Payment as a Service Market

Payment as a Service Market - Global Industry Assessment & Forecast

Segments Covered

By Component Platform, Services

By Service Professional Services, Managed Services

By Vertical Retail, Hospitality, Media and Entertainment, Healthcare, Banking, Financial Services, and Insurance (BFSI), Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 7631.06 Million | |

| USD 41030.43 Million | |

| 23.40% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Global Payment as a Service Market

Payment as a Service Market- By Components, Services, Vertical and Region.

Market Synopsis:

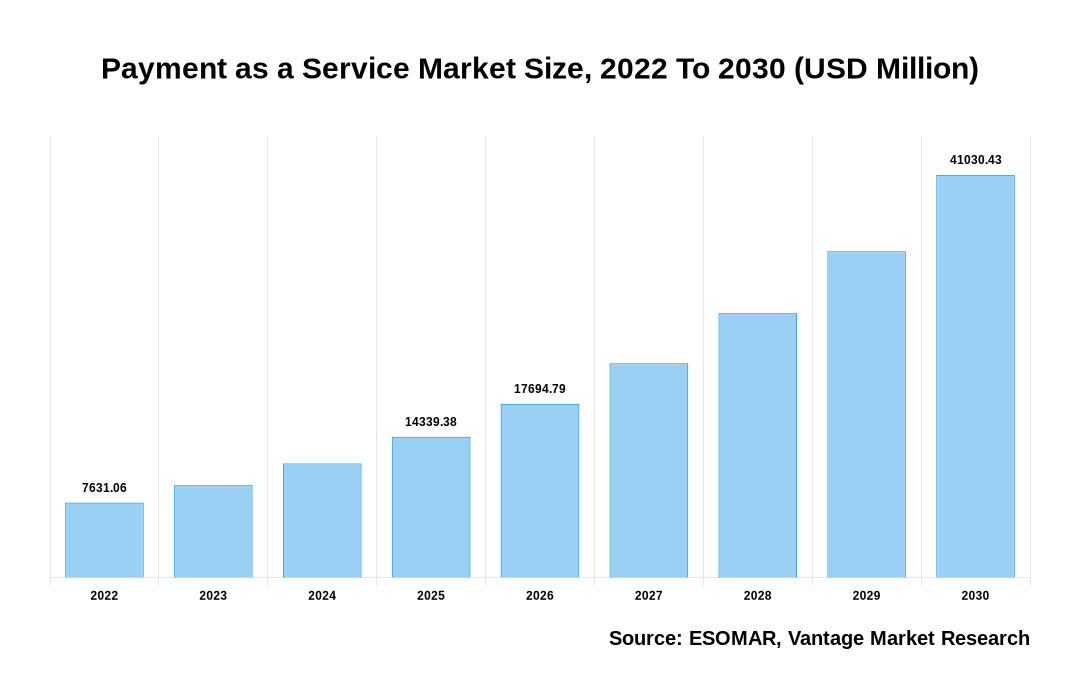

The Global Payment as a Service Market is valued at USD 7631.06 Million in the year 2022 and is expected to reach a value of USD 41030.43 Million by the year 2030. The Global Market is projected to grow exhibiting a Compound Annual Growth Rate (CAGR) of 23.40% over the forecast period.

Payment as a Service Market Size, 2022 To 2030 (USD Million)

AI (GPT) is here !!! Ask questions about Payment as a Service Market

Payments as a service (PaaS) is a marketing term for a software-as-a-service that connects a collection of worldwide payment systems. The architecture is represented by a layer or overlay that sits on top of these different systems and allows both the payment system and the PaaS to communicate with one other. Standard Application Programming Interfaces (APIs) provided by the PaaS provider govern communication. Another factor driving market growth is the growing trend of moving from on-premise to cloud-based service models. To minimize costs and provide products faster, payment providers are gradually transitioning from traditional physical servers and on-premise deployments to cloud-based deployments. As a result of the shift in cloud deployment strategy, alternative solutions and digital wallets have grown in popularity.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Smartphone penetration is increasing, which is fueling the expansion of online sales of products and services. Customers can enjoy a simple and convenient shopping experience using online shopping mobile applications. The demand for a simple and convenient shopping experience is driving a trend toward digital and cashless transactions. Smartphone penetration is increasing, which is fueling the expansion of online sales of products and services. Customers can enjoy a simple and convenient shopping experience using online shopping mobile applications. The demand for a simple and convenient shopping experience is driving a trend toward digital and cashless transactions.

The global rise of payment-as-a-service (PaaS) is being fueled by the increase in e-commerce Company. One of the primary factors fueling the rise of PaaS solutions is a fundamental transition from an on-premise strategy to a cloud-based service model. Shoppers are searching for a simple and secure way to pay for their products, which is allowing retailers to experiment with new technology. Governments in many nations have launched a number of steps to promote payment solutions based on safe and real-time transactions. The key elements driving the global rise of payment-as-a-service are quick, secure payment options and an optimized customer experience. Because of the tremendous growth of the e-commerce business, retailers are rapidly adopting digital payment technology.

Market Segmentation:

The Payment as a Service Market is segmented on the basis of Components, services and verticals. On the basis of Components, the market is segmented into platform and services. On the basis of Service, the market is segmented into professional services and managed services. On the basis of vertical, the market is segmented retail, hospitality, media and entertainment, healthcare, banking, financial services, and insurance (BFSI),others (sports and leisure, NGO, government, energy and utilities, and education).

Based on Services:

On the basis of Power Output, the market is segmented into professional services and managed services. In 2020, the market was led by the Managed services. Managed services are critical since they are directly tied to improving customer experience; thus, businesses cannot afford to ignore them because they assist them maintain their market position. Companies are finding it more difficult to focus on their core business processes while also supporting a variety of other functions, which highlights the importance of managed services. These services provide the technical expertise needed to keep API-based payment solutions up to date and maintain. Managed services take care of all pre- and post-deployment questions, as well as customer requests. Managed services are typically outsourced so that businesses can focus on their core competencies. In the Payment as a Service sector, the advent of hosted payment solutions is likely to increase demand for managed services. Merchants can use managed services to decrease infrastructure complexity and operational costs while also providing a secure and global infrastructure.

Based on Vertical:

On the basis of Vertical, the market is segmented retail, hospitality, media and entertainment, healthcare, banking, financial services, and insurance (BFSI) and others (sports and leisure, NGO, government, energy and utilities, and education). Due to the tremendous growth of the e-commerce business, retailers are increasingly implementing digital payment technology to provide more comfortable experiences for their customers. According to the Mobile Payments Conference, 1.5 billion individuals throughout the world chose to shop online in 2017. By 2019, there will be 2 billion digital purchasers. Debit cards account for 42.6 percent of all transactions, according to the British Retail Consortium (BRC), while cash accounts for 42.3 percent. According to UK Finance, cards accounted for 77 percent of all retail expenditure in the United Kingdom. Furthermore, merchants are implementing novel technology in order to boost their market awareness and presence. For example, Walmart, the world's largest retailer, has announced that customers will be able to pay for goods in-store using a PayPal Cash Mastercard. Customers will be able to withdraw money and load money into their accounts at Walmart stores using the PayPal mobile app, as the retailer plans to integrate the payment provider's service.

North America is projected to acquire the largest market share during the year 2021

North America accounted is having largest share. The United States has the largest digital payment instrument penetration, accounting for the majority of the region's share in 2021. Google Pay, Apple Pay, and Paypal are the most popular digital payment apps in the United States. The majority of the leading vendors of PaaS solutions and services are based in North America. One of the primary factors fueling PaaS solutions' rise in the region is this is a rise in the use of mobile wallets, which is accelerating the expansion of PaaS. PaaS services are being increasingly adopted by industries such as retail and banking for safe and real-time transactions. E-commerce sales are expanding in the region as a result of faster internet speeds, which is one of the factors fueling the rise of PaaS solutions in North America.

Competitive Landscape:

Key players operating in the Global Payment as a Service Market include First Data (US), TSYS (US), Paysafe (UK), Verifone (US), Ingenico (France), Aurus (US), Agilysys (US) and others.

Segmentation of the Global Payment as a Service Market:

| Parameter | Details |

|---|---|

| Segments Covered |

By Component

By Service

By Vertical

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Payment as a Service in terms of revenue?

-

The global Payment as a Service valued at USD 7631.06 Million in 2022 and is expected to reach USD 41030.43 Million in 2030 growing at a CAGR of 23.40%.

Which are the prominent players in the market?

-

The prominent players in the market are First Data (US), TSYS (US), Paysafe (UK), Verifone (US), Ingenico (France), Aurus (US), Agilysys (US).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 23.40% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Payment as a Service include

- Regulatory Initiatives to Promote Payment Solutions Thriving on Secure and Real-Time Transactions

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Payment as a Service in 2022.

Vantage Market

Research | 08-May-2022

Vantage Market

Research | 08-May-2022