Paper Packaging Market

Paper Packaging Market - Global Industry Assessment & Forecast

Segments Covered

By Material Corrugated Board, Kraft Paper, Molded Pulp, Specialty Paper

By Packaging Type Corrugated Boxes, Bags & Sacks, Folding Cartons, Tapes & Labels, Wrapping Paper, Cups & Trays

By End-Use Industry Food & Beverages, Personal Care & Cosmetics, E-Commerce, Healthcare, Homecare & Toiletries, Electrical & Electronics, Other Industries

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 360 Billion | |

| USD 493 Billion | |

| 4% | |

| Europe | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

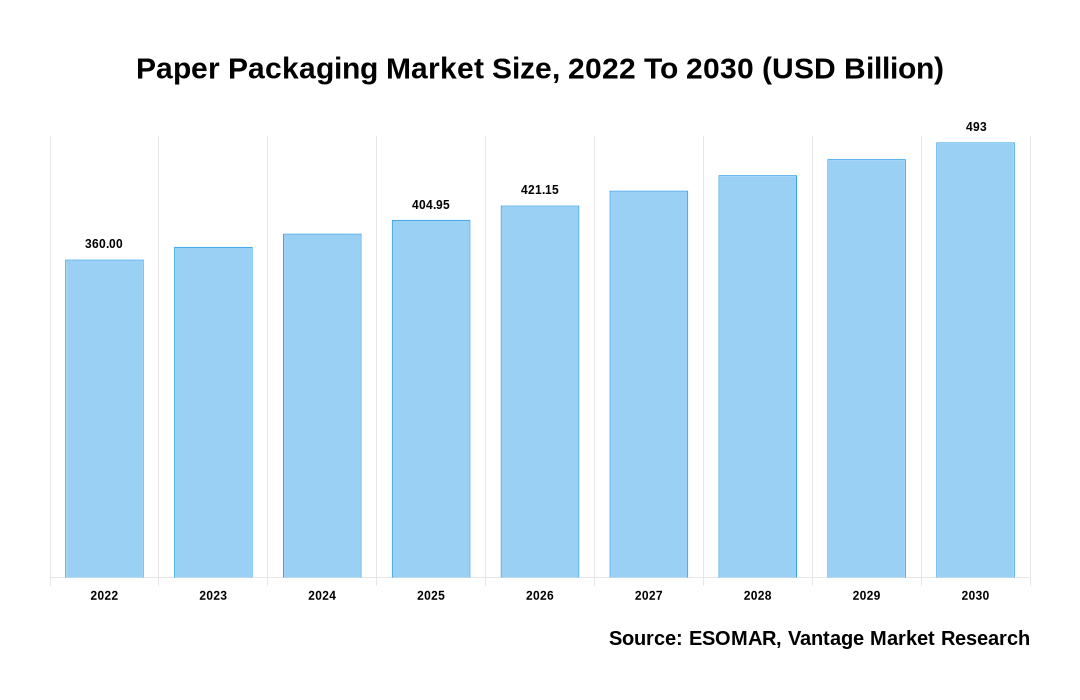

The global Paper Packaging Market is valued at USD 360 Billion in 2022 and is projected to reach a value of USD 493 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 4% between 2023 and 2030.

Premium Insights

The industry is witnessing a paradigm shift towards sustainability, driven by a global push to reduce plastic waste. Paper packaging is emerging as a viable and eco-friendly alternative, aligning with circular economy principles. Innovations in paper manufacturing, enhancing strength and moisture resistance, are broadening the scope of products suitable for paper packaging. For instance, McDonald's, a global fast-food giant, is actively reducing single-use plastic consumption by transitioning to paper packaging. With a commitment to increasing recyclable content, the company uses Forest Stewardship Council (FSC) certified paper in its packaging. McDonald's aims to achieve 100% sustainable fiber-based guest packaging by 2025, demonstrating its dedication to environmental responsibility. Another example includes L'Oréal, the world's largest cosmetics company, spearheading the adoption of paper packaging. Through its division Seed Phytonutrients, L'Oréal USA has introduced shampoo bottles made from recycled, recyclable, and compostable paper. This strategic move is aligned with the company's dedication to reducing industrial waste and transitioning towards sustainable packaging solutions.

Paper Packaging Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Paper Packaging Market

- Changing consumer demands, particularly post-pandemic, influence the industry to develop specialized products. Antibacterial paper packaging for food and healthcare products is a notable example, reflecting a keen focus on health and hygiene.

- In 2022, the Asia Pacific region accounted for the most significant growth, with a revenue share of 43%.

- Europe is expected to be the fastest-growing market during the forecast period.

- The occurrence of Kraft Papers largely influences the market expansion of Paper Packaging.

- The Corrugated Boxes segment is anticipated to lead the global market growth.

- Based on the End-use Industry, the Food and Beverages segment accounted for the potential market growth in 2022.

Top Market Trends

- The industry is witnessing a major shift towards eco-friendly solutions as environmental concerns intensify. Paper packaging increasingly replaces plastic alternatives, aligning with global efforts to reduce plastic waste. Circular economy practices, including the reuse and recycling of paper-based materials, are gaining traction, reflecting a commitment to sustainable packaging solutions.

- Continuous innovations in paper manufacturing are expanding the capabilities and applications of paper packaging. Improved strength, enhanced moisture resistance, and other advancements are broadening the range of products safely packaged in paper. This trend addresses traditional limitations and opens doors for innovative and diverse packaging solutions. Smart packaging, integrating digital technologies for tracking and information sharing, is becoming more prevalent, enhancing convenience and consumer engagement.

- Biodiversity concerns are gaining attention within the paper packaging industry. Issues related to unsustainable forestry practices and their impact on biodiversity are being acknowledged. Leading companies are optimizing their supply chains to use more sustainable raw materials and address biodiversity loss.

Report Coverage & Deliverables

Get Access Now

Economic Insights

Biodegradable and renewable paper has emerged as a preferred choice, aligning with global efforts to reduce plastic usage. The stringent regulations and policies to curb plastic pollution have further boosted the demand for paper packaging solutions. The versatility of paper packaging, catering to diverse industries like food and beverage, pharmaceuticals, and e-commerce, contributes to its widespread adoption, creating a robust economic outlook for the paper packaging market. Furthermore, economic factors such as the rising e-commerce sector drive the demand for paper packaging. The surge in online retail activities has led to an increased need for reliable and sustainable packaging solutions to make sure the safe delivery of products. As the paper packaging market continues to innovate with advanced technologies, such as bio-based coatings and smart packaging solutions, it is likely to witness sustained growth, offering economic opportunities for businesses involved in producing and distributing paper packaging materials.

Market Segmentation

The Global Paper Packaging Market is segregated into the below-mentioned segments as:

The global Paper Packaging market can be categorized into Material, Packaging Type, End-Use Industry, Region. The Paper Packaging market can be categorized into Corrugated Board, Kraft Paper, Molded Pulp, Specialty Paper based on Material. The Paper Packaging market can be categorized into Corrugated Boxes, Bags & Sacks, Folding Cartons, Tapes & Labels, Wrapping Paper, Cups & Trays based on Packaging Type. The Paper Packaging market can be categorized into Food & Beverages, Personal Care & Cosmetics, E-Commerce, Healthcare, Homecare & Toiletries, Electrical & Electronics, Other Industries based on End-Use Industry. The Paper Packaging market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East & Africa based on Region.

Based on Material

Kraft Paper Segment to Have Major Market Revenue in the Forecast Period

In 2022, the kraft papers segment dominated the market. Kraft papers play a pivotal role in driving the expansion of the paper packaging market. Crafted from softer wood fibers, kraft paper exhibits impressive durability, superior grip strength, and flexibility. These inherent qualities make it an ideal choice for manufacturing various paper packaging solutions. Also, the robustness and sturdiness of kraft paper further extend its application to diverse industrial and commercial uses, thereby fueling the growth of this market segment.

Based on the Packaging Type

Corrugated Boxes Segment Expects Dominion Status in the Projected Timelines

The corrugated boxes segment predominantly leads the paper packaging market. This market has grown considerably due to the increasing demand for packaging across various industries, including food and beverages, electrical and electronics, and e-commerce. The upsurge in online shopping platforms has further heightened the demand for paper packaging items like corrugated boxes. These boxes offer optimal protection during both shipping and handling processes, contributing significantly to expanding the corrugated boxes segment.

Based on End-use Industry

Food & Beverages Segment Expected to Lead Maximum Market Share Globally

In 2022, the most prominent sector was the food and beverage segment, and the global demand for food products primarily drives its dominance. The growing inclination towards packaged and processed foods has further intensified the reliance on paper packaging. The escalating demand for fast food and frozen products also necessitates effective packaging, leading to an increased preference for paper packaging solutions. Using paper for packing food items serves as a protective measure, mitigating the adverse impacts of plastic packaging. Furthermore, the ease of disposing of paper is a pivotal factor contributing to the expansion of this segment.

Based on Region

Asia Pacific is Dominating the Global Market and Forecast to Continue the Dominance

The Asia Pacific region led the global paper packaging market in 2022. The expansion of urban areas and increased disposable incomes throughout the region have resulted in a notable upswing in the request for packaged products, especially within the food and beverage industry. This necessitates efficient and sustainable packaging solutions, and paper has emerged as the frontrunner. Moreover, the e-commerce boom has further fueled the growth of the paper packaging market. Also, the growing environmental awareness among consumers is another key driver of the market's expansion. As concerns about plastic pollution escalate, consumers increasingly seek sustainable alternatives like paper packaging. This shift in consumer preference has created a lucrative market for paper packaging companies.

Competitive Landscape

The competitive landscape of the paper packaging market is consistently changing, marked by the entry of new participants and the strategies of existing ones to stay pertinent.

The key players in the global Paper Packaging market include - International Paper Company (U.S.), WestRock Company (U.S.), DS Smith PLC (UK), Mondi Group PLC (UK), Smurfit Kappa Group PLC (Ireland), Georgia-Pacific LLC (U.S.), Sonoco Products Company (U.S.), Amcor PLC (Australia), Holmen AB (Sweden), Mayr-Melnhof Karton AG (Austria), Hood Packaging Corporation (Canada), Oji Holdings Corporation (Japan), Stora Enso Oyj (Finland) among others.

Recent Market Developments

- In September 2023, Smurfit Kappa and WestRock unveiled a strategic transaction to form a leading global leader in sustainable packaging solutions.

- In August 2023, Amcor introduced curbside-recyclable AmFiber™ Performance Paper packaging in North America, a component of the broader AmFiber portfolio. Endorsed by How2Recycle®, the performance paper adheres to re-pulpability criteria for curbside recycling, enabling brands to offer consumers more sustainable end-of-life options for their packaging.

- In September 2022, Smurfit Kappa declared the signing of an agreement to acquire PaperBox in Rio de Janeiro. This acquisition of PaperBox extends the company's footprint in Brazil and diversifies its range of products.

- In May 2022, Mondi, a prominent player in sustainable packaging and paper, joined forces with German machine supplier Beck Packautomaten to introduce an innovative functional barrier paper solution tailored for automated eCommerce packaging. This collaborative effort aims to transform the eCommerce landscape by substituting plastic packaging with sustainable alternatives and crafting appropriately sized packaging for diverse product categories.

Segmentation of the Global Paper Packaging Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Material

By Packaging Type

By End-Use Industry

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Paper Packaging in terms of revenue?

-

The global Paper Packaging valued at USD 360 Billion in 2022 and is expected to reach USD 493 Billion in 2030 growing at a CAGR of 4%.

Which are the prominent players in the market?

-

The prominent players in the market are International Paper Company (U.S.), WestRock Company (U.S.), DS Smith PLC (UK), Mondi Group PLC (UK), Smurfit Kappa Group PLC (Ireland), Georgia-Pacific LLC (U.S.), Sonoco Products Company (U.S.), Amcor PLC (Australia), Holmen AB (Sweden), Mayr-Melnhof Karton AG (Austria), Hood Packaging Corporation (Canada), Oji Holdings Corporation (Japan), Stora Enso Oyj (Finland).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 4% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Paper Packaging include

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Paper Packaging in 2022.

Vantage Market

Research | 16-Jan-2024

Vantage Market

Research | 16-Jan-2024