Medical Device Testing Market

Medical Device Testing Market - Global Industry Assessment & Forecast

Segments Covered

By Service Type Testing Services, Inspection Services, Certification Services

By Sourcing Type In-house, Outsourced

By Device Class Class I, Class II, Class III

By Technology Active Implant Medical Device, Active Medical Device, Non-Active Medical Device, In-vitro Diagnostic Medical Device, Ophthalmic Medical Device, Orthopedic and Dental Medical Device, Vascular Medical Device, Other Medical Device Technologies

By Regions North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 9.40 billion | |

| USD 13.26 billion | |

| 4.40% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

Medical Device Testing Market: By Services, Sourcing, Technology, and Region

Market Synopsis:

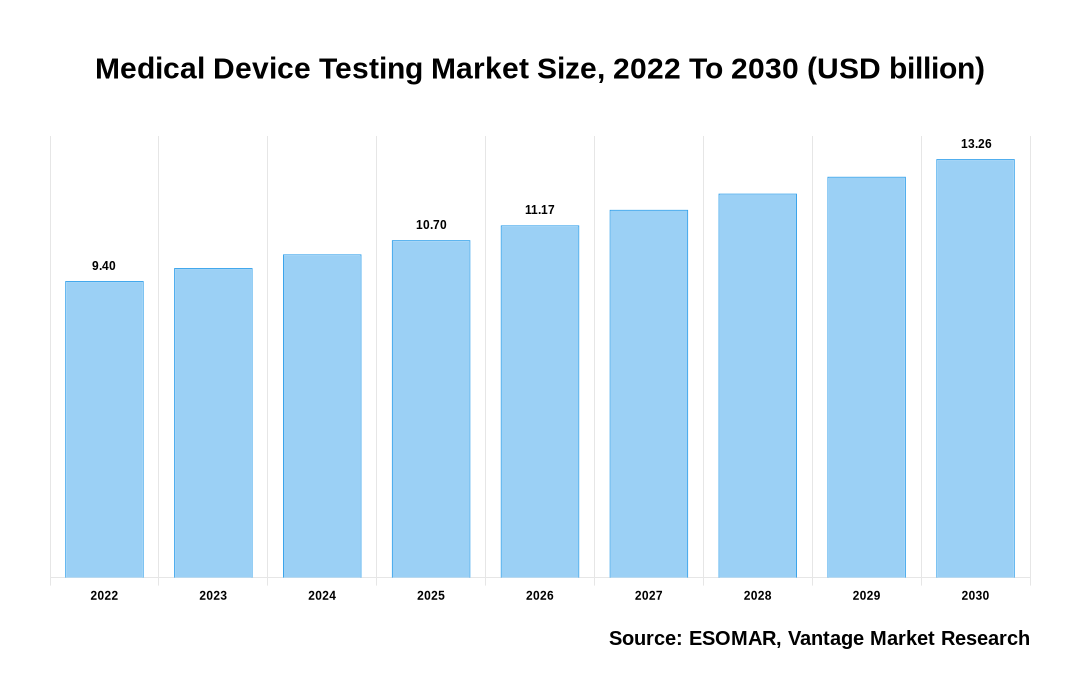

The global Medical Device Testing market is expected to grow from USD 9.40 billion in 2022 to USD 13.26 billion by 2030, at a CAGR of 4.40% during the forecast period 2021–2028.

A rise in medical device recalls has prompted many medical device companies to consider their testing and quality control measures, and this is on the rise. Many of these companies are now conducting independent testing or hiring third-party firms for testing so they can ensure that the devices they sell don't create more harm than good.

Medical Device Testing Market Size, 2022 To 2030 (USD billion)

AI (GPT) is here !!! Ask questions about Medical Device Testing Market

The number of issues related to medical devices is on the rise as well, with over 3,000 such problems reported in 2018 alone. These issues include malfunctions within specific products as well as those instances when a product doesn't quite live up to expectations – no matter how rare those events may be – which might lead patients to file lawsuits. By ensuring that their devices meet certain standards and regulations before selling them, companies can help reduce some of the risks involved.

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Market Segmentation:

The global Medical Device Testing and certification market is segmented into, service type, sourcing type, device class. On basis of service type, market is segmented into testing services, inspection services, certification services, and other services. On basis of sourcing type, market is segmented into in-house and outsourced. On basis of device class, market is segmented into Class I, Class II, and Class III. On basis of technology, market is segmented into active implant medical device, active medical device, non-active medical device, in vitro diagnostic medical device, ophthalmic medical device, orthopedic and dental medical device, and other technologies.

Hospitals and Medical Device Companies are Under Increased Pressure to Outperform

Hospitals and medical device companies are also under increased pressure to ensure that patients get everything they need, even if it means providing multiple devices to make the patient's life easier. This is especially important when it comes to hospital beds, wheelchairs, special wound care equipment, respiratory aids for sleep apnea sufferers and many other specific types of devices.

Another factor playing into this rise in testing has been changes made by regulatory agencies like the FDA (U.S. Food and Drug Administration). These agencies have begun placing stricter controls on certain kinds of procedures involving medical device manufacturers because often times these corporations aren't doing enough to ensure their products do what they're supposed to do putting them out on the market. As a result, manufacturers and hospitals alike are now taking the time to conduct more thorough testing on their products before putting them out there. In addition to this, medical device companies have increased their internal quality control measures so they can catch any issues earlier in the process when it's likely less expensive to fix them.

Testing Services to Dominate the Global Medical Device Testing Market

The Food and Drug Administration (FDA) regulates medical devices, which is a broad category that includes everything from contraceptives to heart valves. It has been estimated that more than 1 million of these products are used in the US every day. Given this huge number, it goes without saying that failure of which can lead to serious injury and even death of the patient. It is therefore, crucial for manufacturers of these devices to be sure their products do not fail. One way they ensure such quality is by subjecting them to stringent tests before releasing them on the market following approval by the FDA on compliance with standards on safety and usefulness.

While device testing is done before they are bought to market, there comes a time when manufacturers must subject their products to further testing to make sure there are no defects. With the need for quality assurance ever increasing, related service industries have sprung up that provide Medical Device Testing services for manufacturers and other businesses.

A lot of these companies offer these services for devices that already made it to the market as well. This is because products may fail after release to the public due to mishandling or use beyond how they were intended by design. A good example of this is faulty heart valves implanted inside patients' bodies which were later found out to be defectively designed leading them malfunction thus requiring replacement surgery.

Asia Pacific to Witness Fastest Growth in Medical Device Testing Market

The medical device market in Asia Pacific is expected to grow at a CAGR of 5.4% during the forecast period propelled by the continuous growth of ageing population coupled with increasing healthcare expenditure management. The growing number of skilled medical professionals and evolving reimbursement framework are further expected to boost the market growth during the forecast period. Asia-pacific accounted for around 32% share of global revenue, growing at a CAGR of 5.4%. China alone accounts for over 35% share of the region's revenue as it comprises a significant portion of total Asian population. India and Japan are other major contributor accounting for more than 45% share of the regional market collectively.

Competitive Landscape:

The med-tech market is full of competition. Huge companies are constantly developing new products to compete for the biggest share of the market. With so many companies in the med-tech business, what's being done to protect consumers? After all, these are life supporting devices people are putting in their bodies. The three largest players in Medical Device Testing industry are Medtronic plc (US), Siemens AG (Germany), and Terumo Corporation (Japan). These companies have seen steady growth over the past five years.

Some of the key players in the global Medical Device Testing market are Medtronic plc (US), Siemens AG (Germany), and Terumo Corporation (Japan), SGS (Switzerland), Eurofins Scientific (UK), Bureau Veritas (UK), Intertek (UK), TÜV SÜD (UK), and DEKRA (UK).

The Medical Device Testing is Segmented as Follows:

| Parameter | Details |

|---|---|

| Segments Covered |

By Service Type

By Sourcing Type

By Device Class

By Technology

By Regions

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Medical Device Testing in terms of revenue?

-

The global Medical Device Testing valued at USD 9.40 billion in 2022 and is expected to reach USD 13.26 billion in 2030 growing at a CAGR of 4.40%.

Which are the prominent players in the market?

-

The prominent players in the market are Medtronic plc (US), Siemens AG (Germany), and Terumo Corporation (Japan), SGS (Switzerland), Eurofins Scientific (UK), Bureau Veritas (UK), Intertek (UK), TÜV SÜD (UK), and DEKRA (UK)..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 4.40% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Medical Device Testing include

- Increasing Trend of Service Outsourcing to Drive the Market

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Medical Device Testing in 2022.