Personalized Medicine Market

Personalized Medicine Market - Global Industry Assessment & Forecast

Segments Covered

By Product Personalized Medicine Diagnostics, Personalized Medicine Therapeutics, Personalized Medical Care, Personalized Nutrition & Wellness

By Application Oncology, Neurology, Cardiology, Antiviral, Psychiatry, Immunology, Other Applications

By End Users Hospitals & Clinical Care, Diagnostic Companies And Testing Facilities, Academic Research Institutes And Research Laboratories, Contract Research Organizations, Bio and Health Informatics Companies, Other End Users

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 330.8 Billion | |

| USD 746.01 Billion | |

| 10.7% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

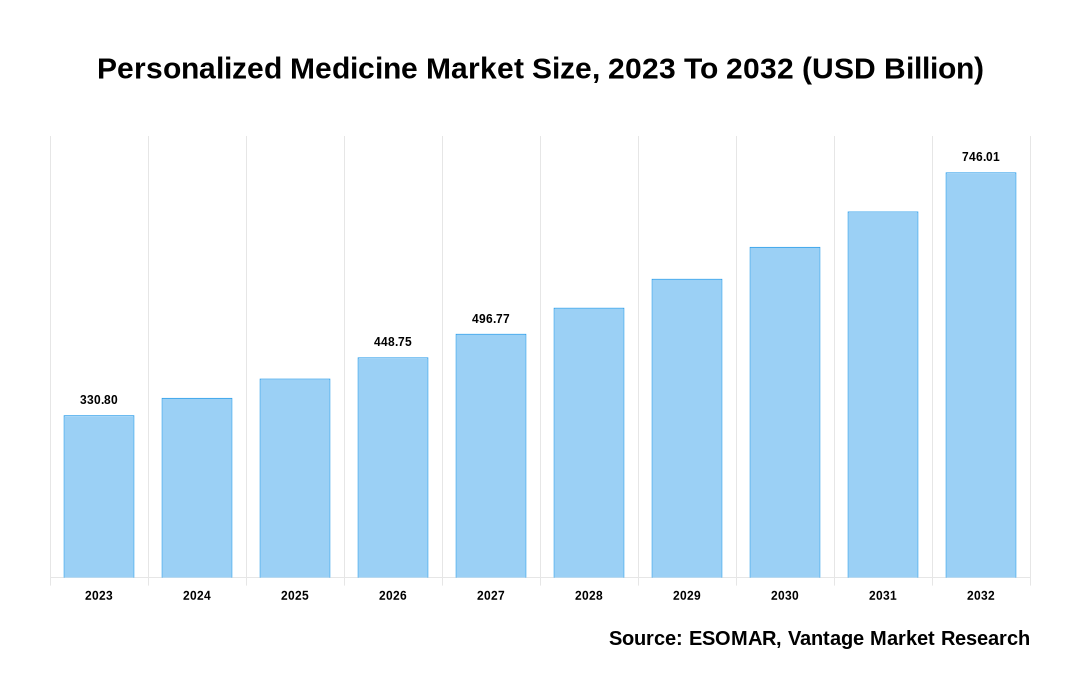

The global Personalized Medicine Market is valued at USD 330.8 Billion in 2023 and is projected to reach a value of USD 746.01 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 10.7% between 2024 and 2032.

Key highlights of Personalized Medicine Market

- North America dominated the market in 2023, obtaining the largest revenue share of 47.5%,

- The Asia Pacific region will witness a remarkable growth during the forecast period,

- The Personalized Nutrition & Wellness segment dominated the Personalized Medicine market with the largest market share of 56.5% in 2023,

- The Oncology segment continued to assert its dominance by end-users, capturing the largest market share of 42.1% in 2023,

- Hospitals And Clinical Care dominated the market with a significant market share of 39.2% in 2023,

- The rising adoption of direct-to-consumer genetic testing services and the proliferation of digital health technologies further permit people to manage their health actively, driving demand for personalized healthcare solutions.

Personalized Medicine Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Personalized Medicine Market

Personalized Medicine Market: Regional Overview

North America Dominated Sales with a 47.5% share in 2023. North America has fueled the demand for personalized medicine due to its advanced healthcare infrastructure, substantial investments in research and development, and the heightened prevalence of chronic diseases. For instance, nearly 60% of adult Americans have at least one chronic illness in 2022, according to the National Association of Chronic Diseases. The leading causes of death in the US are chronic illnesses like diabetes, cancer, and cardiovascular disease. The support by research institutes and pharmaceutical giants, who increasingly prioritize personalized medicine across various disease areas, driving its integration into both research efforts and drug discovery processes.

U.S. Personalized Medicine Market Overview

The US Personalized Medicine market, valued at USD 112.4 Billion in 2023 to USD 254.6 Billion in 2032, is anticipated to grow at a CAGR of 9.5% from 2024 to 2032. Advancements in genomic research, diagnostic technologies, and therapeutic interventions tailored to individual patients fueled the market for Personalized Medicine. For instance, in 2022, the FDA approved two new siRNA therapies, expanded the indications for many currently available personalized therapies, approved five gene and cell-based therapies, and approved several new diagnostic indications to enable targeted treatment decisions for various medical conditions. With a growing emphasis on precision healthcare, this market encompasses multiple applications, including pharmacogenomics, molecular diagnostics, and targeted therapeutics, the increasing prevalence of chronic diseases, the rising adoption of personalized treatment approaches, and supportive regulatory initiatives. For instance, Six out of ten adults in the US suffer from chronic diseases, according to the CDC, in 2022.

The global Personalized Medicine market can be categorized as Product, Application, End Users, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product

By Application

By End Users

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Personalized Medicine Market: Product Overview

In 2023, the Personalized Nutrition & Wellness segment dominated the market, accounting for 56.5%. The Personalized Medicine market, segmented by the Product, includes Personalized Medicine Diagnostics, Personalized Medicine Therapeutics, Personalized Medical Care, Personalized Nutrition & Wellness. There is a growing recognition of the role of individualized dietary and lifestyle interventions in optimizing health outcomes. Leveraging advancements in biotechnology and data analytics, personalized nutrition and wellness offerings are tailored to individuals' genetic profiles, health metrics, and lifestyle preferences, enabling more precise diet, exercise, and supplementation recommendations. With consumers increasingly prioritizing preventive healthcare and wellness initiatives, the personalized nutrition segment is poised for continued expansion, driving the Personalized Medicine market.

Personalized Medicine Market: Application Overview

In 2023, the Oncology application generated 42.1% of the revenue. The Application segment is divided into Oncology, Neurology, Cardiology, Antiviral, Psychiatry, Immunology, and Others. Personalized medicine is pivotal in most cancer diagnosis, remedy, and management. Tailored treatment plans, guided by genetic profiling and molecular diagnostics, are revolutionizing oncology care, providing patients with more effective and less toxic remedy alternatives. For instance, according to the American Most Cancers Society in 2022, personalized medication gives a multitude of advantages, such as identifying people at higher cancer threat, early cancer detection, precise diagnosis, tailored choice of greatest treatment options, and monitoring patient reaction to remedy, together enhancing the efficacy and precision of cancer management techniques.

Personalized Medicine Market: End Users Overview

The Hospitals and Clinical Care segment had a significant market share of 39.2% in 2023. The End Users segment is bifurcated into Hospitals and Clinical Care, Diagnostic Companies and Testing Facilities, Academic Research Institutes and Research Laboratories, Contract Research Organizations, Bio and Health Informatics Companies, and Others. Personalized healthcare services are mostly provided by hospitals and clinical care settings, which use multidisciplinary care teams, modern diagnostic equipment, and genomic profiling to customize treatment programs to meet the needs of each patient. As personalized medicine continues to reshape healthcare delivery, hospitals, and clinical care providers are poised to play a central role in driving its adoption and integration into routine clinical practice, ultimately enhancing patient outcomes and advancing precision medicine initiatives.

Key Trends

- There is a growing trend from Conventional diagnostic strategies to genomic and molecular diagnostics. These techniques analyze genetic and molecular markers to provide more precise information about a patient's condition, leading to better-informed treatment decisions.

- Bioinformatics and AI are revolutionizing the analysis of healthcare data. Leveraging these technologies, researchers can sift through massive datasets to discover applicable biomarkers, predict how patients reply to remedies, and optimize therapeutic techniques tailored to individual traits.

- Direct-to-consumer genetic testing allows individuals to access information about their genetic makeup and health risks without involving a healthcare provider. This trend has empowered consumers to manage their health and understand their genetic predispositions proactively.

Premium Insights

The escalating prevalence of chronic diseases is prompting a shift towards targeted and personalized treatment approaches. For instance, approximately one-third of persons worldwide are affected by multiple chronic diseases (MCCs). Technological improvements in genomics and molecular diagnostics are facilitating the identification of biomarkers and the improvement of tailored treatments, improving remedy efficacy and patient results. Additionally, strategic collaborations between pharmaceutical groups, diagnostic corporations, and research institutions are spurring innovation and accelerating the commercialization of personalized medicine products, shaping the future landscape of healthcare delivery. For instance, in November 2022, Danaher Corporation and Duke University forged a strategic alliance for the first Danaher Beacon for Gene Therapy Innovation. The Danaher Beacons program aims to use cutting-edge science to construct technologies and programs that enhance human health. The primary areas of attention encompass information sciences, genomic drug treatments, precision diagnostics, and next-generation biomanufacturing.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Growing Prevalence of Chronic diseases, including cardiovascular disorders, cancer, diabetes, and neurological conditions, are becoming more widespread globally due to factors like aging populations, sedentary lifestyles, and dietary habits

According to data by WHO in 2023, Chronic diseases account for 74% of all fatalities worldwide. Chronic disease conditions often require long-term management and treatment, driving up healthcare costs and burdening healthcare systems. Personalized medicine offers a promising technique to address these demanding situations by tailoring treatments to the particular traits of each patient's disease, genetic makeup, and lifestyle factors. By targeting the particular molecular pathways driving disease progression, personalized remedies aim to enhance outcomes, minimize side effects, and optimize the affected person's well-being.

One significant challenge facing the widespread adoption of personalized medicine is the high costs associated with genomic testing, targeted therapies, and other personalized interventions

Developing and implementing personalized medicine treatments requires sophisticated technologies, specialized expertise, and extensive research and development efforts, driving up production and healthcare delivery costs. The complexity of customized medicine may additionally necessitate additional patient education, counseling, and follow-up care sources. These higher expenses can pose financial limitations for patients and healthcare systems, limiting access to personalized remedies and hindering market growth.

Collaboration among healthcare providers, pharmaceutical corporations, research institutions, and technology companies is increasing the availability of customized medicine solutions

Partnerships between companies allow the creation of novel diagnostics, drugs, and treatments/therapies catered to the unique requirements of each patient by pooling knowledge, resources, and data. Collaborative research initiatives enable the translation of scientific discoveries into clinical applications, accelerating the pace of innovation in personalized medicine. Furthermore, partnerships between industry stakeholders and regulatory organizations can help address regulatory challenges, streamline approval techniques, and ensure the safe and powerful implementation of personalized medicine technologies and treatment plans. For instance, Genomic Medicine Sweden (GMS) and the German Centers for Personalized Medicine (ZPM) will work together in February 2022 to apply precision medicine in healthcare through structural, content-specific, and strategic initiatives.

Competitive Landscape

The competitive landscape of the Personalized Medicine market is characterized by a dynamic interplay of established pharmaceutical companies, emerging biotechnology firms, and innovative startups. Key players, including Roche, Thermo Fisher Scientific, and Illumina, hold their dominance via significant R&D investments, strategic partnerships, and acquisitions to strengthen their portfolio of precision medication services. Meanwhile, agile startups like 23andMe disrupt conventional healthcare models with direct-to-customer genetic testing and data-driven approaches. At the same time, biotech innovators like CRISPR Therapeutics push the boundaries of gene editing technologies. Moreover, the market witnesses collaborations among pharmaceutical giants and diagnostic agencies, fostering synergies in drug improvement and partner diagnostics. As the demand for tailor-made healing procedures continues to surge and technological improvements boost up, the personalized medicine landscape remains distinctly competitive, fostering innovation and reshaping the destiny of healthcare delivery.

The key players in the global Personalized Medicine market include - Abbott Laboratories (U.S.), Merck & Co. Inc. (U.S.), Astrazeneca (UK), Pfizer Inc. (U.S.), Glaxosmithkline PLC (UK), Novartis AG (Switzerland), Amgen Inc. (U.S.), Bayer AG (Germany), Eli Lilly & Company (U.S.), Illumina Inc. (U.S.), Danaher Corporation (U.S.), QIAGEN (Germany), 23andMe Inc. (U.S.), Roche (Switzerland), Thermo Fisher Scientific (U.S.), GE Healthcare (U.S.), Precision Biologics (Canada) among others.

Recent Market Developments

- In July 2023, a recent Simvastatin Medication Insight study from 23andMe is one of a series of investigations that explore how genetics may affect a person's response to specific medications and the likelihood of potential side effects. The Simvastatin Medication Insight study examines how each person reacts to the statin medication simvastatin, which lowers blood cholesterol and is marketed under Flolipid and Zocor.

- In June 2023, Qiagen declared that the Danish National Genome Center had chosen its "QCI Interpret" software to offer sequencing-based cancer patient solutions. The program designed for variant interpretation and reporting was selected to evaluate cancer outcomes derived from whole-genome sequencing information. This development is a component of Denmark's personalized treatment approach, which aims to provide WGS as the norm for appropriate patient populations.

- In June 2023, GE Healthcare presented its most recent personalized medicine and precision care innovations at the 2023 annual Society of Nuclear Medicine and Molecular Imaging (SNMMI) conference. The business introduced the SIGNA PET/MR system in personalized medicine, which is intended to help physicians identify the tiniest lesions, look into novel tracers, and create more precise treatment plans for every patient.

- In June 2023, with a high degree of accuracy, Illumina's new PrimateAI-3D AI system diagnoses individuals with genetic abnormalities that cause disease. The method is trained on genomic sequences and using deep neural network designs. PrimateAI-3D seeks to provide precise predictions about variations that cause disease to tackle the obstacles that impede the practical application of personalized genomic medicine.

- In April 2023, Precision Biologics declared the completion of its initial Phase I clinical trial involving humans, utilizing their innovative monoclonal antibody, NEO-201. Patients with resistant solid tumors were involved in the trial. NEO-201 has shown the ability to decrease immune suppressive cells, which may be accountable for diminishing the anti-cancer efficaciousness of checkpoint inhibitors like Keytruda.

- In August 2022, Using the AVISE RADR platform, Exagen started the "TiGER" trial to validate a new, less invasive genomic diagnostic test for rheumatoid arthritis. By finding biomarkers in synovial tissue for drug response in rheumatoid arthritis, the study will contribute to the establishment of tailored medicine as the mainstay of care and assist in treating the illness.

Vantage Market

Research | 27-Mar-2024

Vantage Market

Research | 27-Mar-2024

FAQ

Frequently Asked Question

What is the global demand for Personalized Medicine in terms of revenue?

-

The global Personalized Medicine valued at USD 330.8 Billion in 2023 and is expected to reach USD 746.01 Billion in 2032 growing at a CAGR of 10.7%.

Which are the prominent players in the market?

-

The prominent players in the market are Abbott Laboratories (U.S.), Merck & Co. Inc. (U.S.), Astrazeneca (UK), Pfizer Inc. (U.S.), Glaxosmithkline PLC (UK), Novartis AG (Switzerland), Amgen Inc. (U.S.), Bayer AG (Germany), Eli Lilly & Company (U.S.), Illumina Inc. (U.S.), Danaher Corporation (U.S.), QIAGEN (Germany), 23andMe Inc. (U.S.), Roche (Switzerland), Thermo Fisher Scientific (U.S.), GE Healthcare (U.S.), Precision Biologics (Canada).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 10.7% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Personalized Medicine include

- Growing Prevalence of Chronic diseases, including cardiovascular disorders, cancer, diabetes, and neurological conditions, are becoming more widespread globally due to factors like aging populations, sedentary lifestyles, and dietary habits

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Personalized Medicine in 2023.