Medical Protective Equipment Market

Medical Protective Equipment Market - Global Industry Assessment & Forecast

Segments Covered

By Product Type Surgical Masks, N95 Respirators, Gloves, Protective Clothing, Gowns, Face Shields, Head Cover, Other Products

By Usability Disposable, Reusable

By End User Hospitals & Clinics, Government Organizations, Ambulatory Surgical Centers, Diagnostic & Research Laboratories, Other End Users

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 38.1 Billion | |

| USD 63 Billion | |

| 6.5% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

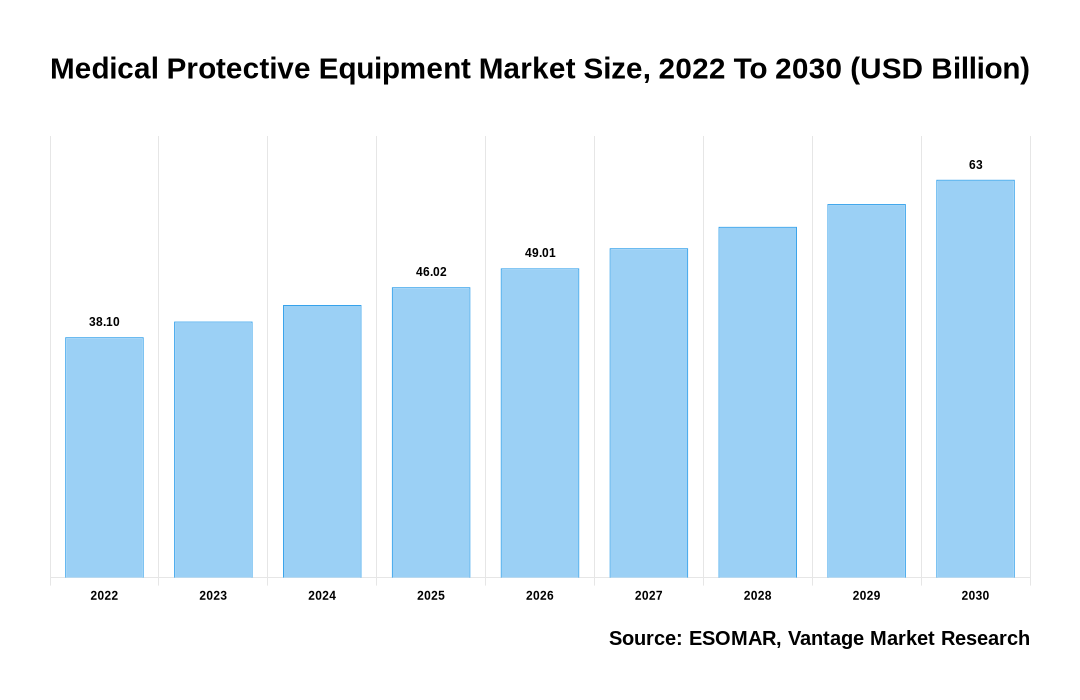

The global Medical Protective Equipment Market is valued at USD 38.1 Billion in 2022 and is projected to reach a value of USD 63 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 6.5% between 2023 and 2030.

Premium Insights

Healthcare spending plays a significant role in the demand for Medical Protective Equipment. The Centers for Medicare & Medicaid Services (CMS) reported that, the National Health Expenditure (NHE) in the United States saw a 2.7% growth in 2022, reaching a staggering $4.3 trillion, equivalent to $12,914 per person. The GDP (Gross Domestic Product) in the U.S. was significantly increased by this spending, which was 18.3% of the GDP. Notably, Medicare spending in the U.S. experienced an 8.4% increase to reach $900.8 billion in 2021, making up 21% of the total National Health Expenditure, while Medicaid spending also surged by 9.2% to reach $734.0 billion, accounting for 17% of the entire National Health Expenditure. This growth in healthcare spending directly impacts the demand for Medical Protective Equipment. Per the Peter G. Peterson Foundation, the total U.S. healthcare spending reached $4.3 trillion in 2021, translating to approximately $12,900 per person. This marked an increase of nearly 3.0% from the previous year.

Medical Protective Equipment Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Medical Protective Equipment Market

- In the United Kingdom, the Office for National Statistics recorded a healthcare expenditure of £280.7 billion in 2021, equivalent to £4,188 per capita, constituting 12.4% of that year’s GDP.

- North America generated more than 42.90% of revenue share in 2022.

- Asia Pacific is expected to grow quickly from 2023 to 2030.

- The gloves segment accounted for the immense market growth and contributed over 28.5% of the total revenue share in 2022.

- The reusable segment revealed the most significant market growth, contributing more than 54.2% of the total revenue share in 2022.

- In 2022, the hospitals and clinics segment generated the most revenue at 34.6%.

Economic Insights

Governments and healthcare institutions worldwide have increased their investments in PPE to ensure the safety of frontline healthcare workers and the general public. In addition, the supply chain for Medical Protective Equipment has faced challenges due to manufacturing and global trade disruptions. Many countries have implemented export restrictions and hoarding of PPE supplies, leading to shortages in some regions. The dependence on a limited number of suppliers, especially in countries like China, has also contributed to supply chain vulnerabilities.

Report Coverage & Deliverables

Get Access Now

Top Market Trends

- Increasing demand for N95 respirators: The COVID-19 pandemic has significantly increased the demand for N95 respirators, which protect healthcare workers from airborne particles and infectious diseases. For example, 3M, a leading manufacturer of N95 respirators, experienced a surge in demand and had to increase production to meet the needs of healthcare facilities.

- Emphasis on manufacturing reusable and eco-friendly protective equipment: With growing environmental concerns, there is a rising trend towards manufacturing reusable and eco-friendly protective equipment. For instance, some companies have introduced reusable cloth masks that can be washed and reused, reducing waste and the need for disposable masks.

- Adoption of innovative technologies: The Medical Protective Equipment market has adopted innovative technologies to enhance safety and comfort. For example, some companies have developed smart masks with built-in sensors to monitor air quality and filter efficiency, providing real-time data to the user.

- Increasing focus on local production: The COVID-19 pandemic exposed the dependency of many countries on international suppliers for Medical Protective Equipment. As a result, there is a growing trend towards promoting local production capabilities to ensure a stable supply chain. Governments are encouraging companies to invest in domestic manufacturing facilities to meet the increasing demand.

- Integration of fashion and aesthetics into protective equipment: The pandemic has led to the integration of style and aesthetics into protective equipment, making them more appealing and comfortable. Some companies have collaborated with fashion designers to create masks and other protective equipment with unique designs and patterns.

Market Segmentation

The Global Medical Protective Equipment Market can be segmented as:

The global Medical Protective Equipment market can be categorized into Product Type, Usability, End User, Region. The Medical Protective Equipment market can be categorized into Surgical Masks, N95 Respirators, Gloves, Protective Clothing, Gowns, Face Shields, Head Cover, Other Products based on Product Type. The Medical Protective Equipment market can be categorized into Disposable, Reusable based on Usability. The Medical Protective Equipment market can be categorized into Hospitals & Clinics, Government Organizations, Ambulatory Surgical Centers, Diagnostic & Research Laboratories, Other End Users based on End User. The Medical Protective Equipment market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East & Africa based on Region.

Based on Product Type

The Glovesholds the largest share

The gloves segment in the Medical Protective Equipment market has witnessed significant growth in 2022. This can be attributed to several factors, including an increase in the number of surgeries and procedures, a rise in the incidence of infectious diseases, and a growing awareness about the importance of hand hygiene among healthcare professionals. Additionally, the increase in the incidence of infectious diseases, such as COVID-19, has led to a surge in demand for gloves. Gloves are a critical personal protective equipment (PPE) item recommended to prevent the spread of infectious diseases. Healthcare professionals and individuals in other industries where contact with potentially contaminated surfaces is common rely on gloves to protect themselves and others from infection.

Based on Usability

The Reusable segment dominates the market

The reusable segment in the Medical Protective Equipment market has been experiencing significant growth in 2022. Cost-effectiveness, environmental sustainability, scientific developments, governmental backing, industry collaborations, and the COVID-19 pandemic's effects are some of the causes that have contributed to this expansion. In addition, in recent times, there has been a growing emphasis on infection control and prevention, especially in healthcare settings. When properly cleaned and sterilized, reusable Medical Protective Equipment can protect against infections adequately. This has prompted healthcare facilities to invest in reusable products to ensure the safety of both healthcare workers and patients.

Based on End-user

Hospitals & Clinics accounted for the Largest Market Share

Hospitals and Clinics experienced the most significant market growth in 2022 owing to the increasing focus on safety and infection control, rising patient volumes, stringent regulations and standards, technological advancements, increasing healthcare expenditure, and the adoption of telemedicine. In addition, healthcare professionals are becoming more aware of the importance of using Medical Protective Equipment to safeguard themselves and their patients from infections. They are increasingly realizing the potential risks associated with their work and are taking proactive measures to ensure their safety. This has contributed to the steady growth of the market.

Based on Region

North America mentioned the Largest Market Share

North America accounted for the most considerable market growth in 2022, primarily attributable to the increasing awareness among its population concerning the utilization of Medical Protective Equipment. Furthermore, elevated levels of air pollution, governmental initiatives, and the introducing of new products are key drivers fostering growth within the examined market in this region. The escalating count of surgical procedures also plays a pivotal role in propelling market expansion, generating a heightened demand for Medical Protective Equipment. For instance, in 2021, the Canadian Institute for Health Information (CIHI) reported a total of 26,456 gallbladder removal surgeries, 22,441 fractures, and 21,941 cesarean surgeries performed in Canada within the 2020-2021 timeframe among individuals aged 18-64. Consequently, this surge in surgical procedures has increased demand for surgical masks and gloves, contributing significantly to market growth in the North American region.

Competitive Landscape

The Medical Protective Equipment market is highly competitive, with many players operating in the industry. These companies range from established multinational corporations to smaller regional manufacturers and distributors. Industry characteristics include intense rivalry, technical improvements, and a constant need to abide by regulations and satisfy client needs. For instance, LG Electronics introduced a cutting-edge electronic face mask designed specifically for the residents of South Korea. Dubbed the "PuriCare Wearable Air Purifier," this innovative mask incorporates two H13 HEPA filters and a respiratory sensor that intelligently adapts the fan speed to the wearer's breathing pattern. Likewise, Optrel has unveiled the P.Air Clear, an N95 respirator officially approved by NIOSH, featuring a transparent window. This clear window enables enhanced communication and facial recognition and ensures adequate protection against airborne particles.

The players in the global Medical Protective Equipment market include 3M Company (U.S.), Ansell Limited (Australia), Cardinal Health Inc. (U.S.), DuPont de Nemours Inc. (U.S.), Hartalega Holdings Berhad (Malaysia), Honeywell International Inc. (U.S.), Kimberly-Clark Corporation (U.S.), Top Glove Corporation (Malaysia), Medline Industries Inc. (U.S.), AMD Medicom Inc. (Canada), Alpha ProTech (Canada) among others.

Recent Market Developments

- In March 2023, The Australian manufacturer of personal protective equipment, Ansell, inaugurated a new manufacturing facility in Perundurai, Tamil Nadu, with an initial investment of $20 million. This facility is dedicated to the production of surgical gloves.

- In December 2022, DuPont officially declared an extended collaboration with Team Rubicon, an organization led by veterans specializing in providing humanitarian assistance to communities before, during, and after disasters and crises.

- In December 2022, Optrel introduced the P. Air Clear, an N95 respirator approved by NIOSH, featuring a transparent window. This clear window enhances communication and facial recognition while protecting against airborne particles.

- In May 2022, Honeywell unveiled two new NIOSH-certified respiratory solutions to address healthcare workers' requirements. These latest additions broaden Honeywell's portfolio of personal protective equipment (PPE) designed for healthcare professionals, drawing upon the company's extensive experience producing respiratory protection solutions over several decades.

Segmentation of the Global Medical Protective Equipment Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Product Type

By Usability

By End User

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 19-Sep-2023

Vantage Market

Research | 19-Sep-2023

FAQ

Frequently Asked Question

What is the global demand for Medical Protective Equipment in terms of revenue?

-

The global Medical Protective Equipment valued at USD 38.1 Billion in 2022 and is expected to reach USD 63 Billion in 2030 growing at a CAGR of 6.5%.

Which are the prominent players in the market?

-

The prominent players in the market are 3M Company (U.S.), Ansell Limited (Australia), Cardinal Health Inc. (U.S.), DuPont de Nemours Inc. (U.S.), Hartalega Holdings Berhad (Malaysia), Honeywell International Inc. (U.S.), Kimberly-Clark Corporation (U.S.), Top Glove Corporation (Malaysia), Medline Industries Inc. (U.S.), AMD Medicom Inc. (Canada), Alpha ProTech (Canada).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 6.5% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Medical Protective Equipment include

- Increasing Number of Surgeries

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Medical Protective Equipment in 2022.