Orthobiologics Market

Orthobiologics Market - Global Industry Assessment & Forecast

Segments Covered

By Product type Demineralized Bone Matrix (DBM), Allograft, Bone Morphogenetics Protein (BMP), Viscosupplementation, Synthetic Bone Substitutes, Stem Cell Therapy

By Application Spinal Fusion, Trauma Repair, Reconstructive Surgery

By End Use Hospitals, Outpatient Facilities

By Region North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 6.56 Billion | |

| USD 10.4 Billion | |

| 5.9% | |

| Europe | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

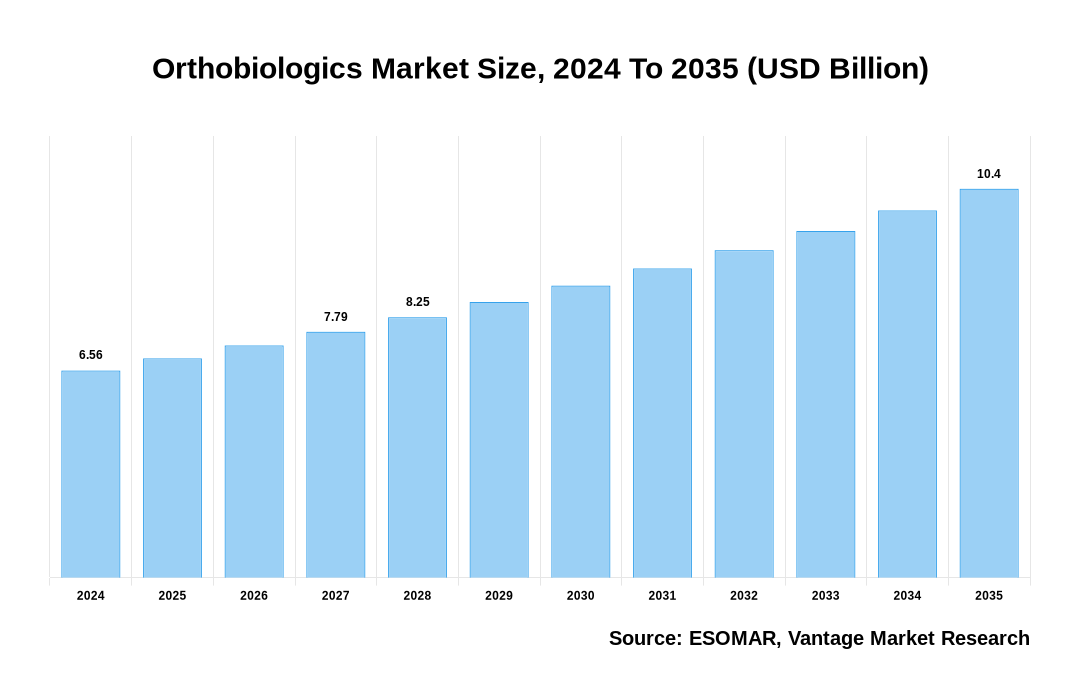

The global Orthobiologics Market is valued at USD 6.56 Billion in 2024 and is projected to reach a value of USD 10.4 Billion by 2035 at a CAGR (Compound Annual Growth Rate) of 5.9% between 2025 and 2035.

The Orthobiologics focuses on biologically-derived products used in the treatment of musculoskeletal injuries and disorders. These products promote faster healing of injuries and improve outcomes for surgeries, especially in orthopedics. The market includes a wide range of materials such as growth factors, bone grafts, stem cells, and other biologic agents.

Key Highlights

- In 2024, based on the Product type, the Viscosupplementation category accounted for significant market share of 41.80%.

- Based on the Application, the Spinal Fusion category accounted for significant market share of 52.30% in 2024

- In 2024, based on the End Use, the Hospitals category accounted for significant market share of 62.90%

- North America dominated the market with 48.30% market share in 2024

- Europe region is anticipated to grow at the highest CAGR during the forecast period

Orthobiologics Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Orthobiologics Market

Product Type Overview

The product type segment is divided into Demineralized Bone Matrix (DBM), Allograft, Bone Morphogenetics Protein (BMP), Viscosupplementation, Synthetic Bone Substitutes, and Stem Cell Therapy. The Viscosupplementation segment held the dominant share in 2024, accounting for significant market share of 41.80%.

Viscosupplementation products are recognized for their strong safety profile, with minimal risk of adverse effects or complications, making them an ideal option for a broad patient demographic, including those unsuitable for surgical interventions or seeking non-pharmacological pain management alternatives. For instance, According to American academy of orthopedic surgeons, Younger patients with symptomatic chondromalacia have several nonoperative options, including weight loss, NSAIDs, and physical therapy, but those options have variable levels of success with patients. However, there is significant public interest in viscosupplementation—also known as hyaluronic acid (HA) injections. Additionally, HA has been shown to have the highest effect size of all knee OA treatments.

The stem cell therapy segment is anticipated to witness the fastest CAGR over the forecast period. Globally, rising healthcare expenditure and growing emphasis on personalized medicine, has created a favorable environment for the expansion of the stem cell therapy market. Moreover, advancements in biotechnology and regenerative medicine have led to the development of innovative techniques and products for the stem cell therapy.

Application Overview

The application segment is divided into spinal fusion, trauma repair, and reconstructive surgery. The spinal fusion segment held the dominant share in 2024, accounting for significant market share of 52.30%.

The spinal fusion segment is driven by the rising prevalence of spinal disorders and advancements in surgical techniques. According to the McLaren Health Care report, Spinal fusion refers to any surgery where two or more vertebrae are joined together. Interbody fusion is a more advanced technique that involves removing the damaged disc between the vertebrae and replacing it with a bone graft or implant, promoting natural bone growth and long-term spine stability. The success rates of lumbar interbody fusion are remarkable; 80-90% of patients experience major pain relief and improved mobility, with fusion success rates as high as 90-95%. This surgery offers lasting results for many individuals with spine conditions.

Reconstructive surgery segment in the market is anticipated to register a significant growth rate over the forecast period. According to ISAPS Reports, Global Survey on Aesthetic/Cosmetic Procedures at the ISAPS Olympiad Athens World Congress 2023, which brought together more than 1,000 attendees from 90 countries to discuss the latest scientific research, innovations and techniques to improve patient safety in aesthetic plastic surgery. The report shows a 11.2% overall increase in procedures performed by plastic surgeons in 2022 with more than 14.9 million surgical and 18.8 million non-surgical procedures performed worldwide. Moreover, Both surgical and non-surgical procedures showed increases since the last survey (16.7% and 7.2% respectively) with a significant increase of 57.8% in non-surgical procedures in the last four years.

End Use Overview

The End Use segment is divided into Hospitals and Outpatient Facilities. The hospitals segment held the dominant share in 2024, accounting for significant market share of 62.90%.

Hospitals play a crucial role in the utilization of orthobiologics due to their advanced medical infrastructure and comprehensive healthcare services. Major factor of segment is the increasing demand for minimally invasive procedures. Orthobiologics provide an alternative to normal surgical procedures by utilizing the body's natural healing processes. Moreover, the integration of advanced imaging technologies and surgical methods in hospitals makes it possible for orthopedic surgeons to administer orthobiologics agents with accuracy, thereby facilitating tissue regeneration and accelerating recovery.

Regional Overview

In 2024, the North America captured 48.30% of the revenue share.

North America Orthobiologics market is driven by advancements in regenerative medicine, an increasing prevalence of musculoskeletal disorders, and the rising adoption of minimally invasive procedures. Moreover, growing aging population in the region will escalate the market growth. Additionally, regulatory support and the presence of key market players investing in research and development further bolster market expansion. Hospitals and ambulatory surgical centers are key end-users, with a growing demand for orthobiologic products like bone grafts, stem cell-based therapies, and platelet-rich plasma driving the market forward.

The U.S. {Keyword}} market, valued at USD 2.85 Billion in 2024 to USD 5.02 Billion in 2035, is anticipated to grow at a CAGR of 7.3% from 2025 to 2035. The market is driven by technological innovation and research results in a continuous flow of improved orthobiologic products. The rising incidence of conditions such as osteoarthritis, spinal disorders, and sports injuries has fueled demand for innovative treatment options, including bone graft substitutes, growth factors, and stem cell-based therapies. For instance, In July 2023, HSS Sports medicine surgeon received a $50,000 grant from the Orthopedic Research and Education Foundation to study an injectable knee biologic.

Europe market is growing rapidly, the growth trajectory is driven by a with an aging population and rising life expectancy, the prevalence of age-related musculoskeletal conditions such as osteoarthritis fuels demand for orthobiologic interventions. Furthermore, presence of various key market players in the region is boosting the market growth. For instance, According to International Osteoporosis Foundation, in Spain a fragility fracture due to osteoporosis occurs every two minutes, i.e. a total of 330,000 fractures per year. The incidence is on the rise due to the progressive aging of the population: in fact, it is estimated that the number of fragility fractures will increase by around 30% by the year 2034, reaching 370,000 cases per year.

Germany Orthobiologics market is driven by rising prevalence of orthopedic disorders, and increasing demand for minimally invasive treatments. Germany is home to nearly 90,000 sports clubs with around 28 million members. More than half (52 percent) of over-18s do sport regularly, according to a survey conducted by the Techniker Krankenkasse (health insurance fund). For many people, sport serves as a healthy counterbalance to their work lives. More than a third (37 percent) of those surveyed said they took more than one hour of exercise per day – either on foot or by bike. 66 percent manage at least half an hour of exercise per day. Additionally, the presence of leading manufacturers and collaborations between medical institutions and research organizations further enhance the adoption of orthobiologics. Regulatory support and reimbursement frameworks also play a critical role in facilitating market expansion in Germany.

Based on the provided market data, Vantage Market Research offers customizations in the reports to meet the specific needs of clients.

Key Trends

- Rising Prevalence of Musculoskeletal Disorders: Increasing cases of conditions such as osteoarthritis, degenerative disc diseases, and sports injuries are boosting the demand for orthobiologic solutions

- Shift Toward Minimally Invasive Procedures: Patients and healthcare providers are increasingly favoring minimally invasive treatments, with orthobiologics offering faster recovery and reduced complications compared to traditional surgeries

- Advancements in Biomaterials and Regenerative Therapies: Continuous innovation in stem cell therapies, platelet-rich plasma (PRP), and bone graft substitutes is enhancing treatment efficacy and broadening the scope of applications

- Integration of Technology: Advanced imaging and delivery techniques, such as 3D printing and AI-guided surgeries, are enhancing the precision and effectiveness of orthobiologic applications

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Rising Demand for Minimally Invasive Surgeries

The growing preference for minimally invasive surgical procedures is driving demand, attributed to their advantages, including shorter recovery periods, reduced post-operative discomfort, and a lower risk of complications compared to traditional open surgeries. This trend is significantly boosting the adoption of bone grafts and substitutes designed to align with minimally invasive techniques, enhancing procedural efficiency and patient outcomes. These grafts and substitutes need to be easily implantable through small incisions and provide adequate support for bone healing and regeneration in minimally invasive procedures, thus driving innovation and development in the Orthobiologics market.

Increasing Prevalence of Orthopedic Conditions

Globally, increasing incidence of orthopedic conditions such as osteoarthritis, fractures, and sports injuries. The market rising is attributed to lifestyle changes, including dietary factors, sedentary habits, and the prevalence of sports and recreational activities. As these conditions become more widespread, the demand for bone grafts and substitutes is also growing. Orthobiologics, by enhancing the body's natural healing mechanisms, are playing a crucial role in addressing these conditions, improving patient outcomes, and drive the market growth.

Rising Aging Population

The global aging population is expanding rapidly, with a substantial proportion of the elderly experiencing musculoskeletal conditions such as osteoarthritis, fractures, and degenerative spine disorders. As individuals age, their bones and joints undergo degenerative changes, leading to an increased need for orthopedic interventions. This demographic shift presents a significant growth opportunity for the Orthobiologics market, as older adults increasingly require bone grafts and substitutes to support orthopedic procedures.

Competitive Landscape

The Orthobiologics market is characterized by the presence of both established players and emerging companies, each strive for market share through product innovation, strategic partnerships, and geographic expansion. Industry giants like Medtronic Plc, DePuy Synthesis, Zimmer Biomet, Stryker Corporation, Anika Therapeutics Inc, Orthofix Inc, Bone Biologics Corp., Globus Medical, Bioventus LLC. Key market participants are leveraging advancements in biomaterials, regenerative medicine, and minimally invasive techniques to develop differentiated products and expand their portfolios.

The key players in the global Orthobiologics market include - Medtronic Plc, DePuy Synthesis, Zimmer Biomet, Stryker Corporation, Anika Therapeutics Inc, Orthofix Inc, Bone Biologics Corp., Globus Medical, Bioventus LLC among others.

Recent Market Developments

Globus Medical completes merger with NuVasive

- In September 2023, Globus Medical Inc. a leading musculoskeletal solution company, announced it has completed its previously announced merger with NuVasive, Inc. The company combined will provide surgeons and patients with one of the most comprehensive offerings of musculoskeletal procedural solutions and enabling technologies to impact the care continumm

Isto Biologics Launches Influx™ Fibrant, a New Line of Advanced Allograft

- In June 2022, Isto Biologics is a leader in surgical-based, orthobiologic regeneration technologies and cell-based therapies, announced today the launch of Influx™ Fibrant, an unprecedented line of functional constructs derived from 100% cortical allograft. The cutting-edge line consisting of five new products includes Fibrant Anchor, Boat, Bullet, Pak and Wrap

The global Orthobiologics market can be categorized as Product type, Application, End Use and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product type

By Application

By End Use

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 03-Jan-2025

Vantage Market

Research | 03-Jan-2025

FAQ

Frequently Asked Question

What is the global demand for Orthobiologics in terms of revenue?

-

The global Orthobiologics valued at USD 6.56 Billion in 2023 and is expected to reach USD 10.4 Billion in 2032 growing at a CAGR of 5.9%.

Which are the prominent players in the market?

-

The prominent players in the market are Medtronic Plc, DePuy Synthesis, Zimmer Biomet, Stryker Corporation, Anika Therapeutics Inc, Orthofix Inc, Bone Biologics Corp., Globus Medical, Bioventus LLC.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 5.9% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Orthobiologics include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Orthobiologics in 2023.