Injection Moldings Market

Injection Moldings Market - Global Industry Assessment & Forecast

Segments Covered

By Machine Type Hydraulic, Electric, Hybrid

By End-Use Industry Automotive, Consumer Goods, Packaging, Healthcare, Electrical electronics, Others

By Product Type Plastic, Rubber, Metal, Ceramic, Others

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 262.9 Billion | |

| USD 394.3 Billion | |

| 5.20% | |

| Asia Pacific | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

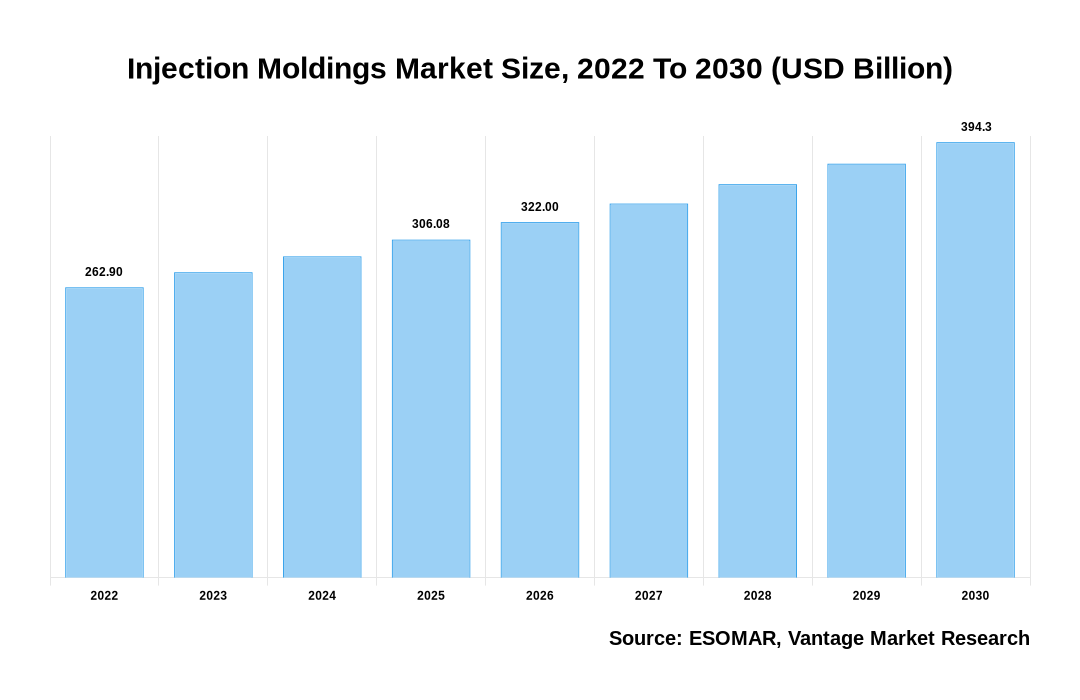

The global Injection Moldings Market is valued at USD 262.9 Billion in 2022 and is projected to reach a value of USD 394.3 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 5.20% between 2023 and 2030.

Premium Insights

Injection Moldings equipment includes mechanical machinery that use Injection Moldings methods to produce injection-molded plastic items. Injection Moldings equipment with clamping force proportions ranging from less than 200 tons to more than 500 tons is available in the industry. Plastics, rubber, metal, and ceramics are manufactured using Injection Moldings equipment. It is composed of two key components: an injection unit that functions similarly to an extruder and a clamping unit that is connected to mold operation. The Injection Moldings machine improves product precision, flexibility, and energy efficiency in the manufacturing process, assisting in the production of a wide range of products.

Injection Moldings Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Injection Moldings Market

- The rising need for huge quantities of thousands of identical parts at lower costs, combined with design flexibility and precision from various end-user sectors such as wrapping, medical, and electronics, is likely to fuel market expansion.

- In 2022, injection molding in plastics led the market.

- Asia-Pacific showed its market strength in 2022, attaining the greatest revenue share of 40.60%.

- Between 2023 and 2030, the North American region is projected to increase at a significant compound annual growth rate (CAGR).

Top Market Trends

- Bridge tooling is appropriate for fine-tuning the process, evaluating project ROI, and testing prior to market entry. These supportive measures have boosted market growth in the Injection Moldings industry.

- Growth is likely to be driven by the expanding packaging and medical device industries. Manufacturing injection molded components in-house by OEMs can be a considerable challenge in terms of productivity, cost, and quality. Many players are opting for Injection Moldings service outsourcing because it provides strategy optimization, streamlined inventory, economies of size, quick start-up time, and increased quality, among other benefits.

- Injection Moldings is becoming more popular for producing lightweight and durable materials such as carbon fiber and glass fiber-reinforced polymers. These materials are utilized in a wide range of applications, including automobile parts, aircraft components, and sporting goods.

- Increased demand for complicated and accurate parts: Injection Moldings can be used to create complicated, accurate parts with close tolerances. As a result, it is suitable for a wide range of industries, including electronics, medical devices, and aerospace.

- To fulfill the increased need for complicated and precise parts, new Injection Moldings technologies such as multi-material Injection Moldings and two-shot Injection Moldings are being developed. These technologies enable the manufacturing of multi-material or multi-color parts in a single Injection Moldings process.

- Sustainable Injection Moldings technologies and materials are in high demand. This is being driven by both consumers and businesses seeking solutions to lessen their environmental effects.

Report Coverage & Deliverables

Get Access Now

Economic Insights

Injection Moldings is a time-consuming and labor-intensive technique. There may be fewer skilled individuals accessible to work in Injection Moldings plants during times of economic distress. Injection Moldings companies may struggle to meet demand as a result of this. Tariffs on imported or exported commodities might result from trade wars. This can increase the cost of Injection Moldings for both enterprises that import raw materials and companies that export final goods. Currency fluctuations might also have an impact on the growth of the Injection Moldings market. If the value of the local currency falls, foreign molding by injection tools and machinery may become more expensive. It may be difficult for Injection Moldings companies to make investments in new equipment as a result of this.

Market Segmentation

Injection Moldings The global Injection Moldings market can be categorized into Machine Type, End-Use Industry, Product Type, Region. The Injection Moldings market can be categorized into Hydraulic, Electric, Hybrid based on Machine Type. The Injection Moldings market can be categorized into Automotive, Consumer Goods, Packaging, Healthcare, Electrical electronics, Others based on End-Use Industry. The Injection Moldings market can be categorized into Plastic, Rubber, Metal, Ceramic, Others based on Product Type. The Injection Moldings market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East & Africa based on Region.

Based on Product Type

Plastic to Lead Maximum Market Share Due to the Low-Cost Technology

In 2022, the Plastic segment is poised to dominate the global market for Injection Moldings because of the low-cost technology that plastic provides for high-volume manufacturing runs and applications that require design consistency and precise tolerances. Recent advances to reduce the rate of faulty manufacture have promoted mass production of sophisticated plastic structures, particularly in packaging, consumer goods, and construction, boosting industry growth. Because of features such as strong tensile strength, higher metal tolerance, and high-temperature endurance, the need for plastic resins in injection molding is increasing. Furthermore, these resins offer a reduction in manufacturing waste, product weight, and total manufacturing costs, consequently boosting industry growth.

Based on End-Use Industry

Packaging Segment Expects Dominion Owing to the Growing Investments in Food Processing and Pharmaceuticals

In 2022, the Packaging segment will dominate the Injection Moldings market. Changes in consumer tastes, sustainability, and e-commerce penetration are driving up demand for injection molding in packaging. Furthermore, rising investments in the food processing, pharmaceutical, and personal care industries are growing the need for packaging items as a service. The growth of the injection moulding market is anticipated to be significantly influenced by the artificial intelligence, development of smartphones, and voice recognition technologies, as well as by the existence of organisations focused on technology. Rising demand for connectors, plug connectors, sensors, electronic components, and other electronics, as well as electronic components and other electronics, is likely to drive growth.

Based on Region

Asia Pacific To Dominate Global Sales Owing to High Demand for Increased Investments in Packaging and Medical Sector

In 2022, the Asia Pacific region emerged as the dominant player in the Injection Moldings market. A favorable industrial growth environment, abundant raw materials, low-cost labor, and increased investments in packaging, medical, and electronics applications are likely to drive demand for these items over the projection period. Rising healthcare expenditures and an older population are expected to boost medical sector growth in North America. China is a substantial client due to its growing population and rapid urbanization, which has grown the regional Injection Moldings market. Furthermore, China's Injection Moldings market had the biggest market share, while India's Injection Moldings market was the region's fastest-growing market.

The Injection Moldings industry in North America is rapidly growing in popularity. The advancement of medical technologies, the increased usage of smartphones, the development of lightweight automotive components, and the growth of the construction industry have all increased the demand for plastic injection molding in this region. With a revenue of USD 20891 million in 2022, the United States is the region's largest market. North America's hospitalization rate has risen, fuelling demand for healthcare injection molding services. Furthermore, fast innovation in the container and vehicle industries is expected to drive market growth.

Competitive Landscape

The global Injection Moldings market is highly competitive, with various key players operating in the industry. Some of the major companies in the market include C&J INDUSTRIES; Formplast GmbH; All-Plastics; Biomerics; HTI Plastics; The Rodon Group; EVCO Plastics; Majors Plastics, Inc.; Tessy Plastics; Proto Labs, Inc.; Currier Plastics, Inc.; H&K Müller GmbH & Co. KG; Hehnke GmbH & Co KG; TR PLAST GROUP; D&M Plastics, LLC. These businesses are concentrating their efforts on research and development in order to create unique and long-lasting products. Furthermore, strategic alliances, mergers, and acquisitions are common in the industry as organizations strive to extend their product offerings and market presence.

The key players in the global Injection Moldings market include - C&J INDUSTRIES; All-Plastics; Biomerics; HTI Plastics; The Rodon Group; EVCO Plastics; Majors Plastics, Inc.; Proto Labs, Inc.; Tessy Plastics; Currier Plastics, Inc.; Formplast GmbH; H&K Müller GmbH & Co. KG; Hehnke GmbH & Co KG; TR PLAST GROUP; D&M Plastics, LLC among others.

Recent Market Developments

- In August 2023, BASF announced the creation of PA 6.10 CF, a novel bio-based nylon resin created from renewable resources and bonded with carbon fiber for additional strength and stiffness. The new resin is likely to be used in a wide range of applications, such as automobile parts, sporting goods, and electronics.

- In October 2022, Evco Plastics proposed a USD 11 million expansion of manufacturing capacity in Wisconsin, USA. The company now operates 183 Injection Moldings machines.

- In July 2022, ALPLA spent $850,000 on a mold shop in India. The mold shop in India will be the company's third such plant, following those in Austria and Germany. The Indian mold shop may be able to create local solutions using global technologies. ALPLA's total investment in Pashamylaram, India, may rise to USD 61 million as a result of this venture.

Segmentation of the Global Injection Moldings Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Machine Type

By End-Use Industry

By Product Type

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Injection Moldings in terms of revenue?

-

The global Injection Moldings valued at USD 262.9 Billion in 2022 and is expected to reach USD 394.3 Billion in 2030 growing at a CAGR of 5.20%.

Which are the prominent players in the market?

-

The prominent players in the market are C&J INDUSTRIES; All-Plastics; Biomerics; HTI Plastics; The Rodon Group; EVCO Plastics; Majors Plastics, Inc.; Proto Labs, Inc.; Tessy Plastics; Currier Plastics, Inc.; Formplast GmbH; H&K Müller GmbH & Co. KG; Hehnke GmbH & Co KG; TR PLAST GROUP; D&M Plastics, LLC.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 5.20% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Injection Moldings include

- High demand from packaging industry

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Injection Moldings in 2022.