Smart Gas Market

Smart Gas Market - Global Industry Assessment & Forecast

Segments Covered

By Devices Type Automatic Meter Reading (AMR), Advanced Meter Infrastructure (AMI)

By Component Solution, Service

By End User Commercial & Industrial, Residential

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 15.2 Billion | |

| USD 45.3 Billion | |

| 16.9% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

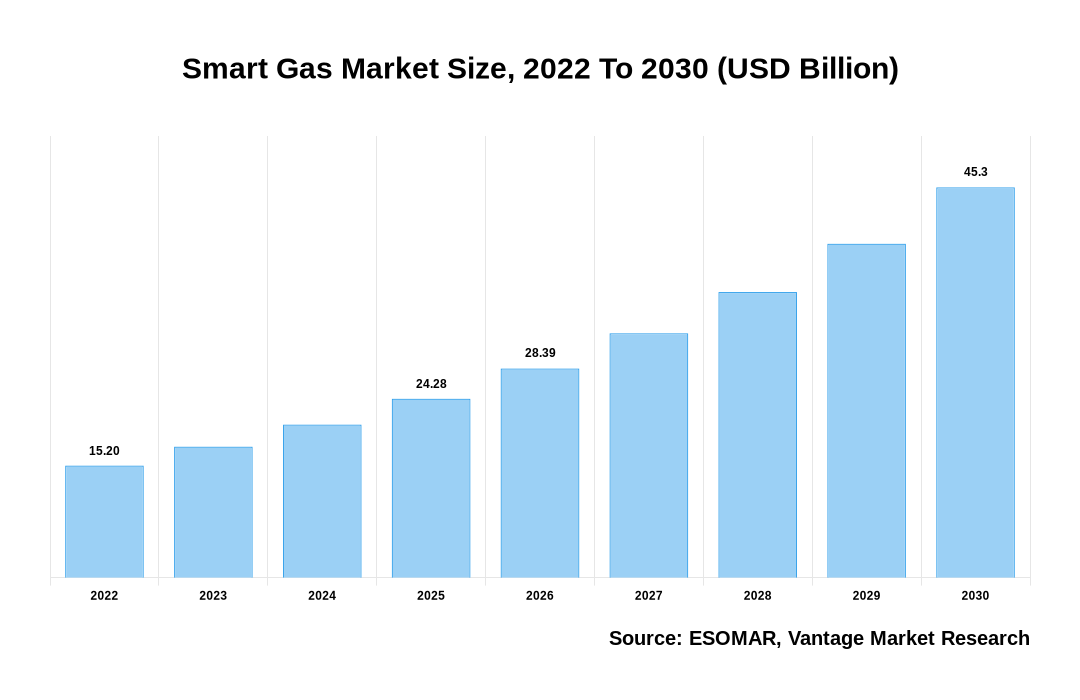

The global Smart Gas Market is valued at USD 15.2 Billion in 2022 and is projected to reach a value of USD 45.3 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 16.9% between 2023 and 2030.

Premium Insights

AMI is crucial in the smart gas market, enabling real-time monitoring, measurement, and remote gas consumption management. The deployment of AMI systems has seen significant growth worldwide. According to the Global AMI Tracker by Wood Mackenzie, the global cumulative installed base of gas-related AMI endpoints reached approximately 33.7 million by the end of 2020. North America led the market with around 20.4 million endpoints. The increasing demand for natural gas as a cleaner and more sustainable alternative to other fossil fuels is also driving the growth of the smart gas market. According to the International Energy Agency (IEA), natural gas consumption is expected to increase by around 1.6% annually until 2024. Governments and regulatory bodies across the globe are emphasizing energy efficiency and sustainability in the gas sector, driving the adoption of smart gas solutions. For instance, the European Union's aim to achieve energy efficiency goals has led to directives promoting smart gas meters. According to the European Commission, by 2024, 80% of households in the European Union should have smart meters installed. 4.5 thousand smart gas meters were installed in non-residential buildings throughout Great Britain in 2022, representing an increase of around 162% over the previous year, according to the UK Department for Business, Energy, and Industrial Strategy.

Smart Gas Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Smart Gas Market

Key Highlights

- By Component, the high demand for the Solutions category will increase the Smart Gas Market from 2023 to 2030.

- By Devices Type, the automatic meter reading (AMR) channel segment holds the largest share globally from 2023 to 2030.

- By end user, the commercial & industrial segment holds the largest share globally from 2023 to 2030.

- In 2022, North America dominated the market with the highest revenue share of 48.5%.

The COVID-19 pandemic has highlighted the importance of remote monitoring and control capabilities in the gas industry. The need to minimize physical visits and ensure continuity of operations has accelerated the adoption of remote monitoring solutions in the smart gas market. According to a survey by Smart Energy International, 86% of respondents in the gas sector believe that remote monitoring and control systems will become increasingly important in the post-pandemic era.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Economic Insights

Customers' interest in and demand for beverages like Smart Gas have grown because of a shift in consumer preference toward functional beverages that can provide good health impacts. For instance, the Institute of Food Technologists (IFT) estimates that functional beverages in the U.S. beverage industry maintained a 4% market share in 2017. Yogurt and kefir generated from fermented milk are typically used to make probiotic beverages. This, however, has a significant advantage over other probiotic beverages in that it can be drunk by those with celiac disease and lactose intolerance because it is made by fermenting sweetened tea. In 2020, the increased accessibility of non-alcoholic beverages, their expanded online range, and a decline in alcohol consumption will have shifted consumer preferences toward Smart Gas, according to a research paper published in BioMed Central. During the projected period, novel taste variations are also anticipated to fuel market expansion.

Top Market Trends

- Growing demand for energy conservation: With the increasing need for sustainable and green energy solutions, governments and organizations actively promote adopting smart gas technologies. One of the key factors driving the demand for energy conservation is the rising concerns over carbon emissions and their environmental impact. Smart gas technologies offer advanced monitoring and control capabilities, enabling efficient distribution and consumption of gas. This helps in minimizing wastage and reducing greenhouse gas emissions. Additionally, integrating smart gas solutions with IoT (Internet of Things) and AI (Artificial Intelligence) technologies further enhances their functionality and effectiveness. These technologies enable real-time monitoring, predictive analytics, and automation, allowing for more precise control and optimization of gas usage. The increasing focus on energy efficiency and cost savings also drives the adoption of smart gas solutions. Smart gas meters, for example, provide accurate and real-time data on gas consumption, enabling consumers to make informed decisions and adjust their usage accordingly. This helps in reducing energy consumption and lowering utility bills.

- Increasing adoption of smart gas meters to Augment Growth: Smart gas meters are advanced devices that help monitor and record gas consumption accurately. These meters are integrated with communication modules, allowing real-time data transmission to utility companies. They provide accurate billing information, offer real-time analysis of gas usage patterns, and enable remote monitoring and control of gas supply. The need for efficient and accurate billing and the rising demand for resource conservation and sustainability has led to the increased adoption of smart gas meters. Moreover, government initiatives to promote the use of smart meters, increasing investments in smart grid technologies, and the growing focus on renewable energy sources are also contributing to the growth of the smart gas market. The increasing adoption of smart gas meters is transforming the gas utility sector, improving efficiency, reduced operational costs, and enhanced customer experience.

Market Segmentation

The global Smart Gas market can be categorized as Component, Devices Type, End-User, and Region. Based on Component, the market can be categorized into Solutions and Services. Furthermore, based on Devices Type, the market can be categorized into Automatic Meter Reading (AMR) and Advanced Meter Infrastructure (AMI). Additionally, based on End-user, the market can be split between Commercial & Industrial and Residential. Likewise, based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Component

Solutions to Accommodate Maximum Market Share Because of the Benefits Associated with Smart Gas Solutions

In 2022, Solutions dominated the market. This segment encompasses a comprehensive range of smart gas solutions, including advanced metering infrastructure, gas sensors, leak detection systems, and remote monitoring platforms. The increasing demand for efficient energy management and cost-effective gas distribution drove the growth of this segment. These smart gas solutions offer enhanced accuracy, real-time data monitoring, and remote access capabilities, enabling utilities and consumers to optimize their gas usage, detect leakages, and reduce wastage. The Solutions segment's dominance highlights the growing adoption of smart gas technologies and their significant role in promoting sustainability and operational efficiency.

Based on Product Type

Automatic Meter Reading (AMR) to Accommodate Maximum Market Share as it Allows Real-Time Monitoring of Gas Consumption and Provides Accurate Data on Gas Usage

In 2022, Automatic Meter Reading (AMR) dominated the market. AMR enables real-time and remote reading of gas meters, eliminating the need for manual meter reading. This technology provides accurate and up-to-date consumption data, enabling precise billing, improved customer service, and effective energy management. AMR systems also offer advanced analytics and data insights, allowing gas utilities to optimize operations and enhance efficiency. With its significant benefits and widespread adoption, AMR played a crucial role in revolutionizing the gas sector and establishing itself as the key technology in the smart gas market.

Based on the End User

Commercial & Industrial to Express Dominion Due to the Increasing Adoption of Smart Gas Solutions by Commercial Buildings and Industries

Between 2023 and 2030, the commercial & industrial is anticipated to grow fastest. Several factors, including the increasing demand for efficient and cost-effective energy solutions in large-scale commercial and industrial facilities, drive this. Smart gas solutions offer enhanced monitoring, optimization, and control of gas usage, leading to improved energy management and business cost savings. Additionally, the C&I segment often has complex gas infrastructure requirements, such as multiple gas meters and extensive pipelines, making it more conducive to implementing smart gas technologies. As a result, the commercial & industrial segment is projected to dominate the Smart Gas Market due to its significant demand and potential for adoption.

Based on Region

North America to Lead Global Sales Owing to Rapid Adoption of Advanced Technologies, and Favourable Government Initiatives

The North American region holds the largest market share for smart gas globally. This is primarily due to the region's advanced infrastructure and technological advancements. The growing demand for efficient and sustainable energy solutions and the increasing focus on reducing carbon emissions has further fueled the adoption of smart gas solutions in North America. Additionally, government initiatives and regulations promoting smart grid development and the integration of advanced metering infrastructure have played a significant role in driving the smart gas market in the region.

In the Asia Pacific, the market is expected to witness the fastest growth during the forecast period due to the factors such as rapid urbanization, increasing population, and government initiatives to improve infrastructure. China and India have been investing much effort into upgrading its current infrastructure and incorporating smart technologies to improve gas distribution systems and operational efficiency, which is helping to fuel the growth of the smart gas market in the Asia Pacific.

Competitive Landscape

The smart gas market is highly competitive and fragmented in nature. Major players in the market include Itron Inc., Honeywell International Inc., Aclara Technologies LLC, and Elster Group GmbH. These companies focus on strategic partnerships, mergers and acquisitions, and product innovation to gain a competitive edge in the market. They also invest in research and development activities to develop advanced smart gas solutions. Additionally, companies are expanding their geographic presence and investing in technological advancements to meet evolving customer demands and stay ahead in the competitive market.

The key players in the global Smart Gas market include - Siemens AG (Germany), Honeywell International Inc. (U.S.), Itron Inc. (U.S.), EDMI Limited (Singapore), Landis+Gyr AG (Switzerland), ABB Ltd. (Switzerland), Holley Technology Ltd. (China), Secure Meter Ltd. (India), Elster Group GmbH (Germany), Aclara Technologies LLC (U.S.), Yokogawa Electric Corporation (Japan), Kamstrup A/S (Denmark) among others.

Recent Market Developments

- Oct 2022: Through enhanced electrification and digitization (Electricity 4.0), Schneider Electric introduced several solutions to assist its clients in navigating the energy and climate change problems. According to the company, the new solutions were developed to give businesses the resources and assistance they require to plan, digitize, and decarbonize their business operations, expedite sustainability commitments, and resolve the energy issue. The business added that they promote the adoption of the smart grid, improve energy management in buildings, and permit the reduction of some of the world's most harmful greenhouse gases from energy infrastructures, eliminating a large source of energy waste and emissions. The company's newly unveiled solution consists of Schneider Electric EcoCare, GM AirSeT, and EcoStruxure Energy Hub.

- July 2022: Sevier County Utility District (SCUD) is collaborating with Itron, Inc. and its channel partner, United Systems & Software (USS), to implement Itron's AMI Essentials for Gas. It comprises Temetra Itron's cutting-edge meter data management system and 15,000 Itron Cellular 500G Gas Modules. The utility will be able to streamline meter readings, enhance operations throughout the SCUD gas district in Tennessee, and gain more visibility into its gas distribution system.

Segmentation of the Global Smart Gas Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Devices Type

By Component

By End User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Smart Gas in terms of revenue?

-

The global Smart Gas valued at USD 15.2 Billion in 2022 and is expected to reach USD 45.3 Billion in 2030 growing at a CAGR of 16.9%.

Which are the prominent players in the market?

-

The prominent players in the market are Siemens AG (Germany), Honeywell International Inc. (U.S.), Itron Inc. (U.S.), EDMI Limited (Singapore), Landis+Gyr AG (Switzerland), ABB Ltd. (Switzerland), Holley Technology Ltd. (China), Secure Meter Ltd. (India), Elster Group GmbH (Germany), Aclara Technologies LLC (U.S.), Yokogawa Electric Corporation (Japan), Kamstrup A/S (Denmark).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 16.9% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Smart Gas include

- Digitalization of distribution grids and optimization of network operations

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Smart Gas in 2022.

Vantage Market

Research | 28-Jul-2023

Vantage Market

Research | 28-Jul-2023