Oleochemicals Market

Oleochemicals Market - Global Industry Assessment & Forecast

Segments Covered

By Types Fatty Acid, Fatty Alcohol, Glycerin, Other Types

By Applications Pharmaceuticals & Personal Care Products, Food & Beverages, Soaps & Detergents, Polymers, Other Applications

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 20.37 Billion | |

| USD 35.55 Billion | |

| 7.20% | |

| Asia Pacific | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Premium Insights

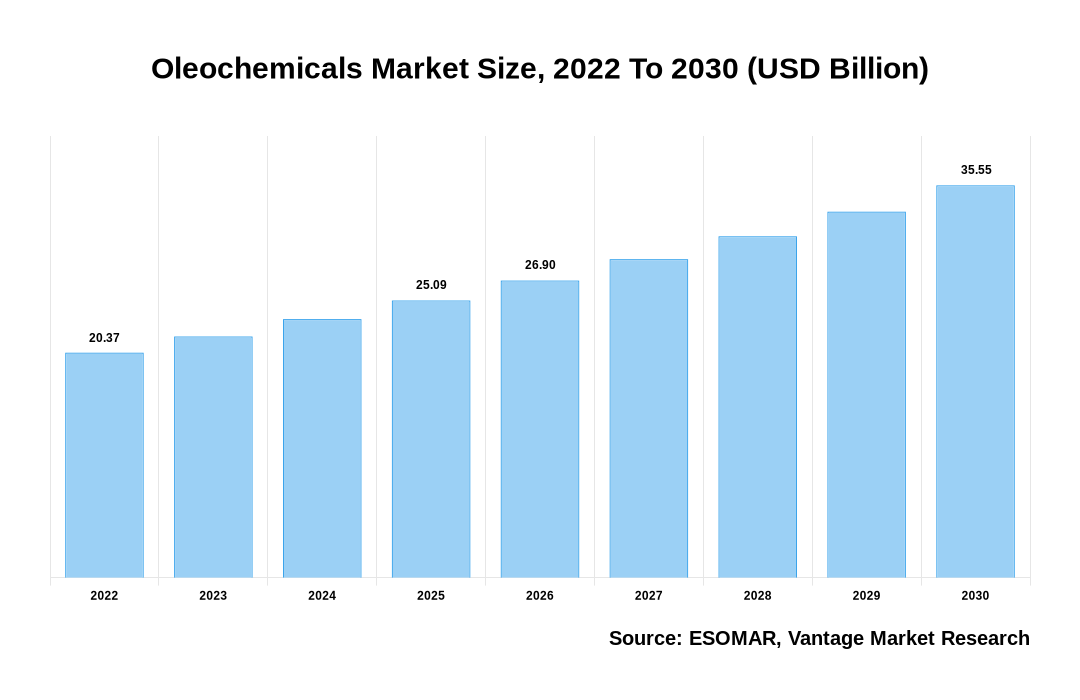

The Global Oleochemicals Market is valued at USD 20.37 Billion in 2022 and is projected to reach a value of USD 35.55 Billion by 2030 at a CAGR of 7.20% over the forecast period.

Various factors are driving the growth of this market, including developments in materials science and engineering, increasing demand for biodegradable packaging, and rising environmental concerns. One of the major contributors to the growth of the Oleochemicals market is materials science and engineering. Advancements further support this trend in manufacturing techniques, such as 3D printing, which allows for tunable production of complex shapes and sizes. Additionally, there is a growing demand for biodegradable packaging due to concerns over human health and the environment. In addition, green chemistry has emerged as a key trend in the Oleochemicals market, which focuses on improving the sustainability of chemical processes. In the field of materials science and engineering, there have been several developments that are driving the Oleochemicals market. These include advancements in nanotechnology, which is helping to create new materials with unique properties; an increase in the usage of renewable resources; and the development of new analytical methods. One example of how nanotechnology is helping to drive the Oleochemicals market is the development of nanocomposites. These are materials composed of small particles that are scale-dependent and have unique properties. One example is fullerenes, which are structures made up of carbon atoms arranged in a hexagonal shape. These structures have unique physical and chemical properties that can be exploited in various applications, such as fuel cells and solar panels.

Oleochemicals Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Oleochemicals Market

Another factor driving the Oleochemicals market is today’s available resources for manufacturing these materials. For example, petrochemicals can make polyolefins, a material used to produce plastic goods and other products. Moreover, there has been a growth in new analytical methods for monitoring and analyzing Oleochemicals that better elucidate their underlying molecular mechanisms. The increasing demand for biodegradable packaging is one of the key factors driving the Oleochemicals market. These products can be used to package food, beverages, and other consumables, and their usage is expected to grow shortly. Some key reasons for this are people’s environmental concerns about plastic waste and the health benefits that biodegradable materials may provide. Another factor contributing to the growth of the Oleochemicals Market is the growing popularity of natural products. Consumers are becoming more aware of the risks associated with conventional packaging products, such as Bisphenol A (BPA), and are looking for environmentally friendly alternatives. This trend is expected to continue soon as consumers become more interested in sustainable practices. One of the primary ways companies benefit from this trend is through innovative packaging technologies. For example, some companies are developing biodegradable materials that can be composted or recycled back into new packaging products. Others are developing artificial intelligence-based packaging systems that can learn how a product should be packaged over time. This technology allows manufacturers to create custom packages for different products without changing existing manufacturing processes. The rising environmental concerns are driving the Oleochemicals market.

Increasing awareness about the harmful effects of Environmental pollutants on the environment, society, and human health motivates various industries to develop innovative technologies and products that would help reduce these pollutants. This also contributes to the demand for Oleochemicals in various end-uses such as paints, coatings, plastics, detergents, etc. Regarding technology, several companies focus on producing renewable Oleochemicals using green growth strategies such as organic farming, solar energy, and wind power generation. In addition, they are also focusing on developing new synthetic methodologies that reduce environmental impact while maintaining desired performance characteristics. Additionally, many players are adopting Zero Waste policies which call for seamless collaboration among upstream producers, downstream users, and land managers to prevent waste from reaching landfills. The key restraints on the Oleochemicals market are increased government regulation and safety concerns. These concerns have been exacerbated by environmental issues, a growing awareness of the negative impact of chemicals on human health and increasing cost pressures. Increased government regulation has created uncertainty for companies regarding how to comply with regulations and whether they can afford to do so. This uncertainty has led some companies to exit the Oleochemicals market or downsize their operations. Safety concerns have resulted in bans or restrictions on the production of some chemicals, which are expected to increase in the future. Environmental issues are also restraining the Oleochemicals market. Pollution caused by substances used in oleochemical production (such as fracking) is causing an increase in air quality problems worldwide. This pollution is environmentally and economically costly, leading to increased demand for clean technology that can reduce emissions from industrial processes.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Top Market Trends

● One of the primary drivers of the growth of the oleochemical market is an environmental concern. As awareness about climate change increases, companies are looking for ways to reduce their carbon footprints. This has led to a surge in sales of environmentally friendly Oleochemicals.

● Another trend affecting the oleochemical market is medical application. Growing concerns about Alzheimer's disease and other forms of dementia are driving increased interest in products that can improve cognitive function. In addition, products that help protect against cancer are also gaining popularity.

● The manufacturing decoupling trend is another important factor driving the growth of the oleochemical market. In recent years, there has been a dramatic increase in production capacity on a global scale. This has increased reliance on intermediates and final products produced using oleo chemistry instead of traditional chemicals.

● The growing popularity of renewable energy sources such as solar and wind is also boosting the demand for Oleochemicals. These energy sources require considerable amounts of chemical products to be processed and formed into actual power. Thus, the market for Oleochemicals is expected to grow significantly in the coming years.

● Another key trend influencing the market for Oleochemicals is increasing awareness about health hazards posed by exposure to common chemicals. As a result, companies are looking to develop alternative solutions that are free from harmful side effects. This drive is expected to propel sales of Oleochemicals in the coming years.

● Another trend that is gaining momentum in the Oleochemicals market is the use of advanced renewable fuels. This includes fuels such as hydrogen, ethanol, and biodiesel. These fuels are becoming increasingly popular because they are environmentally friendly and reduce greenhouse gas emissions. They also have numerous other benefits, such as providing energy stability and reducing dependence on foreign oil supplies.

● Another trend in the Oleochemicals market is improving the performance of polymers. This includes materials used for products such as plastics, fibers, and additives. Improvements in these materials often result from advancements in engineering and chemistry. This has increased demand for these products, contributing to growth in the Oleochemicals market.

● Another trend seen in the Oleochemicals market is the development of biotech products. This includes products that use novel biology or biochemistry to improve performance or create new materials. Examples of this include new drugs and enzyme-based materials. Because these products are still largely experimental, their demand remains uncertain, but their potential remains significant.

Market Segmentation

The market is segmented based on Types, Applications & Region. Based on Types, the market is segmented into Fatty Acid, Fatty Alcohol, Glycerin, and Other Types. Furthermore, based on Applications, the market is segmented into Pharmaceutical & Personal Care, Food & Beverages, Soap & Detergents, Polymers, and Other Applications. Likewise, based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Types

The Fatty Acid segment dominated the market, accounting for almost three-quarters of the Oleochemicals market in 2021. The growth of this segment is mainly driven by increased demand for functional molecules and additives in the cosmetics and food industries. Other major product types include surfactants, biocides, and fragrances. The demand for fatty acids from various application areas, such as pharmaceuticals, agrochemicals, food additives, cleaning agents, and textile coatings, is expected to grow steadily over the next few years. This will be supported by increasing investments in R&D by key players across the globe. There is also growing awareness about their health benefits among consumers, which is driving their adoption in new applications. The biotechnology and vegetable oil segments are expected to experience relatively low growth over the forecast period owing to high penetration levels of existing products in these markets. On the other hand, growing health concerns about eating processed foods are anticipated to drive innovation and growth in the biological segments over the next few years.

Based on Applications

Pharmaceuticals & Personal Care Products are the two dominant application segments in the Oleochemicals market. These segments accounted for over two-thirds of total revenue in 2021. The growth prospects of these two segments are robust owing to increased demand from the healthcare industry, which is expected to proliferate over the next decade. The pharmaceutical segment is expected to grow faster due to the increasing number of chronic diseases, such as cancer and diabetes, being treated with prescription drugs. This is expected to drive demand for new Oleochemicals products used in drug formulation and production.

On the other hand, Personal Care Products are projected to grow moderately due to rising advertising spending across various geographies and an increasing trend toward natural cosmetics among consumers. This will help increase sales of hair care products, skincare products, and toothpaste. The shift in customer desire for natural and eco-friendly products has fueled the expansion of the personal care and cosmetics sector. Producers have improved and introduced new, innovative technology to conform to the government's regulatory frameworks. The United States should see a rise in demand for cosmetics as the pharmaceutical and personal care industries find more uses for them. There will be an increased need for glycerol derivatives in the pharmaceutical, food, and beverage sectors. Demand for Oleochemicals is expected to rise throughout the forecast period due to growth in the cleaning products sector. The Oleochemicals industry is expected to grow as more organic cosmetics and toiletries are produced using bio-based raw ingredients. Stabilizers, biobased thickeners, and food additives are predicted to drive the market. Therefore, the sector as a whole should expand.

Based on Region

Asia Pacific is the largest market for Oleochemicals, accounting for over 40% of the total revenue in 2021. Growth in this region is chiefly due to increased demand from the automotive and electronics industries. However, sluggish growth rates in other regions are restraining overall Oleochemicals market growth. Europe is the second-largest market for Oleochemicals, with a revenue share of around 27%. North America is expected to account for a smaller share, at around 16%. This regional segregation has significant implications for the way the market will develop. For instance, Europe and North America are already well-covered in terms of companies, resulting in considerable competition and few new entrants. Asia Pacific, on the other hand, offers ample opportunities for new entrants owing to its large population base and growing automotive and electronics sectors.

Competitive Landscape

The key players in the Global Oleochemicals market include- Cargill Inc. (US), SABIC (Saudi Arabia), Kuala Lumpur Kepong Berhad (Malaysia), BASF SE (Germany), Oleon N.V. (Belgium), IOI Group Berhad (Malaysia), Wilmar International & Kao Corp. (Singapore) and others.

Recent Market Developments

● In May of this year (2019), PT Apical Kao Chemicals finished building a new factory to generate fatty acids. This business is a partnership between Kao Corp and Apical Group Limited. This partnership was crucial in expanding manufacturing capacities and ensuring a steady supply.

● According to a press release from Emery Oleo Chemicals, the company's new fatty acid Ester product line, branded under the name Emery E, will be available beginning in September 2020. These fatty esters provide biodegradability, good color stability, and lack of odor are all bonuses. ● Emery Natural Oleochemicals has released an innovative new product called EMEROX Polyols. Its better performance qualities and increased efficiency and sustainability benefit end users.

Segmentation of the Global Oleochemicals Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Types

By Applications

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 12-Jan-2023

Vantage Market

Research | 12-Jan-2023

FAQ

Frequently Asked Question

What is the global demand for Oleochemicals in terms of revenue?

-

The global Oleochemicals valued at USD 20.37 Billion in 2022 and is expected to reach USD 35.55 Billion in 2030 growing at a CAGR of 7.20%.

Which are the prominent players in the market?

-

The prominent players in the market are Cargill Inc. (US), SABIC (Saudi Arabia), Kuala Lumpur Kepong Berhad (Malaysia), BASF SE (Germany), Oleon N.V. (Belgium), IOI Group Berhad (Malaysia), Wilmar International & Kao Corp. (Singapore).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 7.20% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Oleochemicals include

- Growth In Personal Care & Cosmetics Industry

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Oleochemicals in 2022.