Prosthetic Heart Valve Market

Prosthetic Heart Valve Market - Global Industry Assessment & Forecast

Segments Covered

By Product Mechanical Heart Valve, Tissue Heart Valve, Transcatheter Heart Valve

By Position Mitral Valve, Aortic Valve, Other Positions

By End User Hospitals, Ambulatory Surgical Centers, Other End Users

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 7.77 Billion | |

| USD 20.08 Billion | |

| 11.13% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

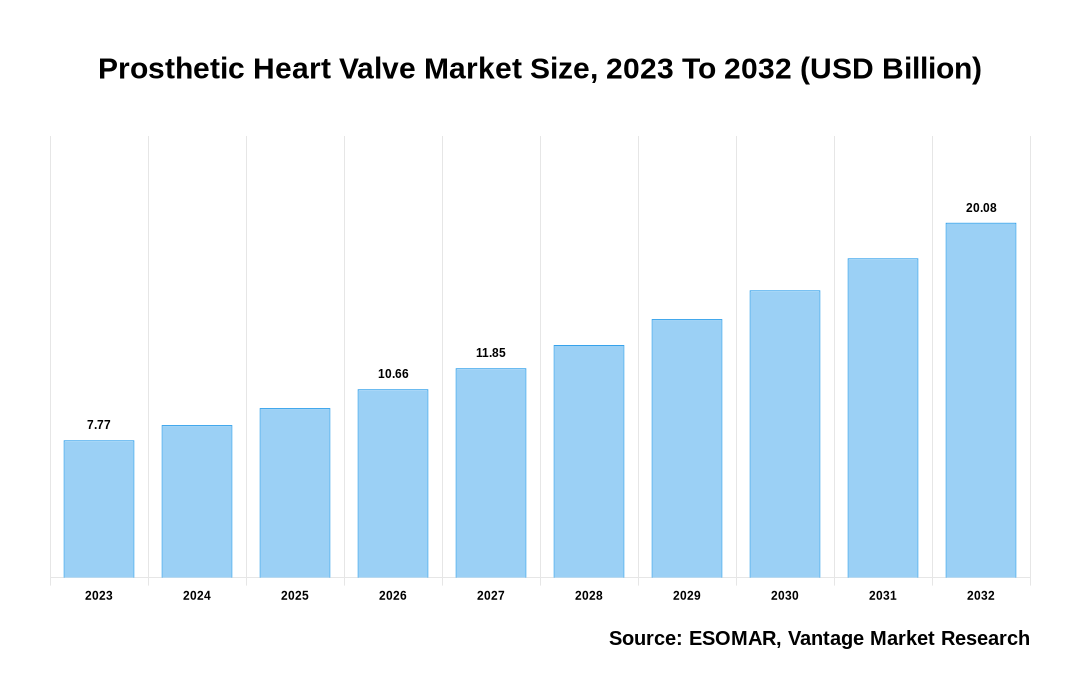

The global Prosthetic Heart Valve Market is valued at USD 7.77 Billion in 2023 and is projected to reach a value of USD 20.08 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 11.13% between 2024 and 2032.

Key highlights of Prosthetic Heart Valve Market

- The North American region shown its dominance in the market in 2023, obtaining the largest revenue share of more than 40.8%,

- In 2023, the Asia Pacific region is expected to have a substantial market share and be experiencing remarkable growth,

- The Transcatheter Heart Valve segment dominates the market with 40.6% of the market share in 2023,

- The Mitral Valve segment will continue to assert its dominance by position, capturing the largest market share of 37.5% in 2023,

- Hospitals dominated the market with a significant market share of 73.2% in 2023,

- Accelerated funding for research and development (R&D) is pivotal in improving next-generation prosthetic heart valve technology. With more financial resources allotted to R&D tasks, scientific device producers can invest in cutting-edge technologies, novel substances, and advanced production strategies to enhance prosthetic coronary heart valves' performance, durability, and biocompatibility.

Prosthetic Heart Valve Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Prosthetic Heart Valve Market

Prosthetic Heart Valve Market: Regional Overview

North America Dominated Sales with a 40.8% share in 2023. This regional dominance may be attributed to several factors, including a well-established healthcare infrastructure, a high prevalence of cardiovascular diseases, and widespread adoption of advanced medical technologies. For instance, valvular heart disease affects around 100 million people worldwide each year. Additionally, robust research and development activities and favorable reimbursement policies have contributed to the region's leadership in the market. North America is home to several leading medical device manufacturers and research institutions, fostering a culture of innovation and using the development of cutting-edge technologies within the area of cardiac care. Additionally, favorable reimbursement policies and regulatory frameworks in nations such as the USA and Canada provide conducive surroundings for market increase and adoption of advanced medical devices, in addition to solidifying North America’s position as a key market leader. Moreover, the place's robust recognition of patient effects, coupled with a well-established network of healthcare companies, ensures a timely right of entry to high-quality cardiac care, thereby maintaining the demand for prosthetic heart valves.

U.S. Prosthetic Heart Valve Market Overview

The U.S. Prosthetic Heart Valve market, valued at USD 2.21 Billion in 2023 to USD 5.38 Billion in 2032, is anticipated to grow at a CAGR of 10.4% from 2024 to 2032. The market for Prosthetic Heart Valve in the USA is constantly growing and evolving because of the complicated healthcare system, advanced medical technology, and a huge patient population; the U.S. remains a key market for Prosthetic Heart Valve. The USA benefits from a strong community of healthcare providers and renowned hospitals and cardiac centers, which offer specialized care and get admission to modern treatments for heart valve disorders. For instance, valvular heart disease affects about 2.5% of Americans, but it is more prevalent in older persons. Valvular heart disease affects roughly 13% of those born before 1943. Moreover, favorable reimbursement policies and regulatory frameworks facilitate the adoption of prosthetic heart valves, driving market growth. Technological advancements, especially in minimally invasive strategies, including transcatheter heart valve replacement (TAVR), are increasingly gaining traction in the U.S., imparting more secure and efficient treatment alternatives to sufferers. Additionally, rising awareness about cardiovascular health and increasing healthcare expenditure further fuel the country's demand for prosthetic heart valves.

The global Prosthetic Heart Valve market can be categorized as Product, Position, End User, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product

By Position

By End User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Prosthetic Heart Valve Market: Product Overview

In 2023, the Transcatheter Heart Valve segment dominated the market with 40.6% market share. The {Keyword}} market, segmented by product, includes Mechanical Heart Valve, Tissue Heart Valve, and Transcatheter Heart Valve. This segment's prominence can be attributed to numerous factors, including the growing adoption of minimally invasive techniques, including transcatheter aortic valve replacement (TAVR) and transcatheter mitral valve replacement (TMVR). These procedures offer patients less invasive treatment options with shorter recovery times and reduced risks compared to traditional open-heart surgeries, driving their widespread acceptance among physicians and patients alike. Additionally, advancements in transcatheter heart valve technologies, expanded indications, and favorable reimbursement policies further bolstered the segment's growth. It solidified its position as a key prosthetic heart valve market player.

Prosthetic Heart Valve Market: Position Overview

In 2023, the Mitral Valve segment accounted for over 36.2% market share. The Position segment is divided into Mitral Valve, Aortic Valve, and Others. This segment's significant share can be attributed to the prevalence of mitral valve disorders and the increasing adoption of mitral valve replacement procedures to address these conditions. Mitral valve disorders, together with mitral regurgitation and mitral stenosis, affect a large patient population globally, necessitating the use of prosthetic mitral valves to restore proper coronary heart function. For instance, according to a study, diseases, including mitral valve stenosis, are rare, particularly in developed nations. In the United States, it affects roughly 1 in every 100,000 people. It is more prevalent in developing countries, particularly those with restricted access to healthcare and antibiotics. Furthermore, advancements in mitral valve technology, together with transcatheter mitral valve replacement (TMVR) and tissue-engineered valves, have improved remedy options for patients with mitral valve diseases, contributing to the segment's boom and reinforcing its role as a key player in the Prosthetic Heart Valve market.

Prosthetic Heart Valve Market: End User Overview

The Hospitals segment accounted for the largest market share of 73.2% in 2023. The End User segment is bifurcated into Hospitals, Ambulatory Surgical Centers, and Other End Users. This segment's substantial share can be attributed to hospitals' pivotal role as primary healthcare providers for patients requiring prosthetic heart valve interventions. Hospitals possess the necessary infrastructure, medical expertise, and specialized cardiac care facilities to perform complex surgical procedures, including heart valve replacements and repairs. Moreover, hospitals often serve as centers of excellence for cardiovascular care, attracting patients seeking advanced treatment options and specialized care from renowned cardiac surgeons and multidisciplinary healthcare teams. The Hospital segment's dominance underscores the critical importance of hospital-based healthcare delivery in addressing the growing burden of cardiovascular diseases and meeting the diverse clinical needs of patients requiring prosthetic heart valve interventions.

Key Trends

- The increasing global focus on personalized medicine is reshaping trends in the Prosthetic Heart Valve market, recognizing the necessity for tailored solutions in cardiovascular care. A deeper understanding of individual patients drives this shift needs, prompting advancements in imaging technologies and diagnostic capabilities to customize prosthetic heart valve treatments accordingly, ensuring optimal patient compatibility and outcomes.

- There is a rising preference for minimally invasive surgical techniques, and the Prosthetic Heart Valve market witnesses a significant trend towards procedures that offer shorter recovery times, reduced hospital stays, and diminished risk of complications. This preference underscores the growing importance of patient comfort and safety, driving the adoption of less invasive approaches to heart valve replacement.

- Continuous research and development efforts are dedicated to enhancing the biocompatibility and durability of prosthetic heart valves, with a particular focus on materials such as tissue-engineered valves and biodegradable polymers. These innovations aim to address longstanding challenges in valve performance, paving the way for more reliable and long-lasting solutions in cardiovascular care.

Premium Insights

The increasing prevalence of cardiovascular diseases, particularly among the aging population, is a significant driver, fueling demand for prosthetic heart valves. For instance, according to a World Heart Federation (WHF) report in May 2023, the number of deaths from cardiovascular disease (CVD) increased from 12.1 million in 1990 to 20.5 million in 2023 on a global scale. Technological advancements, including minimally invasive procedures such as transcatheter heart valve replacement (TAVR), drive market growth by offering safer and more efficient treatment options. Moreover, rising healthcare expenditure and improving healthcare infrastructure in emerging markets contribute to market expansion by enhancing patient access to advanced cardiac care. Additionally, ongoing innovations in valve design and materials to improve durability and biocompatibility further stimulate market growth by addressing unmet clinical needs and enhancing patient outcomes.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

The surge in heart-related ailments globally underscores the need for prosthetic heart valve interventions to address the growing cardiovascular diseases

With an aging population and increasing prevalence of risk factors such as hypertension and diabetes, the demand for heart valve replacement procedures continues to rise. This trend necessitates proactive measures to expand healthcare infrastructure, improve access to specialized cardiac care services, and implement preventive strategies to mitigate the onset and progression of heart valve disorders. Moreover, collaborative efforts amongst healthcare stakeholders, including policymakers, healthcare companies, industry partners, and patient advocacy organizations, are crucial to addressing the multifaceted demanding situations posed by the growing prevalence of heart-related ailments and ensuring equitable admission to effective treatment options for all patients.

The shortage of skilled healthcare professionals poses a significant challenge in addressing the increasing demand for prosthetic heart valve interventions globally

With a developing prevalence of heart-related illnesses, including heart valve problems, the shortage of thoroughly skilled medical personnel hampers timely access to specialized care, potentially leading to treatment delays and suboptimal patient consequences. Addressing this shortage calls for complete workforce improvement techniques, which include training applications, recruitment tasks, and incentivized retention measures, to ensure that patients obtain well-timed and. high-quality cardiac care.

Ongoing innovations in valve design and materials play a crucial role in driving market growth and improving patient outcomes in the field of prosthetic heart valves

Advances in biomaterials, which include tissue-engineered valves and biodegradable polymers, provide more advantageous biocompatibility and durability, minimizing the risk of complications and enhancing long-term valve overall performance. Furthermore, innovations in valve design, including transcatheter approaches and minimally invasive techniques, contribute to shorter recovery times, reduced hospital stays, and improved patient satisfaction. Continued investment in research and development, coupled with regulatory guidance and market adoption, will, in addition, accelerate the pace of innovation in prosthetic heart valve technology, offering new possibilities to cope with unmet medical needs and enhance the efficiency of taking care of patients with heart valve issues.

Competitive Landscape

The Prosthetic Heart Valve market is highly competitive, and key players strive to innovate and improve patient outcomes. Leading companies such as Edwards Lifesciences, Medtronic PLC, and Abbott Laboratories dominate the market with their extensive product portfolios and established global presence. As more people age and heart problems become more common, there's a big competition among companies selling prosthetic heart valves. The major players in this field offer a wide range of products and are always working on making safer and more effective valves. Some innovative startups are each vying for market share in this rapidly evolving industry. Factors like how much the valves cost, getting approval from regulators, and finding new ways to reach customers are significant for these companies. Regulatory approvals, pricing strategies, and geographical expansion further shape the competitive dynamics of the prosthetic heart valve market, emphasizing the importance of sustained innovation and market agility for companies to maintain their competitive edge and meet the evolving needs of patients worldwide.

The key players in the global Prosthetic Heart Valve market include - Abbott Laboratories (U.S.), Medtronic PLC (Ireland), Meril Life Sciences (India), Boston Scientific Corp. (U.S.), Micro Interventional Devices Inc. (U.S.), Direct Flow Medical Inc. (U.S.), Edwards Lifesciences Corp. (U.S.), LivaNova PLC (UK), JenaValve Technology Inc. (U.S.), Cryolife Inc. (U.S.) among others.

Recent Market Developments

- In March 2022, the U.S. Food and Drug Administration (FDA) has approved Edwards Lifesciences (NYSE: EW)'s MITRIS RESILIA valve, a tissue valve replacement optimized for the mitral position in the heart.

- In January 2022, the inventor and producer of unique transcatheter aortic valve replacement (TAVR) devices, JenaValve Technology, Inc. ("JenaValve" or the "Company"), has announced a strategic investment and exclusive technology licensing agreement with Peijia Medical Limited (HKEX: 9996) in China. Peijia has entered into a deal with JenaValve whereby the former has agreed to provide exclusive rights to develop and commercialize JenaValve's innovative TrilogyTM TAVR systems in the Greater China region for the treatment of patients suffering from either severe symptomatic aortic regurgitation (AR) or severe symptomatic aortic stenosis (AS). Beijing has also committed to additional capital and royalty payments based on various milestone achievements.

- September 2021: To offer more therapeutic choices to patients with aortic or mitral valve disease, Abbott today announced that the EpicTM Plus and Epic Plus Supra Stented Tissue Valves have received FDA approval.

Vantage Market

Research | 05-Apr-2024

Vantage Market

Research | 05-Apr-2024

FAQ

Frequently Asked Question

What is the global demand for Prosthetic Heart Valve in terms of revenue?

-

The global Prosthetic Heart Valve valued at USD 7.77 Billion in 2023 and is expected to reach USD 20.08 Billion in 2032 growing at a CAGR of 11.13%.

Which are the prominent players in the market?

-

The prominent players in the market are Abbott Laboratories (U.S.), Medtronic PLC (Ireland), Meril Life Sciences (India), Boston Scientific Corp. (U.S.), Micro Interventional Devices Inc. (U.S.), Direct Flow Medical Inc. (U.S.), Edwards Lifesciences Corp. (U.S.), LivaNova PLC (UK), JenaValve Technology Inc. (U.S.), Cryolife Inc. (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 11.13% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Prosthetic Heart Valve include

- Surge in heart-related ailments globally underscores the need for prosthetic heart valve interventions to address the growing cardiovascular diseases

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Prosthetic Heart Valve in 2023.