Payment Orchestration Platform Market

Payment Orchestration Platform Market - Global Industry Assessment & Forecast

Segments Covered

By Functionalities Cross Border Transactions, Risk Management, Advanced Analytics & Reporting

By End-Use E-Commerce, Travel & Hospitality Industry, Healthcare, BFSI, Other End Uses

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 969.84 Million | |

| USD 4854.12 Million | |

| 22.30% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Market Synopsis:

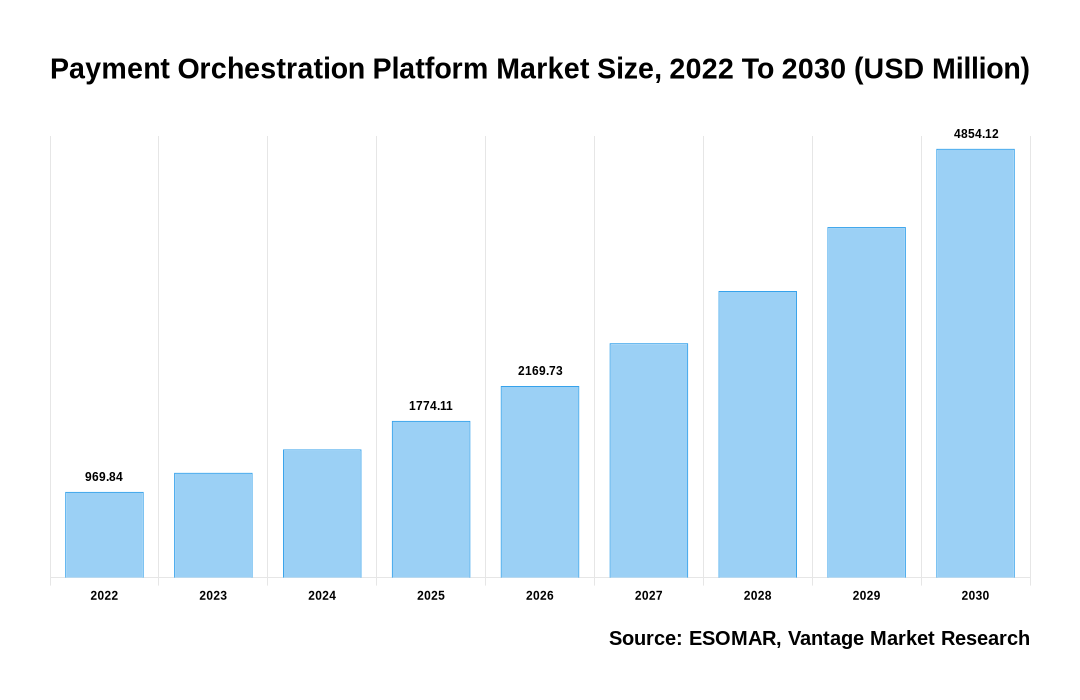

The Global Payment Orchestration Platform Market was valued at USD 969.84 Million in the year 2022 and is forecast to reach a value of USD 4854.12 Million by the year 2030. The Global Market is anticipated to grow to exhibit a Compound Annual Growth Rate (CAGR) of 22.30% over the forecast period.

Payment Orchestration Platforms aid merchants in creating an optimized payment flow, reducing overall operational cost, and increasing profitability. Payment Orchestration Platforms also aid in the quick adoption of novel technologies and assist in tracking consumer trends and preferences shifts. Increasing digitization and rising use of online payments by consumers are also expected to favor Payment Orchestration Platform Market growth. In addition, the increasing popularity of Buy Now Pay Later (BNPL) among E-Commerce stores is expected to bolster demand for Payment Orchestration Platforms to optimize payment flows. Increasing the adoption of Payment Orchestration Platforms by merchants will also favor market potential across the forecast period. However, the increasing incidence of cyberattacks is expected to restrain the overall Payment Orchestration Platform Market growth through 2028.

Payment Orchestration Platform Market Size, 2022 To 2030 (USD Million)

AI (GPT) is here !!! Ask questions about Payment Orchestration Platform Market

Payment Orchestration Platform Market Segmentation:

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

The Payment Orchestration Platform Market is segmented based on Functionalities, End-Use, and Region. Based on the segment Functionalities, the market is sub-segmented as Cross Border Transactions, Risk Management, and Advanced Analytics & Reporting. Based on the End-Use segment, the market is sub-segmented as E-Commerce, Travel & Hospitality Industry, Healthcare, BFSI, and Other End-Uses.

Based on Functionalities:

Based on segment Functionalities, the market is sub-segmented into Cross Border Transactions, Risk Management, and Advanced Analytics & Reporting. The demand for Cross Border Transactions and Risk Management Functionalities is expected to drive the overall Payment Orchestration Platform Market growth over the forecast period. In addition, increasing urbanization and the rising popularity of online sales channels that enable shopping from all corners of the world are expected to drive the number of Cross Border Transactions.

Based on End-Use:

Based on the segment End-Use, the market is sub-segmented into E-Commerce, Travel & Hospitality Industry, Healthcare, BFSI, and Other End-Uses. The E-Commerce and BFSI sub-segments are anticipated to exhibit highly lucrative growth opportunities across the forecast period owing to the increasing penetration of digital technologies in the fintech infrastructure. In addition, the rising digitization of the BFSI sub-segment is also expected to bolster Payment Orchestration Platform Market growth through 2028. Furthermore, increasing E-Commerce activity is expected to majorly drive Payment Orchestration Platform Market growth as merchants will increase the adoption to accommodate a rising number of payments. In addition, the increasing popularity of BNPL trends is expected to boost growth in E-Commerce sales across the forecast period.

North America Accounts for a Dominant Market Share

In the global industry landscape, North America Payment Orchestration Platform Market accounted for a significant market share of 46.1% in 2021. The rapid adoption of novice technologies and the presence of crucial payment providers are expected to be prominent factors driving Payment Orchestration Platform Market growth. Increasing digitization and the rising popularity of online payment technologies coupled with rapid adoption by consumers are expected to bolster Payment Orchestration Platform Market growth at a stellar pace across the forecast period. Increasing smartphone proliferation in the United States and Canada is expected to prominently drive the overall Payment Orchestration Platform Market growth across the forecast period. In addition, increasing investments in digital payment technologies and rising research and development in the fintech industry are expected to be prominent trends driving Payment Orchestration Platform Market growth in this region.

The Asia Pacific region is expected to witness speedy growth compared to other regions worldwide. This growth can be attributed to rapid digitization and increasing technological proliferation in this region over the forecast period. As a result, China and India are anticipated to be the key markets in this region through 2028.

Competitive Landscape:

The key players in the Global Payment Orchestration Platform Market include- IXOPAY, Cell Point Digital, Payoneer, Aye4fin GmbH, Corey, APEXX Fintech Limited, Amadeus IT Group SA, Rebilly, Modo payments, Spreedly, Optile and others.

Segmentation of the Global Payment Orchestration Platform Market:

Parameter

Details

Segments Covered

By Functionalities

By End-Use

By Region

Regions & Countries Covered

Companies Covered

Report Coverage

Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST

analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market

attractiveness analysis by segments and North America, company market share analysis, and COVID-19

impact analysis

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

FAQ

Frequently Asked Question

What is the global demand for Payment Orchestration Platform in terms of revenue?

-

The global Payment Orchestration Platform valued at USD 969.84 Million in 2022 and is expected to reach USD 4854.12 Million in 2030 growing at a CAGR of 22.30%.

Which are the prominent players in the market?

-

The prominent players in the market are IXOPAY, Cell Point Digital, Payoneer, Aye4fin GmbH, Corey, APEXX Fintech Limited, Amadeus IT Group SA, Rebilly, Modo payments, Spreedly, Optile.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 22.30% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Payment Orchestration Platform include

- Growing e-commerce platforms

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Payment Orchestration Platform in 2022.

Vantage Market

Research | 11-Jul-2022

Vantage Market

Research | 11-Jul-2022