Microfluidics Market

Microfluidics Market - Global Industry Assessment & Forecast

Segments Covered

By Product Type Microfluidic-based devices, Microfluidic Components, Material

By Application In-vitro Diagnostics, Pharmaceutical & Life Science Research and Manufacturing, Therapeutics

By End User Hospitals & Diagnostic Centers, Academic & Research Institutes, Pharmaceutical and biotechnology Companies

By Region North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 22.8 Billion | |

| USD 74.78 Billion | |

| 14.1% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

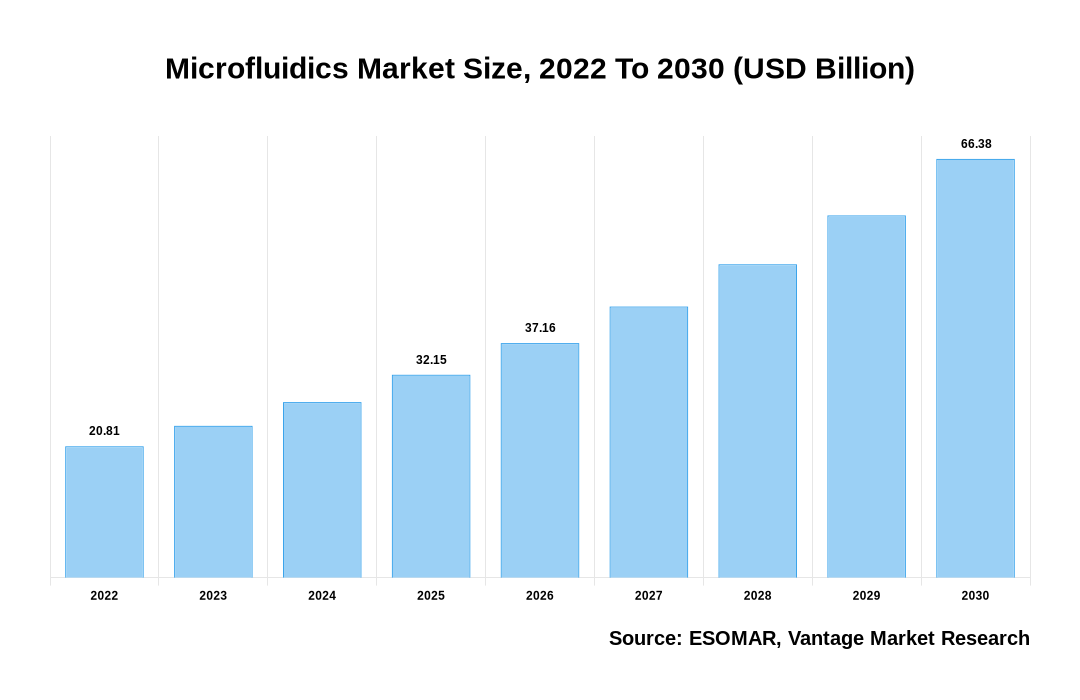

The global Microfluidics Market is valued at USD 22.8 Billion in 2023 and is projected to reach a value of USD 74.78 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 14.1% between 2024 and 2032. The market is driven by growing use of microfluidic devices in diverse research and diagnostic fields is anticipated to fuel market growth. For instance, the past decade has seen a rise in the number of microfluidic devices used in ophthalmology.

Key Highlights

- Microfluidics is the science and technology of manipulating and controlling fluids, typically on a micro-scale, through channels that are often just a few micrometers in diameter. It enables precise handling of tiny fluid volumes (usually nanoliters to picoliters) and is commonly used in applications like biological and chemical analysis, diagnostics, drug development, and lab-on-a-chip devices

- Based on the Product Type, the Microfluidic-based devices category accounted for significant market share in 2023

- In 2023, by Application, In-vitro Diagnostics dominated the market with significant market share

- Based on End User, Hospitals & Diagnostic Centers dominated the market with significant market share in 2023

- North America dominated the market with 42.2% market share in 2023

- Asia Pacific region is anticipated to grow at the highest CAGR of 15.5% during the forecast period

Microfluidics Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Microfluidics Market

Product Type Overview

The Product Type segment is divided into Microfluidic-based devices, Microfluidic Components and Material. The Microfluidic-based devices segment held the dominant share in 2023, accounting for significant market share.

The integration of microfluidics into point-of-care testing (POCT) devices is a key application of this technology. Microfluidics allows for both detection and fluid control within a single component, enhancing sensitivity and specificity for detecting target analytes in small sample volumes, thus addressing many limitations of traditional POCT diagnostics. Microfluidic-based POCT devices are commonly used in molecular biology, as well as chemical and biochemical analyses. For instance, Revogene, a cartridge-based real-time PCR device that uses microfluidics to test for C. difficile, Strep B, and Streptococcus A, delivering results in about 2 minutes.

Application Overview

The Application segment is divided into In-vitro Diagnostics, Pharmaceutical & Life Science Research and Manufacturing, Therapeutics. In 2023, the In-vitro Diagnostics segment held largest share in the Microfluidics market.

IVD systems incorporating microfluidic technologies, such as point-of-care diagnostics, PCR systems, analyzers, and electrophoretic systems, are increasingly used by diagnostic, pharmaceutical, and biotechnology companies, as well as in forensic applications. These devices have various advantages, such as more portability because of their small size, increased testing frequency, reduced reagent and sample consumption, and quicker, more precise analysis. The increasing use of microfluidic-based IVD technologies is also being fueled by the availability of affordable consumables and the capacity of point-of-care devices to produce quick results with integrated, compact systems while also lowering costs.

Regional Overview

In 2023, the North America captured 40.2% of the revenue share.

North America Microfluidics market is driven by the presence of advanced healthcare infrastructure, high demand for point-of-care diagnostics, and strong research and development activities in biotechnology and pharmaceuticals. Additionally, key industry players and startups in the U.S. and Canada are continuously advancing microfluidic applications, particularly in personalized medicine and drug delivery systems.

U.S. Microfluidics market, valued at USD 7.02 Billion in 2023 to USD 24.28 Billion in 2032, is anticipated to grow at a CAGR of 14.8% from 2024 to 2032. The primary driver of the market expansion is the expansion of research funding from industry and government agencies. The increasing need for microfluidic devices in research and diagnostics has accelerated the commercialization of devices created in laboratories and encouraged collaboration between academia and business. For instance, Fluidigm Corporation signed a letter contract with the National Institute of Biomedical Imaging and Bioengineering and the National Institutes of Health as part of the Rapid Acceleration of Diagnostics (RADx) program. With a proposed budget of up to USD 37 million, the initiative aimed to enhance production capacity and output for COVID-19 testing using Fluidigm's microfluidics technology.

Asia Pacific region is anticipated to grow at the highest CAGR of 15.5% during the forecast period, driven by its advanced research infrastructure, growing economy, and low labor costs. International companies are eager to invest in the untapped microfluidics market in APAC, where diagnostic tests using microfluidic technology are largely dominated by foreign firms. However, local players are introducing innovative solutions, particularly in terms of performance and cost-effectiveness, which could help them gain market share in the near future.

In China, the government has launched the "Made in China 2025" initiative, aimed at strengthening the domestic industry, including the medical devices and pharmaceuticals sectors. As a key technology for life sciences and diagnostic applications, microfluidics is expected to benefit from the funding allocated under this strategic plan.

Based on the provided market data, Vantage Market Research offers customizations in the reports to meet the specific needs of clients.

Key Trends

- Point-of-Care Diagnostics: There is increasing demand for portable, easy-to-use diagnostic tools, and microfluidics plays a critical role in enabling these devices

- Miniaturization and Integration: The push towards smaller, more integrated systems is driving the development of microfluidic "lab-on-a-chip" devices

- Advances in 3D Printing and Manufacturing Technologies: 3D printing and advanced manufacturing techniques are making the production of complex microfluidic devices more accessible and customizable

- Government Support and Funding: Governments across the world are supporting research and development in microfluidics through funding and grants, especially in healthcare and diagnostics

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

The Microfluidics market is driven by increasing technological advancements

Technological advancements in microfluidic components aim to enhance and streamline procedures in the healthcare sector. Research labs have been using integrated microfluidic systems for more than 20 years. But during the past decade, new developments like large-scale microfluidic integration and soft lithography have greatly enhanced their use in medical and biological sciences research. These advancements have sped up development efforts and allowed researchers to do more complicated and sophisticated tests using microfluidic chips.

Integrating microfluidics into established workflows

Less than a decade ago, the first microfluidic screening devices were introduced to the market. The field of drug discovery and development can benefit greatly from the promise that microfluidics technology presents for further instrument miniaturization and integration, as well as increased automation and lower costs. Despite these benefits, it may take 10 to 15 years for microfluidics to fully replace traditional macro-scale research instruments. Until then, the market will experience sporadic adoption of microfluidic devices, leading manufacturers to face competition from established technology providers.

Expanding the use of microfluidics in drug delivery technologies presents significant growth opportunities

Drug delivery devices that are implanted offer as an instance of how cutting-edge technology could offer competitors new opportunities. The development of wearable and portable medical delivery devices that are accurate and dependable is made possible by microfluidics. Insulin pumps, which are among the most common microfluidics-based pharmaceutical drug delivery systems, exemplify this trend. Different micro-pumping methods are also being developed, and over the next two to three years, more of these devices should be made available.

Competitive Landscape

The Microfluidics market is marked by the presence of several prominent players, including Beckton Dickinson and Company, Agilent Technologies, Inc., and Bio-Rad, alongside global leaders such as F. Hoffmann-La Roche Ltd. and Danaher Corporation. Key competitors like Illumina, Inc., Fluidigm Corporation, and Abbott Laboratories drive innovation and technological advancements, while firms such as Biomérieux SA, Hologic, and Quidel Corporation contribute to the dynamic market through specialized solutions. The industry is characterized by intense competition, rapid technological developments, and a focus on enhancing diagnostic and research capabilities.

The key players in the global Microfluidics market include - F. Hoffmann-La Roche Ltd., Danaher Corporation, Illumina Inc., Fluidigm Corporation, Abbott Laboratories, Biomérieux SA, Hologic, Quidel Corporation, Beckton Dickinson and Company, Agilent Technologies Inc., Bio-Rad among others.

Recent Market Developments

Standard BioTools, Inc. Launches X9 Real-time PCR System

In February 2023, Amar Equipment, an India-based company, unveiled NanoMake, a microfluidics-based device aimed at advancing preclinical research for mRNA COVID-19 vaccines. Such product introductions are expected to drive market growth

Amar Equipment Introduces NanoMake Microfluidics Device for mRNA Vaccine Research

In November 2023, Microfluidics, a division of IDEX Material Processing Technology (MPT), launched its latest processor, engineered for large-scale cell disruption, essential in producing biological products like antigens for vaccines and viral vectors for gene therapy

Microfluidics, a Division of IDEX MPT, Launches New Processor for Cell Disruption

In January 2023, SCIEX launched the Intabio ZT system, the first fully-integrated microfluidic chip platform that combines imaged capillary isoelectric focusing (icIEF) separation with UV detection

SCIEX Unveils Intabio ZT System, a Microfluidic Chip-Based Platform

In October 2022, Standard BioTools, Inc. introduced the X9 Real-time PCR system, a genomics instrument utilizing microfluidics technology, designed to enhance efficiency and data output in a single run. This launch was anticipated to strengthen the company's product portfolio

The global Microfluidics market can be categorized as Product Type, Material, Application, End User and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Product Type

By Application

By End User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 16-Sep-2024

Vantage Market

Research | 16-Sep-2024

FAQ

Frequently Asked Question

What is the global demand for Microfluidics in terms of revenue?

-

The global Microfluidics valued at USD 22.8 Billion in 2023 and is expected to reach USD 74.78 Billion in 2032 growing at a CAGR of 14.1%.

Which are the prominent players in the market?

-

The prominent players in the market are F. Hoffmann-La Roche Ltd., Danaher Corporation, Illumina Inc., Fluidigm Corporation, Abbott Laboratories, Biomérieux SA, Hologic, Quidel Corporation, Beckton Dickinson and Company, Agilent Technologies Inc., Bio-Rad.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 14.1% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Microfluidics include

- Rising demand for point-of-care testing

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Microfluidics in 2023.