Smart Meters Market

Smart Meters Market - Global Industry Assessment & Forecast

Segments Covered

By Type Smart Electric Meter, Smart Gas Meter, Smart Water Meter

By Technology AMI, AMR

By Component Hardware, Software

By End User Residential, Commercial, Industrial

By Communication RF, PLC, Cellular

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 22.8 Billion | |

| USD 50.35 Billion | |

| 9.2% | |

| Europe | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

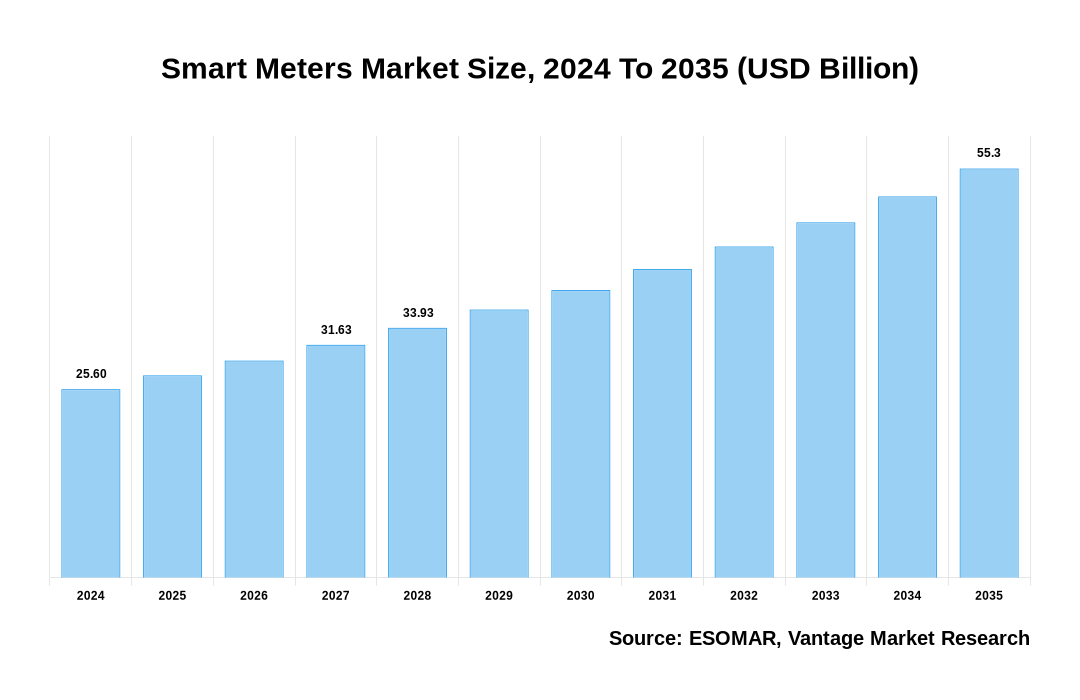

The global Smart Meters Market is valued at USD 22.8 Billion in 2023 and is projected to reach a value of USD 50.35 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 9.2% between 2024 and 2032.

Key highlights of Smart Meters Market

- The Asia Pacific region dominated the market in 2023, obtaining the largest revenue share of 47.2%,

- The European region will witness remarkable growth with a CAGR during the forecast period,

- In 2023, the Smart Electric Meter segment dominated the Smart Meters market with significant market share of 47.1%,

- The AMI Technology segment dominated the market with largest market share in 2023,

- In 2023, the Residential segment dominated the Smart Meters market with 70.2% market share,

- The rise of IoT and advancements in communication technologies further drives the adoption of smart meters by enabling seamless data transmission and connectivity.

Smart Meters Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Smart Meters Market

Smart Meters Market: Regional Overview

Asia Pacific Dominated Sales with a 47.2% share in 2023. Asia Pacific's leadership position is driven by rapid urbanization, significant investments in smart grid infrastructure, and government programs supporting energy efficiency and the integration of renewable energy sources. Large-scale smart city efforts and strict legal requirements to update outdated utility infrastructures in nations like China, Japan, and India are driving this expansion. China, the leading segment in Asia Pacific, is approaching full deployment of smart meters, driven by strict mandates from its two main grid companies, South China and State Grid. As China nears full rollout, annual demand is expected to decrease, but the country remains a major manufacturer and consumer of smart meters, dominated by state-owned enterprises. Japan plans to install up to 80 million smart meters by 2024 and invest JPY 20 trillion (USD 155 billion) in new power grid technology, energy-saving homes, and other initiatives to lower its carbon footprint.

Smart Meters Market: Type Overview

The Smart Electric Meter segment dominated the Smart Meters market with the largest share of 47.1% in 2023. The Smart Meters market, segmented by the Type, is bifurcated into Smart Electric Meter, Smart Gas Meter and Smart Water Meter. The ability of smart electric meters to optimize electricity distribution, improve grid reliability, and assist energy-saving measures propels the Smart Meters market dominance. Smart electric meter adoption is largely driven by government policies and incentives that are intended to lower carbon emissions and improve energy efficiency. The acceleration of urbanization and growing smart city efforts drives the Smart Meters market. As global power production increased by 2.3% in 2022, government support and investments are expected to accelerate the deployment of smart meters worldwide.

Smart Meters Market: Technology Overview

In 2023, the significant revenue was generated by AMI. The Smart Meters market, segmented by the Technology, is divided into AMI and AMR. AMI systems which comprise data management systems, communication networks, and smart meters are essential for improving energy management, supplying real-time data, and strengthening grid adoption. AMI makes it feasible for consumers to communicate in both directions, which improves demand adaptability, accuracy of billing, and effectiveness of outage management. AMI's abilities are enhanced by using its integration with IoT, AI, and ML technologies, which makes it an excellent choice for utilities looking to modernize their infrastructure.

Smart Meters Market: End User Overview

The Residential segment dominated the Smart Meters market with the largest share of 70.2% in 2023. The Smart Meters market, segmented by the End-User, is bifurcated into Residential, Commercial and Industrial. The widespread installation of smart meters in homes to enhance power efficiency, deliver accurate billing, and give clients comprehensive insights into their power usage is driving the dominance of smart meters in residential systems. This market is similarly supported through government regulations and incentives designed to lower residential power use and include renewable energy resources. The growing reputation of smart home technology and rising customer focus regarding power performance are additional factors contributing to the high adoption rates in the market.

Key Trends

- Consumer-centric energy solutions are becoming more and more popular. Smart meters give consumers comprehensive information about how much energy they use, enabling them to make better decisions and engage in more energy-saving activities.

- There is a growing trend towards integration of AI, ML, and IoT technologies in smart meters. This allows for automated problem detection, predictive analytics, and sophisticated data management. Better grid management, more economical energy use, and individualized consumer information are made possible by these advancements.

- There is a growing emphasis on ensuring the cybersecurity of smart meter gadgets and safeguarding customer information. In order to alleviate these concerns and gain back customers' trust, industry participants are investing heavily in security measures.

Premium Insights

The Smart Meters market is being driven by the increasing demand for real-time monitoring and management of utility systems, which enhances operational efficiency and reliability. The rising focus on sustainability and the integration of renewable energy sources necessitates the use of advanced metering solutions for efficient energy distribution. The market is growing as a result of growing customer awareness, the requirement for precise billing, and developments in AI and ML that provide smart metering systems more analytical and predictive power.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

The adoption of smart meters is accelerating due to their ability to provide real-time data on energy, water, and gas usage

These devices enable utilities to monitor their systems continuously, improving efficiency and reliability. Real-time facts reduce time and lowers operating costs through enabling the quicker detection and correction of problems like outages, leaks, or inefficiencies. Smart meters offer users with complete usage pattern insights, encouraging more responsible and sustainable energy consumption practices. Adoption of smart meters is also being pushed through governments and regulatory organizations as part of larger smart grid projects that support environmental objectives, enhance electricity safety, and consist of renewable electricity resources.

The Smart Meters market faces significant challenges like economic factors and budgetary constraints have led to a decline in infrastructure development investments, which are crucial for the deployment of smart meters

Utilities often require substantial capital to upgrade existing infrastructure to support smart meter technology, and in times of economic downturn or fiscal tightening, such investments are often postponed or scaled back. Additionally, the ROI on smart meter projects can be lower than anticipated. The high initial costs of purchasing and installing smart meters, coupled with the costs associated with system upgrades and maintenance, can result in long payback periods. Smaller utilities and those operating in areas with low economic resources are more affected financially, making it challenging for them to justify the expense.

Competitive Landscape

The competitive landscape of the Smart Meters market is characterized by rapid technological advancements, significant investments in infrastructure, and a growing emphasis on energy efficiency and sustainability. Established technological giants like Siemens, Itron, and Honeywell are important players in the market because they use their vast R&D resources and global reach to stay dominant. For instance, in 2022, Landis+Gyr will be showcasing the newest hardware and software solutions for electricity, heat, gas, and water metering.

The key players in the global Smart Meters market include - Neptune Technology Group Inc. (U.S.), Honeywell International Inc. (U.S.), Suntront Technology (China), Wasion Group (Hong Kong), Aichi Tokei Denkei Co. Ltd. (Japan), Badger Meter (U.S.), Sensus (U.S.), Holley Metering Ltd. (China), Siemens AG (Germany), Kaifa Technology (China) among others.

Recent Market Developments

- In January 2023, The Water and Sanitation Corporation (WASAC) in Kigali, the capital of Rwanda, selected Diehl Metering for meter technology to update its network for its sustainability initiatives, according to a January 2023 announcement from Diehl Stiftung & Co. KG. WASAC acknowledged that AURIGA was a good fit for achieving its main goal of lowering non-revenue water by putting up trustworthy meters. A future AMR solution will be built around the AURIGA water meter.

- In September 2022, using a variety of bearer services, including 4G, NB-IoT, and RF Mesh, EDMI has introduced their brand MIRA, which is communications agnostic and allows end-to-end visibility and control based on industry standard protocols including DLMS, IDIS, and LWM2M.

- In November 2022, in order to support utilities and cities in their goal of connecting with customers to speed the modernization of energy, water, and smart solutions supplied in international markets, Itron, Inc. has teamed with a variety of technological innovators, consultants, service providers, and channel partners.

The global Smart Meters market can be categorized as Type, Technology, Component, End User, Communication, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Technology

By Component

By End User

By Communication

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Smart Meters in terms of revenue?

-

The global Smart Meters valued at USD 22.8 Billion in 2023 and is expected to reach USD 50.35 Billion in 2032 growing at a CAGR of 9.2%.

Which are the prominent players in the market?

-

The prominent players in the market are Neptune Technology Group Inc. (U.S.), Honeywell International Inc. (U.S.), Suntront Technology (China), Wasion Group (Hong Kong), Aichi Tokei Denkei Co. Ltd. (Japan), Badger Meter (U.S.), Sensus (U.S.), Holley Metering Ltd. (China), Siemens AG (Germany), Kaifa Technology (China).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 9.2% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Smart Meters include

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Smart Meters in 2023.