Spinal Implants Market

Spinal Implants Market - Global Industry Assessment & Forecast

Segments Covered

By Product Type Spinal Fusion Devices, Non-Fusion Devices, Spine Biologics, Others

By Material Metallic Material, Polymers Material, Ceramic Material, Others

By Procedure Open Surgery, Minimally Invasive Surgery

By End User Hospitals, Orthopedic Centers, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Snapshot

| 2024 | |

| 2025 - 2035 | |

| 2019 - 2023 | |

| USD 9.8 Billion | |

| USD 16.1 Billion | |

| 6.4% | |

| Europe | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

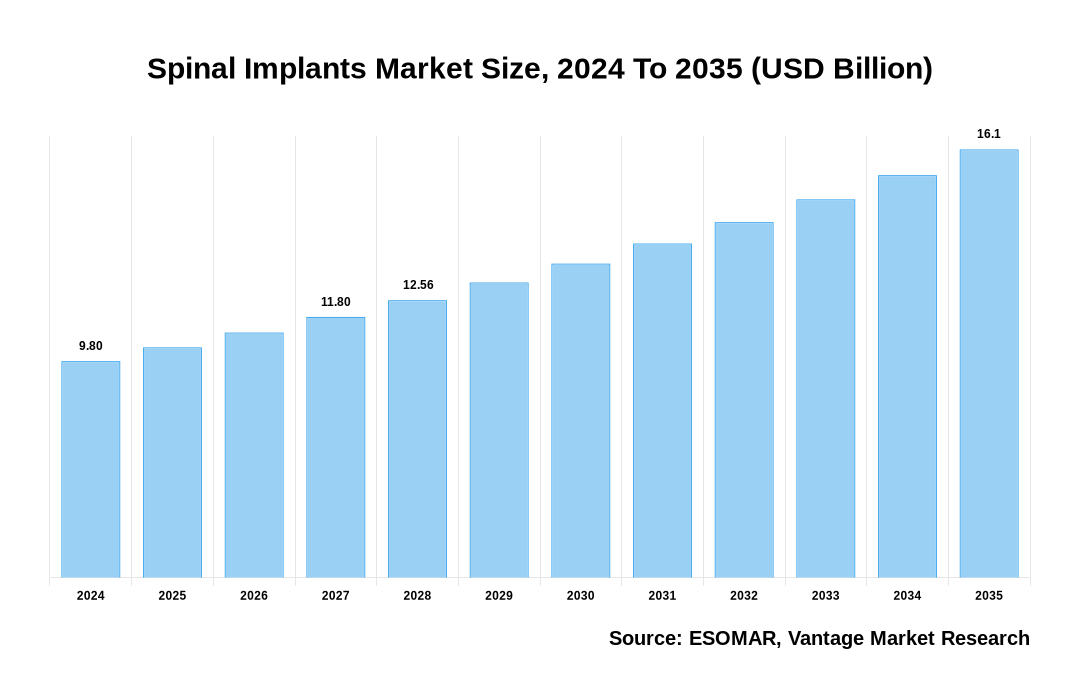

The global Spinal Implants Market is valued at USD 9.8 Billion in 2024 and is projected to reach a value of USD 16.1 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 6.4% between 2025 and 2035.

Spinal implants are specialized medical devices used in surgical procedures to stabilize and support the spine. They play a crucial role in correcting spinal deformities, alleviating pressure on the spinal cord and nerves, and promoting the healing of vertebral structures. Commonly used implants include rods, screws, plates, and interbody cages, crafted from materials like titanium, stainless steel, or bioresorbable polymers. Spinal implants are integral to surgeries such as spinal fusion, decompression, and the treatment of spinal fractures or deformities. By providing structural support, spinal implants help restore mobility and enhance the quality of life for individuals with spinal conditions.

Key Highlights

- In 2024, based on the Product Type, the Spinal Fusion Devices category accounted for significant market share of 59.20%.

- In 2024, based on the Procedure, the Open Surgery category accounted for significant market share of 58.40%.

- In 2024, based on the End User, the hospitals category holds the largest market share

- In 2024, based on the Material, the Metallic Material category holds the largest market share in Spinal Implants market

- North America dominated the Spinal Implants market with largest market share of 37.58% in 2024

- Europe region is anticipated to grow at the highest CAGR during the forecast period

Spinal Implants Market Size, 2024 To 2035 (USD Billion)

AI (GPT) is here !!! Ask questions about Spinal Implants Market

Product type Overview

The product type segment is divided into Spinal Fusion Devices, Non-Fusion Devices, Spine Biologics, and Others. The Spinal Fusion Devices category is divided into Thoracic & Lumbar Fusion Devices, Cervical Fusion Devices, Expandable Fusion Cages, and Others. The Spinal fusion devices segment held the largest share of 59.20% in the Spinal Implants market.

The spinal fusion devices segment is driven by aging population and increasing prevalence of spinal disorders also contribute to the high demand for segment. spinal fusion surgeries are commonly performed to treat various spinal conditions such as degenerative disc disease, spondylolisthesis, and fractures. The spinal implants surgeries involve the use of spinal fusion devices, which help stabilize and align the spine, promoting bone growth and healing. For instance, in November 2023, Orthofix Medical Inc., a leading global spine and orthopedics company, announced the full U.S. commercial launch of the WaveForm® L Lateral Lumbar Interbody System. Designed for lateral lumbar interbody fusion (LLIF) procedures, the 3D-printed WaveForm L features a porous structure that prioritizes strength and stability to provide a robust fusion environment.

The expansion of Spinal Implants market’s non-fusion devices can be credited to the availability of diverse spinal implants stimulators, the non-fusion device segment is driven by global prevalence of spinal disorder and the growing elderly demographic. Non-Fusion procedures typically entail minimal disturbance to adjacent tissues, potentially leading to expedited recovery periods when contrasted with conventional fusion surgeries. Also, the market’s growth is further boost by the introduction of advance spinal surgery technologies by industry players.

Procedure Overview

The procedure segment is divided into open surgery, and minimally invasive surgery. The open surgery segment held the largest share of 58.4% in the Spinal Implants market.

The open surgery can be attributed to the widespread adoption of traditional open surgical techniques for complex spinal conditions requiring clear visualization and precise implant placement. Open surgeries are often preferred for treating severe spinal deformities, fractures, or tumors, where extensive access is necessary to achieve optimal outcomes. Despite the growing interest in minimally invasive procedures, the proven efficacy, accessibility, and broader surgeon familiarity with open surgical methods continue to drive their significant market presence in the spine implants sector.

Minimally invasive surgeries are associated with less tissue damage, reduced blood loss, and faster recovery times compared to traditional open surgeries. This has led to an increasing preference for minimally invasive procedures among patients and surgeons, driving the demand for spinal implants that can be used in these surgeries. For instance, in September 2024, Medtronic plc, the global leader in medical technology, announced the latest additions to its minimally invasive spine surgery ecosystem, making it the only company to combine spinal implants, biologics, navigation, robotics, and AI-powered data to surgeons and patients.

Material Overview

The Material segment is divided into metallic material, polymers material, ceramic materials, and others. The metallic material segment held the largest market share in 2024 for Spinal Implants market.

The metallic material segment is driven by the widespread use of materials like titanium and stainless steel, known for their superior strength, biocompatibility, and corrosion resistance. Metallic implants provide excellent stability and durability, making them ideal for various spinal procedures such as fusion and fracture repair. Additionally, advancements in metallurgical technologies have enhanced the performance of these materials, further solidifying their position as the preferred choice among surgeons and patients alike.

End User Overview

The End User segment is divided into hospitals, orthopedic centers and others. The hospitals segment held the largest market share in 2024 for Spinal Implants market.

Some of the procedures offered at hospitals are microscopic minimally invasive spinal decompression, laser-assisted endoscopic discectomy, percutaneous spinal fusion surgery, and total disc replacement surgery. Furthermore, hospitals are generally well equipped for carrying out spinal implant procedures and are generally more preferred, that’s the major reason for driving the hospital segment in Spinal Implants market.

Regional Overview

In 2024, the North America captured largest revenue share of 37.58%.

North America Spinal Implants market is driven by developed healthcare infrastructure, increasing spinal cord injury cases, increasing prevalence of spinal disorders and injuries in the region, which has led to a growing demand for advanced spinal implant technologies, and the presence of a large number of market players in the region According to shepherd centers, spinal cord injuries tend to affect more men than women, and nearly half of people who sustain a spinal cord injury are between the ages of 16 and 30 due to the increased likelihood of risky behaviors. Also, North America is a home to many prominent players in the spinal implant industry, which has fueled innovation and advancements in technology, leading to increased adoption rates among patients and healthcare professionals.

U.S. Spinal Implants Market

The U.S. Spinal Implants market is driven by companies are actively pursuing FDA clearance for their spinal fixation systems to comply with rigorous safety and efficacy standards established by regulatory authorities. This focus on meeting stringent requirements not only ensures product reliability but also supports their efforts to expand globally, thereby driving growth of Spinal Implants market within the country. For instance, in March 2024, Bioretec Ltd., a pioneer in biodegradable orthopedic implants, has been granted Breakthrough Device Designation for its RemeOs™ Spinal Interbody Cage implant from the US Food and Drug Administration, confirming that the product represents a breakthrough technology in spinal surgery. RemeOs Spinal Interbody Cages are intended to be used to restore intervertebral height and facilitate intervertebral body fusion in the cervical spine.

Europe Spinal Implants Market

The European Spinal Implants market is expected to account for a substantial share driven by increasing incidence of road accidents leading to spinal injuries. Additionally, the aging population in Europe is experiencing a rise in spinal deformities such as disc compression, further driving the need for advanced spinal surgery solutions. Also, the changing perception of patients about the benefits of spinal implants and the availability of advanced implant materials and designs will further boost the market's expansion in the region.

Key Trends

- Integration of Robotic-Assisted Surgery: Robotic systems are being incorporated for precision implant placement, reducing human error and improving outcomes

- Rising Prevalence of Spinal Disorders: Increasing cases of degenerative disc disease, spondylolisthesis, and spinal deformities are driving the demand for spine implants

- Technological Advancements: Innovations such as 3D-printed implants, motion-preserving devices, and bioresorbable materials are transforming the market landscape

- Growing Adoption of Minimally Invasive Surgeries: Surgeons are increasingly favoring minimally invasive techniques for faster recovery and reduced postoperative complications

- Focus on Biocompatible Materials: Increased use of titanium, polyetheretherketone (PEEK), and other biocompatible materials for enhanced durability and patient safety

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Rising Prevalence of Spinal Disorders

The increasing prevalence of spinal disorders such as degenerative disc disease, scoliosis, and spinal stenosis is a major factor driving the demand for Spinal Implants market. With an aging population and the rise of sedentary lifestyles, the occurrence of these conditions is growing, leading to a higher demand for surgical treatments. Patients experiencing chronic back pain and mobility challenges are increasingly opting for surgical solutions, encouraging healthcare providers to utilize advanced spinal implant technologies. These implants not only improve patients' quality of life but also enable faster recovery and better surgical outcomes.

Advancements in Technology

Advancements in spinal implant design and materials are opening up substantial market opportunities, particularly through innovations like minimally invasive techniques, 3D printing, and smart implant technology. Minimally invasive surgeries are gaining traction as they offer faster recovery, reduced scarring, and lower surgical risks, making them highly appealing to both patients and healthcare providers. Additionally, 3D printing enables the production of customized implants tailored to an individual’s anatomy, resulting in a precise fit and improved performance. Meanwhile, smart implants equipped with sensors provide real-time data monitoring, facilitating personalized post-operative care and significantly enhancing patient outcomes.

Competitive Landscape

The Spinal Implants market is characterized by the presence of both established players and emerging companies, each strive for market share through product innovation, strategic partnerships, and geographic expansion. Industry giants like Alphatec, Globus Medical, Johnson & Johnson Services Inc, Medtronic Inc, NuVasive Inc, Stryker Corporation, Zimmer Biomet Holdings Inc, Orthofix Medical Inc, Ulrich Medical, Spineart. Key market companies in the Spinal Implants market are investing heavily in research and development to enhance their product offerings, thereby driving market growth. These players are also adopting various strategic measures to expand their global reach, such as entering into contractual agreements, increasing investments, pursuing mergers and acquisitions, and collaborating with other organizations.

The key players in the global Spinal Implants market include - Alphatec, Globus Medical, Johnson & Johnson Services Inc, Medtronic Inc, NuVasive Inc, Stryker Corporation, Zimmer Biomet Holdings Inc, Orthofix Medical Inc, Ulrich Medical, Spineart among others.

Recent Market Developments

Proprio Announces Strategic Partnership with Biedermann to Revolutionize Surgery Through AI-Powered Guidance

- In April 2024, Proprio, the leader in AI-powered surgical technology, today announced a landmark multi-phase partnership with the Biedermann Group, the prominent innovator in next generation spinal implant systems and procedural solutions. Initially, the companies will collaborate to integrate Biedermann's advanced spinal implants with Proprio’s Paradigm system, which harnesses AI, computer vision, and augmented reality to provide unprecedented real-time visualization and guidance to surgeons in the operating room

DePuy Synthes Receives FDA Clearance for the TriALTIS™ Spine System and Navigation Enabled Instruments

- In October 2023, Johnson & Johnson MedTech announced that DePuy Synthes, The Orthopaedics Company of Johnson & Johnson, has secured 510(k) clearances from the U.S. Food and Drug Administration (FDA) for the TriALTIS™ Spine System and for TriALTIS™ Navigation Enabled Instruments

The global Spinal Implants market can be categorized as Product type, Material, Procedure, End User and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product Type

By Material

By Procedure

By End User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Spinal Implants in terms of revenue?

-

The global Spinal Implants valued at USD 9.8 Billion in 2024 and is expected to reach USD 16.1 Billion in 2035 growing at a CAGR of 6.4%.

Which are the prominent players in the market?

-

The prominent players in the market are Alphatec, Globus Medical, Johnson & Johnson Services Inc, Medtronic Inc, NuVasive Inc, Stryker Corporation, Zimmer Biomet Holdings Inc, Orthofix Medical Inc, Ulrich Medical, Spineart.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 6.4% between 2025 and 2035.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Spinal Implants include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Spinal Implants in 2024.