Medical Device Outsourcing Market

Medical Device Outsourcing Market - Global Industry Assessment & Forecast

Segments Covered

By Service Regulatory Affairs Services, Product Design and Development Services, Contract Manufacturing, Quality Assurance, Product Upgrade Services, Product Testing & Sterilization Services, Product Implementation Services, Product Maintenance Services

By Application Cardiology, Orthopedic, Ophthalmic, IVD, Diagnostic Imaging, Drug Delivery, Dental, Endoscopy, Diabetes Care, General and Plastic Surgery, Other Applications

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 129.03 Billion | |

| USD 347.63 Billion | |

| 11.57% | |

| North America | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

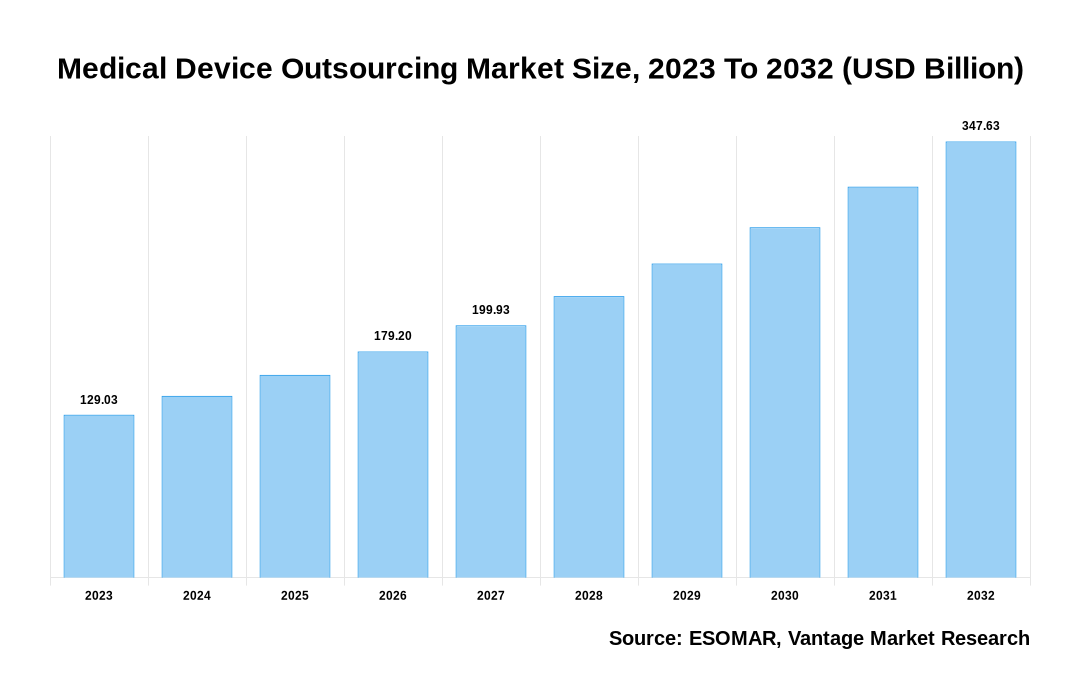

The global Medical Device Outsourcing Market is valued at USD 129.03 Billion in 2023 and is projected to reach a value of USD 347.63 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 11.57% between 2024 and 2032.

Key highlights of Medical Device Outsourcing Market

- The Asia Pacific region contributed the highest market growth, with revenue of 40% in 2023,

- The market is projected to be predominantly led by North America during the forecast period,

- In 2023, the Contract manufacturing segment accounted for major market growth and contributed more than 53.8% of the total revenue share,

- Based on Application, the Cardiology segment accounted for the market share of about 20% in 2023,

- The outsourcing of devices for general and plastic surgery is expected to experience a rapid CAGR of 12.8% between 2024 and 2032,

- The global surge in Cardiovascular diseases, inclusive of conditions like myocardial infarction and atrial traumatic inflammation, is driving the demand for cardiovascular devices. This trend is significantly impacting the outsourcing landscape.

Medical Device Outsourcing Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Medical Device Outsourcing Market

Medical Device Outsourcing Market: Regional Overview

Asia Pacific Dominated Sales with a 40.2% share in 2023. The Asia Pacific region presents lucrative opportunities to expand the medical device outsourcing market. This expansion is attributed to a substantial patient population dealing with various health conditions, particularly neurological and cardiac disorders. Furthermore, most medical device companies choose to manufacture their devices in the Asia Pacific region, primarily due to lower labor costs, advancements in technical expertise, and reduced overhead expenses. Consequently, these combined factors have significantly boosted the growth of the medical device outsourcing market in this geographical area.

The global Medical Device Outsourcing market can be categorized as Service, Application, and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Service

By Application

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Medical Device Outsourcing Market: Service Overview

In 2023, the contract manufacturing segment dominated the market with a 53.8% share. Based on the Service, the market can be categorized into Regulatory Affairs Services (Clinical Trials Applications And Product Registrations, Legal Representation, Regulatory Writing And Publishing), Product Design and Development Services (Designing & Engineering, Molding, Machining, Packaging), Contract Manufacturing (Accessories Manufacturing, Assembly Manufacturing, Component Manufacturing, Device Manufacturing), Quality Assurance, Product Upgrade Services, Product Testing & Sterilization Services, Product Implementation Services, and Product Maintenance Services.

The growing emphasis on reducing production costs fosters this segment’s expansion. The increasing complexities in manufacturing contribute to the overall market growth. Addressing medical device manufacturer’s significant concerns and producing high-quality and safe devices for patient care is paramount. Furthermore, the stringent inspection requirements in medical device development have led to the establishment of numerous standards and regulations, thereby generating a demand for manufacturing services.

Medical Device Outsourcing Market: Application Overview

In 2023, the cardiology segment accounted for over 20% market share. The Application segment is divided into Cardiology, Orthopedic, Ophthalmic, IVD, Diagnostic Imaging, Drug Delivery, Dental, Endoscopy, Diabetes Care, General and Plastic Surgery, and Others. The high occurrence of conditions like angina pectoris, myocardial infarction, hypertensive heart disease, rheumatic heart disease, atrial fibrillation, and congenital heart disease is driving the augmented demand for cardiovascular devices at the global level. Additionally, the high complexity of cardiovascular devices, the need for technical expertise, and the manufacturing of such devices may contribute to higher costs for original equipment manufacturers (OEMs), potentially leading to increased outsourcing of these devices.

Key Trends

- The market is experiencing growth propelled by the escalating complexity of medical device manufacturing. This complexity necessitates specialized expertise and resources, prompting companies to engage in outsourcing partnerships.

- The industry is witnessing a strong trend toward cost optimization, with companies strategically outsourcing various aspects of medical device production to enhance efficiency and reduce overall manufacturing expenses.

- The heightened level of inspection and stringent regulatory compliance standards in the development of medical devices are influencing outsourcing decisions. Companies are seeking manufacturing services that align with these regulatory demands.

- Companies are dynamically adapting to evolving market dynamics, including shifts in consumer preferences and advancements in healthcare practices. This adaptability is driving strategic decisions regarding outsourcing partnerships.

Premium Insights

The medical device industry is undergoing a notable shift characterized by its technology-driven and swiftly expanding nature, leading to heightened and diverse competition among companies. New entrants leverage outsourcing to enhance competitiveness by efficiently sourcing necessary resources or through strategic acquisitions. The rise in the medical device market is attributed to demographic shifts, notably population aging, and the burgeoning economies of emerging countries such as China, India, and Latin America. The World Health Organization’s findings underscore the potential social burden arising from increased medical supply and expenses for the elderly, necessitating advanced solutions for diseases prevalent in this demographic. Established industry players are adopting outsourcing strategies across various operations, including research and development, manufacturing, services, and licensing. The outsourcing market within the medical device sector is poised for substantial growth, with a forecasted annual increase of 10.5% by 2025.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool : Vantage Point

Economic Insights

Adopting a variable cost structure through medical device outsourcing presents substantial economic advantages for branded manufacturers. This strategic outsourcing approach enables Original Equipment Manufacturers (OEMs) and Contract Development and Manufacturing Organizations (CDMOs) to optimize operational costs, enhancing financial flexibility. Over the long term, there is an anticipated trend of greater alignment between OEMs and CDMOs regarding economic and risk management incentives. This alignment is crucial for sustaining financial flexibility while establishing robust protocols to refine forecasting accuracy and proactively identify and mitigate potential bottlenecks in the production process. This integrated approach not only supports cost efficiency but also ensures a resilient and agile supply chain in the dynamic landscape of the medical device industry.

Competitive Landscape

Key players in this sector include established firms with extensive experience and a comprehensive portfolio of outsourcing services. These services often cover the entire product lifecycle, from research and development to regulatory compliance and manufacturing. Furthermore, companies are increasingly forming strategic outsourcing partnerships to navigate the intricate landscape of medical device production. Collaborative efforts are aimed at leveraging external expertise and capabilities.

The key players in the global Medical Device Outsourcing market include - Eurofins Scientific (Luxembourg), Integer Holdings Corporation (U.S.), Pace Analytical Services LLC (U.S.), Intertek Group PLC (UK), Plexus Corp. (U.S.), IQVIA Inc. (U.S.), North American Science Associates LLC (U.S.), Charles River Laboratories (U.S.), West Pharmaceutical Services Inc. (U.S.), WuXi AppTec (China), TE Connectivity (Switzerland), Freyr Solutions (Singapore) among others.

Recent Market Developments

- In August 2023, Eurofins Scientific, a prominent global provider of testing services for biopharmaceutical products, entered into an outsourcing agreement with Astellas. This agreement involves outsourcing one of Astellas’ internal testing laboratories, specifically Astellas Analytical Science Laboratories Inc.

- In September 2022, NAMSA, a prominent MedTech Contract Research Organization (CRO) providing comprehensive development services worldwide, partnered with InspireMD, Inc. and announced a strategic outsourcing collaboration to speed up the development and commercialization of medical devices.

FAQ

Frequently Asked Question

What is the global demand for Medical Device Outsourcing in terms of revenue?

-

The global Medical Device Outsourcing valued at USD 129.03 Billion in 2023 and is expected to reach USD 347.63 Billion in 2032 growing at a CAGR of 11.57%.

Which are the prominent players in the market?

-

The prominent players in the market are Eurofins Scientific (Luxembourg), Integer Holdings Corporation (U.S.), Pace Analytical Services LLC (U.S.), Intertek Group PLC (UK), Plexus Corp. (U.S.), IQVIA Inc. (U.S.), North American Science Associates LLC (U.S.), Charles River Laboratories (U.S.), West Pharmaceutical Services Inc. (U.S.), WuXi AppTec (China), TE Connectivity (Switzerland), Freyr Solutions (Singapore).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 11.57% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Medical Device Outsourcing include

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Medical Device Outsourcing in 2023.

Vantage Market

Research | 18-Feb-2024

Vantage Market

Research | 18-Feb-2024