Ships Turbocharger Market

Ships Turbocharger Market - Global Industry Assessment & Forecast

Segments Covered

By Type Commercial, Private, Navy

By Technology Single Turbocharger, Twin-turbocharger, Electro-assist Turbocharger, Variable Geometry Turbocharger (VGT)

By Operation Axial Flow Turbocharger, Radial Flow Turbocharger

By End user Navy & Defence Systems, Cargo & Shipping Industries, Fisheries, Oil & Gas

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 648.4 Million | |

| USD 1121 Million | |

| 7.1% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

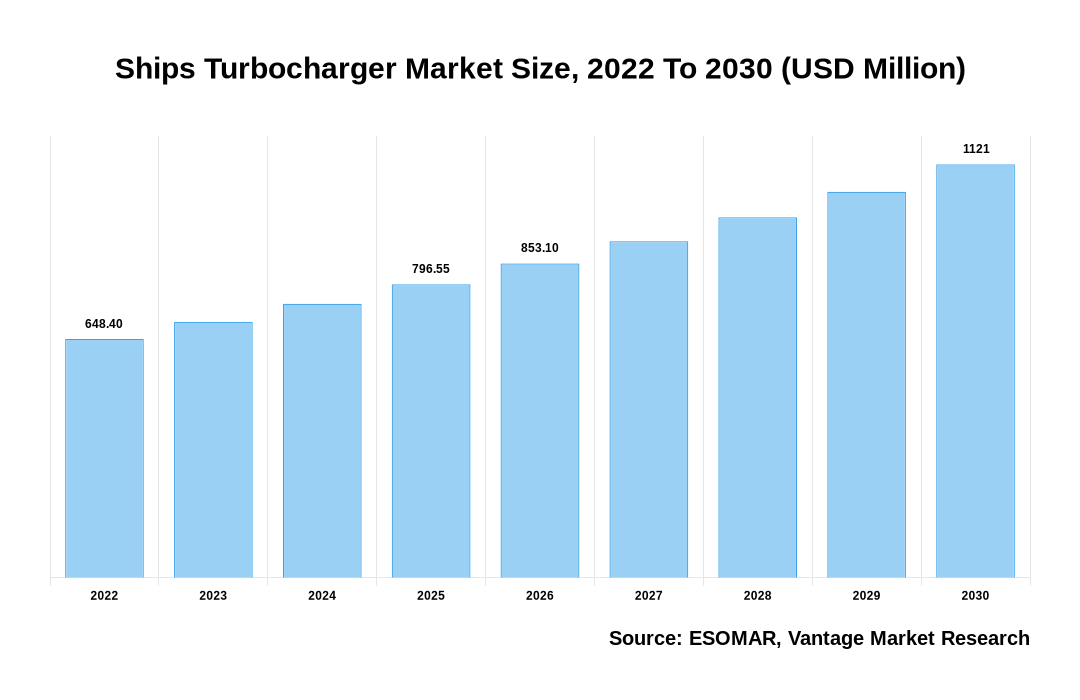

The global Ships Turbocharger Market is valued at USD 648.4 Million in 2022 and is projected to reach a value of USD 1121 Million by 2030 at a CAGR (Compound Annual Growth Rate) of 7.1% between 2023 and 2030.

Premium Insights

The maritime industry's increased emphasis on environmental sustainability and rigorous emission rules has fueled demand for turbochargers. Turbochargers help to improve engine efficiency, which can result in emissions reductions of up to 15% or more, assisting with compliance with evolving international pollution requirements such as IMO Tier III. For instance, Accelleron plans to release next-generation axial turbochargers in low-speed and big medium-speed turbochargers for the maritime and power industries by 2025 for net-zero carbon fuel applications such as green ammonia.

The shift to cleaner-burning fuels such as liquefied natural gas (LNG) and dual-fuel engines has created specialist turbochargers. When compared to ordinary marine diesel engines, these turbochargers can improve combustion efficiency, resulting in 3-5% fuel savings and up to 30% pollution reductions. For instance, Accelleron introduced the TX Turbocharger for high-speed diesel and gas engines, which is 30% less in weight and takes up 16% less space.

The coronavirus outbreak, corporate closures, lockdowns, and travel bans have severely impacted the ships turbocharger industry. Due to stringent prohibitions on public gatherings, research and development operations in marine turbocharger firms worldwide have yet to be impeded. Manufacturers in the maritime turbocharger sector are recovering from massive losses caused by slowing activity. With vaccinations becoming more widely available worldwide, industry participants in the marine turbocharger market are focusing on novel goods and superior technology to attract a variety of end-use industries. Following the commencement of the COVID-19 epidemic, the marine turbocharger market is gaining traction, with a significant increase in demand. The rising need for fuel-efficient marine engines will drive expansion in the worldwide marine turbocharger market in the coming years.

Ships Turbocharger Market Size, 2022 To 2030 (USD Million)

AI (GPT) is here !!! Ask questions about Ships Turbocharger Market

Geopolitical pressures and shifts in maritime security goals can impact naval modernization and fleet expansion, influencing turbocharger demand in the marine sector. By 2025, naval fleets are expected to invest $15-20 billion in turbocharger-related enhancements.

Key Highlights

- North America generated more than 43.30% of revenue share in 2022

- Asia Pacific is expected to grow at the quickest from 2023 to 2030

- Based on type, the commercial ships segment contributed a significant revenue share in 2022

- Based on technology, the single turbocharger recorded the most important market share in 2022

- Based on operation, the Radial segment led the market during 2022

- Based on End-user, Navy & Defense generated the largest revenue share in 2022

Economic Insights

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Shifts in global commerce and economic situations may reverberate and influence turbocharger demand in the shipping industry. With the ongoing recovery of global commerce volumes, turbocharger installations are expected to climb by 5-7% per year, representing an increase in marine activities. According to projections, naval fleets will direct significant investments ranging from $15 to $20 billion toward turbocharger-related advancements by 2025. Throughout the forecast period, the market is experiencing significant economic expansion in developing countries such as India, Japan, and China. This expansion is driven by a developing panorama of shipbuilding activities bolstered by critical Original Equipment Manufacturers (OEMs), such as Mitsubishi Heavy Industries and MAN Energy Solutions.

Top Market Trends

- Rising Emphasis on Fuel Efficiency: With increased environmental concerns and stricter emission laws, ship operators emphasize improving fuel efficiency. Turbochargers are critical for achieving pollution limits because they optimize engine performance and reduce fuel consumption.

- Adoption of Hybrid and LNG-Powered Engines: The marine industry is moving toward more ecologically friendly propulsion systems, such as hybrid and LNG engines. Turbochargers are critical for increasing the efficiency and output power of various alternative propulsion systems.

- Technology Advancements: Continuous developments in turbocharger technology, such as new materials, design innovations, and digitalization, improve its performance, durability, and dependability. This results in increased engine efficiency and longer maintenance intervals.

- Increasing Ship Sizes and Power Demands: To achieve performance requirements while complying with pollution standards, larger vessels and ships with higher power demands require more robust and efficient turbocharging solutions.

- Existing Vessel Retrofitting and Upgrading: Retrofitting turbochargers onto existing vessels is a cost-effective solution to improve engine efficiency and comply with current rules. Shipowners are increasingly contemplating turbocharger upgrades to enhance fleet performance.

Market Segmentation

The Global ships turbocharger market can be categorized into Type, Technology, Operation, End-user, and Region.

The market is seggregated based on type into commercial, private, and navy. Based on the Technology, the ship’s turbocharger market has been segmented into Single Turbochargers, Twin-turbocharger, Electro-assist Turbochargers, and Variable Geometry Turbochargers (VGT). Based on operation, the market is bifurgated into Axial Flow Turbochargers and Radial Flow Turbochargers. The end-user divides the market into Navy & Defence Systems, Cargo & Shipping Industries, Fisheries, and Oil & Gas. Likewise, the market is segmented based on region: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Type

Commercial ships hold the largest share

Commercial ships have the most significant market share, accounting for significant revenue of the overall market. This is because retail maritime businesses are expanding their need for ship turbines. Ship turbines are increasingly used to power commercial ships because they are more efficient and environmentally friendly than traditional steam turbines. Furthermore, developing new technologies, such as better control systems and materials, boosts demand for commercial ship turbines.

Based on Technology

Single turbochargers will dominate the market during Forecast Period.

The single turbo category is gaining commercial popularity since it is more efficient and cost-effective for powering ships. Single-turbo ship turbines use a single turbine to power the ship's propeller, making them more efficient than twin-turbo ship turbines. Furthermore, single-turbo-ship turbines are less sophisticated and require less maintenance than twin-turbo-ship turbines, making them a less expensive option. Because of the widespread use of turbochargers in China and Japan, single turbos are becoming increasingly popular throughout Asia-Pacific and Europe. Single turbos are inexpensive and dependable, making them an excellent choice for smaller engines. They are also less complex and easier to maintain than dual turbos, making them a superb powerboat alternative.

Based on operation

The radial segment will lead the market

The radial sector of ship turbines will dominate the market throughout the forecast period. Radial segment ship turbines outperform their axial counterparts in terms of efficiency due to a higher-pressure ratio that allows for greater energy extraction from steam. Their compact size allows quicker installation and maintenance, potentially saving shipowners money. Radial segment turbines have higher reliability due to fewer moving parts, which reduces the possibility of operational errors, and adds to their desirability. The radial segment's improved efficiency stems from its balanced steam flow distribution, which results in optimum condensation and less energy waste. This is further bolstered by shorter blades, which minimize friction and hence energy loss.

Based on End-user

Navy & Defense will lead the market

The navy and defense segment is expected to lead the ship turbines market. The critical need for robust and dependable ship turbines to enable naval warships to navigate and endure harsh operational situations is central to this prognosis. The navy's and military sector's significant investment in ship turbines is a key driver, indicating a booming and continuous need for these critical components. This sector's position as a technological trailblazer strengthens it, as it frequently embraces cutting-edge advances in ship turbine technology, fueling continual demand.

Based on Region

North America will lead the market

Due to various compelling factors, North America is expected to lead the ship turbines market over the projected period. The largest of these is North America's significant naval fleet, which has increased demand for ship turbines to accommodate the large number of navy ships. Concurrently, the region's commitment to innovation is demonstrated by developing pioneering technologies, such as advanced control systems and novel materials. This raises the allure of ship turbines due to their improved efficiency and reliability, making them appealing to naval entities throughout the region. Furthermore, North America's growing need for enhanced shipping capacity drives demand for ship turbines to power the rising fleet required for moving goods and commodities.

Competitive Landscape

The global ships turbocharger market is fragmented, with established players and large technology companies, manufacturers, suppliers, and contractors from different countries, each contributing to the overall supply and demand for ships’ turbochargers. Several notable players and businesses control a large amount of the market. These firms frequently have significant resources, cutting-edge technology, and established contracts with various sector forces worldwide. For instance, Mitsubishi Heavy Industries Marine Machinery & Equipment Co., Ltd. (MHI-MME) signed a licensing deal with Mitsui E&S Machinery Co., Ltd. in 2022, granting the company the right to produce and distribute its MET turbochargers.

The players in the global ships turbocharger market include Kawasaki Heavy Industries, Ltd, Kompressornenbau Bannewitz GmbH, La Meccania Turbo Diesel, MAN Diesel & Turbo, Mitsubishi Heavy Industries, Marine Machinery & Equipment Co., Ltd., MTU Friedrichshafen, Napier Turbochargers Ltd., Shanghai Darwin Marine Parts, ABB, BorgWarner Turbo Systems, Cummins Inc., Hedemora Turbo & Diesel AB, IHI Corporations, Istanbul Marine Turbine Service among others.

Recent Market Developments

- 2022: Accelleron, formerly known as ABB Turbocharging, and Japan Engine Corporation (J-ENG) signed a deal that will allow Accelleron turbochargers to be used in UE Engines, one of the top three producers of low-speed marine engines in the world.

- 2022: Mitsubishi Heavy Industries Marine Machinery & Equipment Co., Ltd. (MHI-MME) signed a licensing deal with Mitsui E&S Machinery Co., Ltd., granting the company the right to produce and distribute its MET turbochargers.

- November 2022: Hyundai Global Service (HGS), the aftercare business of shipbuilder and engine manufacturer Hyundai Heavy Industries, will launch will collaborate with ABB Turbocharging to offer an engine part-load optimization (PLO) service for shipowners looking to reduce emissions under International Maritime Organization (IMO) requirements.

Segmentation of the Global Ships Turbocharger Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Technology

By Operation

By End user

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Ships Turbocharger in terms of revenue?

-

The global Ships Turbocharger valued at USD 648.4 Million in 2022 and is expected to reach USD 1121 Million in 2030 growing at a CAGR of 7.1%.

Which are the prominent players in the market?

-

The prominent players in the market are Kawasaki Heavy Industries, Ltd, Kompressornenbau Bannewitz GmbH, La Meccania Turbo Diesel, MAN Diesel & Turbo, Mitsubishi Heavy Industries, Marine Machinery & Equipment Co., Ltd., MTU Friedrichshafen, Napier Turbochargers Ltd., Shanghai Darwin Marine Parts, ABB, BorgWarner Turbo Systems, Cummins Inc., Hedemora Turbo & Diesel AB, IHI Corporations, Istanbul Marine Turbine Service.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 7.1% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Ships Turbocharger include

- Rising seaborne trade and sea transportation activities drives market

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Ships Turbocharger in 2022.