Oligonucleotide Synthesis Market

Oligonucleotide Synthesis Market - Global Industry Assessment & Forecast

Segments Covered

By Product Synthesized Oligonucleotides, Oligonucleotide-based Drugs, Reagents, Equipment

By Application Therapeutic Applications, Diagnostic Applications, Research Applications

By End User Hospitals, Pharmaceutical & Biotechnology Companies, Diagnostic Laboratories, CROs and CMOs, Academic Research Institutes

By Region North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 7.3 Billion | |

| USD 24.1 Billion | |

| 16.1% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

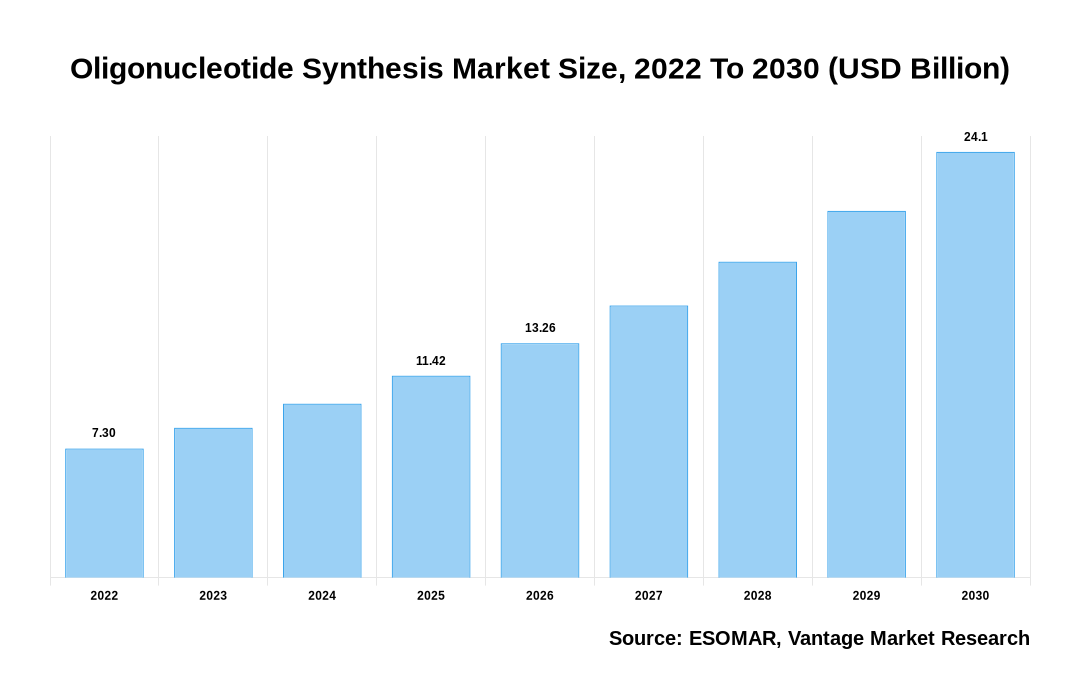

The global Oligonucleotide Synthesis Market is valued at USD 7.3 Billion in 2022 and is projected to reach a value of USD 24.1 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 16.1% between 2023 and 2030.

Premium Insights

The Oligonucleotide Synthesis market is experiencing a significant growth and investment increase. This is mainly due to key players in the pharmaceutical industry making strategic moves. Vertex Pharmaceuticals has made a substantial investment of $250 million in Entrada Therapeutics. This investment aims to develop treatments targeting myotonic dystrophy type 1. The partnership also involves exploring an oligonucleotide therapy from Entrada that shows potential in restoring muscle function. This move highlights the industry's recognition of the potential benefits of oligonucleotide therapies in treating specific medical conditions. Similarly, GSK has partnered with Wave Life Sciences and agreed to invest $170 million in advancing up to 11 oligo programs. This collaboration demonstrates GSK's commitment to exploring and developing various oligonucleotide-based therapeutic solutions. It is expected to significantly contribute to the ongoing advancements in oligonucleotide research and development.

Oligonucleotide Synthesis Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Oligonucleotide Synthesis Market

- Agilent Technologies has recently announced a significant investment of $725 million to double its manufacturing capacity for therapeutic nucleic acids, including oligonucleotides. This forward-looking project aims to meet the growing market demand and reflects Agilent's confidence in the potential of oligonucleotide therapies.

- The North American region generated more than 39.8% of revenue share in 2022.

- The Asia Pacific region is expected to grow at the quickest rate from 2023 to 2030.

- The Oligonucleotide-based Drugs segment accounted for the most significant market growth in 2022.

- The Research Applications segment revealed the most significant market growth, contributing more than 28.7% of the total revenue share in 2022.

- The Academic Research Institutes segment accounts for the most considerable revenue of 41.3% in 2022.

Economic Insights

In the biotechnology and pharmaceutical industries, oligonucleotide synthesis is essential to research and development efforts. These industries heavily rely on oligonucleotides for genomic studies, gene expression analysis, and drug target identification. The demand for synthesized oligonucleotides drives the growth of companies providing these services and generates significant economic activity in the sector. One of the top vendors of unique oligonucleotides for research, diagnostics, and treatments is Integrated DNA Technologies (IDT). They provide extensive goods and services, including instruments for gene editing, RNA and DNA synthesis, and custom design services.

Report Coverage & Deliverables

Get Access Now

Top Market Trends

- Researchers and clinicians are increasingly seeking custom oligonucleotides to meet the specific needs of their genomics, personalized medicine, and synthetic biology research, such as gene expression analysis, gene editing, PCR, and diagnostics. For instance, a research lab investigating the impact of specific genes on disease might require custom oligonucleotides for probe design or gene synthesis purposes.

- The use of oligonucleotides has become more popular due to gene editing tools and the advancement of therapies. This has resulted in a significant increase in the market for therapeutic oligonucleotides as more candidates are entering clinical trials and gaining regulatory approvals. Growing requirement for high-quality oligonucleotides specifically in research, diagnostics, and therapeutics has necessitated the use of advanced automation and optimization of synthesis protocols to ensure consistent quality, purity, and yield.

- The development of automated synthesis using phosphoramidite chemistry and new solid supports and reagents have greatly improved oligonucleotide synthesis. Furthermore, emerging technologies like flow chemistry and microfluidic devices show promise in achieving miniaturized and high-throughput synthesis.

- Customized oligonucleotides find applications in next-generation sequencing, PCR, and gene silencing, aiding in the advancement of research. Customized oligonucleotides are enhancing the precision and efficiency of next-generation sequencing. By targeting specific genomic regions for sequencing, these customized oligonucleotides aid in identifying disease-associated genetic variations.

Market Segmentation

The Global Oligonucleotide Synthesis Market is categorized into the segments as mentioned below:

The global Oligonucleotide Synthesis market can be categorized into Product, Application, End User, Region. The Oligonucleotide Synthesis market can be categorized into Synthesized Oligonucleotides, Oligonucleotide-based Drugs, Reagents, Equipment based on Product. The Oligonucleotide Synthesis market can be categorized into Therapeutic Applications, Diagnostic Applications, Research Applications based on Application. The Oligonucleotide Synthesis market can be categorized into Hospitals, Pharmaceutical & Biotechnology Companies, Diagnostic Laboratories, CROs and CMOs, Academic Research Institutes based on End User. The Oligonucleotide Synthesis market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East and Africa based on Region.

Based on Product

The Oligonucleotide-based Drugs Expected to Hold the Largest Share

Oligonucleotide-based drugs hold most of the market share owing to the increasing range of nucleic acid-based treatments, which use oligonucleotides to target specific genes precisely and influence disease processes at a molecular level. This class includes numerous healing methods, including antisense oligonucleotides, small interfering RNAs (siRNAs), and RNA (mRNA). A better understanding of disease mechanisms at the genetic level has shown the enhancement in innovative approaches to resolving a wide range of disorders, from genetic diseases to specific types of cancer. The approval and commercialization of oligonucleotide-based medications, such as mRNA vaccines and RNA interference therapies, are the primary drivers of this market segment's growth.

Based on Application

Research Applications Expected to Dominate the Market

Research applications led the market with maximum CAGR in 2022. There has been an increasing demand for primers, especially in gene sequencing experiments. They are also utilized in fluorescent detection and target amplification, leading to the development of diverse primer designs with various detection chemistries. In addition, the advanced PCR systems are designed to detect and quantify gene expression, tailored to the specific needs of molecular biology research. Consequently, there is a growing need for primers customized for these advanced PCR systems. This demand arises from the requirement for precise gene expression quantification, which is expected to drive the growth of the primer market.

Based on the End User

Academic Research Institutes held a Significant Market share and Expected to Continue its Dominance

Academic research institutes mentioned considerable growth in the market in 2022. This was primarily because universities and academic research institutes conducted extensive genomic research, often in cooperation with private investors or with government support. Developed nations have made considerable investments in genomic research to improve their competitiveness in the global market. Academic institutes offer a perfect platform for collaboration among exclusive stakeholders, such as researchers, scientists, enterprise gamers, and regulatory bodies. These collaborations foster knowledge exchange, innovation, and research-driven solutions. Oligonucleotide synthesis industry players often partner with academic research institutes to access their expertise, resources, and facilities, thereby driving the growth of both parties.

Based on Region

North America will Lead the Market in the Forecast Period

North America led the oligonucleotide synthesis market due to the increasing prevalence of chronic and rare diseases among the population, companies investing more in research and development, and the concentration of major market players in the region. According to Cancer Facts and Figures 2022, in the United States alone, there will be about 1.9 million new instances of cancer in 2022. These figures illustrate the influence of these causes. Furthermore, according to data from Breastcancer.org, there will be 51,400 new cases of non-invasive breast cancer and roughly 287,850 new cases of invasive breast cancer in 2022. The growing burden of cancer highlights the need for advanced therapeutics, specifically oligonucleotide therapeutics, which will drive market growth.

Competitive Landscape

Companies are primarily responsible for synthesizing oligonucleotides in large quantities and offering a wide range of synthesis options to meet the diverse needs of researchers and industries. They invest in advanced technology and high-throughput structures to enhance the efficiency of oligonucleotide synthesis. One example of an oligonucleotide manufacturer is Integrated DNA Technologies (IDT), which offers a broad portfolio of custom oligonucleotide synthesis services and develops innovative solutions for research and diagnostic applications. In addition, universities and research institutions contribute to the growth of the oligonucleotide synthesis industry by conducting groundbreaking research in the field. For instance, the research team at the MIT (Massachusetts Institute of Technology) has evolved novel techniques for synthesizing complicated oligonucleotide systems, increasing the possibilities for their use in fields consisting of therapeutics and materials science.

The players in the global Oligonucleotide Synthesis market include Agilent Technologies Inc. (U.S.), Atdbio Ltd. (UK), LGC Limited (UK), Bio-Synthesis Inc. (U.S.), Eurofins Genomics (Luxembourg), Kaneka Eurogentec S.A. (Belgium), General Electric (U.S.), Genscript (U.S.), Ajinomoto Co. Inc. (Japan), Danaher Corp. (U.S.), Merck Kgaa (Germany) among others.

Recent Market Developments

- January 2023: Agilent Technologies announced that it will spend $725 million to double its manufacturing capacity for therapeutic nucleic acids, or oligonucleotides. The project is the latest in a round of industry investment responding to fast growth in a market that Agilent currently values at $1 billion per year.

- July 2022: WuXi STA, a subsidiary of WuXi AppTec, launched a new large-scale oligonucleotide and peptide manufacturing facility at its Changzhou campus. The new launch allows for an increased capacity and capability to meet the growing global demand for oligonucleotide and peptide therapeutics development and manufacturing.

- April 2022: Bachem entered a strategic collaboration with Eli Lilly & Company to develop and manufacture active pharmaceutical ingredients based on oligonucleotides, a rising new class of complex molecules. Lilly's novel oligonucleotide manufacturing technology is implemented with Bachem's expertise and engineering infrastructure according to the agreement.

Segmentation of the Global Oligonucleotide Synthesis Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Product

By Application

By End User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Oligonucleotide Synthesis in terms of revenue?

-

The global Oligonucleotide Synthesis valued at USD 7.3 Billion in 2022 and is expected to reach USD 24.1 Billion in 2030 growing at a CAGR of 16.1%.

Which are the prominent players in the market?

-

The prominent players in the market are Agilent Technologies Inc. (U.S.), Atdbio Ltd. (UK), LGC Limited (UK), Bio-Synthesis Inc. (U.S.), Eurofins Genomics (Luxembourg), Kaneka Eurogentec S.A. (Belgium), General Electric (U.S.), Genscript (U.S.), Ajinomoto Co. Inc. (Japan), Danaher Corp. (U.S.), Merck Kgaa (Germany).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 16.1% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Oligonucleotide Synthesis include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Oligonucleotide Synthesis in 2022.

Vantage Market

Research | 14-Mar-2024

Vantage Market

Research | 14-Mar-2024