Petroleum Coke Market

Petroleum Coke Market - Global Industry Assessment & Forecast

Segments Covered

By Type Fuel Grade, Calcined Coke

By Physical Form Needle Coke, Sponge Coke, Catalyst Coke, Shot Coke, Purge Coke

By Application Power Plants, Cement Kilns, Steel, Aluminum, Fertilizer, Other Applications

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 39.5 Billion | |

| USD 64.26 Billion | |

| 7.2% | |

| Asia Pacific | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

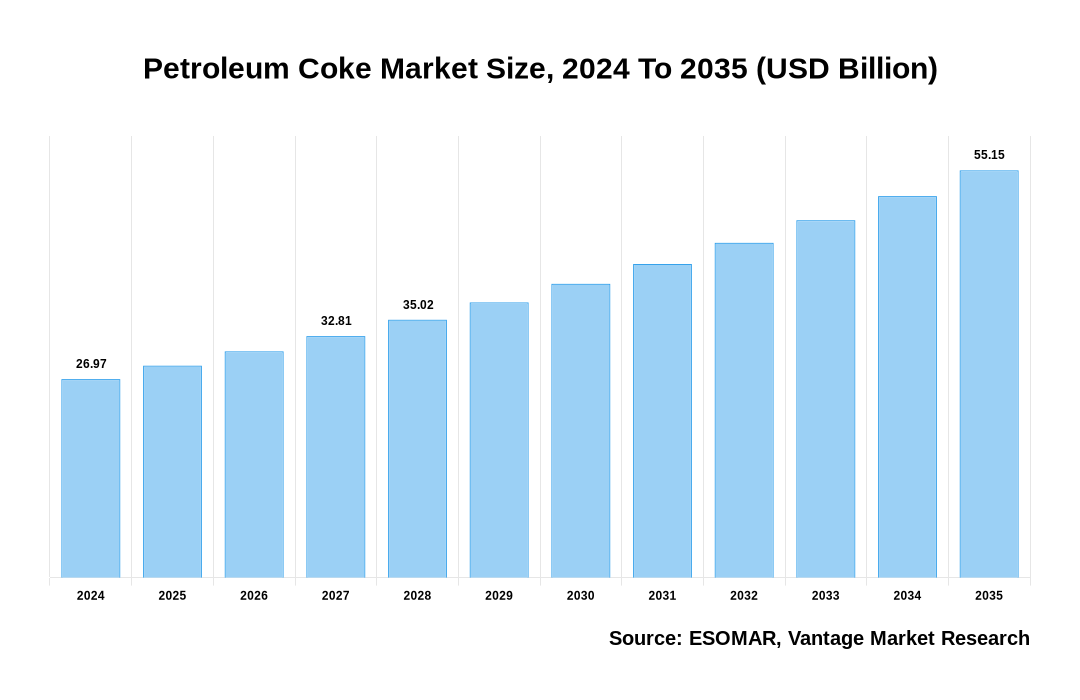

The global Petroleum Coke Market was valued at USD 39.5 Billion in 2022 and is projected to reach a value of USD 64.26 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 7.2% between 2023 and 2030.

Premium Insights

Petroleum Coke, sometimes known as petcoke, is a carbon-rich solid by-product of oil refining and one of a class of fuels known collectively as cokes. Cokering is a thermo-based specialized technique that breaks down petroleum's long-chain hydrocarbons into shorter-chain ones. The global Petroleum Coke market is anticipated to expand rapidly due to the energy and cement industries' insatiable demand for power, particularly in Asia-Pacific's developing economies. The growth of the global Petroleum Coke market could be bolstered by the rapid expansion of steel production due to the growth of the transportation, highway, railway, automotive, and construction industries. In addition to its use as a cost-effective alternative fuel, Petroleum Coke could be profitable in producing certain compounds and as a fuel for confined power generation.

Petroleum Coke Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Petroleum Coke Market

Increasing demand from the cement and power generation industries is the primary factor driving the growth of the Petroleum Coke market. The cement and power generation industries rely heavily on fuel-grade petcoke. The increasing cement and energy production sectors in developing nations like China and India also expand the Petroleum Coke market. Increasing exports of Petroleum Coke also contribute to the expansion of the market. It is anticipated that the altering trend of using pet coke in a medical, electrical component, and ceramics applications due to its numerous advantages will propel market growth. Petcoke is corrosion-resistant, lightweight, highly ductile, and has exceptional electrical and thermal conductivity. In addition, the rapid expansion of electronic industries is anticipated to stimulate the growth of the petcoke market.

Due to the increase in steel production, the market for Petroleum Coke is anticipated to expand. Steel production has increased due to increased demand for automobiles, transportation infrastructure, and highway structures. Petcoke is a feedstock in coke production and can be mixed with coal in the iron and steel industries. Utilization of pet coke reduces energy intensity by just over 1 percent and coking coal consumption by 16 percent. In December 2022, for instance, the output of produced and unprocessed steel was 94.66 million tonnes (MT) and 102.49 million tonnes (MT), respectively, according to the Indian Government's export promotion agency IBEF. In addition, crude steel production is anticipated to increase by 8 to 9 percent YoY to 112 to 114 million tons in the fiscal year 2022. Consequently, the expansion of the Petroleum Coke marketplace is driven by the rise in steel production due to advancements in the rail, vehicle, highway, and transportation industries.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Economic Insights

The Ukraine-Russia War, sometimes known as the Russo-Ukrainian War, is an ongoing military confrontation in Eastern Ukraine between Ukraine and Russian-backed rebels in the Donbass area that began in 2014. The war has resulted in thousands of deaths, severe devastation, and human displacement. Political difficulties and economic sanctions have also arisen between Ukraine and Russia, as diplomatic tensions between Russia and other nations in the international community. Despite multiple ceasefires and peace discussions, the conflict is still ongoing. The impact of the Ukraine-Russia War on the global economy remains enormous in 2023. The battle has contributed to a worldwide economic slump and raised geopolitical tensions. Ukraine-Russia commercial ties have deteriorated, decreasing foreign commerce and regional investment. Civilians have been displaced, infrastructure has been damaged, and military spending has increased, diverting resources from constructive economic operations. Continued sanctions and political tensions between Russia and other nations have exacerbated economic instability.

Top Market Trends

1. Rising Demand for Steel: Because of the increased demand for steel, the production rate of calcined petcoke has increased significantly. Steel output climbed by 3.8 percent to 1,690 million tonnes, while steel consumption increased by 5.1 percent to 1,693 million tonnes, according to the World Steel Association. The steel sector is developing rapidly in Asia Pacific regions such as India. India is the world's second-largest steel manufacturer, with capacity increasing from 106.5 million tons in 2018 to 137.975 million tons in 2019. The steel sector is also expanding significantly in the North American area, particularly in the United States. During the North American Free Trade Agreement (NAFTA), the monthly steel consumption index in the United States climbed by 3.7% yearly from January to August 2018. Steel usage climbed by 1% in Argentina and 4% in Ecuador between January and November 2018. During the projected period, increased demand for steel and steel-related goods will drive the calcined petcoke market.

2. Increasing Preference of Calcined Petroleum Coke: Calcined Petroleum Coke has a larger carbon content than coal, holding roughly 90% carbon, and has a calorific value of more than 7,000 kcal/kg, meaning it's nearly double that of coal. Calcined Petroleum Coke has a lower value than coal since it is a by-product of refineries. Because there is now no replacement for calcined Petroleum Coke, the market's need is increasing significantly. The major features of high yield and low price have resulted in end users' increasing preference for Calcined Petroleum Coke over coal.

Market Segmentation

The global Petroleum Coke market can be categorized on the following: Type, Physical Form, Application, and Region. Based on Product, the market can be segmented into Fuel Grade and Calcined Coke. Additionally, by Physical Form, the market can be segmented across Needle Coke, Sponge Coke, Catalyst Coke, Shot Coke, and Purge Coke. Furthermore, by Application, the market can be further split into Power Plants, Cement Kilns, Steel, Aluminium, Fertilizer, and Other Applications. Likewise, based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Type

Fuel Grade Coke to Dominate Global Market Owing to Higher Calorific Value Compared to its Counterpart

Fuel-grade coke led the industry and is predicted to develop rapidly over the projection period due to the product's high calorific value. Because of its low cost and high calorific value, fuel-grade coke is used in the cement and power industries. Growing cement and electricity production in new economies such as India, China, and Japan will increase product demand shortly. Fuel-grade coke produces titanium dioxide in paints, colorings, aluminum, steel, and fertilizer industries. Over the projected period, rising demand from the aluminum and steel sectors is expected to drive Petroleum Coke consumption. Calcined coke is expected to develop significantly throughout the projected period as the application scope of needles calcinated coal in battery electrodes expands.

Based on Application

Cement Kilns to Account for the Largest Market Share Owing to Increased Consumption from the Construction Sector

The need for cement has grown due to rising demand in many areas, such as dwellings, commercial development, and industrial building. In the cement industry, pet coke is used as a fuel source. The limestone absorbs the SO2 generated during thermal decomposition in some cement manufacturing plants that solely use pet coke instead of coal. For example, despite the worldwide epidemic and flood scenarios, China's cement sector grew steadily in 2020, mainly to infrastructure expansion and real estate investment. In 2020, 2.377 million cubic meters of cement were manufactured yearly, representing a 1.6% increase over the previous year. As a result, the rise of the cement sector is expected to drive the energy coke market. Increased investment by major manufacturers is a crucial trend gaining popularity in the Petroleum Coke industry. Power plants are the second fastest-growing component of the Petroleum Coke business. The increased demand for aluminum as an energy source and carbon for generating electricity to heat cement kilns. The increased need for power plants is expected to enhance demand for this industry.

Based on Region

Asia Pacific to Dominate Global Sales Owing to Significant Investments in Power Generation Sector

The Asia Pacific Petroleum Coke market is expected to receive a significant push shortly, riding on the astounding rise of China and India's expanding economies. The cement business in India is projected to consume a substantial amount of Petroleum Coke. Power plants in China are expected to consume a significant amount of Petroleum Coke to generate electricity. Population growth and rapid modernization in Asia are predicted to boost the hopes of Petroleum Coke makers in these countries. More chances are expected to emerge in Asia, as the area leads the international Petroleum Coke industry in demand, driven by massive imports. The Indian government has launched initiatives such as '100 smart cities' and 'Housing for All by 2022,' projected to propel the Indian residential building market throughout the forecast period. According to the Australian Trade and Investment Commission, Singapore's government spends at least S$2 billion each month on public infrastructure. In addition, the government forecasted that Singapore's average building demand for 2018 and 2019 will range between S$26 billion and S$35 billion. According to the International Trade Administration (ITA), China's building value in 2018 was USD 893.58, with an anticipated increase to USD 968.06 by 2019. Furthermore, the Chinese construction sector is expected to develop at a 5% annual rate in real terms between 2023 and 2020.

Currently, the United States is thought to be the main player in the export of Petroleum Coke. The cheap cost of Petroleum Coke is anticipated to be a primary draw for its import, as a large amount of electricity might be generated at a reasonable cost. Aside from that, a considerable amount of heat may be created with a tiny amount of Petroleum Coke. Because of its timely and simple availability, Petroleum Coke is a preferred alternative to natural gas and coal.

Competitive Landscape

Big players in the market are spending heavily on R&D to increase their product variety, which bodes well for the future growth of the Petroleum Coke market. Market participants are engaging in a wide range of strategic operations to enhance their foothold in the face of rapid market expansion, such as the introduction of new products, the formation of contractual agreements, the completion of mergers and acquisitions, the rise of investments, and the cooperation with other organizations. To thrive and survive in today's increasingly competitive market, the Petroleum Coke business must offer competitively priced goods. Producers in the global Petroleum Coke industry often manufacture locally to reduce operational costs, which benefits customers and expands the market sector. Some of the most significant benefits have lately been available in the Petroleum Coke industry.

The key players in the global Petroleum Coke market include - BP PLC (UK), Chevron Corporation (U.S.), Essar Oil Ltd. (India), Exxon Mobil Corporation (U.S.), HPCL - Mittal Energy Limited (India), Indian Oil Corporation Ltd. (India), Marathon Petroleum Corporation (U.S.), Saudi Arabian Oil Co. (Saudi Arabia), Trammo Inc. (U.S.), Valero Energy Corporation (U.S.), Reliance Industries Limited (India), Phillips 66 Company (U.S.), PJSC Luke Oil (Russia) among others.

Recent Market Developments

· September 2022: According to a recent report on EINPresswire.com, the elements that form the worldwide business landscape are examined in depth in a study of the Petroleum Coke (Petcoke) industry.

· November 2021: Sanvira Carbon FZC is Oman's first Petroleum Coke calcining (CPC) facility in the Sohar Freezone. Oman is the globe's biggest crude exporter outside of Opec. To help refineries in the Islamic state of Oman better use the massive quantities of Petroleum Coke produced as a by-product of refining, a $150 million investment was made in Sanvira Carbon FZC. The annual output of calcined pet coke from Sanvira Carbon is projected to reach over 600,000 tons.

· January 2021: More than two hundred and fifty thousand barrels of crude oil per day, or 65 percent, would be added to ExxonMobil's refining capacity, the company revealed.

Segmentation of the Global Petroleum Coke Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Physical Form

By Application

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Petroleum Coke in terms of revenue?

-

The global Petroleum Coke valued at USD 39.5 Billion in 2022 and is expected to reach USD 64.26 Billion in 2030 growing at a CAGR of 7.2%.

Which are the prominent players in the market?

-

The prominent players in the market are BP PLC (UK), Chevron Corporation (U.S.), Essar Oil Ltd. (India), Exxon Mobil Corporation (U.S.), HPCL - Mittal Energy Limited (India), Indian Oil Corporation Ltd. (India), Marathon Petroleum Corporation (U.S.), Saudi Arabian Oil Co. (Saudi Arabia), Trammo Inc. (U.S.), Valero Energy Corporation (U.S.), Reliance Industries Limited (India), Phillips 66 Company (U.S.), PJSC Luke Oil (Russia).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 7.2% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Petroleum Coke include

- Increase in the usage of adhesives

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Petroleum Coke in 2022.

Vantage Market

Research | 19-Apr-2023

Vantage Market

Research | 19-Apr-2023