Metalworking Fluids Market

Metalworking Fluids Market - Global Industry Assessment & Forecast

Segments Covered

By Type Straight Oils, Soluble Oils, Semi-synthetic Fluids, Synthetic Fluids

By Product Type Removable Fluid, Protecting, Forming, Treating

By End Use Industry Transport Equipment Manufacturing, Metal Fabrication, Machinery, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 11.69 Billion | |

| USD 16.01 Billion | |

| 3.55% | |

| North America | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

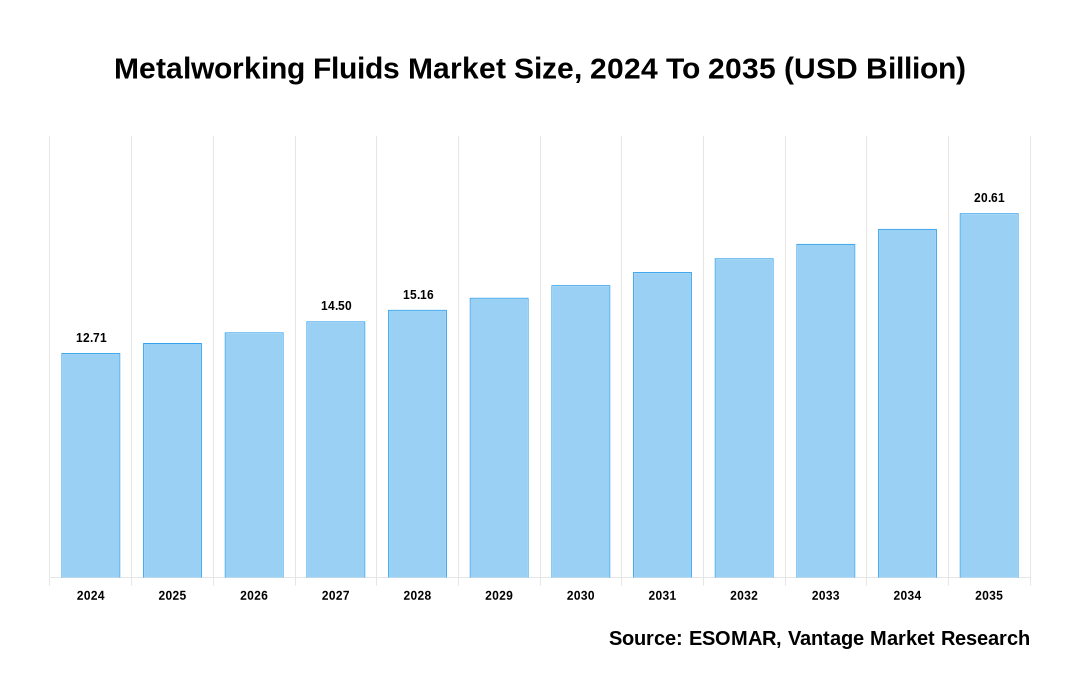

The global Metalworking Fluids Market is valued at USD 11.69 Billion in 2023 and is projected to reach a value of USD 16.01 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 3.55% between 2024 and 2032.

Key Highlights

- In 2023, Asia Pacific led the market, capturing 41.2% market share due to region's growing adoption of automation and advanced manufacturing technologies, which has increased demand for specialty metalworking fluids

- The North America region is expected to grow at significant CAGR projected throughout the forecast period

- By Product Type, Removable Fluid dominated the market in 2023 with a market share of 47.5% because of its superior performance in cooling, lubrication, and ease of removal, making it highly preferred across various metalworking processes

- Among various End Use Industries, the Machinery segment accounted for the largest market share of 40.5% in 2023 owing to the high demand for metalworking fluids in machinery manufacturing and maintenance, driven by the sector's expansion and technological advancements

Metalworking Fluids Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Metalworking Fluids Market

Regional Overview

Asia Pacific Dominated Sales with a 41.2% share in 2023. Asia Pacific’s supremacy is driven by its robust industrialization, fueled by powerhouse economies like China, India, Japan, and South Korea. The need for metalworking fluids, which are necessary for various machining processes crucial in component manufacturing and assembly, has increased due to the exponential expansion witnessed by the automotive, aerospace, industrial, and construction sectors in Asia Pacific.

The Asia-Pacific region asserted its dominance in the market primarily driven by escalating demand from the agriculture and construction sectors. The heavy equipment sector is expanding in the region due to growing economic development and industrialization, especially in nations like China, India, and Japan. Metalworking fluids are essential to the production of large machinery and equipment. Consequently, with the rising demand for such machinery, the need for metalworking fluids is poised to escalate in the foreseeable future.

Machine tools, heavy electrical equipment, cement, material handling, plastics processing, process plant, earthmoving, construction, and mining equipment are just some of the various sub-sectors that comprise up the heavy machinery companies. For instance, China's 14th Five-Year Plan offers a chance to propel the nation's rural and agricultural modernization, leading to a rise in the use of heavy machinery in building and farming operations. Furthermore, India witnessed a notable surge in the export of construction equipment, with a 26% increase in sales to 1,35,650 units in the 2023–24 fiscal year.

Japan is experiencing steady growth in the production of agricultural machinery. According to data from the Japanese Agricultural Machinery Manufacturers Association (JAMMA), the total production of various farm equipment, including rice huskers, power threshers, and vegetable machinery, reached 459,426 units in 2023.

End Use Industry Overview

In 2023, the Machinery segment dominated the market with the largest share of 40.5%. The market is segmented by the End Use Industry, includes Transport Equipment Manufacturing, Metal Fabrication, Machinery, Others.

The importance of the machinery segment highlights the significance it is to the need for metalworking fluids in a variety of production processes. A wide range of industries operate under machinery, including those in the automotive, aerospace, construction, and industrial machinery manufacturing sectors. For machining processes like cutting, drilling, milling, and grinding which are essential for the creation of components and machinery parts these sectors heavily rely on metalworking fluids.

The growing industry adoption of automation and modern manufacturing technologies is responsible for the Machinery segment's supremacy. The need for specialized metalworking fluids designed for contemporary machining processes is growing as manufacturers aim to increase productivity, accuracy, and efficiency. Additionally, stringent quality standards and the need for superior surface finish in machinery production further drive the demand for high-performance metalworking fluids, consolidating the Machinery segment's position as the primary end-user industry in the market.

The Machinery segment is well-positioned to maintain its dominance in the market due to ongoing technical innovations, industrial automation, and the continued expansion of manufacturing operations worldwide. The rise in demand can be ascribed to the growing application of Metalworking Fluids (MWFs) in automotive, earthmoving, and agricultural equipment. Predictions suggest that the market will rise significantly, mostly due to increased demand from construction equipment manufacturers. These fluids are essential to machining processes because they increase the sump's lifespan and enable manufacturers save funds over the years.

Top Trends

- The market is significantly impacted by the growing trend of new production technologies, such as automation and Industry 4.0, being used. More advanced and specialized fluids with improved cooling capabilities, increased efficiency, and extended tool life are needed for these technologies.

- There is a growing trend in industry towards novel metalworking fluid formulations is being driven by the growth of electric vehicles (EVs) and the growing usage of lightweight materials in the aerospace and automotive industries. Manufacturing of electric vehicles and the move to lighter, more efficient materials present difficulties that conventional fluids may not be able to resolve.

- There is a growing trend towards specialized and customized solutions by metalworking fluids companies in market. These businesses frequently concentrate on specialized markets, offering customized goods and services that bigger producers might not. Businesses add to the diversity and vibrancy of the market by precisely and flexibly meeting the needs of particular consumers.

Government Initiatives

- The U.S. government has set a target to enhance the current Corporate Average Fuel Economy (CAFE) standards by 20 percent by 2016, with a subsequent aim of doubling it to 54.5 miles per gallon by 2025.

- The Environmental Protection Agency (EPA) Regulations enforces regulations related to the use, handling, and disposal of metalworking fluids to protect the environment and public health. These regulations may include limits on the discharge of pollutants into waterways and air emissions from manufacturing facilities.

- National Institute for Occupational Safety and Health (NIOSH) Standards develops standards and recommendations for the safe use of metalworking fluids to prevent occupational illnesses and injuries. These standards address factors such as fluid composition, exposure limits, and control measures.

- The China Association of Automobile Manufacturers (CAAM) Partnerships collaborates with manufacturers to promote the adoption of eco-friendly metalworking fluids in the automotive industry. These partnerships aim to reduce environmental impact, improve product quality, and enhance manufacturing efficiency.

- The Confederation of Indian Industry (CII) collaborates with manufacturers to promote the adoption of eco-friendly metalworking fluids and best practices in the industry. These partnerships aim to enhance competitiveness, improve product quality, and reduce environmental impact through sustainable manufacturing practices.

Premium Insights

The Metalworking Fluids market is being driven by the continuous expansion of manufacturing activities across various industries such as automotive, aerospace, machinery, and construction. As these sectors experience growth and technological advancements, the demand for metalworking fluids rises proportionally, as these fluids are indispensable for machining operations such as cutting, drilling, milling, and grinding.

The increasing demand for heavy industry and automotive machinery is anticipated to create an increase in the market. Therefore, the growth of the automobile industry appears to be the main force behind the market. Because metalworking fluids can lower friction between the workpiece and the tool, improve surface quality, make it easier to remove metal chips from surfaces, and extend tool life, they are widely used in the automotive industry. These fluids help increase machine productivity by increasing the effectiveness of machining operations.

The expansion of the automotive segment in China is poised to positively impact the market. For instance, according to the International Organization of Motor Vehicle Manufacturers (OICA), China stands as the largest producer of automobiles globally, manufacturing a staggering 26 413 029 units in 2023 alone. Furthermore, there has been a notable surge in passenger vehicle production in India. For instance, data from the Society of Indian Automobile Manufacturers (SIAM) indicates that passenger vehicle production reached 38,90,114 units for the 2022-2023 period, marking a notable increase compared to the previous year. Therefore, the strong growth in the automotive sector is a major factor contributing to the rise of the market.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

One of the primary drivers for the Metalworking Fluids market is the robust demand stemming from the automobile industry

As one of the largest consumers of metalworking fluids, the automotive sector relies heavily on these fluids for various machining operations involved in the production of vehicles. From engine components to body panels, metalworking fluids are essential for processes such as cutting, milling, drilling, and grinding, ensuring precise shaping and finishing of automotive parts. With the automotive industry experiencing continuous growth and innovation in market, driven by factors such as technological advancements, changing consumer preferences, and stringent regulatory requirements, the demand for metalworking fluids is expected to remain consistently high. The need for specific metalworking fluids is increased in industry as the automotive sector shifts to lightweight materials and electric vehicles (EVs) in order to comply with legal requirements and sustainability goals. Particularly in the manufacturing of electric vehicles (EVs), accurate machining of sophisticated materials like aluminum, composites, and high-strength steels is required, which calls for fluids with outstanding compatibility and performance. Manufacturers of metalworking fluids now have the chance to create novel formulations specifically suited to the demands of electric vehicle production, due to the shift towards electric mobility and lightweighting.

There exists a significant opportunity for product innovation and differentiation in Metalworking Fluids market

Manufacturers are concentrating more on creating new and improved fluid formulas that offer better performance, sustainability, and compatibility with cutting-edge machining technology as competition heats up and customer needs change. This offers businesses the chance to spend money on R&D to produce cutting-edge goods like nanofluids, smart fluids, and bio-based fluids that cater to particular consumer demands in market. Differentiation can also be attained by offering value-added services that address a range of client needs and applications, such as technical assistance, customization, and personalized solutions. In this dynamic and changing industry landscape, producers can obtain a competitive edge, stand out from the competition, gain market share by leveraging chances for product innovation and differentiation.

Competitive Landscape

The Metalworking Fluids market is characterized by a diverse array of global and regional players who are continually innovating to meet the evolving demands of various end-use industries. Major companies such as ExxonMobil, Quaker Houghton, and FUCHS Group dominate the market with their extensive product portfolios and strong distribution networks. These leading companies in the Metalworking Fluids industry make significant investments in R&D to produce cutting-edge formulations with improved environmental sustainability, longer tool life, and higher performance. Furthermore, these businesses frequently use partnerships, mergers, and acquisitions as strategies to increase their market share and improve their technological prowess. However, a large number of small and medium-sized enterprises (SMEs) are also very important in the industry, especially in specialty industries and local marketplaces. These SMEs frequently concentrate on offering niche goods and services that are customized to meet the demands of certain clients. They offer flexibility and unique solutions that larger businesses might not be able to. Stricter environmental restrictions and greater awareness of health and safety issues are driving a growing trend in the market towards sustainable and bio-based metalworking fluids.

The key players in the global Metalworking Fluids market include - Exxon Mobil Corporation, BP p.l.c., Chevron Corporation, Chem Arrow Corporation, LUKOIL, China Petroleum & Chemical Corporation (SINOPEC), Valvoline Inc., TotalEnergies SE, FUCHS, Quaker Houghton, Idemitsu Kosan Co. Ltd. among others.

Recent Market Developments

LANXESS Expands North American Partnership with Palmer Holland to Include Industrial Preservatives for Metalworking Fluids

- In 2024, LANXESS Corporation’s Material Protection Products (MPP) business unit broadened its distribution partnership with Palmer Holland. This expansion enhances Palmer Holland’s portfolio to include metalworking fluids and lubricants, following LANXESS’ acquisition of IFF’s microbial control business.

Univar Solutions B.V. Enters Distribution Agreement with Graphics Services Ltd. for Metalworking Fluids and More in Europe

- In January 2023, Univar Solutions B.V. signed a distribution agreement with Graphics Services Ltd. to supply products such as inks, rust preventive oils, coatings, lubricants, and metalworking fluids across Europe.

Clariant Expands Support for Global Metalworking Fluid Manufacturers with High Lubricity Additives

- In September 2022, Clariant announced it would enhance support for metalworking fluid manufacturers worldwide by providing additives for the development of high lubricity and fully-synthetic metalworking fluids.

SKF and Castrol Collaborate to Offer Industrial Lubricant Recycling with 'Oil as a Service'

- In December 2022, SKF and Castrol partnered to offer industrial lubricant recycling through a combined service, integrating SKF's RecondOil solution with Castrol's metalworking lubricants.

The global Metalworking Fluids market can be categorized as Type, Product Type, End Use Industry and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Product Type

By End Use Industry

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 29-Aug-2024

Vantage Market

Research | 29-Aug-2024

FAQ

Frequently Asked Question

What is the global demand for Metalworking Fluids in terms of revenue?

-

The global Metalworking Fluids valued at USD 11.69 Billion in 2023 and is expected to reach USD 16.01 Billion in 2032 growing at a CAGR of 3.55%.

Which are the prominent players in the market?

-

The prominent players in the market are Exxon Mobil Corporation, BP p.l.c., Chevron Corporation, Chem Arrow Corporation, LUKOIL, China Petroleum & Chemical Corporation (SINOPEC), Valvoline Inc., TotalEnergies SE, FUCHS, Quaker Houghton, Idemitsu Kosan Co. Ltd..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 3.55% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Metalworking Fluids include

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Metalworking Fluids in 2023.