Industrial Enzymes Market

Industrial Enzymes Market - Global Industry Assessment & Forecast

Segments Covered

By Formulation Lyophilized, Liquid, Dry

By Source Microorganism, Plant, Animal

By Application Food & Beverages, Bioethanol, Textiles & Leather, Detergents, Paper & Pulp, Wastewater Treatment, Feed, Soil Treatment, Oil Treatment, Other Applications

By Type Carbohydrates, Amylases, Cellulases, Other Carbohydrates , Proteases, Lipases, Polymerases & Nucleases, Other Types

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 7.1 Million | |

| USD 11.1 Million | |

| 6.1% | |

| USD 2.7 Million | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

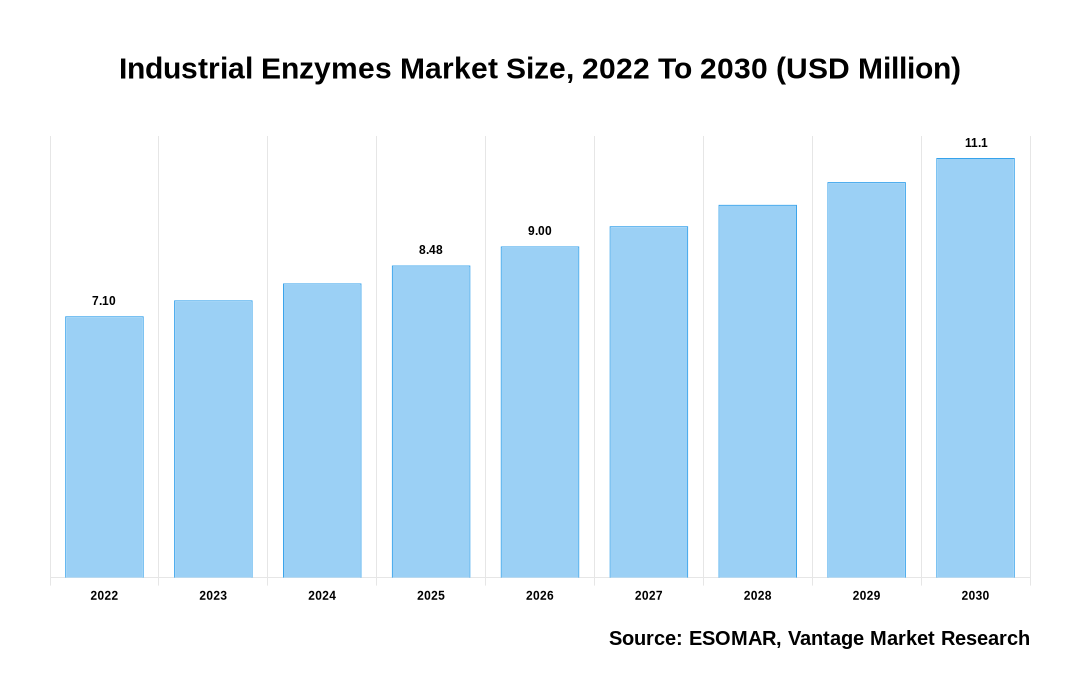

The global Industrial Enzymes Market is valued at USD 7.1 Million in 2022 and is projected to reach a value of USD 11.1 Million by 2030 at a CAGR (Compound Annual Growth Rate) of 6.1% between 2023 and 2030.

Premium Insights

The Industrial Enzymes market's expansion is driven by surg in demand from end-use industries such as animal feed, household cleaning, biofuel, and food and beverage. Growing demand for carbohydrase and proteases in food and beverage applications, particularly in Asia Pacific's emerging economies such as China, India, and Japan, is likely to drive the market. Furthermore, prosperity in developed economies may be attributed to increased industrialization and advancements in the nutraceutical sector. Such factors have significantly increased product demand.

Industrial Enzymes are expected to be in high demand in the animal feed and nutraceutical industries, propelling the industry forward. Furthermore, as consumer health awareness grows, so will the need for functional foods, driving rising product demand in the coming years. The high temperature and pH sensitivity of enzymes, as well as item handling security difficulties, are among the industry's challenges. These factors are predicted to have a direct impact on market growth. Key firms are likely to gain from increased utilization of their products in various end-use industries, including food and beverages, animal feed, biofuels, and diagnostics.

Customers want higher-quality goods with more natural flavour and taste. As a result of this development, there is an increased demand for flavored and appealing processed foods based on industrial enzyme applications. These enzymes act as catalysts in metabolic reactions by breaking down vitamins and minerals and reducing complex chemicals to smaller molecules. These characteristics are expected to drive market expansion.

Industrial Enzymes Market Size, 2022 To 2030 (USD Million)

AI (GPT) is here !!! Ask questions about Industrial Enzymes Market

Economic Insights

Russia and Ukraine are both key markets for industrial enzymes, with various industries relying on these enzymes for multiple purposes. The war could disrupt these markets, affecting regional demand for industrial enzymes. The conflict's insecurity and economic issues may cause a drop in industrial activity, reducing the need for enzymes in industries such as food and drinks, textiles, biofuels, and pharmaceuticals. In response to the war, enzyme manufacturers may seek alternate raw material suppliers or contemplate relocating their manufacturing sites. This change could entail diversifying supply chains to lessen reliance on Ukraine or seeking new markets for agricultural commodities sourcing. Such changes may result in rearranging manufacturing capacity and trade flows in the industry.

Top Market Trends

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

- Advancements in enzyme engineering: In recent years, advances in enzyme engineering and biotechnology have enabled the manufacture of highly efficient and selective enzymes for industrial applications. Enzymes can be modified via genetic engineering and protein engineering approaches to have improved properties such as higher stability, increased catalytic activity, and resistance to harsh operating conditions. These advances in enzyme engineering have broadened the range of industrial processes in which enzymes may be used, fueling market development. In addition, enzymes are frequently used to produce detergents and cleaning products. They aid in the breakdown and removal of various stains and grime, increasing cleaning efficiency. Proteases, lipases, and amylases are enzymes widely found in laundry detergents, dishwashing solutions, and industrial cleaning products. The usage of enzymes in cleaning products is projected to increase as the need for effective and environmentally friendly cleaning solutions grows.

- Focus on sustainable and eco-friendly solutions: The industrial enzymes market is influenced by sustainability and environmental concerns. Enzymes provide several advantages over typical chemical catalysts, including lower energy consumption, less waste formation, and softer reaction conditions. Enzymes are biodegradable and hence offer less of a threat to human health and the environment. As a result, industries across a wide range are increasingly turning to enzymes as a sustainable alternative to traditional chemical processes, fueling the growth of the industrial enzymes market. In addition, biofuel production has increased in response to growing concerns about greenhouse gas emissions and the need for sustainable energy sources. Industrial enzymes, notably cellulases, and amylases, are essential in converting biomass into biofuels like ethanol and biodiesel. As governments and companies focus on renewable energy alternatives, the need for industrial enzymes in biofuel production will rise further.

Market Segmentation

The global Industrial Enzymes market can be categorized on the following: Formulation, Source, Type, Application, and Regions. Based on Formulation, the market can be categorized into Lyophilized, Liquid, and Dry. Based on Source, the market is sub-segmented into Microorganism, Plant, and Animal. By Type, the market is further classified into Carbohydrases, Amylases, Cellulases, Other Carbohydrases, Proteases, Lipases, Polymerases & Nucleases, and Other types. Additionally, by Application, the market can be split between Food & beverages, Detergents, Feed, Bioethanol, Soil treatment, Paper & Pulp, Textiles & Leather, Wastewater treatment, Oil treatment, and Other applications. Likewise, based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Product

Carbohydrase Product to Accomplish Maximum Market Share due to Its Increasing Use in Numerous Industries

In 2022, the carbohydrase product segment dominated the market. This is due to its expanding application in various industries, such as animal feed, pharmaceuticals, and food and beverages. It is primarily used as a catalyst in converting carbohydrates into sugar syrups like fructose and glucose, which are used in the pharmaceutical, food, and beverage industries. It is utilized to produce artificial sweeteners and prebiotic goods like isomaltose for juices and wines.

Based on Application

Food and Beverage Application to Mention Dominion owing to the Increasing Utilization of Enzymes in the Production Process

In 2022, the food and beverage application segment dominated the market. This is due to the increased use of enzymes in manufacturing food and beverage items. Cheese processing, vegetable and fruit processing, oils, and fats processing, grain processing, and other food processing industries such as baking, dairy, and brewing use customized enzyme solutions and patented enzyme products. Proteases, lipases, and carbohydrases are the most often used enzymes in the food and beverage industry.

Based on Source

Microorganisms Source to Show Dominion owing to Its Easy Availability and Low Production Cost

In 2022, the microorganisms source category led the market. This is due to the low cost of production and the ease with which microorganisms are available to enzyme makers. Microorganism-derived enzymes are categorized into three types: bacterial, fungal, and yeast enzymes. Most of these items are used in detergent, culinary, and pharmaceutical applications.

Based on Region

Asia Pacific to Lead Global Sales owing to Increasing Technological Advancement

Continuous advances in enzyme engineering and biotechnology are broadening the variety of industrial enzyme uses. Enzymes can be tailored and optimized to accomplish specific tasks, increasing efficiency and performance. This expands the use of enzymes in industries such as biofuels, medicines, and animal feed. The Asia Pacific area, noted for its biotechnology achievements and research capacities, is at the forefront of these developments and drives demand for advanced industrial enzymes. In addition, food and drinks, textiles, medicines, biofuels, and detergents are among the fast-increasing industries in the Asia Pacific region. Industrial enzymes are used in various industries, including food processing, textile manufacture, medication synthesis, and biofuel production. These sectors' rising volume and complexity fuel the demand for enzymes to improve manufacturing processes and product quality.

North America's market was quickly expanding in 2022. Factors such as the growth of the food and beverage industry, environmental sustainability concerns, biofuel production, developments in biotechnology, stringent regulations, and increased research and development initiatives boost demand for industrial enzymes in the North American area. Industrial enzyme research and development activities are growing in North America. Academic institutions, research organizations, and industry players are funding enzyme discovery, engineering, and optimization. This focus on R&D resulted in the development of innovative enzymes with improved characteristics and expanded capabilities, fuelling demand for industrial enzymes.

Competitive Landscape

Numerous international and regional actors compete fiercely on the global market. Major firms form strategic alliances, mergers and acquisitions, and joint ventures to gain a competitive advantage. Furthermore, producers focus on capacity expansions and R&D for new product development to provide consumers with trend-setting products. Novozymes announced a merger with Chr. Hansen, a Danish agricultural, pharmaceutical, and food component firm, in December 2022. This transaction is a strategic move by Novozymes to improve its market position.

The key players in the global Industrial Enzymes market include - BASF SE (Germany), Novozymes (Denmark), DuPont (U.S.), DSM (Netherlands), ABF (UK), Kerry (Ireland), Advanced Enzyme Technologies (India), CHR. Hansen (Denmark), Amano Enzyme Inc. (Japan), Aumgene Biosciences (India), Megazyme (Ireland), Enzyme Supplies (UK), Creative Enzymes (U.S.), Enzyme Solutions (U.S.), Enzymatic Deinking Technologies (U.S.), Biocatalysts (UK), Sunson IndU.S.try Group (China), Metagen (Finland), Denykem (UK), Tex Biosciences (India) among others.

Recent Market Developments

- December 2022: Novozymes announced the merger with Chr. Hansen, a Danish company of agricultural, pharmaceutical, and food ingredients. This merger is a strategic move for Novozymes to strengthen its hold in the market.

- August 2022: BASF divested its BASF Nutrilife baking enzymes business segment to Lallemand Inc which is an enzyme manufacturer. Lallemand has a unique product portfolio such as Lallemand yeast and bacteria technology platforms.

- November 2022: Novozymes and Novo Nordisk Pharmatech collaborated on the development of best-in-class technical enzymes to support production processes in the biopharmaceutical industry. This collaboration will help Novozymes to scale up the processes in the regenerative medicines market.

Segmentation of the Global Industrial Enzymes Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Formulation

By Source

By Application

By Type

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 16-Mar-2022

Vantage Market

Research | 16-Mar-2022

FAQ

Frequently Asked Question

What is the global demand for Industrial Enzymes in terms of revenue?

-

The global Industrial Enzymes valued at USD 7.1 Million in 2022 and is expected to reach USD 11.1 Million in 2030 growing at a CAGR of 6.1%.

Which are the prominent players in the market?

-

The prominent players in the market are BASF SE (Germany), Novozymes (Denmark), DuPont (U.S.), DSM (Netherlands), ABF (UK), Kerry (Ireland), Advanced Enzyme Technologies (India), CHR. Hansen (Denmark), Amano Enzyme Inc. (Japan), Aumgene Biosciences (India), Megazyme (Ireland), Enzyme Supplies (UK), Creative Enzymes (U.S.), Enzyme Solutions (U.S.), Enzymatic Deinking Technologies (U.S.), Biocatalysts (UK), Sunson IndU.S.try Group (China), Metagen (Finland), Denykem (UK), Tex Biosciences (India).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 6.1% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Industrial Enzymes include

- use of enzymes helps in ensuring the improved quality of products with low manufacturing cost, low energy consumption, and less wastage

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Industrial Enzymes in 2022.