orthopedic implants, is expected to grow. For instance, American College of Rheumatology published in 2023 shows that approximately 790,000 total knee replacements and 450,000 hip replacement surgeries are performed annually in the U.S. More surgical drills are becoming necessary as hospitals and clinics look for ways to fill up on supply to meet the rising number of surgical cases.

The market faces challenges related to quality assurance and sterilization practices

In some regions, particularly in developing countries, there may be inadequate standards for the quality control of surgical instruments, including drills. Furthermore, improper sterilizing procedures increase the danger of infection, which is a major concern in surgical settings. These problems may discourage medical professionals from implementing new surgical drills since the danger of infection or malfunctioning of the equipment may be greater than the advantages. As a result, these difficulties could hinder market expansion, particularly in areas with weak regulatory control and healthcare systems.

The Surgical Drill market presents significant opportunities for companies to innovate and develop new products that cater to the evolving needs of healthcare providers

Surgical drills with improved safety features, including built-in sensors that may give real-time feedback during surgery, or drills made especially for particular kinds of operations, like minimally invasive surgeries, are becoming more and more popular. Businesses can stand out in a highly competitive market by concentrating on these developments and providing surgeons with goods that not only meet but surpass their safety and performance requirements. This emphasis on innovation has the potential to expand the Surgical Drill market.

Competitive Landscape

The Surgical Drill market is characterized by the presence of established medical device companies and innovative startups, each striving to enhance their market share through technological advancements and strategic partnerships. Key players focus on developing drills with improved precision, efficiency, and safety features to meet the evolving demands of surgeons and healthcare facilities. The market is also witnessing increased investment in R&D, leading to the introduction of advanced products such as smart drills with integrated sensors and robotics. Additionally, companies are expanding their global reach through mergers, acquisitions, and collaborations, aiming to strengthen their product portfolios and cater to the growing demand for minimally invasive surgical procedures.

The key players in the global Surgical Drill market include - Medtronic, Johnson & Johnson Services, Inc., Stryker, Apothecaries Sundries Manufacturing Co., ConMed Corporation, 3M, MicroAire, Zimmer Biomet, Arthrex, Inc., B. Braun SE among others.

Recent Market Developments

Myron Meditech Launches Dedicated Website for Orthopedic Bone Drills in January 2024

- In January 2024, Myron Meditech unveiled a new website focused exclusively on orthopedic bone drills. The platform provides comprehensive information on their cutting-edge bone drill technology, making it more accessible to healthcare professionals and aiding in informed purchasing decisions. This launch underscores Myron Meditech's dedication to innovation and customer engagement in the medical device sector

Osteotec Partners with Additive Surgical to Distribute Advanced Spinal Implants in the UK

- In June 2024, Osteotec entered into a partnership with Additive Surgical to distribute spinal implants in the UK. This collaboration seeks to improve the availability of advanced, additively manufactured spinal implants, aiming to enhance patient outcomes and expand Osteotec's orthopedic product range

McGinley Orthopedics Wins Innovative Technology Contract from Vizient for Intellisense Orthopedic Drill

- In February 2023, McGinley Orthopedics was awarded an Innovative Technology contract by Vizient for its Intellisense Orthopedic Drill. This recognition emphasizes the drill's advanced features, which enhance surgical precision and efficiency, potentially leading to better patient outcomes and more streamlined orthopedic procedures across Vizient's vast healthcare network

The global Surgical Drill market can be categorized as Product, Application, End Use and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product

By Application

By End Use

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Surgical Drill in terms of revenue?

-

The global Surgical Drill valued at USD 1.3 Billion in 2023 and is expected to reach USD 2.13 Billion in 2032 growing at a CAGR of 5.7%.

Which are the prominent players in the market?

-

The prominent players in the market are Medtronic, Johnson & Johnson Services, Inc., Stryker, Apothecaries Sundries Manufacturing Co., ConMed Corporation, 3M, MicroAire, Zimmer Biomet, Arthrex, Inc., B. Braun SE.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 5.7% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Surgical Drill include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Surgical Drill in 2023.