Pharmacogenomics Market

Pharmacogenomics Market - Global Industry Assessment & Forecast

Segments Covered

By Product & Service Kits & Reagent, Service

By Technology Sequencing, PCR, Microarray, Other Technologies

By Application Personalized Medicine, Clinical Research, Drug Discovery & Preclinical Development

By Disease Area Cancer, Cardiovascular, Neurological Diseases, Other Disease Areas

By End User Academic & Research Institutes, Pharmaceutical & Biotechnology Companies, Contract Research Organizations

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 3.35 Billion | |

| USD 8.11 Billion | |

| 10.3% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

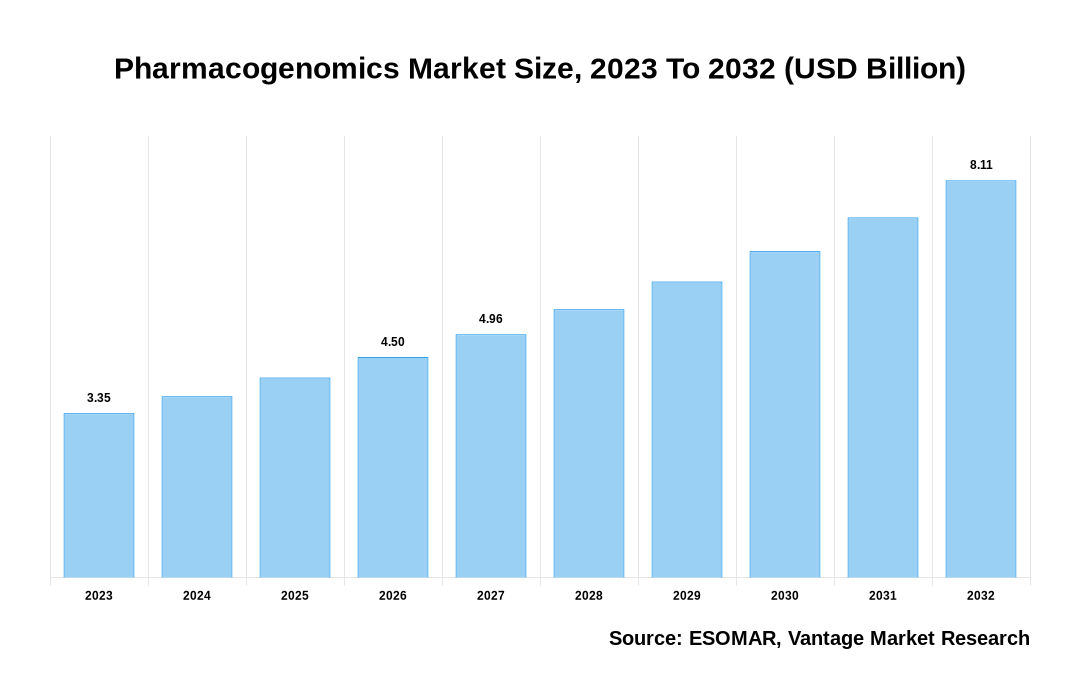

The global Pharmacogenomics Market is valued at USD 3.35 Billion in 2023 and is projected to reach a value of USD 8.11 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 10.3% between 2024 and 2032.

Key highlights of Pharmacogenomics Market

- In 2023, North America led the market, securing the highest revenue share of 36.5%,

- The Asia Pacific region will witness remarkable growth during the forecast period,

- In 2023, the Sequencing segment dominated the Pharmacogenomics market with significant market share,

- In 2023, the Personalized Medicine segment solidified its leading position by application, securing the largest market share,

- The cancer segment dominated the Pharmacogenomics market with 30.1% market share in 2023,

- Developments in genomic technology and bioinformatics have made it easier to identify genetic markers (DNA sequence/gene) associated with drug efficacy and side effects, contributing to market expansion.

Pharmacogenomics Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Pharmacogenomics Market

Pharmacogenomics Market: Regional Overview

North America Dominated Sales with a 36.5% share in 2023. North America Pharmacogenomics market driven by significant investments in personalized medicine and drugs, the region's robust healthcare infrastructure, and the prevalence of numerous chronic diseases. For instance, approximately worldwide, 1 in 3 people is affected by multiple chronic diseases (MCCs). In the United States, where several pharmaceutical and biopharmaceutical companies are headquartered, significant investments in therapeutic development, bolstered by substantial funding from government bodies like the NIH, are expected to contribute to the region's dominance in the Pharmacogenomics market. Additionally, the launch of new products, such as Blue Cross Personalized Medicine, introduced by Blue Care Network in Michigan in May 2022, is poised to drive market growth by enhancing the adoption of Pharmacogenomics products and services.

U.S. Pharmacogenomics Market Overview

The U.S. Pharmacogenomics market, valued at USD 1.02 Billion in 2023 to USD 2.31 Billion in 2032, is anticipated to grow at a CAGR of 9.5% from 2024 to 2032. The United States, with its high chronic disease prevalence, drives the Pharmacogenomics market. For instance, In the U.S., four out of ten persons have two or more chronic diseases, and six out of ten adults have one or more. The accelerated research and development (R&D) of integrated medicine in the United States, facilitated by the active involvement of regulatory bodies and government entities, is projected to enhance market growth throughout the forecast period. The FDA, in particular, has issued guidance documents to streamline milestone reviews across various agencies, outline performance expectations, clarify regulatory strategies, and establish timeliness criteria to facilitate a seamless application process and ensure the attainment of critical deliverables. The adoption of Pharmacogenomics is gaining momentum in the U.S. healthcare landscape as it offers tailored treatment approaches based on individual genetic variations, thereby enhancing medication efficacy and safety.

The global Pharmacogenomics market can be categorized as Product & Service, Technology, Application, Disease Area, End User, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product & Service

By Technology

By Application

By Disease Area

By End User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Pharmacogenomics Market: Technology Overview

In 2023, the Sequencing segment generated significant revenue. The Technology segment is divided into Sequencing, PCR, Microarray, and other technologies. Sequencing technologies, including next-generation sequencing (NGS) and genotyping, play a pivotal role in analyzing genetic variations relevant to drug response, facilitating comprehensive profiling of individual genetic profiles and their implications for medication efficacy and safety. As Pharmacogenomics gains prominence in personalized medicine, sequencing technologies are anticipated to maintain their pivotal role in driving innovation and advancements in therapeutic interventions tailored to individual patient characteristics. This is attributed to their capacity to offer in-depth insights into individual genetic variations, enabling personalized medicine by optimizing drug selection based on unique genetic profiles. The efficiency and cost-effectiveness of high-throughput Sequencing contribute significantly to advancing precision medicine within Pharmacogenomics.

Pharmacogenomics Market: Application Overview

The Personalized Medicine segment had a significant market share in 2023. The Application segment is bifurcated into Personalized Medicine, Clinical Research, Drug Discovery & Preclinical Development. The personalized Medicine segment encompasses the Application of Pharmacogenomics to tailor medical treatments to individual patients based on their genetic makeup, optimizing medicine selection, minimizing adverse reactions and dosage, and monitoring for improved efficacy and safety. With the increasing adoption of personalized medicine approaches in healthcare, fueled by advancements in genomics and molecular diagnostics, the personalized medicine segment is expected to continue its growth trajectory in the Pharmacogenomics market. As the importance of precision medicine gains recognition across various therapeutic areas, including oncology, cardiology, and neurology, the personalized medicine segment remains a key focus area for innovation and investment within the Pharmacogenomics industry.

Pharmacogenomics Market: Disease Area Overview

Cancer generated a significant revenue of 30.1% in 2023. The Disease Area segment is divided into Cancer, Cardiovascular, Neurological Diseases, and Other Disease Areas. With the increasing prevalence of cancer worldwide and the growing recognition of the importance of precision medicine in oncology, the cancer segment is expected to maintain its growth trajectory within the Pharmacogenomics market. For instance, according to the American Cancer Society, about one out of every six fatalities globally is due to cancer. The utilization of cancer genomics for diagnosing, treating, and managing different forms of cancer by analyzing individual genetic variations enables personalized treatment approaches tailored to the specific genetic profiles of cancer patients, dosing, and monitoring for efficacy and safety.

Key Trends

- Healthcare agencies increasingly leverage genetic statistics to customize treatment plans, optimize drug efficacy, and decrease the threat of unfavorable drug reactions. This aims to integrate pharmacogenomic testing into recurring clinical practice to guide medication selection and dosing.

- Advances in technologies, including NGS and genotyping, are increasing the capabilities and accessibility of pharmacogenomic testing. These platforms allow high-throughput evaluation of genetic variations relevant to drug response, facilitating broader implementation in scientific settings.

- The availability of direct-to-purchaser pharmacogenomic trying-out kits allows people to get the right of entry to personalized genetic records without the need for a healthcare provider's prescription. DTC's trying out services provides insights into how an individual's genetic makeup can also impact their reaction to certain medicinal pills, empowering consumers to make more knowledgeable selections about their healthcare.

Premium Insights

The advancement of genomics has revolutionized the understanding of health genetics, with next-generation sequencing technologies accelerating DNA and RNA analysis, yielding vast genetic insights for personalized medicine approaches. The growing focus on customized care has propelled the Pharmacogenomics market, recognizing the profound impact of genetic factors on drug response. Technologies in Pharmacogenomics play a crucial role in identifying genetic variations influencing drug metabolism and efficacy. For instance, in May 2022, Invitae launched a 38-gene testing Invitae Pharmacogenomics (PGx) Panel.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

The growing prevalence of chronic and genetic diseases is a significant driver propelling the Pharmacogenomics market

With an increasing prevalence of conditions like cardiovascular disorders, cancer, diabetes, and neurological ailments, coupled with rising occurrences of genetic disorders, there's a pressing need for more effective and personalized treatment approaches. Pharmacogenomics offers a promising solution by way of considering genetic variations influencing drug metabolism, efficacy, and protection. As healthcare systems strive to enhance patient results while decreasing prices, Pharmacogenomics emerges as a desire for precision medication tailored to individual patient profiles.

The shift towards personalized medicine, driven by advances in genomics, molecular diagnostics, and data analytics, offers immense potential for Pharmacogenomics

Integrating genetic information into clinical decision-making enables healthcare providers to optimize drug selection, dosing, and monitoring according to individual patient characteristics and treatment goals. By doing so, customized medicinal drug processes not only enhance patient results and medication adherence but additionally promise to reduce healthcare costs by minimizing adverse drug reactions and remedy failures.

The Pharmacogenomics market faces growing issues related to patient privacy and data access

Genetic data collection, storage, and analysis raise pertinent ethical, legal, and social considerations regarding patient privacy, data security, and consent. Patients can worry about the confidentiality of their genetic data, potential discrimination based totally on genetic tendency, and the implications of data sharing for studies and commercial purposes. To address these concerns, collaborative efforts among healthcare providers, policymakers, and enterprise stakeholders are vital to set up clear guidelines, regulatory frameworks, and data governance policies that stabilize the advantages of Pharmacogenomics and shield patient rights and privacy. Transparent communication and robust facts safety measures are vital to building trust and ensuring the accountable use of genetic data in healthcare decision-making.

Competitive Landscape

The competitive landscape of the Pharmacogenomics market is dynamic and driven by advancements in technology, research, and strategic collaborations. Key players include pharmaceutical organizations such as Illumina and Thermo Fisher Scientific, biotechnology corporations, diagnostic laboratories, and academic institutions. These entities compete by way of growing innovative pharmacogenomic testing systems, customized medicinal drug solutions, and novel drug remedies tailor-made to person genetic profiles. Moreover, strategic partnerships, acquisitions, and mergers are common techniques organizations employ to enlarge their product portfolios, benefit from entry to proprietary technology, and enhance their market presence. As the field of Pharmacogenomics continues to grow, competition intensifies, leading to increased funding in studies and improvement, regulatory compliance, and advertising efforts to capture market share and address the growing demand for personalized healthcare solutions.

The key players in the global Pharmacogenomics market include - Illumina Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Danaher Corporation (U.S.), Laboratory Corporation of America Holdings (U.S.), Charles River Laboratories (U.S.), Eurofins Scientific (Luxembourg), Bio-Rad Laboratories Inc. (U.S.), Agilent Technologies Inc. (U.S.), Becton Dickinson and Company (U.S.), QIAGEN (Germany), F. Hoffmann-La Roche Ltd. (Switzerland), Revvity (U.S.), IQVIA Inc. (U.S.), Mesa Labs Inc. (U.S.), Medpace (U.S.), MGI Tech Co. Ltd. (China), Takara Bio Inc. (U.S.), PacBio (U.S.), New England Biolabs (U.S.), BGI Genomics (China), Novogene Co. Ltd. (China), Sophia Genetics (Switzerland), Fios Genomics (UK), Personalis Inc. (U.S.), BioAI Health Inc. (U.S.), NeoGenomics Laboratories (U.S.), Macrogen Inc. (South Korea) among others.

Recent Market Developments

- In July 2023, as an essential component of Illumina's cancer product portfolio, Pillar Biosciences Inc.'s spectrum of oncology tests is now offered globally thanks to a partnership between the two companies. This collaboration will create a unique set of complementary tools by combining multiple next-generation sequencing methods. These advances in sequencing methods can improve oncology testing's effectiveness, accuracy, and cost-effectiveness. This partnership aims to increase patient access to individualized cancer treatment choices.

- In January 2023, Verogen, a provider of next-generation Sequencing (NGS) technology for use in forensic analysis and human identification (HID), was purchased by QIAGEN.

Vantage Market

Research | 10-Apr-2024

Vantage Market

Research | 10-Apr-2024

FAQ

Frequently Asked Question

What is the global demand for Pharmacogenomics in terms of revenue?

-

The global Pharmacogenomics valued at USD 3.35 Billion in 2023 and is expected to reach USD 8.11 Billion in 2032 growing at a CAGR of 10.3%.

Which are the prominent players in the market?

-

The prominent players in the market are Illumina Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), Danaher Corporation (U.S.), Laboratory Corporation of America Holdings (U.S.), Charles River Laboratories (U.S.), Eurofins Scientific (Luxembourg), Bio-Rad Laboratories Inc. (U.S.), Agilent Technologies Inc. (U.S.), Becton Dickinson and Company (U.S.), QIAGEN (Germany), F. Hoffmann-La Roche Ltd. (Switzerland), Revvity (U.S.), IQVIA Inc. (U.S.), Mesa Labs Inc. (U.S.), Medpace (U.S.), MGI Tech Co. Ltd. (China), Takara Bio Inc. (U.S.), PacBio (U.S.), New England Biolabs (U.S.), BGI Genomics (China), Novogene Co. Ltd. (China), Sophia Genetics (Switzerland), Fios Genomics (UK), Personalis Inc. (U.S.), BioAI Health Inc. (U.S.), NeoGenomics Laboratories (U.S.), Macrogen Inc. (South Korea).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 10.3% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Pharmacogenomics include

- The growing prevalence of chronic and genetic diseases is a significant driver propelling the pharmacogenomics market

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Pharmacogenomics in 2023.