PET Strapping Market

PET Strapping Market - Global Industry Assessment & Forecast

Segments Covered

By Type Embossed PET Strapping, Smooth PET Strapping

By Width 5-15 mm, 16-25 mm, 26-35 mm, Above 35 mm

By Application Palletizing, Heavy Duty Bailing, Bundling, Others

By End-user Food & Beverage, Construction & Building, Wood, Paper & Allied Industries, Textile & Apparel, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 786.7 Million | |

| USD 1370 Million | |

| 6.4% | |

| North America | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

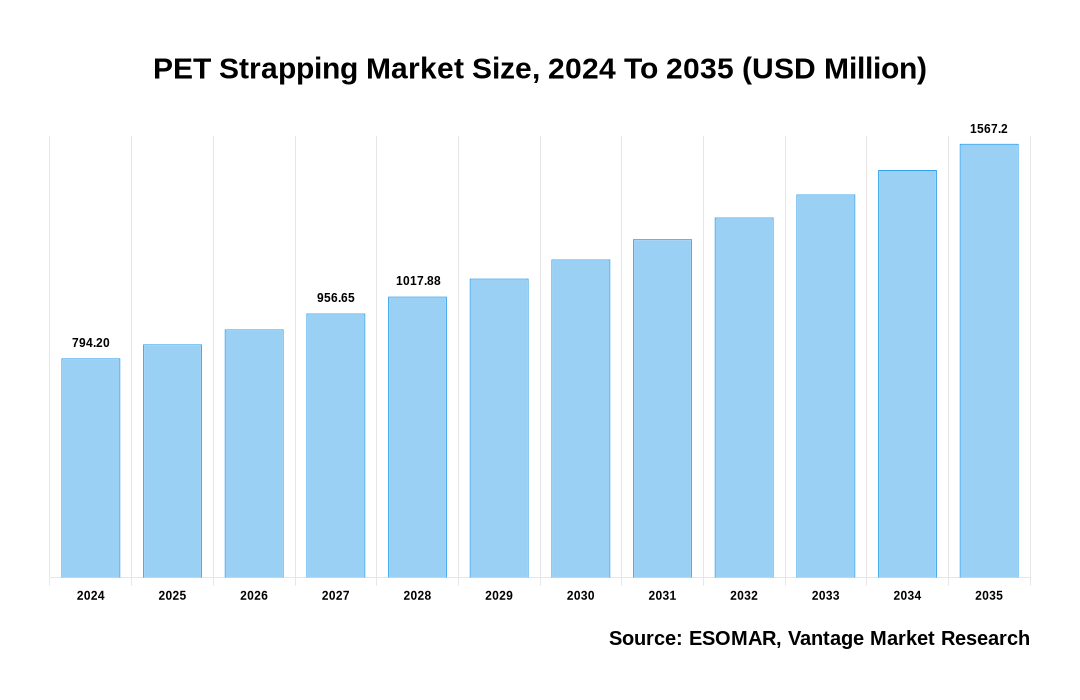

The global PET Strapping Market is valued at USD 786.7 Million in 2023 and is projected to reach a value of USD 1370 Million by 2032 at a CAGR (Compound Annual Growth Rate) of 6.4% between 2024 and 2032. The global market is driven by the increasing demand for sustainable & cost-effective packaging solutions, particularly in industries like logistics, construction, and e-commerce.

Key Highlights

- Asia Pacific dominated the market in 2023, with 40.5% market share due to rapid industrialization, urbanization, and the growth of the e-commerce and logistics sectors in countries like China and India

- North America accounts for around 29.1% of market share in 2023 and is projected to show rapid growth in the global market during the forecast period due to the increasing adoption of sustainable packaging solutions and the strong presence of industries like logistics, automotive, and construction

- Based on End-user, the Food & Beverage segment dominated the market in 2023, with 30.4% of the market share, driven by the need for secure and durable packaging solutions to ensure product safety during transportation

- With the growing environmental concerns, there is a significant shift towards sustainable packaging solutions. PET Strapping, being recyclable and eco-friendly, is gaining popularity as a replacement for traditional materials like steel straps

PET Strapping Market Size, 2023 To 2032 (USD Million)

AI (GPT) is here !!! Ask questions about PET Strapping Market

End-user Overview

Based on End-user, the global market is segmented into Food & Beverage, Construction & Building, Wood, Paper & Allied Industries, Textile & Apparel, and Others. The Food & Beverage segment held the largest revenue share of 30.4% of the global market in 2023.

In the food & beverage industry, PET Strapping is the largest consumer. The high demand for PET Strapping in this sector is driven by its use in palletizing, unitizing, and bundling products. PET Strapping is essential for securing loads during transportation and storage, preventing shifting and damage. It is also used to wrap bales of products like hay & straw, protecting them from contamination. Additionally, PET Strapping is employed to close and secure containers such as drums & boxes, preventing leaks during transit. Its popularity in the food and beverage industry stems from its strength, lightweight nature, resistance to moisture, chemicals, & recyclability, making it a sustainable packaging solution.

Type Overview

Based on Type, the global market is segmented into Embossed PET Strapping and Smooth PET Strapping. In 2023, the Embossed PET Strapping segment captured the largest revenue share in the global market.

The Embossed PET Strapping segment of the PET Strap market is propelling the market growth. This growth is driven by the unique properties of embossed PET Strapping, which features a diamond-shaped pattern that enhances its friction and texture. This pattern improves the grip on secured goods and reduces the likelihood of slippage compared to traditional PET Strapping. The rising demand for embossed PET Strapping in the food & beverage industry, as well as its increasing use in the pharmaceutical & automotive sectors, is contributing to this trend. The growing focus on sustainable packaging solutions and the recognition of the benefits of embossed PET Strapping, such as its superior grip & texture are expected to further boost its market demand.

Regional Overview

In 2023, Asia Pacific dominated the global market with a revenue share of 40.5%. This dominance is propelled by the strong industrialization, growing e-commerce activities, and expansive logistics networks in countries such as Japan, China, & India. The region's substantial manufacturing base and increasing import-export activities demand efficient packaging solutions, with PET straps playing a crucial role. For example, the rapid expansion of online retail giants like Alibaba in China has significantly increased the need for PET Strapping to secure shipments for both domestic and international deliveries.

While Asia Pacific leads the market, North America and Europe also hold significant shares. North America captured around 29.1% of the market in 2023, driven by advanced packaging technologies and strict quality standards. The region's emphasis on sustainable packaging solutions and the rise of automated packaging systems in industries like food and beverage are key factors contributing to the growth of PET straps. In the United States, for instance, the increase in online grocery delivery services has spurred the adoption of PET Strapping to ensure safe and efficient packaging.

In Europe, the focus on reducing carbon footprints and enhancing product safety through innovative packaging solutions drives demand for PET straps. Countries like Germany and France are at the forefront of PET strap adoption due to their strong manufacturing sectors and stringent regulations promoting sustainable packaging practices. German automotive manufacturers, for instance, extensively use PET straps to secure automotive components during transit, underscoring both the reliability and environmental benefits of PET Strapping.

Key Trends

- Rising Demand in Packaging Industries: The increasing adoption of PET Strapping in packaging applications across various industries, including food & beverages, logistics, and construction, is a key driver. PET Strapping offers advantages like high tensile strength, durability, and resistance to corrosion, making it ideal for securing goods during transportation.

- Technological Advancements in Production: Technological advancements in the manufacturing process of PET Strapping are leading to the development of high-performance, cost-effective products. Innovations such as automated strapping machines and enhanced PET resin formulations are improving the efficiency & effectiveness of PET Strapping in various applications.

- Increasing Focus on Cost-Effective Packaging: Companies are increasingly focusing on cost-effective packaging solutions, and PET Strapping provides a lower-cost alternative to steel and other types of strapping without compromising on strength and durability.

- Growth of E-commerce and Logistics Sectors: The exponential growth of the e-commerce and logistics sectors is propelling the demand for secure and reliable packaging solutions. PET Strapping is becoming increasingly important in ensuring the safe delivery of products, reducing the risk of damage during transit.

- Adoption of High-Tension PET Strapping: There is a growing trend towards the adoption of high-tension PET Strapping in industries that require heavy-duty packaging. This type of strapping is favored for its ability to handle high loads, making it suitable for packaging heavy goods in sectors like construction & manufacturing.

Market Dynamics

Rising Demand for PET Straps in the Construction and Food & Beverage Industries

The construction industry's demand for reliable bundling solutions has broadened the use of PET straps. These straps offer a cost-effective alternative to traditional steel bands, effectively securing materials on construction sites. Their strength & durability under heavy loads and harsh weather conditions make them essential for construction logistics. In the food & beverage sector, PET straps are vital for securing palletized products during transit. Their ability to maintain integrity in refrigerated environments & meet food safety standards is critical. As the global food trade expands, PET straps are increasingly important in safeguarding product safety & freshness from production facilities to retail shelves.

E-commerce Boom and the Surge in PET Strap Demand

The rise in online shopping has significantly increased the demand for secure packaging solutions like PET straps. These straps ensure the safe transportation of goods, ranging from small parcels to large packages, while meeting stringent logistics requirements. Amazon's widespread use of PET straps highlights their reliability in managing various product sizes & weights, contributing to the growth of the PET Strap Market. Innovations in PET strap technology, such as the development of Lotryl T copolymer by Arkema, have enhanced their durability & performance. These new formulations improve impact resistance and stretchability, making PET straps more resilient under diverse environmental conditions. This innovation is particularly beneficial for industries needing robust packaging solutions for fragile or heavy items, driving wider adoption across sectors.

Eco-Friendly Trends in PET Strap Manufacturing

With increasing environmental regulations, there is a growing preference for eco-friendly packaging materials. PET straps made from recycled materials, like those produced by Plastofine Industries, provide a sustainable alternative without sacrificing strength or usability, aligning with global efforts to reduce carbon footprints & promote circular economy practices.

Challenges in the Market: Raw Material Price Volatility & Supply Chain Disruptions

On the other hand, the fluctuations in raw material prices, influenced by adverse weather, economic conditions, and other factors, could constrain the market growth. Additionally, any delays or inefficiencies from raw material suppliers, co-packers, or third-party distributors could negatively impact profitability and the market performance.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Competitive Landscape

Advancements in PET Strapping technology, such as FROMM Group’s innovations and the introduction of products like Poly-Strap & Lotryl T copolymer, are expected to drive substantial market growth. FROMM Group's $34.6 million investment in a new facility will significantly boost PET strap production and distribution, addressing the growing global demand. Plastofine Industries' Poly-Strap offers increased strength, eco-friendliness, and versatility, making it attractive to industries seeking sustainable packaging solutions.

Poly-Strap PET Strapping, launched by Plastofine Industries on March 19, 2019, adheres to ASTM standards for type IV polyester strapping and has been approved by the American Association of Rail Roads (AAR). Produced in India, Poly-Strap is known for its strength, safety, cost-effectiveness, and eco-friendliness, being fully recyclable and suitable for various packaging applications. It is designed for seamless use with both manual & automatic tools, allowing tensioning, jointing, and cutting in a single step.

Recent Market Developments

Zerhusen Kartonagen Enhances Packaging Efficiency with Mosca’s Automated Systems

- In July 2024, Zerhusen Kartonagen GmbH in Damme, Germany, enhanced its packaging process with Mosca's fully automatic pallet strapping machine, the KCK-131, and the Saturn S6 stretch wrapper. These machines ensure the secure and versatile transportation of corrugated board products. By automating the strapping and wrapping process, Zerhusen has achieved consistent, reliable packaging, allowing the company to focus more effectively on production.

EAM-Mosca Expands Headquarters to Boost Production Capabilities in Pennsylvania

- In May 2024, EAM-Mosca marked a significant milestone with the expansion of its headquarters in Hazle Township, Pennsylvania. The Mosca Group has renovated and expanded the campus by approximately 11,000 square meters, enhancing its facilities with a new building, office spaces, and approximately 24,000 square meters of production area. The upgraded headquarters will serve as a key hub for strapping machines, straps, spare parts, and services across the USA, Latin America, and the Caribbean.

Mosca Partners with Interzero to Advance Circular Economy in Strapping Production

- In May 2024, Mosca GmbH announced a new initiative to support the circular economy through its partnership with Interzero. The company is leveraging Interzero’s advanced recycling solutions to process PET and PP strapping, reducing the need for new raw materials in their production.

Teufelberger and PreZero Launch Innovative Strapping Recycling Partnership

- In March 2024, Teufelberger and PreZero announced a groundbreaking partnership to revolutionize strapping recycling. This collaboration builds on a contract signed in January, wherein PreZero, a leading independent recycling expert, will handle the recycling of polypropylene & PET Strapping materials. These materials will be collected, transported to specialized recycling facilities, and then sent back to Teufelberger’s production sites.

Teufelberger Secures "OK Recycled" Certification for Sustainable Strapping Solutions

- In February 2024, Teufelberger achieved a significant milestone by obtaining the "OK Recycled" certification from TÜV Austria for its PP and PET Strapping. This certification, awarded in January, underscores Teufelberger’s commitment to sustainability. As the first company with production facilities in Austria and Poland to receive this certification, Teufelberger is recognized for incorporating 100% recycled PET and up to 30% recycled PP into over 1,000 certified products.

The global PET Strapping market can be categorized as Type, Width, Application, End-user, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Width

By Application

By End-user

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for PET Strapping in terms of revenue?

-

The global PET Strapping valued at USD 786.7 Million in 2023 and is expected to reach USD 1370 Million in 2032 growing at a CAGR of 6.4%.

Which are the prominent players in the market?

-

The prominent players in the market are FROMM Packaging Systems Inc., Mosca GmbH, Teufelberger, Messersi Packaging, Maillis Group, Signode, Cordstrap, Samuel Strapping, Polychem Corporation (now known as Greenbridge), Signor Polymers Pvt. Ltd., North Shore Strapping Inc., PAC Strapping, Tian Li Eco Group Holdings Sdn. Bhd., Plastic Extruders Ltd..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 6.4% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the PET Strapping include

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the PET Strapping in 2023.