Real Estate Crowdfunding Market

Real Estate Crowdfunding Market - Global Industry Assessment & Forecast

Segments Covered

By Investors Individual, Institutional

By Property Type Residential, Commercial, Mixed-Use

By Platform Type Equity Crowdfunding, Debt Crowdfunding, Hybrid Crowdfunding

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 11.5 Billion | |

| USD 161.8 Billion | |

| 45.9% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

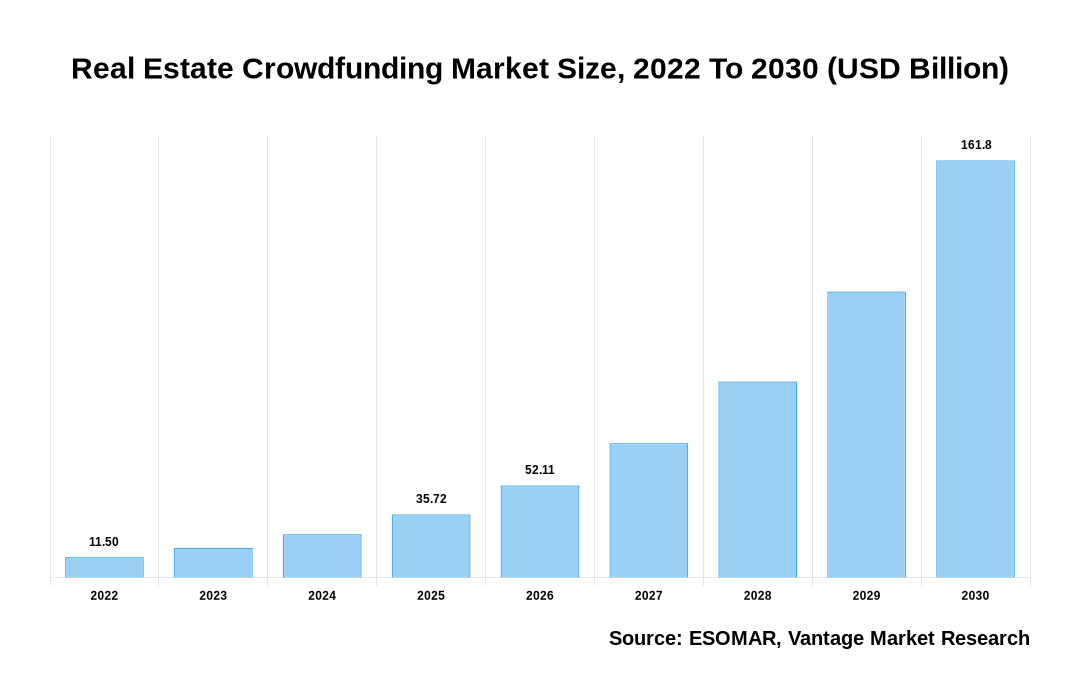

The global Real Estate Crowdfunding Market is valued at USD 11.5 Billion in 2022 and is projected to reach a value of USD 161.8 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 45.9% between 2023 and 2030.

Premium Insights

The Real Estate Crowdfunding market has experienced significant growth in 2022, with more investors turning to this alternative investment vehicle. According to recent studies, the global Real Estate Crowdfunding market is projected to reach $868.9 billion by the end of the year, showcasing a remarkable growth rate of 58% compared to the previous year. This surge in popularity can be attributed to several factors, including the increasing accessibility of real estate investments, the advantages of diversification, and the potential for high returns. The Real Estate Crowdfunding market has grown exponentially over the past few years as people continue to seek stable investment opportunities amidst a turbulent economic landscape, residential properties have remained a safe and lucrative choice. In fact, residential real estate crowdfunding platforms have witnessed an 84% increase in investment activity compared to the previous year.

Real Estate Crowdfunding Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Real Estate Crowdfunding Market

Investors may now browse and choose different projects with ease thanks to the improvement of user-friendly online platforms that support crowdfunding investments. With the number of people who have registered on these platforms increasing by 67% in 2022, this simplicity of use has helped to enhance involvement in crowdfunding. Detailed information, market analyses, and due diligence studies regarding various properties are made available to investors via crowdfunding platforms. Investors now have the information and insights that were previously only available to institutional investors, enabling them to make well-informed decisions. Platforms like Fundrise and RealtyMogul, for instance, use algorithms and data analytics to find prospective investment opportunities and give investors thorough forecasts and risk evaluations. Fundrise is a well-known instance of a real estate crowdfunding platform that is effective. Fundrise has funded more than $1.8 billion for building projects across the US since its 2012 start.

The adoption of beneficial government policies in many nations is also projected to accelerate the industry's growth. For instance, new investors now have more flexibility thanks to revisions in Securities and Exchange Commission (SEC) rules that permit accredited and non-accredited investors to invest in real estate crowdfunding deals through online platforms. Another factor fueling the expansion of the sector is the growing tendency of most real estate crowdfunding platforms to accept cryptocurrency. This pattern is anticipated to draw more investors and open up the real estate market.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Key Takeaways

- North America has generated more than 36% of revenue share in 2022.

- Asia Pacific and European Regions are expected to expand at the fastest CAGR between 2023 and 2032.

- Residential real estate crowdfunding platforms have witnessed an 84% increase in investment activity compared to the previous year.

Economic Insights

The state of the economy as a whole, which includes elements like GDP growth, unemployment rates, and interest rates, can have a big impact on the confidence of investors in the real estate market. Since income must be saved up in order to purchase a property, the co-integration of GDP growth and real estate capital returns is fundamentally logical. With only a few modifications, income can be directly determined from GDP. According to research from Asia, Europe, and the US, the median housing price and GDP per capita are correlated by anywhere between 60% and 95%. Additionally, during a period of high GDP growth, more individuals have the financial means to participate in crowdfunding campaigns, resulting in increased funding opportunities for real estate projects. Economic downturns may result in a decline in investor demand for real estate, which could impede the expansion of the crowdfunding industry. Governmental restrictions on real estate investments can also be a hindrance, affecting the ease of participation and limiting the market's total potential.

Top Market Trends

- Real Estate Tokenization: Tokenization is the process of converting real estate assets into digital tokens. This tendency provides more accessibility, higher liquidity, and fractional ownership of real estate assets. Tokenization increases flexibility and lowers entry barriers by enabling investors to acquire and sell fractional ownership units in real estate assets. For instance, instead of buying an entire property, investors can buy a fraction of it, increasing liquidity and allowing diversification of investments. Tokenization offers a more efficient and transparent investment process, attracting a wider range of investors thanks to blockchain technology's guarantee of transparency and immutability.

- Democratization of Real Estate Investing: A wider spectrum of investors can now invest in real estate projects because of the rise of online platforms such as Fundrise, RealtyShares, Roofstock, PeerStreet, RealtyMogul, Patch of Land, and others which allow for lesser initial investments. For instance, the well-known online real estate investing platform Fundrise enables users to invest in various commercial and residential real estate projects. With this platform, smaller investors can now participate in real estate possibilities that were previously only open to major institutions. Fundrise allows investors to get started with as little as $500. Due to this trend, people from all walks of life can now engage in and diversify their investment portfolios in the once-exclusive realm of real estate investing. Additionally, it has made it possible for smaller real estate developers to get financing and finish their projects. Overall, the market has been transformed by the democratization of real estate investing, which encourages financial inclusion and opens opportunities for private investors to engage in this lucrative sector.

Market Segmentation

The global Real Estate Crowdfunding market can be segmented based on the following: Investor Type, Property Type, Platform Type, and Regions. Based on the Investor Type, the market can be categorized into Individual Investors and Institutional Investors. Additionally, based on Property Type, the market can be split into Residential, Commercial, and Mixed-Use. Furthermore, based on Platform Type, the market can be categorized as Equity Crowdfunding, Debt Crowdfunding, and Hybrid Crowdfunding. Likewise, based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Investor Type

Real Estate Crowdfunding Platforms have made it easier for Individual Investors to access and Invest in Real Estate Projects

Individual investors are the most common investor type in the real estate crowdfunding sector. These are ordinary folks who want to invest their money in real estate ventures without having to raise a lot of money. The accessibility and democratization of real estate investment that crowdfunding platforms provide are what makes individual investors so appealing. Through these platforms, individual individuals can pool their funds with those of other investors to participate in a variety of real estate projects, giving them the chance to diversify their portfolios and generate passive income. Real estate crowdfunding has become a popular investment option for private investors because of its simplicity, reduced entry requirements, and possibility for greater profits.

Based on Property Type

The Dominance of Residential Properties in the Real Estate Crowdfunding market can be attributed to their Wider Market appeal, Lower Investment risks, Predictable Returns, Diverse Options, and Regulatory Environment

Residential properties predominate in the real estate crowdfunding industry among the numerous property kinds. Apartments, townhomes, condominiums, and single-family homes are all examples of residential real estate. Numerous variables contribute to residential homes' dominance. First of all, housing is among the numerous property kinds in the real estate crowdfunding industry in constant demand, which makes it a desirable investment. Second, a wider spectrum of investors can join because residential assets often have lower price points than business or industrial properties. Finally, due to the growing demand for rental properties and the possibility of capital appreciation in desirable neighborhoods, residential properties tend to carry smaller risks and tend to have a wider investor base.

Based on the Platform Type

Equity-Based Crowdfunding Platforms allow Investors to Become Direct Owners of Real Estate Properties

The dominating category among platform types in the Real Estate Crowdfunding market is the Equity-Based Crowdfunding Platform. Equity-based crowdfunding platforms allow investors to become direct owners of real estate properties by contributing capital in exchange for equity shares. This dominance can be attributed to the potential for higher returns and the sense of ownership it provides to investors. Equity-based crowdfunding platforms offer investors opportunities to participate in a diverse range of real estate projects that were previously only accessible to institutional investors or high-net-worth individuals. Moreover, these platforms often provide detailed project information and facilitate investor engagement, enhancing transparency and mitigating risks associated with real estate investments.

Based on Region

The Largest Region in the Real Estate Crowdfunding market in North America, Specifically the United States

North America is the market's largest region, with the United States serving as its primary driver because the US has one of the largest and most mature real estate markets in the world. This attracts both domestic and international investors who seek to diversify their portfolios and invest in attractive real estate opportunities through crowdfunding. The favorable regulatory framework, technical improvements, and a firmly established real estate business are the main causes of this.

Additionally, North America has seen significant progress in technology, making it simpler for investors to take part in real estate crowdfunding initiatives. For instance, Skyline AI is an AI-based real estate investment platform based in the United States. It links investors with real estate possibilities according to their requirements for return, risk, and liquidity. The platform employs its own brand of artificial intelligence to spot opportunities, recognize risk-reward investments, and spot market abnormalities. Additionally, investors may now access crowdfunding platforms from any location at any time thanks to the widespread use of mobile devices and the internet, which has improved the market's convenience and accessibility.

North America has a thriving and developed real estate market, making it a desirable investment choice for both domestic and foreign investors. Investors have a wide range of opportunities to diversify their portfolios and produce healthy returns thanks to the abundance of residential, commercial, and industrial properties. Overall, North America is now the largest region in the real estate crowdfunding sector thanks to a favorable regulatory environment, technology improvements, and a strong real estate market. Although real estate crowdfunding has grown in other locations, like Europe and Asia, they have not yet reached the same levels of revenue as the United States. In nations like the United Kingdom, France, and Germany, where platforms like Property Partner and Bulkestate have operated, the European sector has experienced success. With platforms like Lendlease, CoAssets, and the Tokyo Stock Exchange (TSE) providing real estate investment opportunities, nations in Asia like China, Japan, and South Korea have also embraced real estate crowdfunding.

Competitive Landscape

Numerous international and regional actors compete fiercely on the global market. Major corporations engage in strategic alliances, mergers & acquisitions, and joint ventures to acquire a market advantage. In addition, manufacturers concentrate on capacity expansions and R&D for new product development to offer consumers products that are on trend. While well-known platforms like Realty Mogul, Fundrise, and Patch of Land have a solid following, new competitors are continuously entering the market, offering cutting-edge features and focusing on specialized markets. A broad and dynamic landscape is produced by the market's many investment models, deal formats, and levels of access for accredited and non-accredited investors.

The key players in the global Real Estate Crowdfunding market include - AHP Servicing LLC (U.S.), Crowdestate AS (Estonia), CrowdStreet Inc. (U.S.), DiversyFund Inc. (U.S.), EstateGuru OÜ (Estonia), Fundrise LLC (U.S.), Groundbreaker Technologies Inc. (U.S.), Groundfloor Finance Inc. (U.S.), RealCrowd Inc. (U.S.), RM Technologies LLC (U.S.) among others.

Recent Market Developments

- April 2023: The debut of CrowdStreet REIT I (also known as C-REIT) with iCapital has been announced by CrowdStreet Advisors. This increases the fund's accessibility since it was previously only accessible through CrowdStreet channels and is now also available through iCapital channels.

- May 2023: Ben Miller, the chief executive officer of Fundrise, is attempting to build a $500 million credit fund to profit from the US commercial real estate sector's growing crisis.

- June 2022: Due to the spike in demand from retail investors for fractional real estate, Arrived Homes, a US-based real estate investment platform, intensified its acquisitions. The business purchased 59 single-family rental properties valued at US$23 million in 17 regions.

Segmentation of the Global Real Estate Crowdfunding Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Investors

By Property Type

By Platform Type

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 26-Jul-2023

Vantage Market

Research | 26-Jul-2023

FAQ

Frequently Asked Question

What is the global demand for Real Estate Crowdfunding in terms of revenue?

-

The global Real Estate Crowdfunding valued at USD 11.5 Billion in 2022 and is expected to reach USD 161.8 Billion in 2030 growing at a CAGR of 45.9%.

Which are the prominent players in the market?

-

The prominent players in the market are AHP Servicing LLC (U.S.), Crowdestate AS (Estonia), CrowdStreet Inc. (U.S.), DiversyFund Inc. (U.S.), EstateGuru OÜ (Estonia), Fundrise LLC (U.S.), Groundbreaker Technologies Inc. (U.S.), Groundfloor Finance Inc. (U.S.), RealCrowd Inc. (U.S.), RM Technologies LLC (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 45.9% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Real Estate Crowdfunding include

- The surge in urbanization and disposable income of the middle-class population

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Real Estate Crowdfunding in 2022.