Potash Market

Potash Market - Global Industry Assessment & Forecast

Segments Covered

By Product Potassium Chloride, Potassium Sulphate, Potassium Nitrate, Other Products

By End-use Agriculture, Non-Agriculture

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 59.8 Billion | |

| USD 92.85 Billion | |

| 5.01% | |

| North America | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

The global Potash Market is valued at USD 59.8 Billion in 2023 and is projected to reach a value of USD 92.85 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 5.01% between 2024 and 2032

Market Synopsis

The increasing global demand for food, which necessitates enhanced agricultural productivity drives the Potash market. The demand for higher crop yields grows as the world's population continues to rise projections indicate that it will surpass 10 billion by 2060. With an estimated 13 million metric tons of potash produced annually, Canada ranked first in the world. Major agricultural economies such as China, India, United States, Canada rely heavily on potash fertilizers to sustain their vast agricultural sectors. For instance, in 2023, with an estimated 13 million metric tons of potash produced annually, Canada ranked first in the world.

Technological advancements in agricultural methods and precision farming are also driving the market. Utilizing GPS and other remote sensing technology, among other modern farming techniques, makes it possible to apply fertilizers more precisely, increasing productivity and reducing waste. The efficiency of potash in crop production has been further increased by the development of new fertilizers based on potash and innovative delivery methods.

Potash Industry Highlights

- With 37.5% market share, Asia Pacific dominated the market in 2023 driven by extensive agricultural activities, rapid population growth, supportive government policies, and advancements in agricultural technology

- North America is expected to grow at significant CAGR projected throughout the forecast period

- Potassium Chloride emerged as the leading segment by Product in 2023, commanding a 54.5% market share due to its cost-effectiveness and high potassium content

- In 2023, Agriculture segment leads the market with 92.5% market share, underscoring its critical role in enhancing crop yields and food production

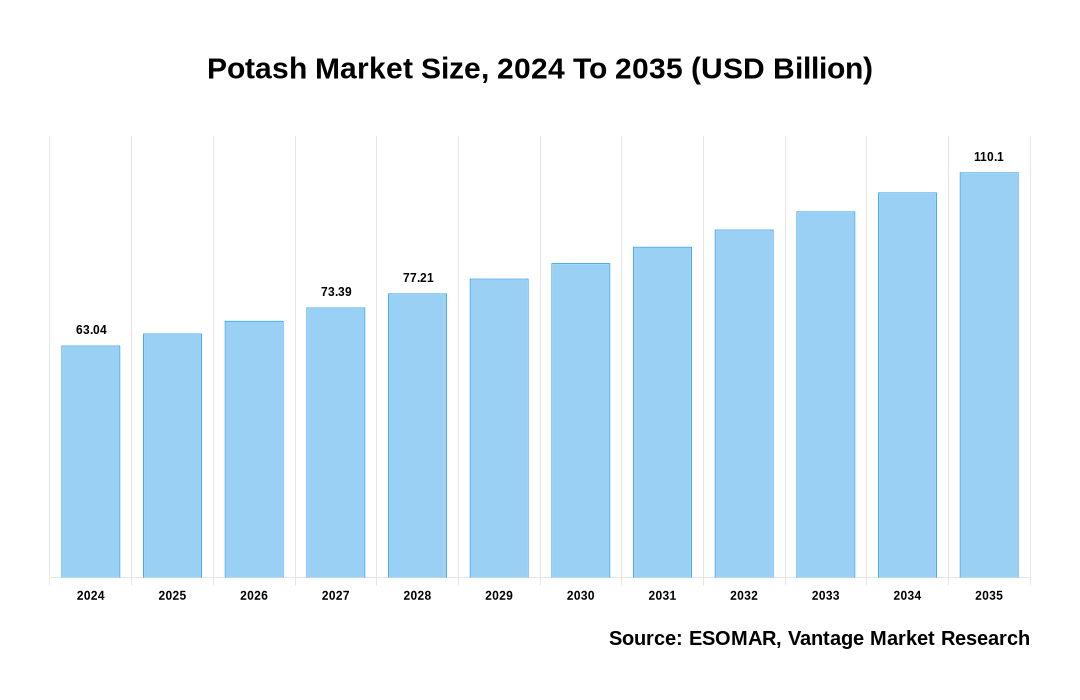

Potash Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Potash Market

Potash Market Regional Overview

Asia Pacific led the market with 37.5% market share because government support and initiatives boosts agricultural productivity and food security

Asia Pacific’s leadership is driven by its robust agricultural sector, which encompasses vast areas of arable land supporting staple crops like rice, wheat, and vegetables. Increasing food demand and a growing population in the region stimulate the use of potash fertilizers to maintain soil fertility and boost crop production. For instance, it is predicted that by 2030, the Asia Pacific region which is home to more than half of the world's population will include around 55% of all agricultural land.

Government initiatives to modernize agriculture and improve food security play a pivotal role in driving potash consumption. Policies supporting agricultural subsidies and incentives for farmers to adopt modern farming practices encourage the use of fertilizers, including potash, to optimize crop production. For instance, in line with the Sustainable Development Goals (SDGs) of the UN, the Indian government's Potash for Life initiative aims to provide farmers and consumers worldwide with revolutionary benefits. Indian Potash Limited (IPL) and ICL are collaborating strategically on this development.

Continued investments in agricultural infrastructure, coupled with ongoing R&D in fertilization techniques, are anticipated to sustain high demand for potash fertilizers. Potash will probably become increasingly important to attaining sustainable agricultural growth as the region improves its agricultural practices and addresses issues like soil degradation and climate change.

Potash fertilizers are in high demand because of countries like China, India, and Indonesia has significant agricultural outputs and are working to increase crop yields and expand food supply to meet the demands of their huge populations.

China's demand for potash is driven by its cultivation of key crops such as rice, wheat, corn, and vegetables. By 2026, China is expected to export over 109 million kg of potash. In 2023, the country imported 473,000 kilograms of potash.

India focuses on crops such as rice, wheat, sugarcane, and cotton, which also contribute to its substantial potash demand. According to FAI, the total consumption of potassic fertilizer in India (measured in K2O content) was 2.61 million tonnes during 2019-20.

Global Potash Reserves Trends

In 2023, Canada possessed the world's largest potash reserves, holding 33.6% of the total. Belarus, the second-largest holder of potash reserves, accounted for approximately 22.9% of global reserves that year. Canada not only just have the largest potash reserves, but it is also the leading producer of potash worldwide. Each year, Canada consistently contributes about one-third of the global potash production.

Distribution of global potash reserve 2023, by Country:

Potash Product Overview

Potassium Chloride segment leads the market with market share of 54.5% because of its widespread availability and its relatively low production cost make it a preferred choice among farmers globally

Potassium chloride is the most widely used potash fertilizer due to its high potassium content and cost-effectiveness. It is especially popular for its efficiency in delivering essential nutrients to a broad range of crops, including cereals, fruits, and vegetables. Additionally, its ease of application and compatibility with various soil types contribute to its significant market share.

Potassium chloride, also known as Muriate of Potash (MOP), serves predominantly as a source of potassium in nitrogen, phosphorus, and potassium (NPK) fertilizers and as a raw material for industrial purposes. Potassium chlorides prefer stems from being cost-effective compared to alternatives like potassium sulfate, while maintaining a relatively high potassium concentration.

The vast agricultural industries in countries such as China and India necessitate widespread adoption of potash products to meet the growing food requirements of their large populations. These countries play pivotal roles in influencing global market demand due to the immense size of their agricultural sectors. For instance, India's agriculture sector boasts the second-largest agricultural land globally, providing employment for approximately half of the country's population.

Potash Market Trends

- Rising Demand for Fertilizers: With the global population growing and the need for increased agricultural productivity, demand for potash fertilizers is on the rise, particularly in emerging economies with expanding agricultural sectors.

- Technological Advancements: Innovations in mining and processing technologies are enhancing the efficiency and environmental sustainability of potash production, reducing costs, and increasing output.

- Sustainable Agriculture Practices: There is a growing emphasis on sustainable and environmentally friendly agricultural practices, driving demand for potash fertilizers that support soil health and reduce environmental impact.

- Research and Development: Increased investment in R&D is leading to the development of more efficient and environmentally friendly potash fertilizers, enhancing nutrient delivery and crop yields.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Potash Market Dynamics

Consolidation in the Potash market is a significant driver due to increasing market demand, economies of scale, and strategic positioning

Potash is essential for agricultural productivity as it is a critical component in fertilizer production. Fluctuations in potash demand and changes in pricing dynamics often influence consolidation efforts. Businesses can better control market volatility and sustain steady revenue by acquiring competitors or forming alliances. Through consolidation, companies can strengthen their market positions, diversify their product offerings, and increase their bargaining power with suppliers and customers. Access to complementary resources or knowledge can also be facilitated through strategic mergers and acquisitions. Government rules and policies can have a significant impact on the dynamics of industry consolidation. Depending on the regulatory landscape, antitrust laws and trade barriers can either facilitate or hinder consolidation efforts.

Currency fluctuations present a significant restraint for the market, impacting the profitability of international trade and investment

Potash is traded globally, and the revenues of producers are often in different currencies than their operational costs. For instance, a Canadian potash producer selling in US dollars but incurring costs in Canadian dollars can see its profits erode if the US dollar weakens against the Canadian dollar. Such fluctuations in exchange rates can cause price instability in the global market, making it challenging for buyers and sellers to plan their budgets and anticipate future pricing. Companies frequently use strategies for hedging to reduce currency risk; although protective, these techniques complicate and increase the expense of financial management.

Investing in infrastructure and research presents significant opportunities for the market to enhance production efficiency, meet rising demand, and innovate new products

More production capacity and fewer operational bottlenecks can be achieved by building new mines, upgrading existing ones, and enhancing transportation networks. This will result in more dependable supply chains as well as lower logistical expenses. Technological advancements through research and development (R&D) investments can result in innovations in mining and processing techniques, including more efficient extraction methods, advanced refining processes, and environmentally friendly production technologies. Such advancements not only improve efficiency but also help companies comply with regulatory requirements and reduce their environmental footprint. Moreover, R&D can drive the creation of new types of potash fertilizers that offer improved nutrient delivery, better performance in various soil types, and greater efficacy in supporting crop yields, opening up new market segments and applications.

Potash Competitive Outlook

The competitive landscape of the Potash market is characterized by the presence of several key players who dominate the global production and distribution of potash. Major companies such as Nutrien Ltd., The Mosaic Company, Uralkali and K+S AG hold significant market shares due to their extensive mining operations and established supply chains. These businesses compete with each other based on things like product quality, cost-effectiveness, production capacity, and geographic reach. Innovations in sustainable mining methods and mining technology are also becoming vital competitive differentiators as businesses work to fulfill rising environmental regulations and global demand.

The key players in the global Potash market include - JSC Belaruskali, Compass Minerals Intl. Ltd., Mosaic Company (MOS), Uralkali, Rio Tinto Ltd., BHP Billiton Ltd., Eurochem, Red Metal Ltd., Encanto Potash Corp. (EPC), Intrepid Potash Inc., K+S Aktiengesellschaft, Nutrien (NTR) among others.

Potash Market Developments

Jordan's Prime Minister Inaugurates Arab Potash Company's New Facility and Unveils 2024-2032 Strategy

- In January 2024, Prime Minister Bisher Khasawneh sponsored the opening of the Arab Potash Company's new general administrative facility in Ghor al-Safi, in the Southern Jordan Valley. During the event, he also dedicated the company's 2024–2028 Strategy. In discussions with the Chairman, CEO, and staff, Prime Minister Khasawneh highlighted the Arab Potash Company as a vital national institution and a major contributor to the national economy.

Uralkali Signs Landmark Potash Supply Agreement with India

- April 2023, Uralkali, a leading global potash producer, has signed a contract to supply potash to India. This agreement makes Uralkali the first producer to reach a deal with Indian Potash Limited (IPL), India's largest importer of mineral fertilizers, for potash supply.

The global Potash market can be categorized as Product, End User and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product

By End-use

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Frequently Asked Questions (FAQs)?

1.How big is the market? What will be the global Potash market size by 2032?

The global Potash market is valued at $59.8 billion in 2023 and is anticipated to reach $92.85 billion by 2032, growing at a CAGR of 5.01% from 2024 to 2032.

2.What is potash used for?

Potash, primarily used in fertilizers (about 95%), promotes plant growth, boosts crop yields, enhances disease resistance, and improves water retention. It is also used in small amounts for industrial chemicals, animal feed, soap making, food production, water softening, road de-icing, pH adjustment, explosives, pharmaceuticals, and glassmaking.

3.Where is potash found?

Potash is distributed globally and ranks as the seventh most abundant element in the Earth’s crust. It can also be found in rainwater (approximately 4 parts per million) and seawater (390 mg/l K). Presently, only 12 countries produce the world’s supply of potash.

4.Who is the largest consumer of potash?

China is the largest consumer of potash, followed by Brazil and the United States.

5.What are the two types of potash?

SOP and MOP are widely adopted potash fertilizers types. They play a crucial role by not only enhancing food quality but also increasing crop yields.

6.Which countries data is covered in the report?

The countries covered in the potash market report are U.S., Canada, Mexico, Germany, France, U.K., Italy, Spain, Nordic Countries, Benelux Union, Rest of Europe, China, Japan, India, New Zealand, Australia, South Korea, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Rest of Asia Pacific, Brazil, Argentina, Rest of Latin America, Saudi Arabia, UAE, Egypt, Kuwait, South Africa, Rest of MEA.

Vantage Market

Research | 01-Aug-2024

Vantage Market

Research | 01-Aug-2024

FAQ

Frequently Asked Question

What is the global demand for Potash in terms of revenue?

-

The global Potash valued at USD 59.8 Billion in 2023 and is expected to reach USD 92.85 Billion in 2032 growing at a CAGR of 5.01%.

Which are the prominent players in the market?

-

The prominent players in the market are JSC Belaruskali, Compass Minerals Intl. Ltd., Mosaic Company (MOS), Uralkali, Rio Tinto Ltd., BHP Billiton Ltd., Eurochem, Red Metal Ltd., Encanto Potash Corp. (EPC), Intrepid Potash Inc., K+S Aktiengesellschaft, Nutrien (NTR).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 5.01% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Potash include

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Potash in 2023.