Pest Control Market

Pest Control Market - Global Industry Assessment & Forecast

Segments Covered

By Pest Type Insects, Rodents, Birds, Other Pests

By Control Method Chemical, Biological, Mechanical, Other Controls

By Mode of Application Residential, Commercial, Others

By Component Equipment and Accessories, Services

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 25.4 Billion | |

| USD 42.6 Billion | |

| 6.68% | |

| 4,47,201.5 Tons | |

| 7,11,411.1 Tons | |

| 5.9% | |

| Europe | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

The Global Pest Control Market is valued at USD 25.4 Billion in 2023 and is projected to reach a value of USD 42.6 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 6.68% between 2024 and 2032.

Key highlights of Pest Control Market

- North America dominated the market in 2023, obtaining the largest revenue share of 35.2%.

- The Insects segment dominated the Pest Control market with the largest market share of 55.6% in 2023.

- The Chemical segment dominated the Pest Control market with the largest market share of 67.9% in 2023.

- By Mode of Application, The Commercial segment dominated the Pest Control market with the largest market share of 51.2% in 2023.

- The Equipment and Accessories segment dominated the Pest Control market with the largest market share of 71.0% in 2023.

- Residential consumers are increasingly turning to professional pest control services to address pest infestations and protect their homes from health risks and property damage.

- Increased waste generation in urban settings provides abundant food sources for pests, while reduced green spaces limit natural barriers and habitats that help control pest populations.

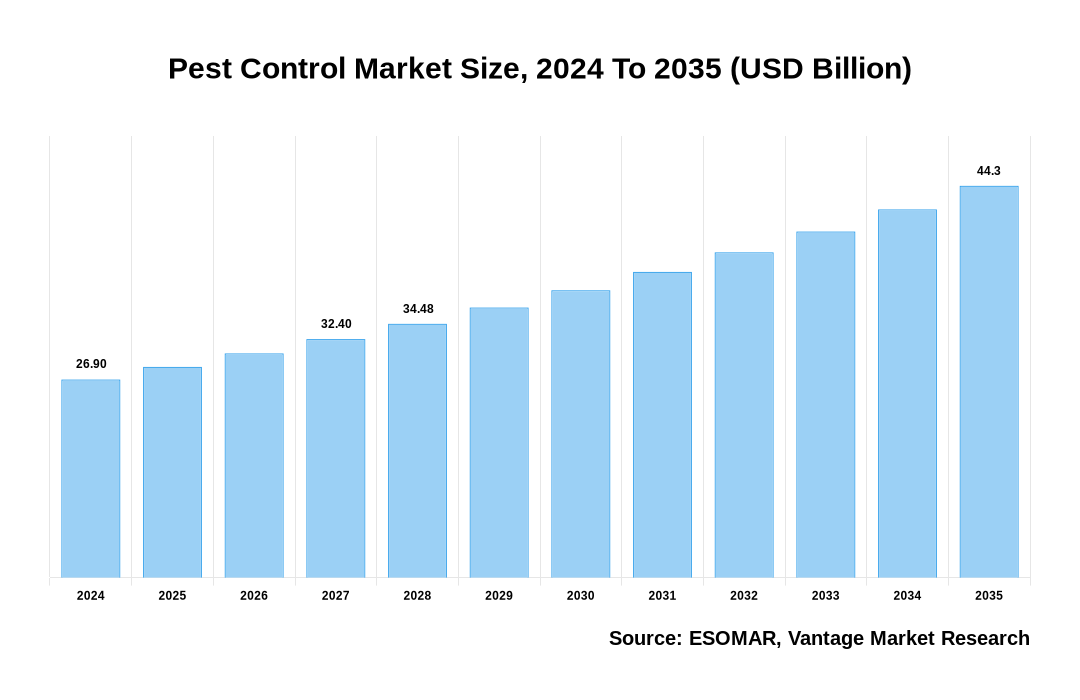

Pest Control Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Pest Control Market

Pest Control Market: Regional Overview

North America Dominated Sales with a 35.2% share in 2023. The pest control market in North America is characterized by its advanced regulatory environment, high consumer awareness, and significant market penetration. The region is dominated by established players like Terminix and Orkin, which have a strong presence across the United States and Canada. This growth is driven by factors such as increasing urbanization, rising demand for integrated pest management (IPM) solutions, and heightened awareness of health and hygiene issues related to pest infestations. Additionally, the stringent regulatory standards imposed by agencies such as the Environmental Protection Agency (EPA) and the Canadian Pest Management Association (CPMA) ensure high-quality and environmentally safe pest control practices.

U.S. Pest Control Market Overview

The Pest Control market in U.S., with a valuation of USD 7147.4 Million in 2023, is projected to reach around USD 11333.9 Million by 2032. This forecast indicates a substantial Compound Annual Growth Rate (CAGR) of 5.9% from 2024 to 2030. The pest control market in the United States is one of the largest and most developed globally. This growth is driven by several key factors, including increasing urbanization, rising awareness about health and hygiene, and the resurgence of bed bugs. As of 2023, over 82% of the U.S. population resides in urban areas, fueling the demand for pest control services. Furthermore, heightened awareness about diseases such as Lyme disease, West Nile virus, and Zika virus has led to a growing emphasis on maintaining pest-free environments. Additionally, climate change, with warmer temperatures and changing weather patterns, has contributed to the spread and survival of pests, further driving the need for effective pest control solutions.

The competitive landscape in the U.S. market features major players such as Rollins Inc., Terminix Global Holdings, Inc., Rentokil Initial plc, Ecolab Inc., and Anticimex Group. Rollins Inc., through its subsidiary Orkin, holds a significant market share. These companies continuously innovate to offer effective and sustainable pest control solutions, focusing on integrated pest management (IPM) techniques that minimize the use of harmful chemicals and emphasize long-term prevention.

The global Pest Control market can be categorized as Pest Type, Control Method, Mode of Application, Component, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Pest Type

By Control Method

By Mode of Application

By Component

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Pest Control Market: Pest Type Overview

In 2023, the Insects segment dominated the market, with the largest share accounting for 55.6% of the overall market. The Pest Control market, segmented by the Pest Type, includes Insects, Rodents, Wildlife, Termites, and Other pests. Insects represent the largest segment of the pest control market due to their high prevalence and the significant impact they have on human health, agriculture, and property. Common insect pests include ants, cockroaches, bed bugs, flies, mosquitoes, and wasps. Each of these pests poses unique challenges and requires specialized control strategies. Effective insect pest control involves a variety of methods, including chemical treatments (insecticides), biological controls (natural predators and pathogens), mechanical controls (traps and barriers), and integrated pest management (IPM) strategies. IPM combines multiple approaches to minimize pest populations while reducing reliance on chemical pesticides, thus promoting environmental sustainability.

Pest Control Market: Control Method Overview

In 2023, the Chemical segment dominated the market, with the largest share accounting for 67.9% of the overall market. The Pest Control market, segmented by the Control Methods, includes Chemical, Biological, Mechanical, and Other Controls. Chemical control methods are among the most widely used in the pest control industry due to their effectiveness and relatively quick results. These methods involve the use of chemical substances, such as insecticides, rodenticides, herbicides, and fungicides, to eliminate or manage pest populations. Insecticides are used to target and kill insects and are available in various formulations, including sprays, baits, dusts, and liquids. Common active ingredients include pyrethroids, neonicotinoids, and organophosphates. Insecticides are used extensively in agricultural settings to protect crops, as well as in residential and commercial spaces to control household pests like ants, cockroaches, and mosquitoes. While chemical control methods are effective, there are growing concerns about their environmental impact and potential health risks to humans and non-target species. Issues such as pesticide resistance, contamination of water sources, and harmful residues on food have led to increased regulation and the development of safer, more targeted chemical formulations.

Pest Control Market: Mode of Application Overview

In 2023, the Commercial segment dominated the market, with the largest share accounting for 51.2% of the overall market. The Pest Control market, segmented by the Mode of Application, includes Residential, Commercial, and Others. The commercial pest control market encompasses a wide range of sectors, including hospitality, food and beverage, healthcare, retail, and office spaces. Pest control in commercial settings is crucial for maintaining regulatory compliance, protecting brand reputation, and ensuring the safety and well-being of employees, customers, and clients. The presence of pests in commercial establishments can lead to significant financial losses, health risks, and legal liabilities. Healthcare facilities, including hospitals, clinics, and nursing homes, have unique pest control requirements due to the vulnerable populations they serve. Pests in healthcare settings can compromise patient safety, lead to healthcare-associated infections, and disrupt operations. The commercial pest control market is driven by regulatory requirements, industry standards, and the need to protect business assets and reputation. Advances in pest control technologies, such as remote monitoring, data analytics, and environmentally friendly treatments, are enhancing the effectiveness and efficiency of commercial pest management programs.

Pest Control Market: Component Overview

In 2023, the Equipment and Accessories segment dominated the market, with the largest share accounting for 51.2% of the overall market. The Pest Control market, segmented by the Component, includes Equipment and Accessories, and Services. In the pest control industry, equipment and accessories play a crucial role in facilitating effective pest management strategies. These components encompass a wide range of tools, devices, and products designed to detect, monitor, and control pests in various environments. Training and Educational Materials are essential for equipping pest control professionals with the knowledge and skills needed to effectively manage pest infestations. Training programs, manuals, reference guides, and online resources provide valuable information on pest biology, behavior, control methods, and safety protocols. Well -trained technicians can deliver high-quality pest control services that meet the needs of residential, commercial, and institutional clients.

Key Trends

- The pest control industry is witnessing a transformative trend with the integration of Internet of Things (IoT) devices and Artificial Intelligence (AI) algorithms in pest monitoring systems. IoT sensors and smart traps deployed in residential, commercial, and agricultural settings collect real-time data on pest activity, environmental conditions, and infestation patterns.

- Bio-based pesticides derived from natural sources offer effective alternatives to synthetic chemicals while promoting ecological balance. The adoption of sustainable pest control solutions is driven by regulatory mandates, consumer preferences for green products, and corporate sustainability initiatives, shaping the future of pest management practices globally.

- Predictive analytics enhances decision-making processes, enabling stakeholders to implement preventive measures, allocate resources effectively, and mitigate pest risks before they escalate. As the demand for proactive pest management solutions grows, the adoption of predict ive analytics is poised to revolutionize the pest control industry, driving innovation and improving outcomes for stakeholders across sectors.

Premium Insights

The global Pest Control market is projected to witness a substantial growth. This is majorly due to the increase in demand for technogically advanced products. As COVID-19 waves hit the countries worldwide, the demand for seaplanes is expected to witness susbtantial growth in the long run. The major companies are continously investing heavily to enhance the production which is projected to enhance the global market growth over the coming years. The development of global competition, technology, and advertising industry have made maintenance, pricing and promotion strategies for the product more complicated. Concerning these challenges, the importance of the marketing channel, as a strategic tool, has rapidly grown. For Instance, In September 2023, The Potomac Company announced two pairs of acquisitions: Viking Termite & Pest Control, an Anticimex company, acquired Last Bite Mosquito Control and Total Home Pest Control; Turner Pest Control, an Anticimex company, acquired National Exterminators.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Growing Awareness of Health and Hygiene Standards

The increasing awareness of health and hygiene standards among consumers and businesses is driving significant growth in the pest control market. As societies become more health-conscious, there's a growing recognition of the critical role that effective pest management plays in maintaining safe and hygienic environments. This heightened awareness is particularly evident in sectors such as healthcare, food processing, and hospitality, where stringent hygiene standards are paramount. According to data from the World Health Organization (WHO), pests like rodents, cockroaches, and mosquitoes can act as vectors for diseases, posing significant health risks to human populations. For instance, rodents are known carriers of pathogens such as Salmonella and Leptospira, while mosquitoes transmit diseases like dengue fever and malaria.

Furthermore, residential consumers are increasingly turning to professional pest control services to address pest infestations and protect their homes from health risks and property damage. According to a survey conducted by Pest Control Association, 72% of homeowners cited health concerns as their primary reason for seeking professional pest control assistance. As urbanization accelerates and populations concentrate in urban areas, the risk of pest infestations escalates due to factors such as increased waste generation and higher population densities. Therefore, the growing awareness of health and hygiene standards, coupled with the impact of global health crises like COVID-19, is driving robust demand for pest control services across various sectors, fueling market growth.

Rising Urbanization and Population Growth

The ongoing trends of urbanization and population growth are pivotal factors driving the expansion of the global pest control market. Urbanization, characterized by the increasing migration of populations from rural to urban areas, has resulted in the concentration of people in densely populated cities. As urban areas expand to accommodate growing populations, various factors contribute to the heightened risk of pest infestations. Increased waste generation in urban settings provides abundant food sources for pests, while reduced green spaces limit natural barriers and habitats that help control pest populations.

Overall, rising urbanization and population growth are driving forces behind the increasing demand for pest control services worldwide. By addressing the challenges associated with urban pest infestations and vector-borne diseases, pest control companies play a crucial role in safeguarding public health, protecting property, and promoting sustainable urban development in the face of rapid urbanization trends.

Competitive Landscape

The global pest control market is highly competitive, with a mix of large multinational companies, regional players, and new entrants competing for market share. Key players in the industry invest heavily in research and development to innovate and differentiate their products and services, thereby enhancing their competitive position. Additionally, strategic collaborations, mergers, and acquisitions are common strategies employed by market players to strengthen their market presence and expand their customer base. The Major key players are Bayer CropScience, Syngenta AG, BASF SE, BELL LABORATORIES, Corteva Agriscience, Rentokil Initial PLC, Anticimex, Ecolab Inc., Sunitomo Chemical Co. Ltd., Rollins Inc., FMC Corporation, ADAMA, PelGar International, Woodstream Corporation.

Recent Developments

- In May 2024, BASF has launched its novel insecticide Cimegra® in Australia, powered by a new active ingredient, Broflanilide®, formulated with BASF technology. Following the successful registration and launch in China in 2023, and Indonesia.

- In November 2023, Adam’s Pest Control announced it has acquired Brooklyn Park, Minn.-based Midwest Pest Management.

- In April 2023, Rollins, Inc, a premier global consumer and commercial services company, today announced that it has acquired FPC Holdings, LLC ("Fox Pest Control" or the "Company"). Fox Pest Control employs more than 1,300 associates and is headquartered in Logan, Utah. The Company ranks as the 13th largest pest management company according to PCT 100 rankings.

FAQ

Frequently Asked Question

What is the global demand for Pest Control in terms of revenue?

-

The global Pest Control valued at USD 25.4 Billion in 2023 and is expected to reach USD 42.6 Billion in 2032 growing at a CAGR of 6.68%.

Which are the prominent players in the market?

-

The prominent players in the market are Bayer CropScience, Syngenta AG, BASF SE, BELL LABORATORIES, Corteva Agriscience, Rentokil Initial PLC, Anticimex, Ecolab Inc., Sunitomo Chemical Co. Ltd., Rollins Inc., FMC Corporation, ADAMA, PelGar International, Woodstream Corporation..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 6.68% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Pest Control include

- Growing Awareness of Health and Hygiene Standards

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Pest Control in 2023.