Ovarian Cancer Drugs Market

Ovarian Cancer Drugs Market - Global Industry Assessment & Forecast

Segments Covered

By Therapeutic Class PARP Inhibitors, Angiogenesis Inhibitors, PD-L1 Inhibitors

By Treatment Chemotherapy, Radiation Therapy, Hormonal Therapy, Targeted Therapy, Other Treatments

By End User Hospital Pharmacy, Retail Pharmacy, Online Pharmacy

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 3.7 Billion | |

| USD 6.67 Billion | |

| 6.8% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

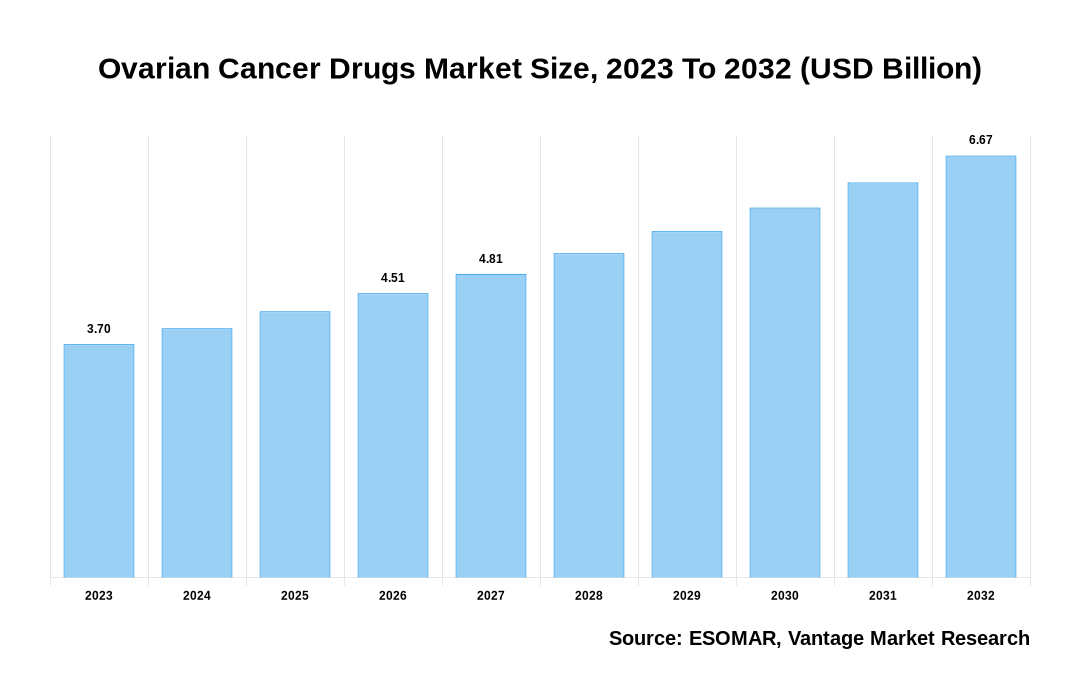

The global Ovarian Cancer Drugs Market is valued at USD 3.7 Billion in 2023 and is projected to reach a value of USD 6.67 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 6.8% between 2024 and 2032.

Key highlights of Ovarian Cancer Drugs Market

- The North American region dominated the Ovarian Cancer Drugs market in 2023, obtaining the largest revenue share of 45.3%,

- The Asia Pacific region is expected to registered the fastest market growth during the forecast period,

- In 2023, the PARP Inhibitors segment accounted for the largest growth of the Ovarian Cancer Drugs Market,

- The Targeted Therapy & Others segment asserted its dominance and captured the largest revenue share of 44.3% in 2023,

- The Hospital Pharmacy segment led the Ovarian Cancer Drugs market with revenue share of 57.1% in 2023,

- The data released by the American Cancer Society in January 2022 indicated that ovarian cancer ranked as the seventh most prevalent cancer in women worldwide, contributing to 4.4% of all female cancer-related deaths. Thus, the rising incidence of ovarian cancer is fueling the expansion of the Ovarian Cancer Drugs market in recent years.

Ovarian Cancer Drugs Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Ovarian Cancer Drugs Market

Ovarian Cancer Drugs Market: Regional Overview

North America accounted for 45.3% of the total revenue in the Ovarian Cancer Drugs market in 2023. Various factors are responsible for this growth. These include well-established healthcare infrastructure in this region, rising patient awareness, enhanced medical facilities, and a surging pharmaceutical and research ecosystem. According to the American Cancer Society, ovarian cancer ranks as the eighth leading cause of cancer-related deaths among women in the United States. In addition, the surge in gynecologic malignancies in women is further accelerating the urgent need for effective drugs and therapies. Thus, the rising incidences of ovarian cancer and the enhancement of novel treatment methods, mainly targeted therapy, are significant drivers of the market.

The approval of regulatory authorities and increased government funding is expanding the market. For instance, Siemens Medical Solutions Inc. received FDA approval for Siemens NAEOTOM Alpha in September 2023. In addition, the CIHR (Canadian Institutes of Health Research) is the primary federal agency responsible for funding health research. The CIHR provides funding for research on ovarian cancer through grants, scholarships, and awards.

U.S. Ovarian Cancer Drugs Market Overview

The US Ovarian Cancer Drugs market, valued at USD 1.44 Billion in 2023 to USD 2.5 Billion in 2032, is anticipated to grow at a CAGR of 6.3% from 2024 to 2032. Increased government funding is a significant driver for the growth of the Ovarian Cancer Drugs market in North America. This funding, provided to both public and private organizations, is majorly utilized in developing new drugs and therapies for treating ovarian cancer. For instance, the National Institutes of Health (NIH) primarily contributes to funding medical research. For example, the National Institutes of Health (NIH) granted $3.3 million for the academic industry partnership between Mays Cancer Center at UT Health San Antonio and a local collaborator in 2022. The NIH also supports the development of new technologies and therapies for the treatment of ovarian cancer.

The global Ovarian Cancer Drugs market can be categorized as Therapeutic Class, Treatment, End User, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Therapeutic Class

By Treatment

By End User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Ovarian Cancer Drugs Market: Therapeutic Class Overview

In 2023, PARP Inhibitors accounted for the largest growth of the Ovarian Cancer Drugs Market. The Therapeutic Class segment is divided into PARP Inhibitors, Angiogenesis Inhibitors, and PD-L1 Inhibitors. The reason behind the continued rise in PARP Inhibitors in the market is due to the strict government restrictions governing activities linked to breast, prostate, and ovarian cancers. These restrictions substantially improved progression-free survival (PFS) and overall survival (OS). Furthermore, top pharmaceutical firms' launch of PARP inhibitors has quickened the increased demand for innovative products and intensified clinical trial efforts. The market demand for PARP inhibitor therapy has expanded as a result of advances in genetic testing technology and precision medicine, which have made it easier to identify individuals who will benefit from this type of treatment.

Ovarian Cancer Drugs Market: Treatment Overview

The Targeted Therapy & Others segment held a significant revenue share of 44.3% in 2023. The Treatment segment covers Chemotherapy, Radiation Therapy, Hormonal Therapy, Targeted Therapy, & Others. Drugs employed in targeted therapy are meticulously designed to pinpoint and eradicate specific characteristics, such as abnormal protein alterations or mutations, present within cancer cells, while minimizing harm to healthy cells. This targeted approach fortifies the immune system's capability to pinpoint and eradicate cancer cells. Furthermore, certain targeted therapies can boost the immune system's ability to fight cancer, which could hasten market growth. Potential funding from research institutes in developing biologically tailored drugs is driving the development of targeted therapeutics for ovarian cancer. Also, the rising prevalence of cancers such as ovarian, gynecological, and breast cancers is also accelerating the escalated demand for targeted therapies in recent years.

Ovarian Cancer Drugs Market: End User Overview

The Hospital Pharmacy segment asserted a maximum revenue share of 57.1% in 2023. The End User segmentation is divided into Hospitals, Retail, and Online Pharmacies. This expansion can be attributed to the growing occurrences of ovarian cancer and the ever-increasing healthcare expenditures. Moreover, hospital pharmacies primarily oversee medication availability within hospitals. Furthermore, enhancements in the organizational framework and the proliferation of hospital pharmacies in emerging nations such as China and India fuel the market's expansion.

Key Trends

- The ability to specifically target cancer cells by minimizing damage to healthy cells is gaining traction in the growth of targeted therapies for Ovarian Cancer. For example, PARP inhibitors like Olaparib (Lynparza) and Niraparib (Zejula) have effectively treated ovarian cancer by targeting specific DNA repair mechanisms in cancer cells.

- Immunotherapy is also an emerging trend in treating Ovarian Cancer by improving the body's immune system. For example, Checkpoint inhibitors like Pembrolizumab (Keytruda) and Nivolumab (Opdivo) have shown potential in clinical trials for ovarian cancer by blocking proteins that inhibit the immune response against cancer cells.

- Enhancement in genetic testing and precision medicine, which helps identify specific genetic mutations in ovarian cancer patients and tailor treatment approaches, is accelerating the high market demand. For example, the use of BRCA gene testing helps identify patients who may benefit from PARP inhibitors.

Premium Insights

The Ovarian Cancer Drugs market is influenced by the alarming statistics surrounding the disease, with ovarian cancer ranking as the 8th most common cancer among women and the 5th leading cause of cancer deaths, surpassing other cancers of the female reproductive system. Epithelial ovarian cancer accounts for the majority of cases, with germ cell and sex cord-stromal types comprising smaller percentages. Despite advancements, the five-year survival rate for early-stage detection remains high at 93%, yet most cases are diagnosed at advanced stages, limiting treatment efficacy. The escalating global cancer burden, particularly in developed regions, drives heightened awareness and diagnosis rates, stimulating market growth. Furthermore, the market witnesses a surge in innovation, exemplified by Inex Innovate's May 2022 launch of the OvaCis Rapid test for ovarian cancer detection in Southeast Asian markets, indicative of a dynamic landscape poised for growth.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

The Ovarian Cancer Drugs market is driven by the expansion of the combination therapies to enhance treatment outcome

Exploration of combination therapies involving multiple drugs or treatment approaches aims to enhance treatment outcomes and overcome resistance. For instance, on June 3, 2023, the Royal Marsden NHS Foundation Trust and the Institute of Cancer Research, London, introduced a novel drug combination for the groundbreaking treatment of ovarian cancer, resulting in significant tumor shrinkage in nearly half of the patients. In a phase 2 trial involving 29 patients, the drug avutometinib was tested alone and in combination with defactinib, showing a remarkable 45% reduction in tumor size in almost half of the trial participants. Additionally, preclinical studies are underway to identify targeted treatments for the disease, further driving market revenue growth. For example, on April 16, 2023, a preclinical study led by scientists from the Perelman School of Medicine at the University of Pennsylvania identified a new target for drug-resistant ovarian cancer. It provided evidence supporting its efficacy as a target for antibody-drug conjugates, resulting in sustainable responses in experimental models.

Growing focus on targeted pathway inhibition and diagnostic innovations propelling the Ovarian Cancer Drugs Market growth

Major pharmaceutical companies are pivotal in advancing clinical trials for ovarian cancer therapeutics, focusing on targeting biological pathways within cancer cells. For example, on June 6, 2023, Zentalis Pharmaceuticals, Inc., a clinical-stage biopharmaceutical firm, unveiled an intermittent phase 2 dose (RP2D) of azenosertib monotherapy, aimed at developing a clinically differentiated small molecule to target the fundamental biological pathways of ovarian cancer. This transitional dosing approach seeks to double efficiency compared to constant dosing, achieving efficacy signals with enhanced safety and tolerability. The company is actively enrolling patients with PARP inhibitor-resistant and platinum-resistant ovarian cancer in new phase 2 RP2D clinical trials of azenosertib monotherapy. Furthermore, major companies are launching novel products and assays to facilitate the identification of ovarian cancer, reflecting ongoing efforts to advance treatment options and diagnostic capabilities in the market.

Competitive Landscape

To meet the unmet medical requirements of patients with ovarian cancer, pharmaceutical companies are engaged in strong competition, which is fueled by novel medicines, regulatory milestones, and calculated worldwide growth initiatives. For example, Elevar Therapeutics, a division of HLB, significantly increased its market share in the highly competitive Ovarian Cancer Drugs market in May 2022 by launching Apealea's marketing in Germany following the drug's listing on Gelbe Liste. At the same time, ImmunoGen became the first company to receive approval for a targeted therapy option when the US FDA accepted its Biologics License Application (BLA) for mirvetuximab soravtansine monotherapy in patients with platinum-resistant ovarian cancer.

The key players in the global Ovarian Cancer Drugs market include - F. Hoffmann-La Roche AG (Switzerland), GlaxoSmithKline PLC (UK), Immunogen Inc. (U.S.), Astrazeneca (UK), Merck KGaA (Germany), Oasmia Pharmaceutical AB (Sweden), Clovis Oncology Inc. (U.S.), Novartis AG (Switzerland), Bristol-Myers Squibb Company (U.S.), Pfizer Inc. (U.S.), Eli Lilly and Company (U.S.), Aravive Biologics (U.S.), Allarity Therapeutics (U.S.) among others.

Recent Market Developments

- In February 2024, F. Hoffmann-La Roche is advancing KSQ-4279 through clinical development. The drug is currently in Phase I trials for ovarian cancer. Phase I drugs targeting ovarian cancer typically aim for a 73% phase transition success rate (PTSR) as a benchmark for progression into Phase II trials.

- In February 2024, AbbVie has finalized its acquisition of ImmunoGen, integrating ImmunoGen into AbbVie's operations. The inclusion of ImmunoGen's ovarian cancer treatment portfolio is poised to expedite AbbVie's capacity to assist patients, broaden its oncology pipeline, and fuel sustained revenue growth over the coming decade.

- In April 2023, AstraZeneca announced that, in the DUO-O Phase III trial, the combination of Lynparza and Imfinzi demonstrated enhanced progression-free survival in newly diagnosed patients with advanced ovarian cancer who lacked BRCA mutations in their tumors.

- In April 2023, Clovis Oncology has reached an agreement to sell Rubraca to the Swiss company Pharma& Schweiz GmbH for an initial payment of $70 million, along with an additional $50 million contingent upon achieving regulatory milestones and $15 million based on sales performance.

Vantage Market

Research | 20-May-2024

Vantage Market

Research | 20-May-2024

FAQ

Frequently Asked Question

What is the global demand for Ovarian Cancer Drugs in terms of revenue?

-

The global Ovarian Cancer Drugs valued at USD 3.7 Billion in 2023 and is expected to reach USD 6.67 Billion in 2032 growing at a CAGR of 6.8%.

Which are the prominent players in the market?

-

The prominent players in the market are F. Hoffmann-La Roche AG (Switzerland), GlaxoSmithKline PLC (UK), Immunogen Inc. (U.S.), Astrazeneca (UK), Merck KGaA (Germany), Oasmia Pharmaceutical AB (Sweden), Clovis Oncology Inc. (U.S.), Novartis AG (Switzerland), Bristol-Myers Squibb Company (U.S.), Pfizer Inc. (U.S.), Eli Lilly and Company (U.S.), Aravive Biologics (U.S.), Allarity Therapeutics (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 6.8% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Ovarian Cancer Drugs include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Ovarian Cancer Drugs in 2023.