Reprocessed Medical Devices Market

Reprocessed Medical Devices Market - Global Industry Assessment & Forecast

Segments Covered

By Product Cardiovascular, Laparoscopic, Gastroenterology, General Surgery Devices, Orthopedic Devices

By End-Use Hospitals, Home Healthcare, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 2.29 Billion | |

| USD 6.72 Billion | |

| 14.40% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Market Synopsis:

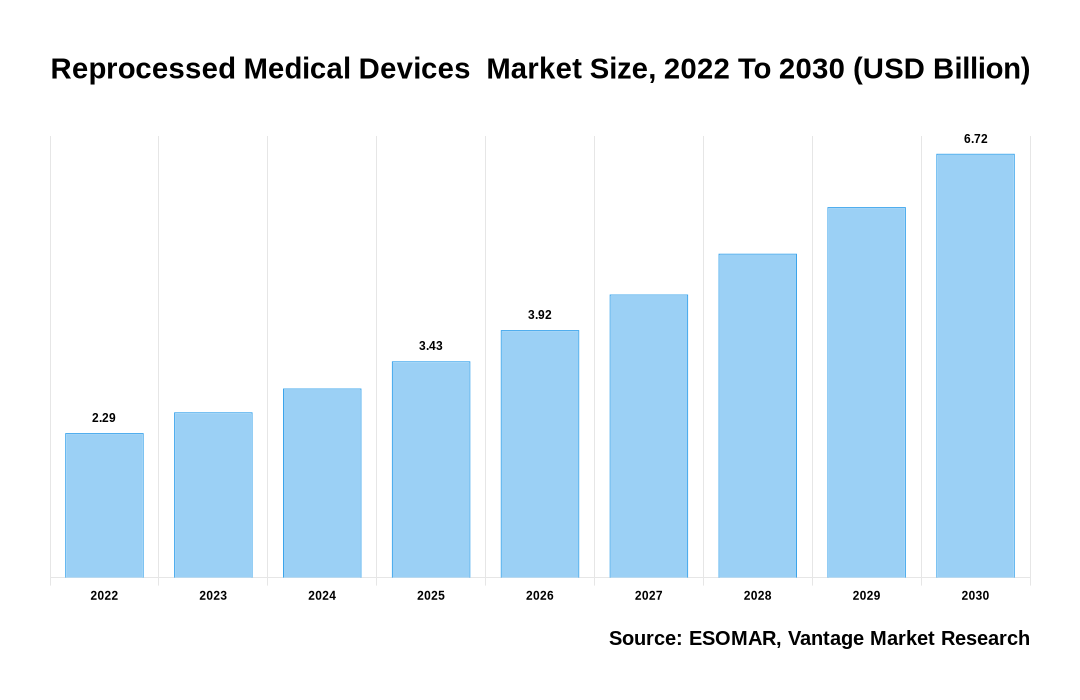

Global Reprocessed Medical Devices market is valued at USD 2.29 Billion in 2022 and is projected to attain a value of USD 6.72 Billion by 2030 at a CAGR of 14.40% during the forecast period, 2022–2028. Reprocessed Medical Devices provide dependable patient care while also saving money in the hospital and benefiting the environment. As hospitals throughout the world look for methods to cut costs, a number of third-party companies, distributors, and product manufacturers are offering reprocessing programmes for specific medical devices. Due to significant unmet demands, this network is increasing in developing nations, which provide additional prospects for recycled medical device businesses. The cost of a reprocessed device can be nearly half that of a new device, therefore choosing reprocessed gadgets can save you a lot of money. Reprocessed Medical Devices is expected to save the healthcare industry billions of dollars each year.

COVID-19, on the other hand, has had a considerable impact on the medical device business. Due to the high risk of the COVID-19 infection spreading during the present pandemic, strict limits have been imposed on the use of reprocessed medical devices. Furthermore, since healthcare providers' attention has shifted to treating COVID-19 patients, certain medical treatment procedures involving the use of reprocessed medical equipment have been postponed in recent months. As a result, demand for reprocessed medical equipment would be relatively sluggish in 2020.

Increasing Investments in Healthcare Infrastructural Development

Reprocessed Medical Devices Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Reprocessed Medical Devices Market

The global healthcare environment has changed dramatically during the last few decades. Unprecedented economic growth has been experienced by many countries around the world. As a result, these economies' economic, cultural, industrial, and healthcare settings have changed dramatically. Widespread regulatory reforms, economic liberalisation, fast growing middle-class populations with increasing purchasing power, and increased investments in infrastructure development have all contributed to the healthcare industry's rapid rise.

A major influence rendering growth driver of the reprocessed market is the increasing pressure to boost the usage of reprocessed medical devices due to the associated benefits such as high-cost efficiency. The aforementioned aspect can be ascribed to the low cost of reprocessing in compared to the production cost of original equipment, as well as the growing desire to reduce medical waste disposal costs.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

The Reprocessed Medical Devices market scope can be tabulated as below:

Market Segmentation:

The Global Reprocessed Medical Devices Market has been segmented by Product into Cardiovascular, Laparoscopic, Gastroenterology, General Surgery Devices and Orthopedic Devices. By End Use into Hospitals, Home Healthcare and Others. Based on Region, the Reprocessed Medical Devices Market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

As the number of cardiovascular procedures and treatments rises, so does the desire for cost-effective options, driving the industry forward. Furthermore, the introduction of low-cost, single-use cardiovascular reprocessed devices has expanded use, contributing to the segment's total growth.

Furthermore, the growing number of FDA approvals for reprocessed cardiovascular products is contributing to the segment's sizeable stake. As a result of industry players' continual efforts to promote reprocessing processes through strategic alliances and regular FDA approvals, this segment is expected to grow lucratively at a CAGR of 20.9 percent. The demand for these items is expected to rise in the future.

North America to Continue Dominating the Reprocessed Medical Devices Market

Due to the well-developed healthcare industry, high adoption rate of Reprocessed Medical Devices , and presence of prominent manufacturers in the area, the market in North America held the highest share in 2020. A primary motivation in this region is the growing need to reduce waste creation and potential environmental damage as a result of the region's growing garbage landfills. The rise of this region is being fueled by rising need to cut healthcare costs, as well as a scarcity of facilities for effective waste disposal.

Furthermore, favourable government measures to raise awareness about equipment reprocessing are projected to generate considerable potential possibilities for this industry. Furthermore, the presence of a strict regulatory environment aimed at ensuring patient safety is projected to expand the market for high-quality reprocessed devices, thereby offering future growth opportunities.

Key Players:

Key participants operating in the Reprocessed Medical Devices market are: Some of the leading players operating in the reprocessed medical devices market include GE Healthcare, Medline Industries, Renu Medical (Arjo), Soma Technology, Stryker, Teleflex Incorporated, Medtronic, Innovative Health, Vanguard AG, Ethicon, and SureTek Medical.

The Reprocessed Medical Devices market is segmented as follows:

| Parameter | Details |

|---|---|

| Segments Covered |

By Product

By End-Use

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 24-Feb-2022

Vantage Market

Research | 24-Feb-2022

FAQ

Frequently Asked Question

What is the global demand for Reprocessed Medical Devices in terms of revenue?

-

The global Reprocessed Medical Devices valued at USD 2.29 Billion in 2022 and is expected to reach USD 6.72 Billion in 2030 growing at a CAGR of 14.40%.

Which are the prominent players in the market?

-

The prominent players in the market are Some of the leading players operating in the reprocessed medical devices market include GE Healthcare, Medline Industries, Renu Medical (Arjo), Soma Technology, Stryker, Teleflex Incorporated, Medtronic, Innovative Health, Vanguard AG, Ethicon, and SureTek Medical..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 14.40% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Reprocessed Medical Devices include

- Increasing Investments in Healthcare Infrastructural Development

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Reprocessed Medical Devices in 2022.