Mexico Logistics Market

Mexico Logistics Market - Global Industry Assessment & Forecast

Segments Covered

By Customer B2B, B2C

By Service Type Transportation, Warehousing, Freight Forwarding, Packaging

By Logistics Model First and Second party Logistics, Third-party Logistics, Fourth-party Logistics

By Geographic Domestic, International

By Application Healthcare, Industrial and Manufacturing, Automotive, Food & Beverage, Retail and E-commerce, Government & Public Utilities, Other Verticals

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 145.6 Billion | |

| USD 248.8 Billion | |

| 6.1% | |

| X | |

| X |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

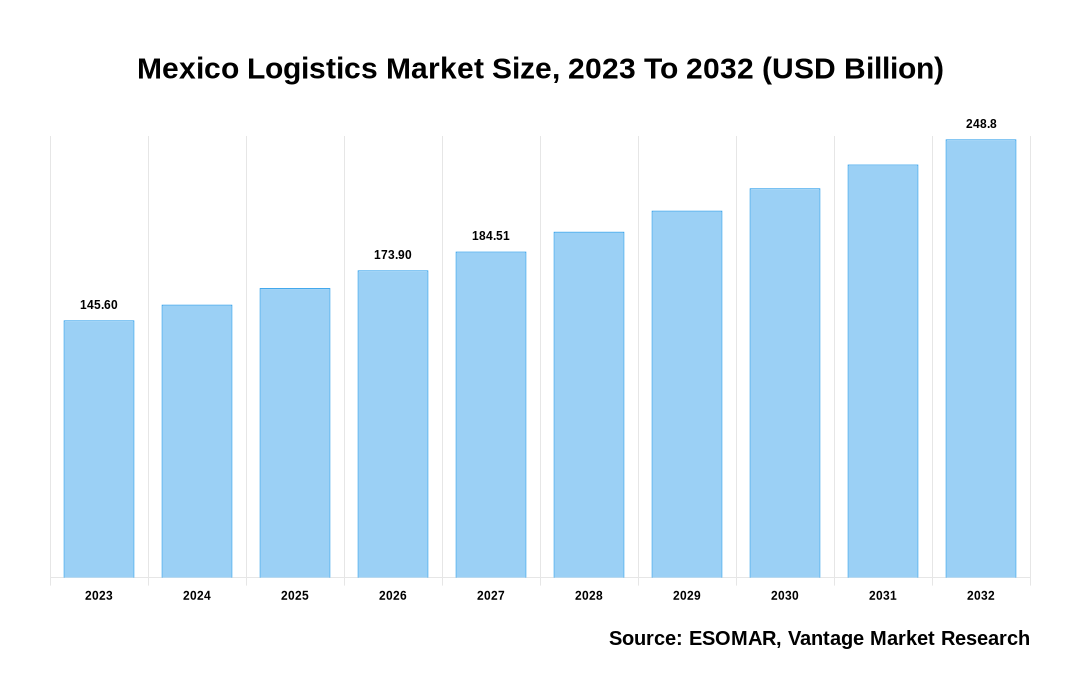

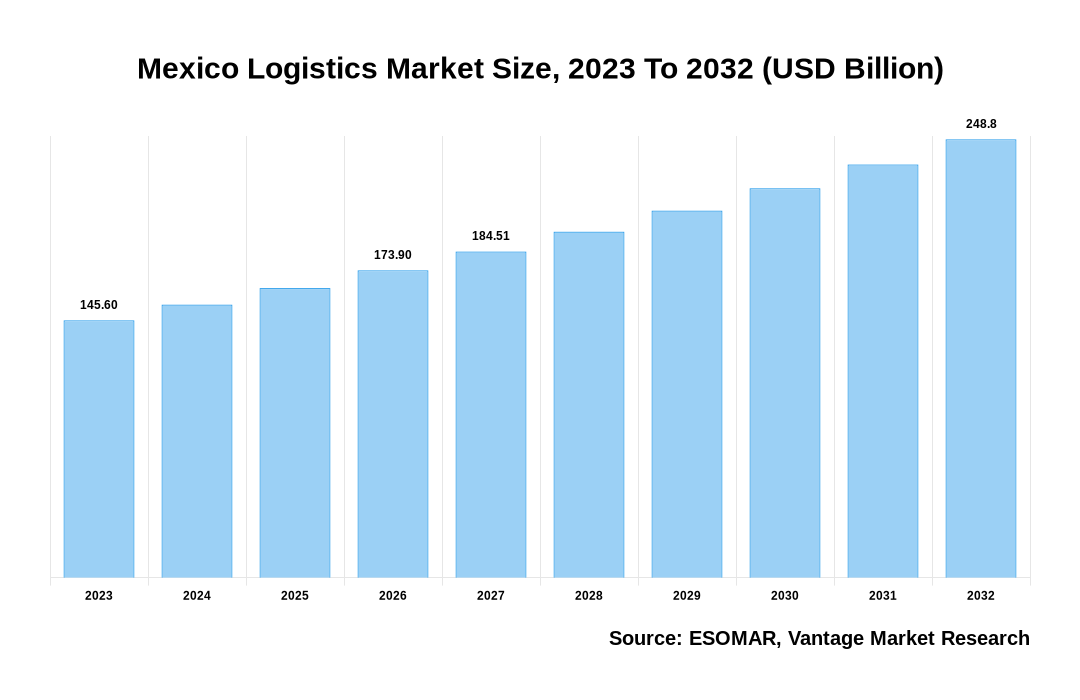

The Mexico Mexico Logistics Market is valued at USD 145.6 Billion in 2023 and is projected to reach a value of USD 248.8 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 6.1% between 2024 and 2032.

Key Highlights of Mexico Logistics Market

- Expanding international trade and globalization, Ongoing investments in transportation infrastructure, and the surge in e-commerce activities is fueling market growth.

- The B2B segment significantly contributed to the market’s expansion, constituting over 72.01% of the overall revenue share in 2023

- Based on Service Type Freight Forwarding category is presumed to witness the fastest growth in the coming years driven by the escalating global trade and the substantial rise in e-commerce, underscoring the imperative for seamless and integrated freight forwarding services.

- In 2023, the First and Second party Mexico Logistics Category dominated the market with around 85.9% share.

- Technological advancements are a key trend shaping the Mexico Logistics industry in Mexico, driving innovation and efficiency across the supply chain.

Mexico Logistics Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Mexico Logistics Market

Mexico Mexico Logistics Market Overview

The Mexico Mexico Logistics market is strategically positioned at the crossroads of North and South America, making it a pivotal player in the global supply chain. With its extensive network of trade agreements and a geographical advantage adjacent to the United States, Mexico serves as a key hub for international trade. The logistical significance of the country is further accentuated by its participation in the United States-Mexico-Canada Agreement (USMCA), providing a framework that promotes seamless trade and cooperation among the North American nations.

Major players in the Mexico Logistics sector have strategically invested in technology and infrastructure to meet the demands of cross-border trade, ensuring the timely and secure movement of goods. Moreover, the Mexico Mexico Logistics market is witnessing a transformative phase driven by technological integration. time tracking, route optimization, and data analytics to enhance operational efficiency. The adoption of Internet of Things (IoT) devices and artificial intelligence (AI) contributes to improved supply chain visibility and decision-making.

The global Mexico Logistics market can be categorized as Customer, Service Type, Mexico Logistics Model, Geographic, Application and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Customer

By Service Type

By Logistics Model

By Geographic

By Application

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Mexico Logistics Market: Customer Overview

In 2023, the B2B dominated the market with a 72.01% share and a market CAGR of 5.0% in the forecast period. The Product segment is separated into B2B, and B2C. Business-to-Business (B2B) Mexico Logistics in Mexico constitutes a foundational element, serving as the backbone for the country's industrial and manufacturing sectors. As Mexico continues to strengthen its position as a global manufacturing hub, the growth observed in B2B Mexico Logistics reflects the integral role it plays in supporting large-scale industrial operations and contributing to the nation's economic development. The growth trajectory in B2B Mexico Logistics in Mexico is indicative of the country's commitment to fostering a conducive environment for industrial development. As businesses within Mexico's industrial landscape continue to expand their operations and engage in global supply chains, B2B Mexico Logistics emerges as a linchpin in supporting their growth aspirations and further solidifying Mexico's status as a key player in the global manufacturing arena.

Mexico Logistics Market: Service Type Overview

In 2023, the Transportation dominated the market and is estimated to continue its dominance during the forecast period. Moreover, the Freight Forwarding category is presumed to witness the fastest growth in the coming years driven by the escalating global trade and the substantial rise in e-commerce, underscoring the imperative for seamless and integrated freight forwarding services. The Livestock segment is categorized into Transportation, Warehousing, Freight Forwarding, and Packaging. The transportation segment stands as a cornerstone in the Mexico Mexico Logistics market, playing a crucial role in facilitating the movement of goods both domestically and internationally. Mexico's strategic location as a key player in North American trade underscores the importance of maintaining a highly efficient transportation network. As trade volumes continue to surge and industries become more interconnected, the transportation segment remains a linchpin in sustaining the momentum of economic growth, ensuring the smooth flow of goods to meet the dynamic demands of the market.

Mexico Logistics Market: Mexico Logistics Model Overview

In 2023, the First and Second party Mexico Logistics Category dominated the market with around 85.9% share and is estimated to continue its dominance during the forecast period. However, the fourth-party Mexico Logistics category is presumed to witness the fastest growth in the coming years. The Function segment is categorized into First-party Mexico Logistics, Second-party Mexico Logistics, Third-party Mexico Logistics, and Fourth-party Mexico Logistics. These Mexico Logistics models are particularly influential in Mexico's industrial landscape, where manufacturing and retail sectors heavily rely on the timely and cost-effective movement of raw materials and goods. As the first touchpoints in the Mexico Logistics journey, 1PL and 2PL providers strategically manage transportation, warehousing, and inventory to ensure optimized supply chain processes. Their adaptability is crucial for industries such as manufacturing, where just-in-time production is a key driver.

Key Trends

- The exponential growth of e-commerce is a defining trend that significantly contributes to the booming Mexico Logistics industry in Mexico. As consumers increasingly turn to online platforms for their shopping needs, there is a surge in demand for efficient and streamlined Mexico Logistics services.

- Technological advancements are a key trend shaping the Mexico Logistics industry in Mexico, driving innovation and efficiency across the supply chain. The adoption of cutting-edge technologies, such as Internet of Things (IoT), Artificial Intelligence (AI), and blockchain, is transforming traditional Mexico Logistics practices.

- The trend of global economic interconnectedness is playing a pivotal role in the boom of the Mexico Logistics industry in Mexico. The country's strategic location, nestled between North and South America, positions it as a crucial hub for international trade and commerce. With an extensive network of trade agreements, Mexico has become an integral part of the global supply chain, fostering economic interdependence with countries worldwide.

Premium Insights

The Mexico Logistics industry in Mexico plays a pivotal role in the nation's economy, facilitating the seamless movement of goods across diverse sectors. Noteworthy transformations within the sector have been observed, marked by an increased integration of technology that includes sophisticated tracking systems and data analytics. This integration has significantly enhanced the visibility and efficiency of the supply chain. The adoption of robotics and automation has also gained prominence, contributing to cost reduction and streamlining warehouse operations. The continued growth of the Mexico Logistics industry is attributed to the surge in e-commerce, where the escalating trend of online shopping necessitates more sophisticated and adaptable distribution networks. This has spurred a demand for innovative last-mile delivery strategies to align with evolving customer expectations. Moreover, businesses are proactively implementing eco-friendly practices and exploring environmentally sustainable modes of transportation, reflecting a commitment to reducing their environmental impact.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

The expansion of international trade and the continual forces of globalization are pivotal drivers propelling the growth of Mexico's Mexico Logistics market. In recent years, Mexico has solidified its standing as a critical player in the global trade landscape, owing to strategic geographical proximity to the United States, a multitude of free trade agreements, and a well-connected transportation network. For instance, according to the International Trade Administration (ITA), Mexico stands as the primary destination for U.S. automotive parts exports and ranks as the fourth-largest global producer of automotive components, contributing a substantial USD 107 billion in annual revenues.

The complexity of regulatory frameworks and bureaucratic hurdles stands as a notable restraint on the growth trajectory of Mexico's Mexico Logistics market. While the country's strategic location and increasing international trade activities contribute to the market's potential, the intricacies of regulatory compliance and bureaucratic processes present formidable challenges for Mexico Logistics operations. Addressing this restraint requires concerted efforts from both the public and private sectors. Streamlining regulatory processes, adopting digital solutions for documentation and customs procedures, and fostering a more transparent and efficient regulatory environment are essential steps.

Competitive Landscape

The competitive landscape of the Mexico Logistics market is characterized by intense rivalry among key players vying for market share. Major players in the Mexico Mexico Logistics market continually invest in digital solutions and innovations to stay competitive and cater to the growing expectations of businesses and consumers alike. Mexico Logistics companies are increasingly adopting green practices not only as a response to regulatory pressures but also to meet the rising demand for socially responsible and sustainable supply chain solutions. Industry leaders are establishing strategic alliances to capitalize on synergies, gain entry into untapped distribution channels, and expedite market penetration.

Recent Market Developments

- In March 2023, Kuehne Nagel, has signed a long-term contract with Decathlon, to expand its operations, ware-housing and distribution capacity in Latin America by 30%. The site has the capacity to store and distribute more than 10 million units per year and will cover Latin American countries such as Chile, Colombia, and Mexico.

- In September 2023, C.H. Robinson announced the opening of a new facility that speeds up trade across the Mexico border, at a time when a growing number of global shippers are nearshoring in order to diversify and fortify their supply chains. It’s one of the largest cross-docks in Laredo, the nation’s No. 1 inland port, where the Mexico Logistics company has been facilitating global business for more than 30 years.

- In July 2023, GEODIS, announced that it has opened a new multi-user warehouse and distribution center in Mexico City. The company unveiled the new facility during a ribbon-cutting ceremony featuring Economic Development Secretary of the State of Mexico Pablo Peralta alongside GEODIS leaders, employees and customers.

FAQ

Frequently Asked Question

What is the global demand for Mexico Logistics in terms of revenue?

-

The global Mexico Logistics valued at USD 145.6 Billion in 2023 and is expected to reach USD 248.8 Billion in 2032 growing at a CAGR of 6.1%.

Which are the prominent players in the market?

-

The prominent players in the market are A.P. Møller – Mærsk, H. ROBINSON WORLDWIDE INC, DB SCHENKER, DEUTSCHE POST AG (DHL GROUP), DSV (DSV PANALPINA), FEDEX, GEODIS, KUEHNE+NAGEL INTERNATIONAL AG, NIPPON EXPRESS, UNITED PARCEL SERVICE INC., XPO, Inc., Accel Logístic.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 6.1% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Mexico Logistics include

Which region accounted for the largest share in the market?

-

X was the leading regional segment of the Mexico Logistics in 2023.