Smart Home Market

Smart Home Market - Global Industry Assessment & Forecast

Segments Covered

By Smart Lighting: Smart Bulbs, Smart Switches, Lighting Control Systems, Dimmers and Color Changing Lights

By Smart Thermostats Programmable Thermostats, Learning Thermostats, Zoned Heating and Cooling Systems

By Home Security and Surveillance: Smart Cameras, Video Doorbells, Motion Sensors, Window and Door Sensors, Security Alarms

By Smart Appliances: Smart Refrigerators, Smart Washing Machines, Smart Ovens, Smart Dishwashers, Smart Coffee Makers, Smart Vacuums

By Home Entertainment and Audio Systems: Smart TVs, Home Theater Systems, Streaming Devices, Smart Speakers, Soundbars, Multi-room Audio Systems

By Smart Energy Management Smart Meters, Energy Monitoring Systems, Home Energy Management Platforms, Solar Energy Systems, Smart Power Strips, Smart Plugs

By Region North America, Europe, Asia-Pacific, Latin America, Middle East and Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 91.30 Billion | |

| USD 195.73 Billion | |

| 10.00% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

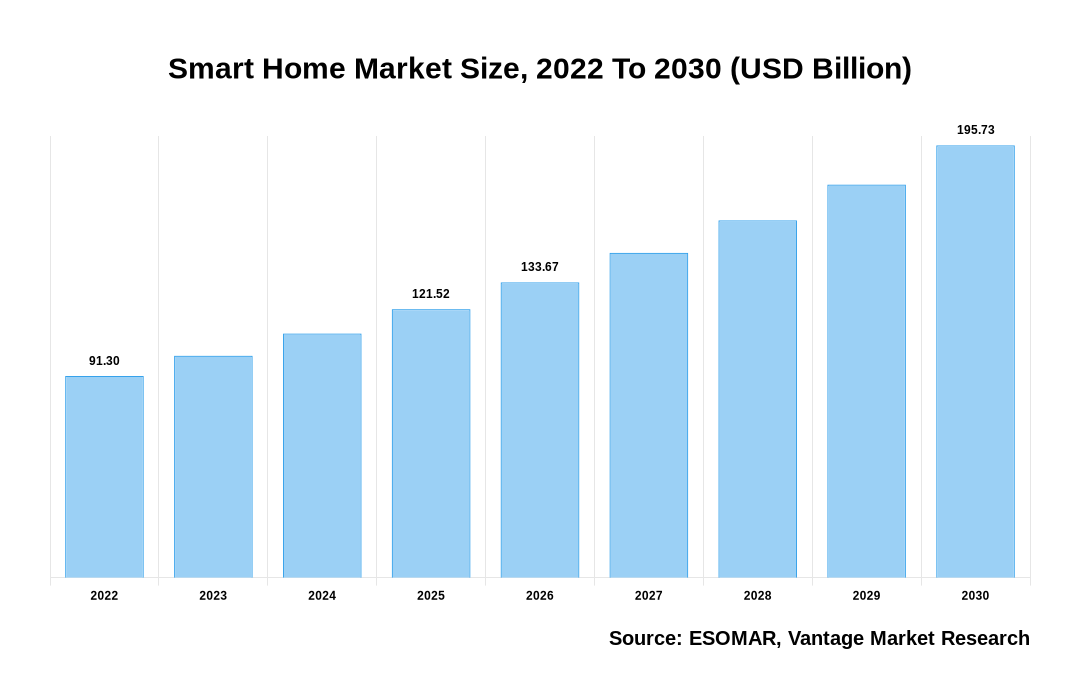

Global Smart Home Market is valued at USD 91.30 Billion in 2022 and is projected to reach a value of USD 195.73 Billion by 2030 at a CAGR of 10.00% over the forecast period.

Premium Insights:

The Smart Home market is experiencing significant growth and transformation, driven by technological advancements, increased consumer awareness, and the desire for enhanced convenience and efficiency in homes. The market encompasses various segments, including smart lighting, security and surveillance, HVAC systems, entertainment systems, energy management, and health and wellness devices. These segments offer a wide range of Smart Home solutions that cater to different needs and preferences. Key trends in the market include voice control and virtual assistants, interoperability and integration among devices, energy efficiency and sustainability, home security and surveillance, artificial intelligence and machine learning, health and wellness applications, DIY installations and Smart Home kits, and data privacy and security. Established technology giants, traditional home automation companies, telecommunications providers, consumer electronics manufacturers, home security specialists, startups, and retailers/e-commerce platforms are all competing in the market. The industry is characterized by collaborations, partnerships, and continuous innovation to create comprehensive and user-friendly Smart Home ecosystems. With a focus on privacy, security, and personalized experiences, the Smart Home market is poised for further growth and development in the coming years.

Market Segmentation

The global Smart Home market can be categorized on the following: Product, Standards & Protocols, Fitment, Sales Channel, and Regions.

Smart Home Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Smart Home Market

Based on Product, the market can be categorized into Security & Monitoring Systems (Security Cameras, Interface, Smart Locks, Access Controls), Smart Lighting Systems (Relays & Switches, Occupancy Sensors, Dimmers, Other Products), Smart Entertainment Systems (Smart Displays/TV, Smart Devices, Sound Bars & Speakers), HVAC Control (Smart Thermostat, Smart Vents, Smart Air-Conditioner), Smart Home Healthcare Systems (Health Status Monitors, Physical Activity Monitors), Smart Kitchen Appliances (Smart Refrigerators, Smart Coffee Makers, Smart Dishwashers, Smart Ovens), Home Appliances (Smart Washing Machines, Smart Water Heaters, Robotic Vacuum Cleaners), and Smart Home Furniture (Sofas & Recliners, Smart Tables & Desks). Based on the Standards & Protocols, the market can be divided into Wireless Protocols (ZigBee, Wi-Fi, Bluetooth, Z-Wave, Thread, Enocean), Wired Protocols (KNX, UPB, X10, BACnet, LonWorks, DALI, Modbus, Ethernet), and Hybrid Protocols (Insteon, C-Bus). By Fitment, the market can be split between New Construction and Retrofit. Based on Sales Channel, the market can be divided into Direct Sales and Indirect Sales. Likewise, based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Product

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Security & Monitoring Systems to Have Highest Market Share

The security & monitoring systems segment is a key component of the smart home market as it provides homeowners with peace of mind and protection against potential threats. This segment includes surveillance cameras, motion detectors, smart locks, and security alarms that can be controlled and monitored remotely via a smartphone or computer. Smart security systems utilize advanced technologies such as facial recognition, voice recognition, and artificial intelligence to increase accuracy and reduce false alarms. Additionally, integrating monitoring systems with other smart home devices, such as lighting and thermostats, can help create a more cohesive and efficient home automation system. As the demand for smart home technology continues to grow, the security & monitoring systems segment is expected to expand as homeowners prioritize the safety and protection of their families and property.

Based on the Standards & Protocols

Wireless Protocols & Standards to Express Largest Revenue

Wireless protocols and standards are a critical segment of the smart home market as they enable devices from different manufacturers to communicate with each other seamlessly. Most smart home devices rely on wireless communication to interact with each other, and numerous wireless protocols and standards are available that cater to different needs and use cases. Some popular protocols and standards include Wi-Fi, Zigbee, Z-Wave, Thread, Bluetooth, and more. Each has its strengths and weaknesses, and homeowners must choose the protocol that best suits their requirements. Wireless protocols and standards are continually evolving, with newer technologies emerging to meet the demands of smart homes. The appropriate protocol selection is vital as it affects the compatibility, security, and performance of smart home devices.

Based on Fitment

New Construction to Accommodate Maximum Market Share

The new construction segment within the smart home market is a rapidly growing sector with immense potential as builders and developers are beginning to see the benefits and demand of integrating smart home technology into new homes. With the increase in affordability and availability of smart home devices, consumers are looking for homes equipped with them as a standard feature. This has made it necessary for builders to offer smart home packages in their new homes; the options are numerous, from security systems to lighting control. This segment is expected to grow significantly in the coming years, with technology and home automation becoming a standard in new home construction.

Based on Sales Channel

Indirect Sales to Have Major Share

The indirect sales segment in the smart home market includes partnerships, dealerships, distributors, and resellers. The growth in demand for smart home devices and systems drives the expansion of the indirect sales segment in the smart home market. The partnership between manufacturers and technology companies also plays a significant role in developing indirect sales. Distributors and resellers help manufacturers to reach a wider audience, while dealerships provide customers with the opportunity to get hands-on experience with the devices before making a purchase. Indirect sales channels can also assist with after-sales services like installation and maintenance. Overall, the indirect sales segment in the smart home market provides manufacturers more opportunities to expand their business and reach new customers.

Recent Market Developments

- January 2023: At CES 2023, Schneider Electric unveils a groundbreaking, simple, smart, and sustainable home energy management solution. The Schneider Home energy management system consists of a home battery for clean energy storage, a high-power solar inverter, a smart electrical panel, an EV charger, and connected electrical sockets and light switches, all managed by the user-friendly Schneider Home app.

- January 2023: Launched by SwitchBot, the Matter interoperability standard is supported by Hub2 and will enable Matter compatibility for SwitchBot Bluetooth devices. The Hub 2 is a stylish smart home gadget with built-in thermo-hygrometer functionality. Users may now access the Apple Home app or any other preferred platform to monitor the current room temperature.

- January 2023: At CES, TP-Link, the top global manufacturer of networking and smart home products, unveiled "Tapo C325WB," a collection of Matter-compatible robot vacuums, video doorbells, and smart door locks. Tapo's next-generation outdoor security Wi-Fi camera features ultra-low light color vision called the C325WB.

- January 2023: The EZVIZ Company unveiled the EZVIZ C6N home security camera on Amazon. One of EZVIZ's most recent home security cameras provides 360-degree coverage in FHD and two-way communication.

- January 2022: With other top smart home manufacturers, Samsung Electronics declared its membership in the Home Connectivity Alliance (HCA), which aims to advance interoperability and improve safety. The association brings together top connected device makers to improve the cross-brand compatibility of smart appliances.

Top Market Trends

- Voice Control and Virtual Assistants: Voice control has become a dominant trend in the Smart Home market, with virtual assistants like Amazon Alexa, Google Assistant, and Apple Siri gaining widespread adoption. Consumers can use voice commands to control various smart devices, from adjusting the thermostat to playing music or managing their daily tasks. The integration of voice control in Smart Home products is simplifying user interaction and enhancing convenience.

- Interoperability and Integration: Interoperability and integration among Smart Home devices and platforms have become crucial for a seamless user experience. Consumers are looking for solutions that allow different devices to communicate and work together harmoniously. Companies are focusing on open standards, protocols, and partnerships to ensure compatibility and enable cross-device connectivity.

- Energy Efficiency and Sustainability: Energy efficiency is a growing concern, and Smart Home technologies are playing a crucial role in optimizing energy consumption. Smart thermostats, lighting systems, and energy monitoring devices enable homeowners to monitor and control energy usage, leading to reduced utility bills and a smaller environmental footprint. Sustainability-focused features and certifications are becoming more prevalent in the market.

- Home Security and Surveillance: Home security is a major driver for Smart Home adoption. Consumers are increasingly investing in smart security systems, including video doorbells, surveillance cameras, and smart locks. These devices provide remote monitoring, real-time notifications, and enhanced control over home security, offering homeowners peace of mind.

- Artificial Intelligence and Machine Learning: Artificial intelligence (AI) and machine learning (ML) technologies are being integrated into Smart Home devices, enabling them to learn user behavior, preferences, and patterns. This allows for personalized automation, predictive analysis, and adaptive control. AI-powered voice assistants also improve their understanding and responsiveness over time.

- Health and Wellness Applications: The Smart Home market is expanding into health and wellness applications. Devices such as smart beds, sleep trackers, and fitness monitors offer insights into users' well-being and help optimize their sleep patterns, exercise routines, and overall health. Additionally, the integration of health monitoring features in Smart Home ecosystems allows for better care of elderly or vulnerable individuals.

- DIY Installations and Smart Home Kits: Do-it-yourself (DIY) installations and Smart Home kits have gained popularity, making Smart Home adoption more accessible and affordable for consumers. These kits provide pre-packaged solutions that include a combination of devices, such as smart speakers, smart plugs, and sensors, along with simplified installation instructions.

- Data Privacy and Security: With the increasing number of connected devices in Smart Homes, data privacy and security have become paramount. Consumers are becoming more aware of the potential risks associated with data breaches and unauthorized access. As a result, there is a growing demand for robust security measures, encryption protocols, and transparent data practices from Smart Home manufacturers and service providers.

Competitive Landscape:

The key players in the Smart Home market include- Honeywell (US), Siemens (Germany), Johnson Controls (Ireland), Schneider Electric (France), ASSA ABLOY (Sweden), Amazon (US), Apple (US), ADT (US), ABB (Switzerland), Robert Bosch (Germany), Sony (Japan), Samsung Electronics (South Korea), Ooma (US), Delta Controls (Canada), Control4 (US), Axis Communications (Sweden), Comcast (US), Smarthome (US), Crestron Electronics (US), SimpliSafe (US), Armorax (US), Canary (US), LG Electronics (South Korea), Lutron (US) and Legrand (France).

Segmentation of Smart Home Market:

| Parameter | Details |

|---|---|

| Segments Covered |

By Smart Lighting:

By Smart Thermostats

By Home Security and Surveillance:

By Smart Appliances:

By Home Entertainment and Audio Systems:

By Smart Energy Management

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Smart Home in terms of revenue?

-

The global Smart Home valued at USD 91.30 Billion in 2022 and is expected to reach USD 195.73 Billion in 2030 growing at a CAGR of 10.00%.

Which are the prominent players in the market?

-

The prominent players in the market are Honeywell (US), Siemens (Germany), Johnson Controls (Ireland), Schneider Electric (France), ASSA ABLOY (Sweden), Amazon (US), Apple (US), ADT (US), ABB (Switzerland), Robert Bosch (Germany), Sony (Japan), Samsung Electronics (South Korea), Ooma (US), Delta Controls (Canada), Control4 (US), Axis Communications (Sweden), Comcast (US), Smarthome (US), Crestron Electronics (US), SimpliSafe (US), Armorax (US), Canary (US), LG Electronics (South Korea), Lutron (US) Legrand (France).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 10.00% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Smart Home include

- Increasing number of internet users and growing adoption of smart devices

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Smart Home in 2022.