Pharmaceutical Glass Packaging Market

Pharmaceutical Glass Packaging Market - Global Industry Assessment & Forecast

Segments Covered

By Product Vials, Bottles, Cartridges & Syringes, Ampoules

By Drug Type Generic, Branded, Biologic

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 18.1 Billion | |

| USD 33.9 Billion | |

| 9.4% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

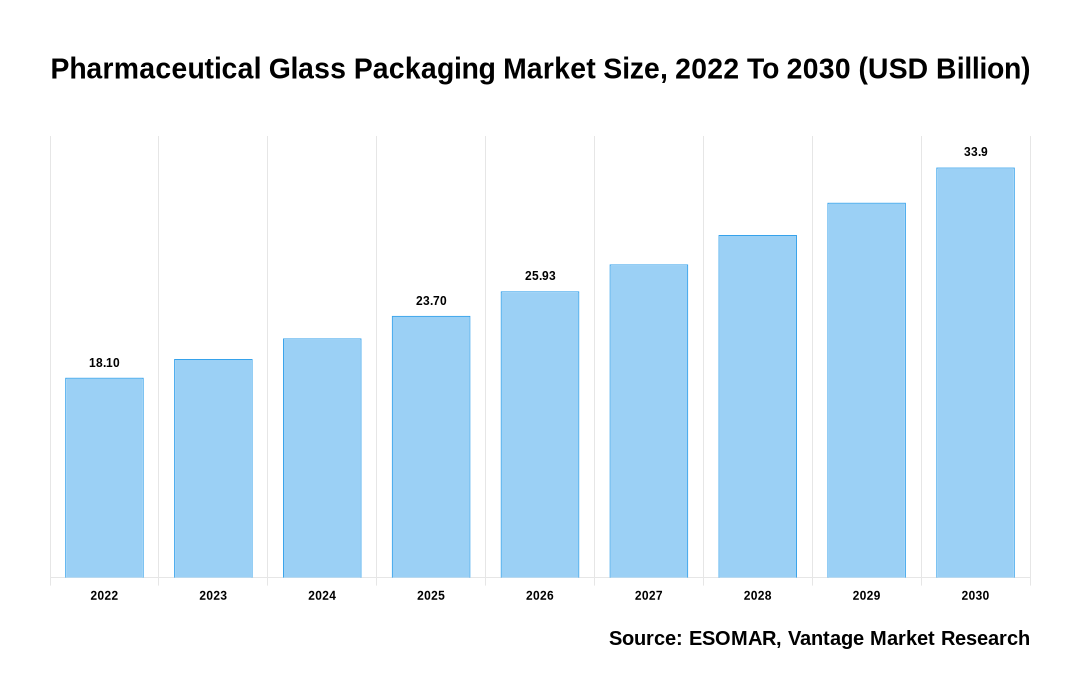

The global Pharmaceutical Glass Packaging Market was valued at USD 18.1 Billion in 2022 and is projected to reach a value of USD 33.9 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 9.4% between 2023 and 2030.

Premium Insights

The term Pharmaceutical Glass Packaging describes a particular kind of glass container made from a blend of components to ensure the secure carriage of various acidity and medical products. Due to its remarkable resistance to temperature changes, glass is frequently used in pharmaceutical packaging. Due to various driving factors, the global Pharmaceutical Glass Packaging market will grow rapidly during the forecast period. The strong demand from the pharmaceutical sector and widespread use of generic injectable medications are predicted to fuel market expansion over the forecast period. The glass hinders atmospheric gases like oxygen and carbon dioxide and cannot reach the main container. This is essential for reducing the danger of drug contamination. Glass containers lessen a drug's vulnerability to oxidative and hydrolytic breakdown.

Pharmaceutical Glass Packaging Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Pharmaceutical Glass Packaging Market

Moreover, glass containers assist in preventing volatile substances from escaping, improving the stability of the medicine. All these variables are expected to drive up product demand during the projected period. The United States Centers for Medicare & Medicaid Services predicts that national health spending will increase by 5.4% annually to reach USD 6.2 trillion by 2030. The U.S. population is predicted to get support from federal healthcare financial aid programs such as the Veterans Administration, U.S. Department of Defense healthcare programs, Affordable Care Act (ACA), Children's Health Insurance Program (CHIP), Medicaid, and Medicare. They may also lead to more pharmaceutical product use, benefitting the nation's market. Strict regulations regarding drug delivery products have been established due to the growing significance of biotech and cost-sensitive medications in the healthcare industry. To increase product shelf life, several producers in the pharmaceutical glass manufacturing sector are concentrating on packaging and investing in vials.

Pharmaceutical Glass Packaging manufacturers have been improving their products' features to meet the needs of the evolving pharmaceutical sector, which may help the market in the United States even more. As an illustration, Corning Incorporated debuted coated, specially constructed Type I borosilicate vials dubbed Corning Velocity Vials in November 2022. Compared to traditional borosilicate vials, these have effective hardness, lowering the risk of breakage and cracking. The COVID-19 pandemic's effects have caused a continually rising high demand for medications and other healthcare services within the pharmaceutical sector. The pandemic's spike in pharmaceutical drug demand has favorably impacted the market. Depending on whether additional COVID-19 vaccines researched by other institutes are approved, the demand is anticipated to reach a new peak.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Economic Insights

Many financial analysts and economists projected that most of the global economy would be in a recession if it weren't already. But, as 2022 ends and 2023 begins, the worldwide recession is anticipated to worsen. Given the crowded labor market, studies have shown that the US experienced a recession during the first half of 2022. Russia's aggressive war on Ukraine still significantly negatively impacts the world economy. Due to several issues, including rising energy prices, inflationary pressure, declining confidence, and declining household spending power, the global economy is predicted to slow considerably in the next few years.

Top Market Trends

1. Rising Utilization of Glass Packaging within the Vaccine Industry: The United States manufactures millions of extra vaccine doses in huge, multi-dose vials. These vials are either consumed domestically or exported to other nations. By 2021, it is anticipated that the Johnson & Johnson, Moderna, and Pfizer-BioNTech vaccines will have been administered to roughly 500 million Americans. There have been several difficulties for producers in transitioning from big multi-dose vials to single-dose vials for distributing vaccinations, although the demand from state officials in the U.S. Most vaccinations are currently given out in the United States in single-dose vials or prefilled syringes. However, the COVID-19 vaccines are given out in multi-dose vials due to the need for their speedy manufacture for the nation's ongoing immunization campaign.

2. Adoption of New Glass Types to Minimize Product Contamination: Glass packaging for pharmaceuticals will be in great demand due to the development of new glass kinds. Their production uses a different network of former glasses to do away with the requirement for boron. While making vials, boron, which is typically utilized in traditional glasses, volatilizes, changing the chemistry in the area of the packaging that comes into contact with the drugs. This might result in the development of glass flakes. The newly created glass lacks boron, resulting in homogenous and chemically robust glass chemistry. Corning Inc. unveiled the boron-free glass under the moniker Valor. Moreover, permanent engraving is being used by glass packaging producers to reduce "year of manufacture" forgery, which is expected to increase demand.

3. Expanding Pharmaceutical Sector: The pharmaceutical sector is expanding quickly, mostly in developing nations like China, India, and Brazil, as well as in industrialized nations like the United States, the United Kingdom, and Germany. The need for glass packaging in the pharmaceutical business is expected to rise due to factors including population growth that is growing exponentially, more health awareness, and rising spending on public healthcare systems. Additionally, it is anticipated that the pharmaceutical business will use more glass due to rising technological advancements and the adoption of cutting-edge manufacturing techniques. Glass's advantages, including its high level of recyclability, transparency, and chemical inertness, are expected to drive up demand for the commodity in the coming years. Glass container is easy to sterilize and impervious to air and moisture.

Market Segmentation

The global Pharmaceutical Glass Packaging market can be categorized into Product, Drug Type, and Region. Based on Product, the market can be categorized into Vials, Bottles, Cartridges & Syringes, and Ampoules. Furthermore, based on Drug Type, the market can be further split into Generic, Branded, and Biologic. Likewise, based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Product

Bottles to Account for the Largest Market Share Owing to Rising Demand from the Pharmaceutical Sector

During the forecast period, the bottles segment will lead the global Pharmaceutical Glass Packaging market. This segment’s expansion is ascribed to its strong protective abilities, rigidity, and chemical inertness. The packaging of pharmaceutical preparations that are solid as well as liquid, such as tablets, capsules, syrups, and ophthalmic treatments, has shifted more and more in favor of bottles. The pharmaceutical industry's rising bottle demand is anticipated to fuel market expansion. Throughout the review period, the vials & ampoules segment is projected to increase quickly. Glass vials shield the product inside from ambient gases like carbon dioxide and oxygen. They are also simple to clean and resistant to particles, contributing to the segment's rise.

Based on the Drug Type

Generic Drug to Accommodate the Largest Market Share Owing to Rising Cases of Chronic Diseases

The segment of generic drugs will dominate the global Pharmaceutical Glass Packaging market during the forecast period. Due to an aging population, an increase in chronic disease cases, and a growth in the number of medicine patents that have expired in recent years, the demand for generic medications has increased globally. Additionally, it is projected that initiatives by governments and healthcare service providers to lower healthcare and prescription costs and provide health insurance coverage will increase the use of generic medications. Due to its regulatory simplicity and exceptional barrier qualities, the rising use of generic medications is anticipated to enhance the need for Pharmaceutical Glass Packaging. The ability of biological medications to treat serious chronic diseases, particularly specific types of autoimmune diseases and cancer, is the key driver of their expansion. However, it is projected that the rise of primary glass packaging for biological pharmaceuticals will be restrained by glass delamination and chipping caused by surface deterioration.

Based on Region

North America to Lead Global Sales Owing to Expanding Pharmaceutical Sector

The region of North America will dominate the global Pharmaceutical Glass Packaging market during the forecast period. Over the next few years, pharmaceutical sector spending will soar in developing nations. Innovative products are predicted to fuel the expansion of the pharmaceutical sector in the region, with the U.S. expected to remain a major driver and most significant market. The advent of generic drugs in the area, which is likely to see consistently high demand in volume and sales, is anticipated to support this expansion.

Due to the sharp rise in consumer base and spending, emerging markets are anticipated to grow faster than developed ones. Rising income levels, more chronic disease cases, and greater healthcare awareness are anticipated to support the expansion of Asia Pacific's emerging markets. As a result of greater awareness, the governments in the Asia Pacific area are extending their public and private healthcare coverage. The government's initiatives to encourage affordable generic medications and lower healthcare costs in developing nations are anticipated to enhance the volume of pharmaceutical items produced, further boosting the market's expansion.

Competitive Landscape

The Pharmaceutical Glass Packaging market exhibits a fragmented competitive environment, with the top competitors controlling most of the market. The major market players have spent much money researching and developing various packaging products and their production processes. There are well-established supply chains and production procedures in industrialized nations like Europe and North America, with many pharmaceutical glass manufacturing enterprises. But, because of the low labor costs and the expanding prospects these nations provide, businesses are moving headquarters to places like Brazil, India, and China.

The key players in the global Pharmaceutical Glass Packaging market include - Corning Incorporated (U.S.), Nipro Corporation (Japan), Stelle Oberg Las GmbH (Austria), Bormio Pharma SPA (Italy), West Pharmaceutical Services Inc. (U.S.), Schott AG (Germany), Hergesheimer AG (Germany), Shandong Medicinal Glass Co. Ltd (China), Beatson Clark (UK), Ardagh Group SA (Luxembourg), Piramal Enterprises Ltd. (India), Şişecam Group (Turkey), Owens-Illinois Inc. (U.S.) among others.

Recent Market Developments

· September 2022: Hergesheimer AG and StevanatoGroup SPA, in joint, created a high-end ready-to-use (RTU) solution platform. The platform first focused on vials based on StevanatoGroup's industry-recognized EZ-fill technology. In terms of greater productivity, higher quality standards, quicker time to market, the cheaper total cost of ownership (TCO), and decreased supply chain risk, the clients are anticipated to gain from the relationship.

· May 2021: Piramida was acquired by Nipro, a Japanese company specializing in pharmaceutical glass packaging. Nipro's production capacity is expected to increase due to the acquisition. Further aids Nipro's ampoules and vials business.

· July 2021: The pharmaceutical manufacturing affiliate of Nipro Corporation, Nipro Pharma Corporation, and AstraZeneca have a contract manufacturing agreement for the fill and finish of Vaxzevria, the COVID-19 vaccine higher than 90. The vaccine will be produced locally in Japan in millions of doses.

· March 2021: The glass mill in Monaca, Pennsylvania, owned by Anchor Hocking Glass Company, was purchased by Stoelzle Glass Group. The Oneida Group's subsidiary is Anchor Hocking Glass Company. The business built its first glass facility outside of Europe, and it's sixth in the United States with the new acquisition.

· December 2020: SCHOTT started production at its new pharmaceutical tubing factory in China. The new facility produces FIOLAX® borosilicate glass tubing, the foundation for packaging items, including ampoules, vials, syringes, and cartridges. As part of a USD 1 billion investment in its global pharmaceutical business, SCHOTT invested USD 73.1 million in the new facility.

Segmentation of the Global Pharmaceutical Glass Packaging Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Product

By Drug Type

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Pharmaceutical Glass Packaging in terms of revenue?

-

The global Pharmaceutical Glass Packaging valued at USD 18.1 Billion in 2022 and is expected to reach USD 33.9 Billion in 2030 growing at a CAGR of 9.4%.

Which are the prominent players in the market?

-

The prominent players in the market are Corning Incorporated (U.S.), Nipro Corporation (Japan), Stelle Oberg Las GmbH (Austria), Bormio Pharma SPA (Italy), West Pharmaceutical Services Inc. (U.S.), Schott AG (Germany), Hergesheimer AG (Germany), Shandong Medicinal Glass Co. Ltd (China), Beatson Clark (UK), Ardagh Group SA (Luxembourg), Piramal Enterprises Ltd. (India), Şişecam Group (Turkey), Owens-Illinois Inc. (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 9.4% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Pharmaceutical Glass Packaging include

- Growth of the Pharmaceutical Industry in Emerging Economies

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Pharmaceutical Glass Packaging in 2022.

Vantage Market

Research | 25-Apr-2023

Vantage Market

Research | 25-Apr-2023