Industrial Gases Market

Industrial Gases Market - Global Industry Assessment & Forecast

Segments Covered

By Type Nitrogen , Oxygen , Carbon Dioxide, Hydrogen , Noble Gas , Others

By Application Manufacturing , Healthcare , Food & Beverages , Metallurgy & Glass , Chemicals & Energy , Retail , Others

By Distribution On-site, Bulk (Liquid Gas Transport) , Cylinder (Merchant)

By Region North America, Europe, Asia Pacific , Latin America , Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 97.52 Billion | |

| USD 158.35 Billion | |

| 6.3% | |

| North America | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

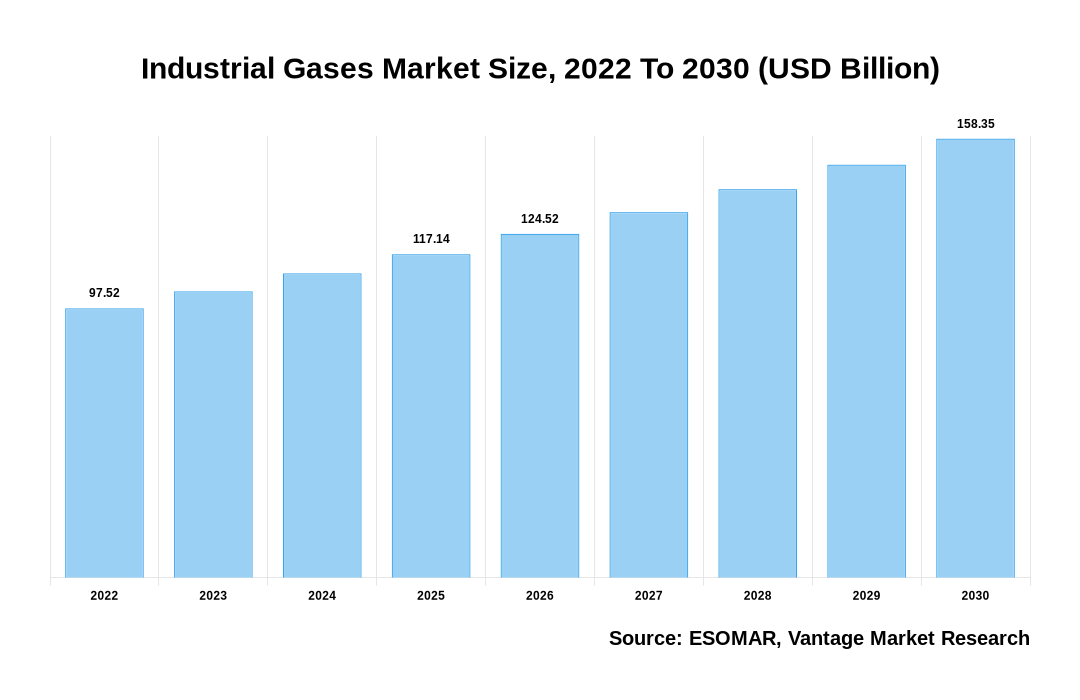

The global Industrial Gases Market is valued at USD 97.52 Billion in 2022 and is projected to reach a value of USD 158.35 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 6.3% between 2023 and 2030.

Premium Insights

The Industrial Gases market has tremendous growth during forecast period due to several factors. The need for industrial gases, which fuel critical operations like metalworking, chemical manufacture, and energy generation, is continuing to rise as a result of the boom in global industrialization and manufacturing activity. The switch to cleaner energy sources, motivated by environmental concerns, stimulates the need for gases like hydrogen in the creation of renewable energy. Industrial Gasesare also necessary due to the healthcare industry's continued expansion for medical procedures, diagnostics, and respiratory treatments. For instance, China increased its funding for public hospitals by two times to USD 38 billion during the previous five years. By 2030, it hopes to more than double the size of the healthcare industry by increasing its worth to USD 2.3 trillion. The Chinese government began implementing measures to encourage and support indigenous medical device innovation, creating market prospects.

Industrial Gases Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Industrial Gases Market

- Technological advancements in the healthcare industry, particularly the growth of suppliers of gas-assisted equipment in the medical industry, are boosting demand for Industrial Gases. For instance, A sizeable fraction of Europe's pharmaceutical companies are represented by the European Federation of Pharmaceutical Industries and Association (EFPIA). 39 of the top pharmaceutical corporations in Europe are represented, along with 36 national pharmaceutical organizations.

- Asia Pacific generated more than 38.5% of revenue share in 2022

- North America is expected to grow at the quickest rate from 2023 to 2030

- Oxygen segment accounted for the largest market growth. It contributed over 26.5% of the total revenue share in 2022 due to its widespread use in industries like metalworking, healthcare, and energy production

- Manufacturing segment revealed the most significant market growth, contributing more than 26.9% of the total revenue share in 2022

- Cylinder (Merchant) segment accounts for largest revenue of 35.8% in 2022

Economic Insights

The Industrial Gases has grown significantly. Industrialization, manufacturing, and energy production are all directly related to increase, which has a significant impact on the demand for Industrial Gases. Key users include the metalworking (27% of the market share), chemical processing (18%), energy (16%), and healthcare (14%) sectors. Economic changes have an impact on the market's trajectory as well; during periods of strong economic expansion, industrial gas consumption can increase by up to 5%, while economic contractions may result in a brief decrease in demand.

Report Coverage & Deliverables

Get Access Now

Top Market Trends

- Growing focus on sustainability: In the industrial gas sector, sustainability is becoming increasingly important. Businesses are attempting to lessen their negative environmental effects, and they are employing Industrial Gasesto do it. Industrial gases, for instance, can be used to lower emissions and increase energy efficiency.

- Technological advancements: New technologies are continuously being introduced, and the industrial gas sector is continually changing. Industrial Gases are becoming safer, more dependable, and more efficient thanks to this new technology.

- Automation and digitalization: To improve the processes for producing, delivering, and monitoring gas, industry players are implementing automation and digital technology. The productivity, safety, and customer service are improved through IoT-enabled sensors and data analytics.

- Rapid manufacturing and processing expansion: There is a rising need for gases across a variety of industries as a result of worldwide production operations. Industrial Gases like oxygen, nitrogen, and hydrogen are increasingly in demand as businesses grow into new areas to support vital activities like combustion, cooling, and chemical reactions.

- Rising popularity and broad integration of electronic devices: The importance of Industrial Gases in complex manufacturing procedures for electronic components, from semiconductor fabrication to display manufacture and circuit board assembly, is highlighted by this development. Precision electronics manufacturing requires the use of precise and highly pure gases, such as nitrogen and helium, to create contamination-free conditions.

Market Segmentation

Industrial Gases The global Industrial Gases market can be categorized into Type , Application , Distribution, Region. The Industrial Gases market can be categorized into Nitrogen , Oxygen , Carbon Dioxide, Hydrogen , Noble Gas , Others based on Type . The Industrial Gases market can be categorized into Manufacturing , Healthcare , Food & Beverages , Metallurgy & Glass , Chemicals & Energy , Retail , Others based on Application . The Industrial Gases market can be categorized into On-site, Bulk (Liquid Gas Transport) , Cylinder (Merchant) based on Distribution. The Industrial Gases market can be categorized into North America, Europe, Asia Pacific , Latin America , Middle East & Africa based on Region.

Based on Type

Oxygen holds the largest share

The Industrial Gases market is expected to be dominated by the oxygen gas because of its widespread across a wide range of sectors. It emerges as a critical catalyst in the field of metalworking, accelerating fuel combustion in key procedures like welding, cutting, and smelting. At the same time, its crucial function in chemical processing manifests, giving rise to a vast array of compounds including fertilizers, polymers, and explosives. Beyond this, oxygen turns its focus to the energy industry, directing the creation of energy from both established renewable sources and conventional fossil fuels. Its significance is seen most strongly in the field of medicine, where it serves as a lifeline for patients with respiratory illnesses in hospitals and clinics.

Based on Application

Manufacturing will dominate the market during Forecast Period

The Industrial Gases market is anticipated to be dominated by the manufacturing application segment. The numerous functions Industrial Gases play throughout operations in this industry are the source of this magnetism in manufacturing. The power couple of oxygen and acetylene take center stage when it comes to welding and cutting. In the meantime, the field of chemical processing harnesses the manufacturing of industrial gases, giving rise to a variety of chemicals including fertilizers, polymers, and explosives.

Based on Distribution

Cylinder (Merchant) will account for largest market share

The cylinder (merchant) category is expected to dominate the Industrial Gases market in 2022, due to its characteristic is user-friendliness, which boasts seamless transportability and usability, making it the go-to option for businesses that frequently require moderate quantities of industrial gases. Additionally, because cylinders are an affordable alternative, it aligns with organizations operating on tight budgets due to its cost-efficiency.

Based on Region

Asia Pacific will lead the market

Asia Pacific is expected to dominate the market for Industrial Gases due to expanding manufacturing industry, which consumes the most industrial gas overall, is foremost among these. Asia Pacific sets a challenging stage with manufacturing powerhouses like China, India, and Japan dotting its vastness. The region develops itself as one of the world's fastest expanding economies, which further supports its ascent. This uptick stimulates increased demand for Industrial Gasesin a variety of industries, such as manufacturing, healthcare, and energy.

Competitive Landscape

The global Industrial Gases market is fragmented, including a diverse array of the presence of several key players, emerging players are capitalizing on specialized solutions, eco-friendly practices, and technological innovations. The industry's evolution hinges on innovation, adaptability, and responsiveness to industry shifts, driving advancements in production, distribution, and tailored solutions across sectors.For instance, in march 2023, A significant player in the industrial gas market, Air Liquide, announced spending about EUR 60 million (about USD 65.64 million) to upgrade two Air Separation Units (ASUs) that the Group uses in the Tianjin industrial basin in China. This statement relates to the extension of a long-term Industrial Gasessupply agreement with Tianjin Bohua Yongli Chemical Industry Co., Ltd. ("YLC"), a BohuaGroup subsidiary.

The players in the global Industrial Gases market include Air Liquide S.A., Yingde Gases Group Company Limited, Airgas Inc., Linde Group, Buzwair Industrial Gases Factories, Messer Group, Taiyo Nippon Sanso Corporation, Air Products and Chemicals Inc., BASF SE, Air Water Incorporation. among others.

Recent Market Developments

- February 2022: In order to deliver hydrogen and steam, Linde stated that it had inked a long-term contract with BASF. The capacity of Linde in the chemical park at Chalampé, France, will be essentially doubled by the construction and operation of a new hydrogen production facility. The new BASF hexamethylenediamine (HMD) production facility will be supplied by this plant. In the first half of 2024, the plant is anticipated to come online.

- January 2022: In Kosi, Uttar Pradesh, India, Air Liquide will invest in a new Air Separation Unit (ASU) devoted to Industrial Merchant activities. 350 tons of oxygen may be produced by this unit per day, up to a maximum of 300 tons. This ASU, which is expected to begin operations by the end of 2023, will be constructed, owned, and run by Air Liquide India.

Segmentation of the Global Industrial Gases Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Type

By Application

By Distribution

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Industrial Gases in terms of revenue?

-

The global Industrial Gases valued at USD 97.52 Billion in 2022 and is expected to reach USD 158.35 Billion in 2030 growing at a CAGR of 6.3%.

Which are the prominent players in the market?

-

The prominent players in the market are Air Liquide S.A., Yingde Gases Group Company Limited, Airgas Inc., Linde Group, Buzwair Industrial Gases Factories, Messer Group, Taiyo Nippon Sanso Corporation, Air Products and Chemicals Inc., BASF SE, Air Water Incorporation..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 6.3% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Industrial Gases include

- Growing Demand for industrial gases in healthcare sector

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Industrial Gases in 2022.