Robotic Process Automation Market

Robotic Process Automation Market - Global Industry Assessment & Forecast

Segments Covered

By Type Software, Service

By Deployment Cloud, On-premise

By Organization Large Enterprises, Small & Medium Enterprises

By Operations Rule Based, Knowledge Based

By Application BFSI, Pharma & Healthcare, Retail & Consumer Goods, Information Technology (IT) & Telecom, Communication and Media & Education, Manufacturing, Logistics & Energy & Utilities, Other Applications

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 4.3 Billion | |

| USD 38.34 Billion | |

| 27.5% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

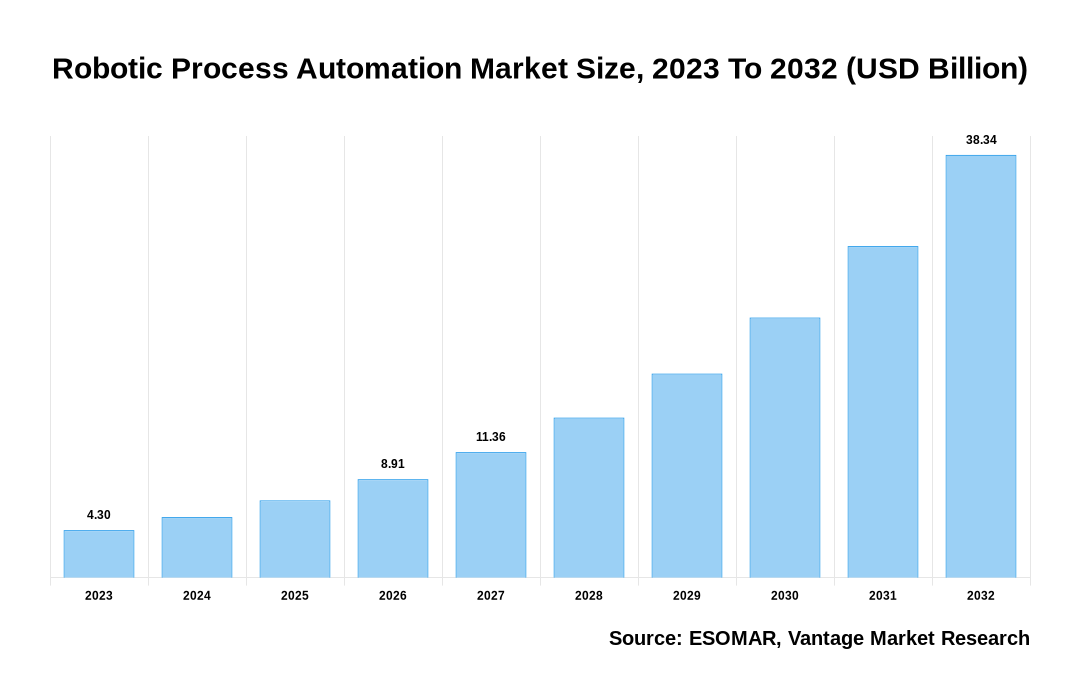

The global Robotic Process Automation Market is valued at USD 4.3 Billion in 2023 and is projected to reach a value of USD 38.34 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 27.5% between 2024 and 2032.

Key highlights of Robotic Process Automation Market

- The North American region dominated the market in 2023, obtaining the largest revenue share of 40.1%,

- The Asia Pacific region will witness remarkable growth with a CAGR during the forecast period,

- The Service segment dominated the Robotic Process Automation market with the largest market share of 65.2% in 2023,

- The On-premise segment dominated the Robotic Process Automation market with a significant market share of 71.5% in 2023,

- Large Enterprises dominated the market with a significant market share of 65.5% in 2023,

- In 2023, the BFSI segment dominated the Robotic Process Automation industry with market share of 30.1%,

- The growing advancements in artificial intelligence and machine learning technologies are enabling the evolution of Robotic Process Automation (RPA) towards intelligent automation, facilitating cognitive capabilities such as natural language processing and decision-making.

Robotic Process Automation Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Robotic Process Automation Market

Robotic Process Automation Market: Regional Overview

North America Dominated Sales with a 40.1% share in 2023. North America dominates the Robotic Process Automation industry due to its mature tech ecosystem, proactive regulatory environment, and a strong emphasis on operational efficiency spanning industries. North America has propelled significant advancements and innovations within the Robotic Process Automation market, shaping its trajectory. The high penetration of Robotic Process Automation (RPA) in the North American region is driven by increasing uptake among government agencies and its utilization in small and medium-sized enterprises (SMEs) to optimize functions like procurement, data entry, and accounting/finance, thus driving market growth.

U.S Robotic Process Automation Market Overview

The U.S Robotic Process Automation market, valued at USD 1.43 Billion in 2023 to USD 10.74 Billion in 2032, is anticipated to grow at a CAGR of 25.1% from 2024 to 2032. The United States Robotic Process Automation market is fueled by increasing RPA integration among government agencies and enterprises to streamline operations, boost productivity, and cut costs. Notably, the US leads in innovation and adoption of robotics, with robot utilization growing, enhancing competitiveness, and generating job opportunities. The automotive sector, in particular, witnessed a significant surge in industrial robot purchases, indicative of RPA's role in bolstering efficiency. Government and regulatory agencies' initiatives to encourage the use of RPA in many industries are expected to fuel more industry expansion. For instance, according to UiPath, over 30 agencies are leveraging RPA solutions to enhance compliance, throughput, and efficiency.

Furthermore, investments in conversational RPA chatbots. For instance, in 2023, the National Science Foundation (NSF) Organization has developed an RPA bot to help inform individuals about forthcoming public meetings and to automate messaging. The NSF organization hosts thousands of meetings a year, so the RPA bot saves the administrative staff more than 25,000 hours of labor.

Robotic Process Automation Market: Type Overview

In 2023, the Service segment dominated the market with the largest share of 65.2%. The Robotic Process Automation market, segmented by the Type, includes Software and Service (Consulting, Implementing, Training). The substantial predominance of the service segment in the Robotic Process Automation market underscores its pivotal role within the RPA ecosystem, offering a comprehensive range of services that include consulting, implementation, training, and maintenance. As businesses increasingly realize the transformative potential of RPA in streamlining operations and boosting efficiency, the demand for service-based solutions has surged, propelling significant growth in this segment. Service providers are continuously innovating to meet evolving client needs and navigate complex technological landscapes, making the Service segment a key driver in shaping the trajectory of the Robotic Process Automation market. Intensified competition among enterprises has spurred RPA service providers to enhance their offerings, leading to continuous upgrades in automation services that prioritize scalability and cost efficiency—implementing RPA as a service aids organizations in identifying automation opportunities, optimizing processes, and building business cases through careful vendor selection and pilot project deployment.

Robotic Process Automation Market: Deployment Overview

In 2023, significant revenue of 71.5% was generated by Robotic Process Automation for On-premise. The Deployment segment is split into Cloud and On-premise. In the Robotic Process Automation (RPA) space, on-premise solutions continue to be the most popular choice due to data security concerns, regulatory compliance needs, and the need for more control over resources and infrastructure. On-premise deployments continue to be preferred despite the rise of cloud-based alternatives, particularly for businesses handling sensitive data or those in highly regulated industries. On-premise installations are expected to remain significant as the need for automation solutions grows, even in the face of growing acceptance of hybrid and cloud-based models, which reflects a changing market environment. On-premise deployment facilitates alignment of RPA access policies with internal protocols and enables effective governance of customer RPA systems.

Robotic Process Automation Market: Organization Overview

In 2023, the Large Enterprises segment dominated the market with a most significant share of 65.5%. The Robotic Process Automation market, segmented by the Organization, is further divided into Large Enterprises and Small & Medium Enterprises. The notable dominance of large-scale organizations in the Robotic Process Automation market highlights their significant investment and adoption of RPA technologies, motivated by the pursuit of operational efficiency, cost savings, and competitive advantages. Leveraging their extensive resources and intricate operational structures, these enterprises increasingly rely on RPA solutions to streamline processes, automate repetitive tasks, and optimize workflows across diverse departments. Consequently, this segment continues to shape the Robotic Process Automation market landscape, driving innovation and establishing benchmarks for implementation and integration strategies. Large enterprises deploy RPA to mitigate time spent on conventional activities, allowing for more focus on strategic decision-making. Furthermore, RPA aids in minimizing human error, enhancing work efficiency, and reducing overhead expenses. Amid the COVID-19 pandemic, RPA vendors have extended licensing periods at no additional cost for existing clients, enabling continued RPA utilization even during challenging times.

Robotic Process Automation Market: Application Overview

In 2023, the BFSI segment dominated the market with the largest share of 30.1%. The Robotic Process Automation market, segmented by the Application, includes BFSI, Communication and Media & Education, Pharma & Healthcare, Retail & Consumer Goods, Information Technology (IT) & Telecom, Manufacturing, Logistics, and Energy & Utilities, and Others. The Banking, Financial Services, and Insurance (BFSI) industry is well-known, which highlights the importance of its integration of Robotic Process Automation (RPA) solutions. This industry is driven by the desire for improved operational efficiency, reduced costs, and regulatory compliance. Within the BFSI sector, RPA technology offers a strong way to automate repetitive tasks, optimize workflows, and increase overall productivity while managing complex processes and strict regulatory requirements. This industry's broad RPA adoption solves industry-specific issues, encourages creativity, and establishes new benchmarks for automation in financial services and insurance processes. This trend of adoption makes it easier for banks and other financial institutions to automate a variety of tasks, including creating accounts, making loans, and making deposits which increases productivity and efficiency. Furthermore, integrating RPA with artificial intelligence (AI) enables the BFSI sector to effectively establish new policies and services. The availability of tailor-made RPA solutions for the BFSI sector from robotic process automation market companies, such as UiPath, has further fueled the segment's growth, offering benefits like an 80% faster reconciliation time and double the transaction processing capacity.

Key Trends

- There is a widespread shift toward Cloud-primarily based RPA solutions, which have become increasingly popular due to their accessibility, scalability, and flexibility, mainly for remote workforces. Cloud-native RPA systems are becoming increasingly popular, allowing organizations to manage and carry out automation projects more efficiently.

- The convergence of RPA with cognitive technologies such as natural language processing (NLP) and computer vision drives intelligent automation. With the help of these features, RPA bots can carry out difficult tasks, decide based on facts, and communicate with users and systems more wisely.

- There is a developing trend towards using process discovery tools to find opportunities for automation, which is becoming increasingly more popular. Organizations may promote innovation and continual development by utilizing advanced analytics capabilities, which offer insights into automation performance, process optimization, and ROI.

Premium Insights

The market for Robotic Process Automation is being driven by various factors, such as the increasing demand for automation solutions like RPA from enterprises due to their need to simplify processes, reduce costs, and improve efficiency. Robotic Process Automation (RPA) is being used more to automate routine work and free up human resources for more strategic endeavors due to the growing amount of repetitive and rule-based tasks across industries and the scarcity of skilled labor. Furthermore, the popularity of cloud-based RPA solutions is rising due to the increase in digital transformation activities following the pandemic and remote work. These solutions provide scalability, agility, and accessibility for enterprises navigating hybrid work settings.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Implementation of RPA streamlines business processes and also revolutionizes the way organizations operate

By automating mundane and repetitive tasks, RPA frees up valuable human resources to concentrate on strategic goals and innovation. RPA bots work tirelessly around the clock to ensure tasks are finished precisely and on time, boosting customer satisfaction and operational efficiency. RPA is scalable; companies may additionally easily develop their automation programs in response to shifting business necessities without committing significant resources to hiring new employees or purchasing new technology.

Data Insecurity Risk Hindering the Implementation of Market in the Financial Sector

RPA offers numerous benefits, but data security and compliance concerns pose significant challenges, particularly in highly regulated industries such as finance. Concerns regarding data integrity, confidentiality, and regulatory compliance arise when RPA is used since it adds to data management and governance complexity. Addressing these concerns requires a complex approach that includes robust encryption techniques, access controls, audit trails, and regular security assessments to protect sensitive data and maintain regulatory compliance.

Cutting-edge technology and RPA integration offer innovative prospects for market innovation

Organizations can attain new intelligence and autonomy in their automation endeavors by integrating RPA with machine learning (ML) and artificial intelligence (AI). AI-powered RPA bots can analyze unstructured data, learn from past interactions, and adapt to changing circumstances, enabling more sophisticated and context-aware automation solutions. The potential of RPA bots to understand and react to human language through natural language processing improves user experience and makes conversational interfaces for process automation possible. Moreover, integrating RPA with advanced analytics and predictive modeling allows businesses to gain actionable insights from automation data, driving informed decision-making and process optimization.

Competitive Landscape

The competitive landscape of the Robotic Process Automation market is characterized by a wide range of key players ranging from well-established industry giants to innovative startups. Prominent firms like Blue Prism, Automation Anywhere, and UiPath continue to rule the market with all-inclusive RPA solutions catered to different company requirements and industry verticals. However as more companies enter the market and existing ones expand their products, competition is getting more intense, which is pushing innovation and distinction in features like cloud compatibility, analytics integration, and cognitive automation. The Robotic Process Automation market is growing and evolving due to the efforts of vendors to enhance their skills and broaden their market reach, facilitated by strategic partnerships, acquisitions, and alliances reshaping the industry.

The key players in the global Robotic Process Automation market include - NTT Advanced Technology Corp. (Japan), OnviSource Inc. (U.S.), Pegasystems Inc. (U.S.), SAP (Germany), UiPath (U.S.), Automation Anywhere (U.S.), Blue Prism Ltd. (UK), BlackLine Systems LLC (U.S.), EdgeVerve Systems Ltd. (India), FPT Software (Vietnam), KOFAX Inc. (U.S.), Microsoft (U.S.), NICE (Israel), Uniphore (U.S.), WorkFusion Inc. (U.S.) among others.

Recent Market Developments

Digital Workforce Partners with Kanta-Häme Welfare Region to Implement RPA for Data Migration

- In April 2024, Digital Workforce, a leading provider of Robotic Process Automation (RPA) services, partners with the Kanta-Häme Welfare Region to implement RPA technology for the smooth migration of active customer data from the ProConsona client information system to the new Saga social care client information system. Scheduled for launch in October 2024, Saga aims to integrate and streamline existing systems. Digital Workforce is leveraging its expertise in RPA to automate data transfer processes, ensuring efficiency and accuracy during the transition phase.

Rockwell Automation and Microsoft Enhance Industrial Automation with Generative AI Partnership

- In October 2023, With generative AI, Rockwell Automation and Microsoft hope to deepen their long-standing partnership and speed up industrial automation design and development. The companies wanted to integrate technologies to improve industrial automation systems that build customers and empower the workforce. Both companies understand that one of the most important areas in which they hope to assist clients in streamlining their processes and increasing employee productivity is using AI to enhance automation across various jobs, from control engineers to decision-makers and operators.

Other Recent Developments

- In April 2023, UiPath revealed that the UiPath Test Suite is being used by NTT DOCOMO, the biggest telecom operator in Japan, to enhance its application delivery infrastructure. Using the Test Suite, an AI-driven automation tool, NTT DOCOMO increased the frequency of release from quarterly to biweekly, significantly reducing the time required for testing mobile applications. This successful deployment highlights how UiPath's use of robotic process automation (RPA) has improved operational efficiency and accelerated digital transformation at a major telecom operator.

- The Kofax, Inc. marketplace—a digital center with connectors, tools, and apps for sophisticated automation software integration with top companies—reopened in April 2023, the company stated. The Kofax, Inc. Marketplace provides access to comprehensive training and pre-made resources that can be integrated with current core platform components, including RPA and Kofax TotalAgility.

- In October 2022, the most recent iteration of Robot Studio, a low-code development environment for robotic process automation (RPA), is now available, according to Pegasystems Inc. Pegasystems Inc.'s existing Robot Studio makes it simpler for users of all skill levels to automate manual operations, which is a response to the growing market need for RPA. This innovation allows businesses to effectively create and manage RPA bots, resolving problems that arise when integrating RPA into business processes.

The global Robotic Process Automation market can be categorized as Type, Deployment, Operations, Application, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Deployment

By Organization

By Operations

By Application

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 03-Jun-2024

Vantage Market

Research | 03-Jun-2024

FAQ

Frequently Asked Question

What is the global demand for Robotic Process Automation in terms of revenue?

-

The global Robotic Process Automation valued at USD 4.3 Billion in 2023 and is expected to reach USD 38.34 Billion in 2032 growing at a CAGR of 27.5%.

Which are the prominent players in the market?

-

The prominent players in the market are NTT Advanced Technology Corp. (Japan), OnviSource Inc. (U.S.), Pegasystems Inc. (U.S.), SAP (Germany), UiPath (U.S.), Automation Anywhere (U.S.), Blue Prism Ltd. (UK), BlackLine Systems LLC (U.S.), EdgeVerve Systems Ltd. (India), FPT Software (Vietnam), KOFAX Inc. (U.S.), Microsoft (U.S.), NICE (Israel), Uniphore (U.S.), WorkFusion Inc. (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 27.5% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Robotic Process Automation include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Robotic Process Automation in 2023.