Sun Care Products Market

Sun Care Products Market - Global Industry Assessment & Forecast

Segments Covered

By Product Adult Sun Cream, Baby Sun Cream, After Sun, Fake Tan/Self Tan, Tanning

By Distribution Channel Hypermarket & Supermarket, Pharmacy & Drug Store, Specialty Store, Online, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 12.37 Billion | |

| USD 18.07 Billion | |

| 4.3% | |

| Asia Pacific | |

| Europe |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

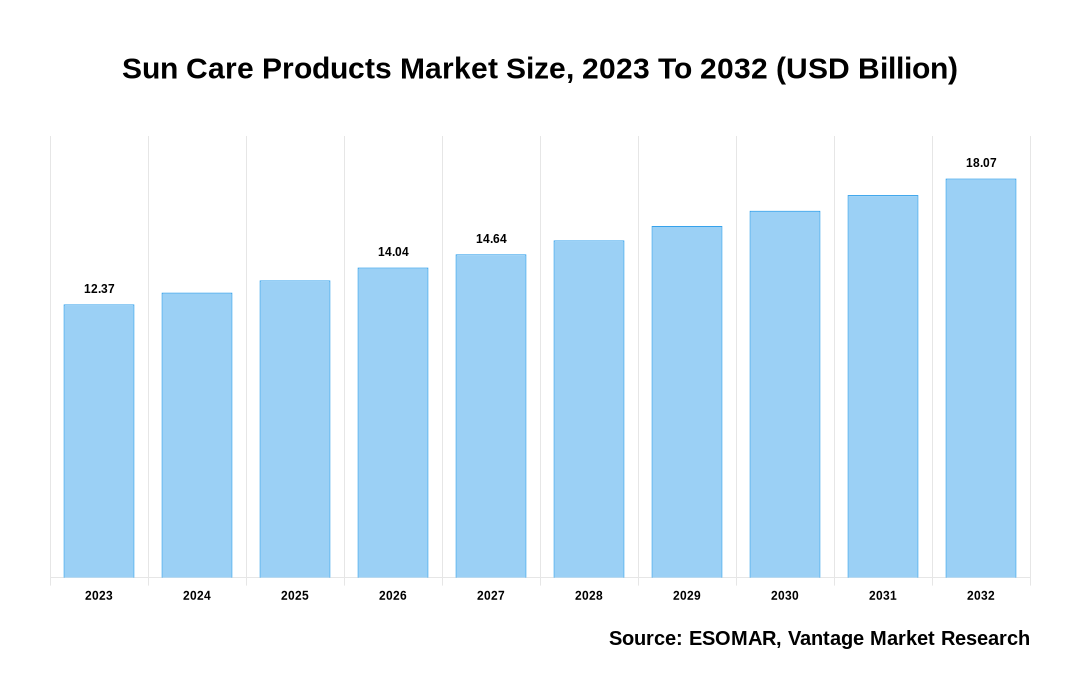

The global Sun Care Products Market is valued at USD 12.37 Billion in 2023 and is projected to reach a value of USD 18.07 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 4.3% between 2024 and 2032.

Key highlights of Sun Care Products Market

- Europe dominated the market in 2023, obtaining the largest revenue share of 36.2%

- The Asia Pacific will witness remarkable growth during the forecast period

- In 2023, the Adult Sun Cream segment dominated the Sun Care Products market with 68.8% market share

- The Hypermarket & supermarket segment continued to assert its dominance by Distribution Channel, capturing the largest market share of 49.02% in 2023

- A growing emphasis on personal grooming and skincare routines contributes to the increasing adoption of sun care products, with consumers seeking advanced formulations offering broad-spectrum protection and skin-nourishing benefits, thereby fueling the expansion of the Sun Care Products market

Sun Care Products Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Sun Care Products Market

Sun Care Products Market: Regional Overview

Europe Dominated Sales with a 41.5% share in 2023. The region has experienced a surge in sun care product demand, propelled by growing consumer awareness regarding the adverse effects of prolonged sun exposure on skin health. Many people from Europe suffer from skin cancer. For instance, The Netherlands had the highest rate of melanoma skin cancer cases among men in the European Union in 2022, with 54.2 incidences per 100,000 people. Denmark had the most significant rate of female infections—51.3 incidences per 100,000 people. This displays the incidence of melanoma skin cancer by gender in the nations that make up the European Union in 2022.

The introduction of sun protection products offering additional benefits like dark spot reduction and anti-aging properties has intensified this demand. Several factors contribute to this regional dominance, including heightened awareness from public health campaigns, stringent regulatory measures ensuring sunscreen efficacy and safety, and a deeply ingrained culture valuing skincare and beauty. Additionally, the prevalence of outdoor activities and tourism in European nations continues to bolster the need for sun care products, consolidating the region's position as a key market player.

U.S. Sun Care Products Market Overview

The US Sun Care Products market, valued at USD 2.74 Billion in 2023 to USD 3.87 Billion in 2032, is anticipated to grow at a CAGR of 3.9% from 2024 to 2032. Skin cancer ranks as a prevalent concern in the United States, driving increased demand for sun protection products due to the population's experiences with both skin cancer and aging-related skin issues. For instance, 1 in 5 Americans develops skin cancer by the age of 70, which highlights the pervasive nature of this disease, emphasizing the need for proactive measures in sun protection and regular skin screenings, according to the "Skin Cancer Foundation". The market is characterized by diverse products catering to various needs, from broad-spectrum protection to specialized formulations addressing specific skin concerns. Moreover, integrating advanced technologies and introducing environmentally friendly options reflect evolving consumer preferences and sustainability concerns.

The global Sun Care Products market can be categorized as Product, Distribution Channel and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product

By Distribution Channel

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Sun Care Products Market: Product Overview

In 2023, Adult Sun Cream generated a significant revenue of 68.8%. The product segment is divided into adult sun cream, baby sun cream, after-sun, fake/self-tan, and tanning. Adults are increasingly turning to sun creams, recognizing their benefits that go beyond just preventing sunburn and premature aging. They understand that these creams offer crucial protection against skin cancer, discoloration, and inflammation, making them an essential part of their skincare routine. For instance, according to skin cancer foundation, using SPF 15 sunscreen on a daily basis as recommended can reduce your risk of melanoma by 50% and squamous cell carcinoma (SCC) by approximately 40%. This widespread popularity among adults reflects their desire for comprehensive skin protection and overall well-being. The popularity is further driven by the cream's versatility, offering broad-spectrum protection to diverse skin types and preferences, as consumers prioritize preventive skincare routines. These creams often feature specialized formulations addressing specific concerns, including oiliness, sensitivity and water resistance for outdoor activities. At the same time, the availability of various SPF levels and textures caters to diverse preferences, solidifying their position as a leader of sun care routines worldwide.

Sun Care Products Market: Distribution Channel Overview

The Hypermarket & supermarket segment had a significant market share of 49.02% in 2023. The Distribution Channel segment is bifurcated into Hypermarkets & supermarkets, Pharmacies & drug stores, Specialty stores, Online, and Others. Sun care products are widely accessible and available through large-scale retail shops such as supermarkets and hypermarkets, which act as convenient hubs for consumers looking for a variety of sun protection alternatives that suit different budgets and preferences. These outlets, with their wide reach and promotional activities, play a crucial role in promoting consumer involvement and product visibility in the market. Moreover, hypermarkets and supermarkets provide sun care products and offer a range of skincare options for both men and women, often with trained personnel in the cosmetics and beauty aisles to offer expert assistance. This wide selection, coupled with the growing demand for cosmetics and limited shelf space, makes these outlets increasingly popular among consumers seeking convenience and choice in their skin care purchases.

Key Trends

- The adverse effects of UV radiation, such as skin cancer, early aging, and sunburn increases need for sun care solutions that provide broad-spectrum protection that is, protection against both kinds of UV radiation have increased.

- Traditional sunscreens were often criticized for being heavy, greasy, and leaving a white cast on the skin. Nowadays, consumers prefer sun care products with lightweight formulations that absorb quickly, feel comfortable on the skin, and don't leave a greasy residue, making them more pleasant to wear throughout the day.

- Demand for sunscreens that are safe for reefs and friendly to the environment has significantly increased as worries about the preservation of marine ecosystems and the degradation of coral reefs have grown. These items are made without hazardous chemicals, which are known to damage marine life and cause coral bleaching.

Premium Insights

According to WHO, skin cancers are the most frequently diagnosed cancer globally, with projections indicating over 1.5 million new cases in 2022. Within this, approximately 330,000 new cases of melanoma were diagnosed worldwide, resulting in nearly 60,000 deaths from the disease in the same year. The main factor driving the Sun Care Products market is consumers' increasing knowledge of the harmful effects of UV radiation on skin health, which is creating a demand for products which protect against skin cancer, premature aging, and sun damage. Innovations in formulations, such as water-resistant and eco-friendly options, cater to evolving consumer preferences, while the surge in outdoor recreational activities further boosts Sun Care Products market growth.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Growing awareness of the detrimental effects of UV radiation on skin health, such as premature aging and skin cancer driving the Sun Care Products market

As consumers become more known about the risks associated with unprotected sun exposure, they are increasingly inclined to prioritize sun protection and incorporate sun care products into their skincare routines. This heightened awareness drives demand for traditional sunscreens and stimulates interest in innovative formulations and products that offer enhanced UV protection and additional skincare benefits. As a result, manufacturers can capitalize on this trend by developing effective sun care solutions and leveraging educational campaigns to raise awareness and drive product adoption.

Increasing consumer preference for natural and organic sun care products presents significant opportunities for manufacturers to expand their product offerings

With growing concerns about synthetic chemicals and their potential impact on skin health and the environment, consumers are seeking safer and more eco-friendly alternatives in their skincare products, including sunscreens. Manufacturers develops natural and organic sun care formulations using plant-based ingredients, mineral sunscreens, and eco-friendly packaging. To cater the demand and lining up with consumers' preferences for sustainable and clean beauty products, companies are trying to differentiate themselves in the market and attract a broader customer base.

Competitive Landscape

The competitive landscape of the Sun Care Products market is characterized by a diverse array of key players striving for market share through innovation, product differentiation, and strategic partnerships. Established multinational corporations such as L'Oréal, Johnson & Johnson, and Beiersdorf AG maintain prominent positions, leveraging their extensive research capabilities, brand recognition, and global distribution networks to maintain a stronghold in the industry. Niche and up-and-coming companies are also gaining ground at the same time, taking advantage of consumer demand for natural, organic, and customized sun care products. Additionally, collaborations between skincare brands and dermatologists and incorporating advanced technologies like UV monitoring and personalized formulations shape the competitive landscape, drive competition, and foster continuous evolution within the Sun Care Products market.

The key players in the global Sun Care Products market include - Beiersdorf AG, Groupe Clarins, Johnson & Johnson, Coty Inc., Shiseido Co. Ltd., L'oreal, CJ Olive Young Corporation, POPxo, The Estee Lauder Companies Inc., Burt's Bees, Bioderma Laboratories, Unilever among others.

Recent Market Developments

- In 2023, The South Korean health and beauty products retailer CJ Olive Young Corporation introduced its line of Greentea Cica Mild suncare sticks in the Japanese market. Plaza, the Japanese lifestyle retailer, sells the product.

- In 2022, POPxo increased the scope of its product line by introducing the POPxo Sun Care line through the ekdoteenapplysunscreen campaign in India.

- In May 2022, L'Oréal announced the release of UVMune 400, a new product with UV filtering technology that shields the skin against ultra-UVA radiation.

- In February 2022, with two debuts skincare brand Beiersdorf is starting a new chapter in the North American market. As part of its global Research and Development strategy, the corporation launched a brand-new Innovation Center in Florham Park, New Jersey. It also opened its new headquarters for North America in Stamford, Connecticut.

FAQ

Frequently Asked Question

What is the global demand for Sun Care Products in terms of revenue?

-

The global Sun Care Products valued at USD 12.37 Billion in 2023 and is expected to reach USD 18.07 Billion in 2032 growing at a CAGR of 4.3%.

Which are the prominent players in the market?

-

The prominent players in the market are Beiersdorf AG, Groupe Clarins, Johnson & Johnson, Coty Inc., Shiseido Co. Ltd., L'oreal, CJ Olive Young Corporation, POPxo, The Estee Lauder Companies Inc., Burt's Bees, Bioderma Laboratories, Unilever.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 4.3% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Sun Care Products include

- Growing awareness of the detrimental effects of UV radiation on skin health, such as premature aging and skin cancer driving the {{Keyword}} market

Which region accounted for the largest share in the market?

-

Europe was the leading regional segment of the Sun Care Products in 2023.