Polystyrene Market

Polystyrene Market - Global Industry Assessment & Forecast

Segments Covered

By Grade General Purpose Polystyrene (GPPS), High Impact Polystyrene (HIPS), Expandable Polystyrene (EPS)

By Form Foams, Films and Sheets, Others

By End User Automotive, Packaging, Building and Construction, Electrical and Electronics, Consumer Goods, Healthcare, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2024 | |

| 2025 - 2034 | |

| 2019 - 2023 | |

| USD 34.34 Billion | |

| USD 57.67 Billion | |

| 5.32% | |

| Asia Pacific | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

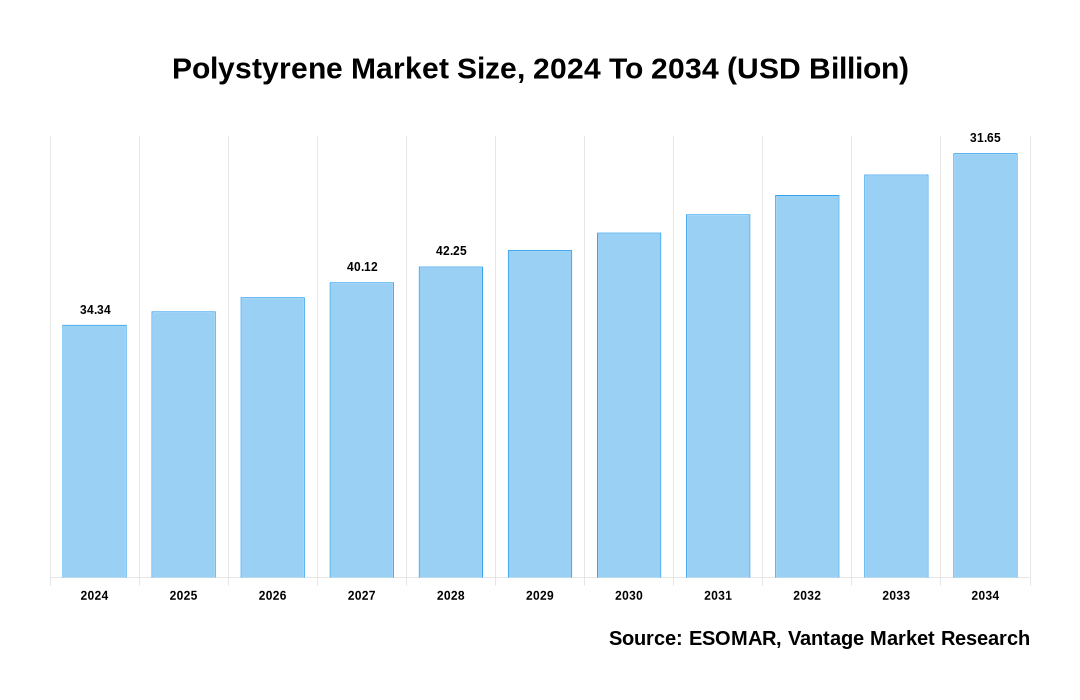

The global Polystyrene market size was USD 32.61 billion in 2023, and is calculated at USD 34.34 Billion in 2024. The market is projected to reach USD 57.67 Billion by 2034, and register a revenue 5.32% over the forecast period (2025-2034).

Premium Insights:

The global Polystyrene market continues to register steady and inclining revenue growth, driven to a major extent by rising demand from packaging, construction, and automotive industries owing to lightweight, durable, and insulative properties. Also, increasing demand for Polystyrene has been increasing in food packaging, especially with rapidly expanding e-commerce. In addition, increasing use in construction applications for excellent thermal insulation properties, and steady traction of emerging trends including shift toward eco-friendly and recyclable Polystyrene solutions, supported by sustainability goals and innovations in biodegradable Polystyrene production are expected to continue to drive revenue growth of the global Polystyrene market. Technological advancements in manufacturing, such as efficient extrusion techniques and recycled Polystyrene production, are also contributing to market growth. Extensive dependence on Polystyrene in packaging, building and construction, and electronics industries, coupled with expanding applications in healthcare and renewable energy sectors are other factors supporting market growth. Increasing popularity of novel applications such as 3D printing materials and medical packaging are also expected to contribute to growth of the market.

Polystyrene is a thermoplastic derived primarily from styrene, which is a byproduct of petroleum refining, and is widely favored for its lightweight, durable, and cost-effective qualities. Raw materials, derived from ethylene and benzene are processed into end products such as Expanded Polystyrene (EPS), General-Purpose Polystyrene (GPPS), and High-Impact Polystyrene (HIPS), and these materials are used across diverse industries and markets. EPS is predominantly used in construction and packaging due to its excellent insulating properties, while GPPS and HIPS find applications in electronics, automotive components, and consumer goods.

Some key benefits of Polystyrene include its superior thermal insulation, moisture resistance, and adaptability, making it invaluable for protective packaging and energy-efficient building materials. Recent advancements focus on sustainable production, including recyclable and biodegradable Polystyrene variants, responding to rising environmental concerns. Innovations in manufacturing processes, such as advanced extrusion techniques and Polystyrene recycling technologies, are driving down production costs and environmental impact.

Major trends in the market indicate a shift toward green packaging solutions and the adoption of Polystyrene in new applications like healthcare packaging, 3D printing, and renewable energy systems. These developments highlight continued relevance and adaptability, as industries increasingly seek materials that balance performance with sustainability. As these trends accelerate, the importance of Polystyrene across sectors and industries is expected to continue to expand over the forecast period.

Polystyrene Market Size, 2024 To 2034 (USD Billion)

AI (GPT) is here !!! Ask questions about Polystyrene Market

Top Polystyrene Market Drivers and Trends:

- Wide Applications Across Industries: Versatility of Polystyrene as a material for a variety and range of applications is the key factor driving extensive use and preference. This material is used extensively across major industries, including construction, packaging, automotive, and electronics, and adaptability for different forms, from foams to rigid plastics, makes it indispensable in applications ranging from thermal insulation in buildings to protective packaging for fragile goods.

- Increasing Demand for Lightweight, Insulative, and Cost-Effective Materials: Industries are prioritizing materials that offer insulation, reduce weight, and control costs, and Polystyrene meets these requirements. Among the various types of materials, expanded Polystyrene is highly valued in the construction industry for energy-efficient insulation, while high-impact Polystyrene is utilized in automotive applications for its resilience. The cost-effectiveness of Polystyrene is also a key factor driving strong demand.

- Technological Advancements and Sustainability Trends: Innovations in recycling and biodegradable Polystyrene production address environmental concerns and enhance appeal of this material, especially as industries adopt more sustainable practices. Research and Development (R&D) in extrusion technology and recycling have reduced production waste, providing eco-friendly alternatives that align with global sustainability goals, which support positive growth of the Polystyrene market.

- Growth in E-commerce and Food Delivery Services: The rise of online shopping and food delivery services has resulted in rise in demand for protective and insulating packaging solutions, with Polystyrene playing a central role. Durability and insulation advantages of EPS packaging make it ideal for packing and transporting food, electronics, and other sensitive products. This trend is further supported by utility in temperature control, which is essential for the perishable goods sector.

Polystyrene Market Restraining Factor Insights

- Environmental and Regulatory Pressures: Rising awareness and concerns regarding plastic pollution and adverse and negative impacts in the environment are driving rising and aggressive scrutiny on Polystyrene. Low recyclability and persistence in the environment make Polystyrene a major contributor to plastic waste, leading to deployment of increasingly stringent regulations worldwide. Governments of various countries are advocating for policies to restrict or ban its use, especially in single-use applications like food packaging. In addition, as industries and economies shift towards sustainable practices, the demand for eco-friendly alternatives continues to rise, often at the expense of traditional materials like Polystyrene. Research and development efforts in finding biodegradable or recyclable alternatives have proven challenging and costly, further adding pressure on manufacturers. These factors collectively, are having a major impact on viability of Polystyrene, especially as environmentally responsible practices become a focal point for consumers and industries alike.

- Health and Safety Concerns Associated with Polystyrene: Styrene is a primary component of Polystyrene, and has been linked to various health risks. It is also classified as a potential carcinogen, affecting both workers handling the material and end consumers. Concerns over styrene exposure have been prompting shift in demand towards safer, non-toxic alternatives in sectors such as packaging, consumer goods, and construction. Research efforts to develop safer forms of Polystyrene face numerous hurdles, particularly in maintaining the cost-effectiveness and functional properties of various materials. As consumers become increasingly health-conscious, the demand for materials with fewer health risks grows, thereby reducing preference and appeal of Polystyrene in applications where direct human contact or food safety is involved. Furthermore, tendency for leaching chemicals when in contact with hot substances further adds to reducing market acceptance, especially for food-related applications.

- Competitive Pressure from Alternative Materials: Availability and use of alternative materials presents a significant challenge in the Polystyrene market. Advances in alternative materials such as bioplastics, polyethylene, and polypropylene offer industries more sustainable, versatile, and cost-effective options over the long term. With innovations in bioplastics and other sustainable materials accelerating, Polystyrene is often perceived as outdated and less competitive in meeting modern environmental and performance standards. This shift has created a competitive landscape where Polystyrene is losing ground to alternatives that better align with regulatory standards and consumer expectations for sustainability. As industries increasingly prioritize green materials, the demand for Polystyrene continues to reduce slowly. As a result, rising preference for materials that offer greater recyclability, environmental safety, and multi-use potential, particularly in sectors such as packaging and construction, is expected to have a negative impact on potential growth of the Polystyrene market over the long term.

Polystyrene Market Opportunities

- Sustainable and Recyclable Solutions: Investing in production of sustainable Polystyrene alternatives and recyclable solutions presents lucrative opportunities for manufacturers. By focusing on developing biodegradable or chemically recyclable Polystyrene, companies can meet increasing regulatory demands and consumer preferences for environmentally friendly products. This not only aligns with the global shift towards sustainability, but also positions companies among companies recognized for eco-innovation, potentially attracting a broader customer base and enabling entry into a segment that prioritizes green materials.

- Market Expansion: Expanding into emerging markets, where demand for affordable and versatile materials remains strong, especially in construction, electronics, and packaging presents major revenue opportunities. Companies can leverage Joint Ventures (JVs) or partnerships with regional players to reduce operational costs and improve supply chain efficiency in such markets. Also, by enhancing product lines to include specialty Polystyrene grades, such as impact-resistant or insulated varieties, manufacturers can cater to industry-specific needs, thereby opening additional revenue streams.

- Mergers, Acquisitions, and Strategic Agreements: Companies can consider mergers, acquisitions, and strategic agreements with companies across the plastic and chemical sectors. By acquiring or collaborating with smaller firms specializing in sustainable material technologies, large Polystyrene manufacturers can strengthen their R&D capabilities and fast-track innovation in recyclable and alternative materials. Such moves can diversify product offerings and increase market share in sectors demanding more sustainable solutions.

Polystyrene Market Segmentation:

By Grade:

- General Purpose Polystyrene (GPPS)

- High Impact Polystyrene (HIPS)

- Expandable Polystyrene (EPS)

- Expanded Polystyrene (EPS)

- Extruded Polystyrene (XPS)

By Form:

- Foams

- Films and Sheets

- Others

By End User:

- Automotive

- Packaging

- Building and Construction

- Electrical and Electronics

- Consumer Goods

- Healthcare

- Others

Segment Insights:

By Grade:

The Expandable Polystyrene (EPS) segment is expected to account for largest revenue share among the grade segments in the global Polystyrene market over the forecast period. Key factors driving growth include excellent insulation properties, lightweight nature, and cost-effectiveness, making it a preferred material in construction and packaging industries, among others. Use of EPS in energy-efficient buildings is also expanding, driven by increasing regulations around sustainable construction. Also, EPS is widely used in protective packaging for fragile goods, which has seen a surge in demand with the growth of e-commerce, further boosting its revenue share.

By Form:

The foams segment is expected to dominate other form segments over the forecast period, primarily due to extensive application in packaging, construction, and insulation. Polystyrene foams, including EPS and XPS, are valued for thermal insulation and shock absorption properties, which are crucial for protecting goods during transportation and for improving building energy efficiency. Increasing demand for insulated buildings in both residential and commercial construction sectors is a key growth driver. Also, rapid growth of the e-commerce sector is driving demand for foam packaging and this is supporting revenue growth of this segment.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

By End User:

The packaging segment is expected to continue to account for largest revenue share among the end user segments over the forecast period. Polystyrene is widely used in packaging applications due to durability, lightweight nature, and cost-efficiency, making it ideal for protecting various consumer goods, electronics, and perishables. With the surge in online shopping and the continued demand for food delivery services, the need for protective and thermal packaging solutions is also rising. In addition, demand for disposable packaging in the food and beverage industry has been rising rapidly, and is contributing to the strong revenue growth of this segment.

Regions and Countries

North America

- United States

- Canada

- Mexico

Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Europe

Asia Pacific

- China

- Japan

- India

Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- South Africa

- United Arab Emirates

- Israel

- Rest of MEA

Polystyrene Market Regional Landscape:

Among the regional markets in 2023, Asia Pacific Polystyrene market led in both demand and production, driven largely by China, India, and Japan. Strong performance of this regional market is due to robust industrial growth, particularly in packaging, construction, and electronics sectors, where polystyrene is widely used. North America Polystyrene market growth is driven by the US due to well-established industrial infrastructure, high consumption rates in packaging, and continued use in construction.

In the Europe Polystyrene market, Germany and France play central roles, with demand driven by increasing industrial applications, although the market faces pressures due to stringent environmental regulations pushing for recyclable materials. Latin America Polystyrene market revenue growth is supported majorly by Brazil and Mexico due to expansion of packaging and construction industries.

Polystyrene Market Competitive Landscape:

Company List:

- INEOS Styrolution Group GmbH

- TotalEnergies

- BASF SE

- Formosa Chemicals & Fibre Corporation

- Kumho Petrochemicals Ltd.

- SABIC

- Trinseo

- Videolar-Innova S/A

- Alpek S.A.B. de C.V.

- CHIMEI

Competitive Landscape:

The competitive landscape in the global Polystyrene market is marked by the presence of several key players, including major chemical and polymer companies such as INEOS Styrolution, BASF SE, and TotalEnergies. These companies lead in terms of market share and often set industry standards due to extensive production capacities, diversified product portfolios, and strong distribution networks across regions. To maintain their market positions and expand their consumer base, leading companies are increasingly focusing on sustainability initiatives, product innovation, and strategic partnerships. Given the rising environmental concerns and regulatory pressures around plastic usage, many key players are investing in recyclable and eco-friendly polystyrene alternatives. For instance, companies are developing chemically recyclable polystyrene to create a circular economy model, aiming to capture demand from eco-conscious consumers and industries.

In addition, product innovation remains a crucial strategy, with companies focusing on high-performance and specialty polystyrene grades, such as impact-resistant and flame-retardant variants, catering to specific industries like electronics and automotive. This approach helps companies differentiate themselves and meet the specialized needs of various sectors. Expansion into emerging markets through strategic partnerships and joint ventures is another important focus, allowing companies to access new consumer bases and capitalize on regional growth opportunities, particularly in Asia Pacific and Latin America.

Furthermore, mergers and acquisitions play a vital role, as leading companies acquire smaller firms or form alliances to bolster their research and development capabilities. These acquisitions also enhance their expertise in sustainable materials, positioning them favorably in a shifting market landscape that increasingly values environmental responsibility and innovation.

Recent Developments

- October 23, 2024: Supreme Petrochem Limited (SPL), which is the largest producer of polystyrene and expandable polystyrene in India, is advancing its operations with a new Mass ABS Project and increasing its capacities for compounds, masterbatches, and EPS at its Amdoshi facility in Maharashtra. The Mass ABS Project aims for a total capacity of 140,000 MTPA, being developed in two phases of 70,000 MTPA each. The first phase is expected to be operational by March 2025. Notably, the Mass ABS process is considered more environmentally sustainable than traditional emulsion processes, as it effectively reduces water pollution. SPL has also secured a licensing and engineering design agreement with Versalis-Eni Chemicals Group for the first phase of this project.

- October 17, 2024: Carlisle Companies Incorporated announced a definitive agreement to acquire the expanded polystyrene (EPS) insulation division of PFB Holdco, Inc., which is backed by The Riverside Company and includes the Plasti-Fab and Insulspan brands, collectively known as ‘Plasti-Fab’. This company is recognized as a leading provider of EPS insulation products, operating primarily in Canada and the Midwestern United States. According to the agreement, Carlisle will acquire Plasti-Fab for USD 259.5 million in cash, which equates to 6.7 times the adjusted EBITDA for the twelve months ending August 31, 2024, factoring in anticipated cost synergies. The deal is subject to standard closing conditions and is projected to be finalized in the fourth quarter of 2024.

Frequently Asked Questions:

Q: What is the global Polystyrene market size in 2024 and what is the projection for 2034?

A: The global Polystyrene market size was calculated at USD 34.34 billion in 2024 and expected to reach USD 57.67 billion in 2034

Which regional market accounted for largest revenue share in 2023, and what is the expected trend over the forecast period?

A: Asia Pacific is expected to account for second-largest revenue share in the global market over the forecast period.

Q: Which are the major companies are included in the global Polystyrene market report?

A: Major companies in the market report are NEOS Styrolution Group GmbH, TotalEnergies, BASF SE, Formosa Chemicals & Fibre Corporation, Kumho Petrochemicals Ltd., SABIC, Trinseo, Videolar-Innova S/A, Alpek S.A.B. de C.V., CHIMEI.

Q: What is the projected revenue CAGR of the global Polystyrene market over the forecast period?

A: The global Polystyrene market is expected to register a CAGR of 5.32% between 2025 and 2034.

Q: What are some key factors driving revenue growth of the Polystyrene market ?

A: Some key factors driving market revenue growth are rising demand from packaging, construction, and automotive industries owing to lightweight, durable, and insulative properties, and increasing demand for polystyrene for food packaging, electronics and devices, and other delicate items, especially with rapidly expanding e-commerce and increasing volumes of online orders.

Vantage Market

Research | 07-Nov-2024

Vantage Market

Research | 07-Nov-2024

FAQ

Frequently Asked Question

What is the global demand for Polystyrene in terms of revenue?

-

The global Polystyrene valued at USD 34.34 Billion in 2024 and is expected to reach USD 57.67 Billion in 2034 growing at a CAGR of 5.32%.

Which are the prominent players in the market?

-

The prominent players in the market are INEOS Styrolution Group GmbH, TotalEnergies, BASF SE, Formosa Chemicals & Fibre Corporation, Kumho Petrochemicals Ltd., SABIC, Trinseo, Videolar-Innova S/A, Alpek S.A.B. de C.V., CHIMEI..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 5.32% between 2025 and 2034.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Polystyrene include

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Polystyrene in 2024.