Onshore Floating Solar Market

Onshore Floating Solar Market - Global Industry Assessment & Forecast

Segments Covered

By Product Type Tracking Floating Solar Panels, Stationary Floating Solar Panels

By Capacity Up to 500KW, 500kw to 1MW, 1MW to 3MW, Greater than 3MW

By Connectivity On Grid, Off Grid

By Technology Photovoltaic, Concentrated Solar Power (CSP), Concentrator Photovoltaics (CPV)

By Panel Type Mono Crystalline, Poly Crystalline, Thin Film

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 21.3 Billion | |

| USD 62.3 Billion | |

| 16.58% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

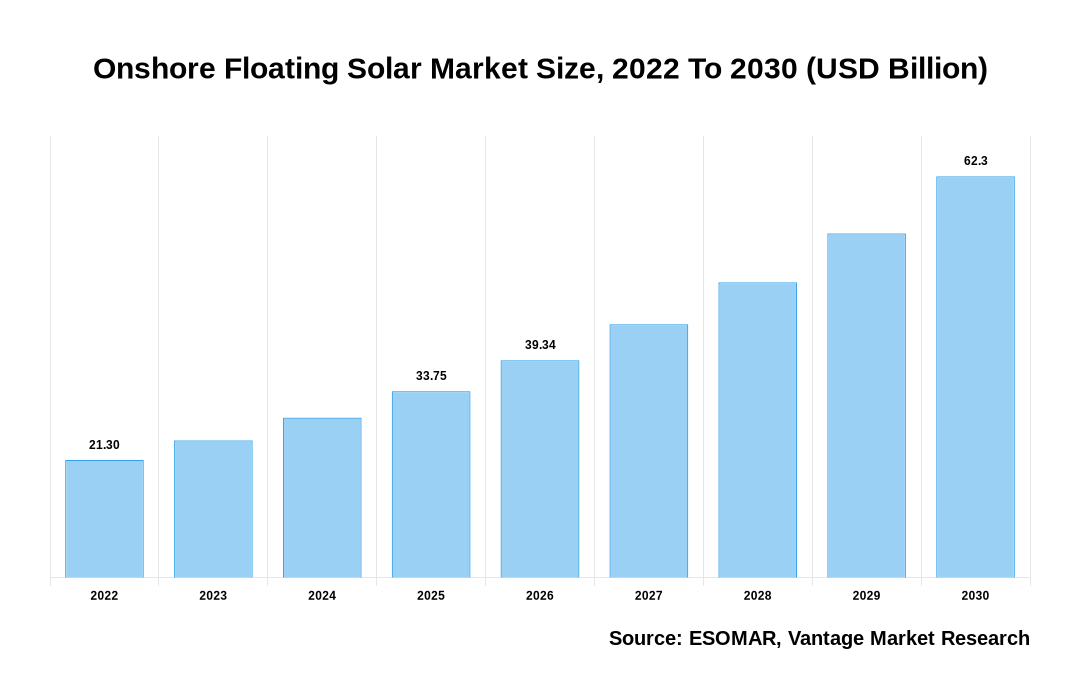

The global Onshore Floating Solar Market was valued at USD 21.3 Billion in 2022 and is projected to reach a value of USD 62.3 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 16.58% between 2023 and 2030.

Premium Insights

Onshore floating solar projects efficiently use land that would otherwise remain idle while reducing the environmental impact associated with ground-mounted solar installations. Solar energy generation offers several advantages, including increased efficiency and additional land utilization. By deploying solar panels on water, the water's cooling effect reduces the panels' temperature, enhancing their performance and efficiency. Furthermore, floating solar plants can use unutilized water surfaces, maximizing land use and reducing the need for additional land acquisition. The concept of onshore floating solar has gained considerable traction in recent years, with numerous developments and installations worldwide. For instance, major projects include the 70 MW floating solar plant in Anhui, China, which is one of the largest in the world. In Southeast Asia, Thailand has been at the forefront of onshore floating solar with the successful implementation of several large-scale projects, such as the 144 MW Sirindhorn Dam Floating Solar Power Plant. Several notable developments have been made in the field of onshore floating solar, showcasing its potential and benefits. One such example is installing the world's largest onshore floating solar farm on the Yamakura Dam in Japan. With an output capacity of 13.7 megawatts (MW), this project utilizes more than 50,000 solar panels to generate clean energy for approximately 5,000 households. Data in numbers further underline the potential of onshore floating solar.

Onshore Floating Solar Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Onshore Floating Solar Market

According to a study by the World Bank, if just 1% of the world's man-made reservoirs were used for floating solar, it could potentially generate around 400 gigawatts (GW) of electricity—equivalent to about one-third of the current global capacity of solar power. In terms of efficiency, onshore floating solar projects have shown better performance than ground-based installations, with studies indicating that floating panels can enhance electricity generation by up to 10% due to the cooling effect of water. Overall, onshore floating solar presents an innovative approach to renewable energy generation, offering numerous benefits, including land conservation, increased efficiency, and reduced environmental impact. With ongoing developments and expanding capacities, this technology continues to shape the future of sustainable energy systems.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Key Takeaways

- The Stationary Floating Solar Panels category is anticipated to hold the largest revenue share in 2023.

- The Greater than 3MW capacity sector held the most significant market share in 2022.

- The On-Grid segment accounted for the largest revenue share in 2022.

- The photovoltaic (PV) category held the biggest market share in 2022 and is anticipated to hold the largest revenue share in 2023.

- The Poly-crystalline sector often held the largest market share.

- North America generated the largest onshore floating solar market revenue, about 43.2%.

Economic Insights

The economic analysis demonstrates the market for onshore floating solar's substantial development potential and financial advantages. The strong rise can be ascribed to several things, including falling solar panel prices, rising interest in renewable energy sources, and the potential for utilizing underutilized bodies of water. According to an economic study, onshore floating solar installations can produce up to 25% more electricity than traditional land-based solar systems, resulting in increased energy output and financial returns. These findings emphasize the lucrativeness of the onshore floating solar business and its potential to promote long-term economic expansion while reducing the effects of climate change.

Top Market Trends

- Cost-effective and efficient: Onshore floating solar is gaining traction in renewable energy due to its cost-effectiveness. Utilizing water surfaces such as lakes and reservoirs eliminates the need for expensive land acquisition, making it an affordable alternative to traditional solar installations. Moreover, studies have shown that floating solar panels have a higher energy yield than their land-based counterparts, as the cooling effect of water enhances their performance, resulting in increased efficiency.

- Compatibility with hydroelectric power: Onshore floating solar complements existing hydropower infrastructure, making it a viable choice for countries with significant hydroelectric potential. The combination of floating solar panels with hydropower facilities can increase power output, as water reservoirs can generate electricity via solar and hydro sources. This hybrid energy generation system maximizes renewable energy generation from existing water assets, promoting efficient utilization of resources and reinforcing the trend towards sustainable power production.

- Integration of complementary technologies: Many floating solar projects now incorporate hydropower plants or water treatment facilities, creating a multi-purpose energy infrastructure. This integrated approach optimizes land and water resources, reducing the overall environmental impact and maximizing energy production potential. Furthermore, combining multiple renewable energy sources enhances grid stability and resilience, making it an important trend in regions aiming to transition to a decentralized and sustainable power supply.

- Exploration of innovative materials for floating platforms: Traditional platforms are typically constructed using steel or aluminum, but recent research and development efforts have introduced alternative materials such as recycled plastics, composites, and lightweight alloys. These advancements aim to reduce costs, increase durability, and enhance the environmental sustainability of floating solar installations. The use of recycled materials also aligns with the circular economy principles, further contributing to the overall sustainability goals of the renewable energy sector.

Market Segmentation

The global Onshore floating solar market can be categorized on the following: Product Type, Capacity, Connectivity, Technology, Panel Type, and Region. Based on Product type, the market is segmented into Tracking Floating Solar Panels and Stationery Floating Solar Panels. Furthermore, based on Capacity, the market is segmented into Up to 500KW, 500kw to 1MW,1mw to 3MW, and Greater than 3MW. Additionally, the market is segmented based on Connectivity into On Grid and Off Grid. Moreover, based on Technology, the market is segmented into Photovoltaic, Concentrated Solar Power (CSP), and Concentrator Photovoltaics (CPV). In addition, based on Panel Type, the market is segmented into Mono- crystalline, Poly-crystalline, and Thin Film. Likewise, based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Product Type

Stationary Floating Account for the Largest Market Share

In the Onshore floating solar market, the stationary floating solar panels category is anticipated to hold the most significant market share. The position of stationary floating solar panels on the water's surface is fixed, and they cannot follow the sun as it moves. Many project developers find this installation an appealing alternative because it is reasonably straightforward and affordable. Furthermore, it is simple to incorporate stationary floating solar panels with the current water infrastructure, which increases their market appeal. In several areas, stationary floating solar panels have been widely used and have shown success when installed in various water bodies, including ponds, lakes, and reservoirs. Their popularity and market dominance have been aided by their relatively cheaper costs, simplicity of installation, and compatibility with existing water infrastructure.

Based on Capacity

Greater than 3MW will dominate the market during Forecast Period

The "Greater than 3MW" capacity sector has the most significant market share. Larger-scale installations are frequently indicated by projects with capacities greater than 3MW, typically carried out by utility-scale developers or significant industrial players. These initiatives use economies of scale and can produce a sizable amount of renewable energy to satisfy the needs of power grids or substantial energy consumers.

Based on Connectivity

On-Grid Category will Accommodate the Majority of the market

The on-grid segment has been linked to a higher market share. On-grid connectivity refers to integrating onshore floating solar systems with the current power grid infrastructure to inject electricity directly into the grid. This connectivity option has benefits such as having access to grid incentives, grid stability, and the capacity to feed the grid with excess energy.

Based on Technology

Photovoltaic (PV) Category typically Holds the Biggest Market Share

The photovoltaic (PV) category typically holds the biggest market share in the onshore floating solar market. The most extensively used and developed method of producing power from sunshine is photovoltaic (PV) technology. Solar panels made of photovoltaic cells are used in photovoltaic systems to directly convert sunlight into electrical energy. This technique is effective, affordable, and versatile for various uses, including on-land floating solar arrays. PV technology has a solid track record and has been widely used for onshore and rooftop solar projects.

Based on Panel

Poly-crystalline panels Hold Significant Revenue

The onshore floating solar industry's poly-crystalline sector often held the largest market share. Multiple silicon crystals are used to create poly-crystalline panels, which have gained popularity for their affordability, comparatively high efficiency, and suitability for mass production. These panels are a popular option in the solar business because they strike a nice mix between performance and cost.

Based on Region

North America accounted for the Most Significant Revenue

North America generated the largest revenue in the onshore floating solar market. The region's strong market growth can be ascribed to several elements, including favorable government incentives and laws encouraging the adoption of renewable energy sources, growing public awareness of the environmental advantages of onshore floating solar, and mature solar energy markets. Additionally, North America's abundance of lakes and reservoirs offers numerous chances for onshore floating solar arrays. For instance, in the United States, California, Colorado, and Nevada reservoirs have become prime locations for large-scale floating solar installations. Florida has also witnessed the deployment of several onshore floating solar projects, taking advantage of its abundant coastlines and inland water bodies. Similarly, Canada has focused on developing floating solar systems on its lakes and reservoirs to enhance its renewable energy capacity. North America has emerged as a key market driving revenue development in the onshore floating solar sector, with a strong focus on sustainability and a rising need for clean energy. Overall, North America's favorable conditions, government support, and technological expertise have propelled it to the forefront of the Onshore Floating Solar market, making it the largest region in terms of market size and development.

Competitive Landscape

Solar energy businesses, engineering firms, project developers, and equipment makers comprise the onshore floating solar market's competitive landscape. Key industry players like Ciel and Terre International, Swimsol, Yellow Tropus Pvt. Ltd., Adtech Systems Limited, Sungrow, EDP S.A. (China Three Gorges Corporation), Ocean Sun AS, KYOCERA Corporation, and Waaree Energies Ltd. actively engage in research and development projects to advance floating solar technology, increase efficiency, and lower costs. Businesses compete based on technological innovation, project development skills, cost-effectiveness, and geographic reach. Corporations frequently engage in strategic alliances, partnerships, and acquisitions to strengthen their market positions and diversify their product lines. Additionally, through laws, incentives, and support systems that promote the adoption of onshore floating solar, governments and regulatory agencies play a critical role in defining the competitive landscape.

The key players in the global Onshore Floating Solar market include - Ciel & Terre International (France), Swimsol (Austria), Yellow Tropus Pvt. Ltd. (India), Adtech Systems Ltd. (India), Sungrow (China), EDP S.A. (Portugal), China Three Gorges Corporation (China), Ocean Sun AS (Norway), KYOCERA Corporation (Japan), Waaree Energies Ltd. (India), Hanwha Group (South Korea), JA SOLAR Technology Co. Ltd. (China), LONGi (China), Trina Solar (China), Vikram Solar Ltd. (India), Wuxi Suntech Power Co. Ltd. (China), Yingli Solar (China), Satkar Softwares Solutions Pvt. Ltd. (India), Baroda Polyform Pvt. Ltd. (India), Jain Irrigation Systems Ltd. (India), Sharp Corporation (Japan) among others.

Recent Market Developments

- February 13, 2023: Iberdrola, the world’s largest producer of renewable energy, announced that it had been awarded its first floating solar power plant in France, with a total capacity of 25 megawatts peak (MWp), in response to a call for tenders issued in June 2022 by the municipality of Kurtzenhouse in Alsace.

- June 28, 2023: Renantis and Ventient Energy – owned by institutional investors advised by the Global Infrastructure group at J.P. Morgan Asset Management – today announced that they intend to join forces to form one of Europe's largest renewable independent power producers (IPPs).

Segmentation of the Global Onshore Floating Solar Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Product Type

By Capacity

By Connectivity

By Technology

By Panel Type

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Onshore Floating Solar in terms of revenue?

-

The global Onshore Floating Solar valued at USD 21.3 Billion in 2022 and is expected to reach USD 62.3 Billion in 2030 growing at a CAGR of 16.58%.

Which are the prominent players in the market?

-

The prominent players in the market are Ciel & Terre International (France), Swimsol (Austria), Yellow Tropus Pvt. Ltd. (India), Adtech Systems Ltd. (India), Sungrow (China), EDP S.A. (Portugal), China Three Gorges Corporation (China), Ocean Sun AS (Norway), KYOCERA Corporation (Japan), Waaree Energies Ltd. (India), Hanwha Group (South Korea), JA SOLAR Technology Co. Ltd. (China), LONGi (China), Trina Solar (China), Vikram Solar Ltd. (India), Wuxi Suntech Power Co. Ltd. (China), Yingli Solar (China), Satkar Softwares Solutions Pvt. Ltd. (India), Baroda Polyform Pvt. Ltd. (India), Jain Irrigation Systems Ltd. (India), Sharp Corporation (Japan).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 16.58% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Onshore Floating Solar include

- Water savings boost market growth for floating solar panels from a reduction in evaporation losses

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Onshore Floating Solar in 2022.

Vantage Market

Research | 11-Aug-2023

Vantage Market

Research | 11-Aug-2023