Industrial Coatings Market

Industrial Coatings Market - Global Industry Assessment & Forecast

Segments Covered

By Technology Waterborne, Solventborne, Powder Coatings, Others (UV- and EB-cured technologies)

By Resin Type Acrylic, Alkyd, Epoxy, Polyester, Polyurethane, Vinyl, Fluoropolymer, Others (Silicone, amino, polyurea, nitrocellulose, plastisol, polyamide, and vinyl-based coatings)

By End-Use Industry General Industrial, Protective, Automotive Refinish, Automotive OEM, Industrial Wood, Marine, Coil, Packaging, Aerospace, Rail

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 105.9 Billion | |

| USD 128.4 Billion | |

| 2.80% | |

| Asia Pacific | |

| Asia Pacific |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

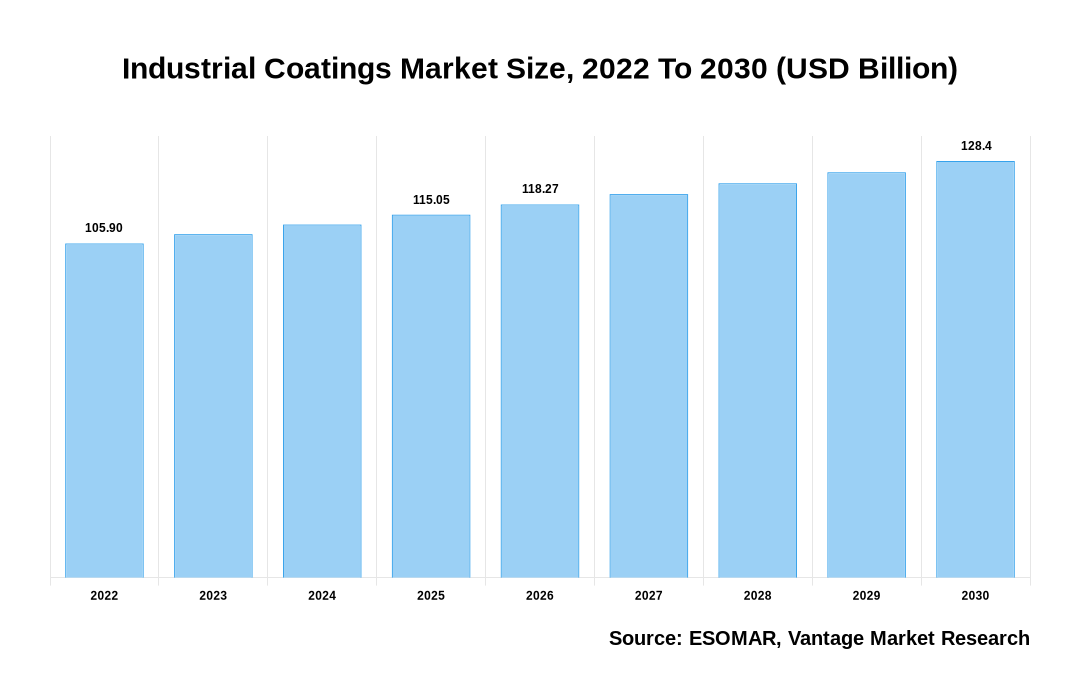

The global Industrial Coatings Market is valued at USD 105.9 Billion in 2022 and is projected to reach a value of USD 128.4 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 2.80% between 2023 and 2030.

Premium Insights

Industrial coatings are specialized paints and protective coverings that are applied to various surfaces in industrial settings. The main purpose of industrial coatings is to provide durable and effective corrosion protection, abrasion resistance, and heat insulation for surfaces in diverse industrial environments. They can be categorized into several types, including epoxy, polyurethane, fluoropolymer, ceramic, and zinc coatings. Industrial coatings are used in various industries like automotive, construction, marine, aerospace, power plants, oil and gas, and others. The industrial coatings market is driven by several factors, including the growing demand for enhanced and advanced coating technologies across several end-use industries such as automotive, aerospace, construction, marine, and machinery.

The outbreak of COVID-19 has impacted the global industrial coatings market in a significant way. The pandemic has caused a slowdown in economic activity and a decline in demand for industrial coatings due to the temporary shutdown of manufacturing facilities and projects. Moreover, supply chain disruptions, transportation restrictions, and workforce shortages have resulted in delays in the delivery of raw materials and finished products, reducing production capacity. On the other hand, the demand for coatings used in healthcare facilities and hospitals has increased due to the need to sanitize surfaces and prevent the spread of the virus. The market for protective coatings used in medical equipment and packaging materials has also grown during the pandemic.

The rise in industrialization and urbanization has led to a surge in demand for buildings and infrastructure, which, in turn, has boosted the demand for industrial coatings. The automotive industry has also witnessed a rise in demand due to the increasing number of vehicles on the road. The need for eco-friendly coatings has led to the use of water-based and powder coatings instead of conventional solvent-based coatings. Moreover, the growth of various end-use industries such as aerospace, marine, and oil & gas has further propelled the demand for industrial coatings as they provide protection against corrosion, heat, and wear. The growing need for maintenance and refurbishment activities in various industries has also contributed to the growth of the industrial coatings market.

Industrial Coatings Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Industrial Coatings Market

Economic Insights

The Russia-Ukraine conflict has had an impact on the industrial coatings industry. Sanctions imposed by countries such as the US and the EU have resulted in limited access to raw materials and equipment from both sides of the conflict. The ongoing uncertainty and instability in the region have also hindered business operations and investments. Some companies have been forced to relocate their manufacturing facilities, while others have had to seek alternative suppliers and markets.

Market Segmentation

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

The global Industrial Coatings market can be categorized on the following: Resin Type, Technology, End-User Industry, and Regions. Based on Resin Type, the market can be categorized into Polyurethane, Epoxy, Acrylic, Polyester, Alkyd, Fluoropolymer, and Others. Additionally, by Technology, the market can be split between Solvent-based, Water-based, Powder coating, High Solids, and Others. Based on End-User Industry, the market can be categorized into General Industrial, Protective, Automotive, Industrial Wood, Coil, Packaging, Marine, Aerospace, and Rail. Likewise, based on Region, the market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Resin Type

Epoxy to Accommodate Maximum Market Share due to its wide use in automotive, transportation, and aerospace industries

In 2022, epoxy category dominated the market. Epoxy coatings are widely used in industrial settings due to their excellent mechanical properties, chemical resistance, and durability. The category of epoxy coatings includes a variety of products, including coatings for floors, walls, and pipelines, as well as primers and sealers. As a result of their superior qualities, epoxy coatings have become increasingly popular in industries such as aerospace, automotive, construction, and marine. Furthermore, the rising demand for eco-friendly coating materials has also contributed to the growth of the epoxy coatings market. Epoxy resins have low levels of volatile organic compounds (VOCs) and can be produced from sustainable sources. This has made them an attractive choice for companies looking to reduce their environmental impact.

Based on Technology

Solvent-based coating to Express Dominion owing to its High Demand from End-use Industries

Between 2023 and 2030, the solvent-based coating is anticipated to grow fastest. This category of coatings has a high revenue due to its overall versatility and popularity in various applications such as automotive refinishing, appliances, and heavy-duty machinery. Solvent-based coatings dry quickly, offer excellent durability, and can be used in a wide range of environments and conditions. Additionally, they provide a superior level of resistance against abrasion, chemicals, and corrosion, making them an ideal choice for harsh industrial environments. Another advantage of solvent-based coatings is that they provide better adhesion than water-based coatings, which means they can adhere to various substrates like metals, plastics, and wood, with greater ease.

Based on End-User Industry

Automotive Industry to Express Dominion owing to its High Demand from End-use Industries

Between 2023 and 2030, the automotive industry channel is anticipated to grow fastest. Firstly, the automotive sector is one of the largest end-users and has a high demand for industrial coatings. Vehicles require a range of coatings for protection, aesthetic improvements, and to enhance the body's durability. Hence, the need for industrial coatings in this sector is always high. Secondly, the automotive industry is highly competitive with continuous innovation and technological advancements. Manufacturers must provide high-quality, durable layers that can be applied efficiently and cost-effectively. This need drives the development of new coatings, which generates more revenue. Lastly, the automotive industry is known for its stringent safety regulations and environmental standards. Industrial coatings play a crucial role in achieving compliance with these standards, and automotive OEMs prioritize meeting these requirements. Therefore, the automotive category will continue to be the highest revenue contributor for the industrial coatings industry.

Based on Region

Asia Pacific to Lead Global Sales owing to Significant Growth in Industries such as Automotive, Construction, and Marine

The Asia-Pacific region is expected to be the largest market for industrial coatings in the coming years. This can be attributed to the increasing demand for industrial coatings in developing countries such as India and China due to the growing industrialization in these countries. The region is home to several emerging economies witnessing rapid industrialization, driving the demand for industrial coatings. The growth of the region's automotive, aerospace, construction, and marine industries is also expected to contribute to the development of the industrial coatings market. In recent years, there has been a significant increase in the production and export of automobiles in the Asia-Pacific region, driving the demand for automotive coatings.

Additionally, the construction industry in the area is also witnessing significant growth due to urbanization and the construction of new infrastructure, leading to a rise in demand for construction coatings. Stringent environmental regulations regarding toxic chemicals in industrial coatings are also propelling the demand for eco-friendly coatings in the region. Governments in the area are promoting eco-friendly coatings to reduce their carbon footprint and promote sustainable development.

Top Market Trends

- Increasing Demand from End-use Industries: Industrial coatings are in high demand from various end-use industries such as automotive, aerospace, construction, marine, and packaging. These coatings are applied to different surfaces for protection against corrosion, abrasion, and wear and tear, among other things. The automotive industry is one of the most significant consumers of industrial coatings. These coatings are used for interior and exterior surfaces of vehicles, providing excellent protection against environmental factors and improving their aesthetics. Moreover, the booming construction industry is also generating high demand for industrial coatings, as these coatings are used for various applications, such as concrete protection and coating for metal surfaces. The increasing focus on sustainable coatings also drives the demand for industrial coatings. Governments have implemented various regulations to reduce VOC emissions from layers, which has led manufacturers to develop eco-friendly coatings. As a result, the demand for water-based industrial coatings is expected to increase significantly in the coming years.

- Advancements in Technology to Augment Growth: Advancements in technology have greatly benefited the industrial coatings industry. New formulations of coatings with improved performance, durability, and sustainability have been developed through nanotechnology, improved pigments, and 3D printing. These advancements have resulted in more resistant layers to corrosion, wear and tear, and UV exposure, making them suitable for a broader range of applications, including aerospace, marine, and automotive industries. Moreover, coatings and materials science advances have enabled manufacturers to produce more environmentally friendly coatings with reduced VOC emissions and sustainable raw materials. This has resulted in a shift towards eco-friendly coatings that meet regulations and standards set by various agencies. Lastly, technological innovations such as automation, robotics, and intelligent coatings are improving industrial coatings' application, performance, and monitoring. Innovative coatings, for instance, can adapt to varying environments, changing color, conductivity, and transparency for enhanced protection and energy efficiency. Overall, technological advancements are driving innovation and improving industrial coatings' quality, efficiency, and sustainability.

Competitive Landscape

The industrial coatings market is highly competitive in nature with the presence of both multinational and local players. Some of the major players operating in the global market include AkzoNobel N.V., PPG Industries Inc., The Sherwin-Williams Company, Axalta Coating Systems LLC, and Jotun A/S, among others. These companies are continuously focusing on product innovation, strategic collaborations, partnerships, and mergers and acquisitions to expand their product portfolio and enhance their market presence. Additionally, market players are also investing in research and development activities to develop sustainable and eco-friendly coatings solutions that cater to the growing demand from various end-use industries.

The key players in the global Industrial Coatings market include - Akzo Nobel N.V.; Axalta Coating Systems, LLC; Jotun, PPG Industries, Inc.; The Sherwin-Williams Company; Nippon Paint Holdings Co., Ltd.; Hempel A/S among others.

Recent Market Developments

- August 2022: Sherwin-Williams launched a new range of coatings for the aerospace industry. The new range, "SkyTech," is designed to provide superior protection against extreme weather conditions, corrosion, and abrasion.

- May 2022: Axalta announced the acquisition of United Paints Group, a leading supplier of industrial coatings in Italy. This acquisition is expected to expand Axalta's presence in the European market and strengthen its portfolio of industrial coatings products.

- March 2022: BASF announced the launch of a new line of low VOC (volatile organic compound) coatings for the industrial sector. The new line, "EcoEfficiency," is designed to help industrial customers reduce their environmental footprint while maintaining high performance and quality standards.

Segmentation of the Global Industrial Coatings Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Technology

By Resin Type

By End-Use Industry

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Industrial Coatings in terms of revenue?

-

The global Industrial Coatings valued at USD 105.9 Billion in 2022 and is expected to reach USD 128.4 Billion in 2030 growing at a CAGR of 2.80%.

Which are the prominent players in the market?

-

The prominent players in the market are Akzo Nobel N.V.; Axalta Coating Systems, LLC; Jotun, PPG Industries, Inc.; The Sherwin-Williams Company; Nippon Paint Holdings Co., Ltd.; Hempel A/S.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 2.80% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Industrial Coatings include

- Increasing demand for environment-friendly coatings

Which region accounted for the largest share in the market?

-

Asia Pacific was the leading regional segment of the Industrial Coatings in 2022.