Indoor Positioning and Navigation System Market

Indoor Positioning and Navigation System Market - Global Industry Assessment & Forecast

Segments Covered

By Technology Ultra-wideband Technology , Bluetooth Low Energy , Wi-Fi , Others

By Application Asset & Personnel Tracking , Location-Based Analytics , Navigation & Maps , Others

By Component Sofware, Hardware, Services

By End user Healthcare , Retail , Manufacturing , Travel & Hospitality , Office Spaces, Public Spaces , Logistics & Warehouses , Others

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 10.2 Billion | |

| USD 90.2 Billion | |

| 31.6% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

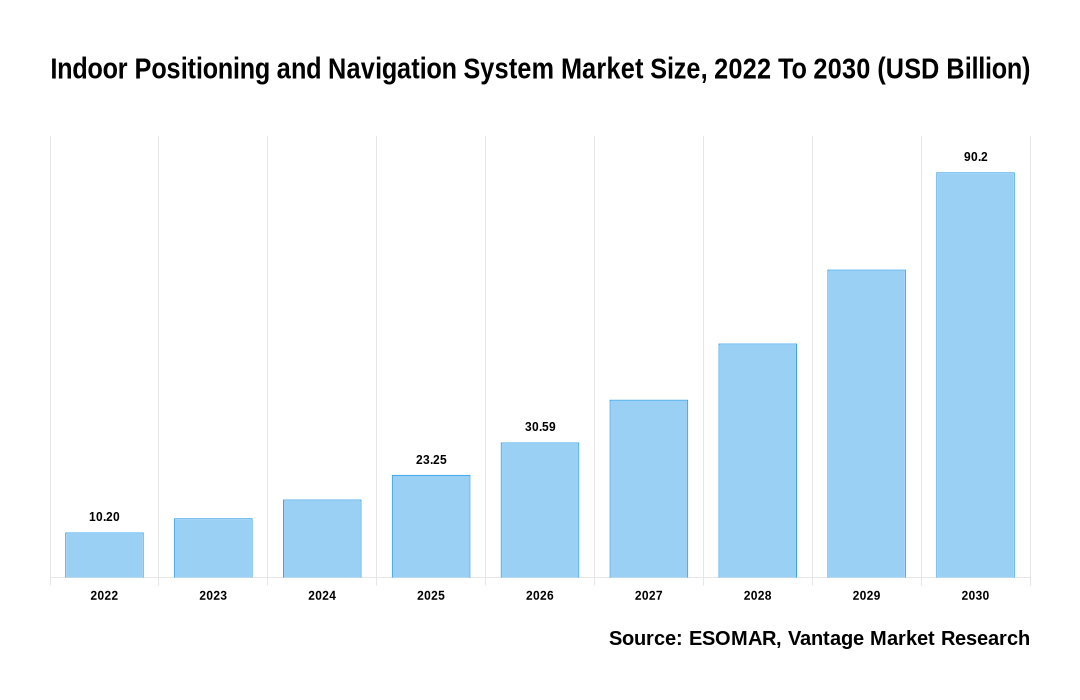

The global Indoor Positioning and Navigation System Market is valued at USD 10.2 Billion in 2022 and is projected to reach a value of USD 90.2 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 31.6% between 2023 and 2030.

Premium Insights

According to a GSMA study, approximately 41% of people worldwide have exploited the power of cell phones. Concurrently, the mobile internet reached a watershed moment, with a startling 4.2 billion subscribers on a global scale by 2022. The development of cutting-edge mobile applications, the accelerating digitalization wave, the dynamic landscape of mobile commerce, and progressive technology advancements have all contributed to a spike in the indoor positioning industry.

Economic estimates intensify mobile supremacy, with the GSM Association forecasting a massive revenue spike in the North American mobile business. According to the forecast, the United States will surpass China by 50% in the worldwide mobile market. This massive shift is driven by a firm commitment to transition to 5G services, boosting sales to record heights. By the end of the year, an astounding 24% of links on the continent will be operating within 5G network domains, with projections climbing to 46% by 2025, representing a remarkable 200 million 5G connections.

Indoor Positioning and Navigation System Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Indoor Positioning and Navigation System Market

The COVID-19 epidemic ushered in a paradigm shift in the business sector, promoting a proactive approach to employee contact and activity tracking. Numerous businesses have used contact-tracing technology in an effort to reduce workplace-related infection outbreaks. In response to this growing demand, indoor location solution providers quickly produced new products or updated current offerings, effectively adapting to their client’s changing needs and contributing to the pandemic's fight.

Key Highlights

- North America generated more than 42.30% of revenue share in 2022

- Asia Pacific is expected to grow at the quickest rate from 2023 to 2030

- Based on Technology, the Wi-Fi segment contributed a significant revenue share in 2022

- Based on application, the Asset and Personnel Tracking segment recorded the most important market share in 2022

- Based on component, Hardware contributed to the largest share market in 2022

- Based on End-user, the Retail segment has dominated the market during 2022

Economic Insights

Report Coverage & Deliverables

- Real-Time Data Updates:

- Competitor Benchmarking

- Market Trends Heatmap

- Custom Research Queries

- Market Sentiment Analysis

- Demographic and Geographic Insights

Get Access Now

Smart cities' firm economic impact has resulted in significant investments, accounting for around 30-35% of overall spending. Indoor positioning plays a critical role in this transformational landscape, managing the creation of efficient urban ecosystems. As a result of the strong market expansion, job possibilities are expected to increase by 15-20%, particularly in dynamic industries such as software development, data analytics, and geographic information systems (GIS). This increase in job opportunities corresponds to the growing demand for skilled individuals, driven by the booming indoor positioning and navigation business. Manufacturers at the forefront of innovation and using indoor navigation technologies stand to gain 15-20% operational efficiency. These advances translate into benefits such as reduced downtime, process optimization, and significant cost reductions. Collaborations in the indoor positioning and navigation market likely support innovation and industry growth, accounting for 20-25% of collaborations. These connections cross boundaries, allowing for technology exchange, cooperative endeavors, and collective advances in the indoor positioning scene. For instance, Inpixon announced in March 2023 a collaboration deal with Schauenburg Systems, an original equipment manufacturer of mine safety systems and equipment, to sell Inpixon's real-time location technology to South African mining businesses. The parties will attempt to sell hundreds of thousands of nanoLOC chips and other Inpixon core technologies that provide real-time tracking, collision avoidance, and proximity applications for the mining industry under the terms of the agreement.

Top Market Trends

- Increasing adoption of smartphones: Smartphones are becoming more common, which is boosting the use of indoor location and navigation systems. These gadgets include built-in sensors that can determine the user's location and use that information to deliver interior navigation services.

- Growing demand for asset tracking: Asset tracking is becoming increasingly popular. Asset tracking is an everyday use for Indoor Positioning and Navigation System. These systems are used by businesses in various industries to track the movement of assets such as inventory, equipment, and staff. This data can boost productivity, security, and customer service.

- Increasing use of location-based services: As the use of location-based services (LBS) grows, so does the market for indoor positioning and indoor navigation systems. LBS enables businesses to give customers customized services depending on their location.

- Technological Advancements: The development of new technologies is significantly impacting the Indoor Positioning and Navigation System market. These technologies include ultra-wideband (UWB), visual positioning, and the Internet of Things (IoT). UWB is a radio technique that uses high frequencies for accurate indoor positioning. Because it employs shorter wavelengths, UWB is more precise than other technologies, such as Wi-Fi and Bluetooth. This allows for a more precise determination of the user's position. Cameras are used in visual positioning to track the movement of people and objects indoors. The Internet of Things (IoT) is a linked devices that can gather and transmit data that can collect and share data. This information can increase the precision and efficiency of Indoor Positioning and Navigation System.

Market Segmentation

The Global indoor positioning and navigation market can be categorized into Technology, Application, Component, End-user, and Region.

The market is bifurcated based on the technology into Ultra-wideband Technology.

Bluetooth Low Energy, Wi-Fi, Others. Based on the application, the Indoor Positioning and Indoor Navigation market has been segmented into Asset & Personnel Tracking,

Location-Based Analytics, Navigation & Maps, Others. Based on components, the market is bifurcated into hardware, software, and services. Based on End-Users, the market is segregated into Logistics & Warehouses, Healthcare, Retail, Manufacturing, Travel & Hospitality, Office Spaces, Public Spaces, and Others. Likewise, the market is segmented based on Region: North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Based on Technology

Wi-Fi holds the largest share

The Wi-Fi segment is the leading category in the Indoor Positioning and Navigation System industry, accounting for the lion's market share. This predominance can be ascribed to the widespread deployment of Wi-Fi networks within interior locations, which provide vast coverage. Furthermore, the low cost of Wi-Fi technology adds to its attractiveness, making it a popular choice among organizations looking for efficient indoor location and navigation solutions.

Based on the Application

Asset & Personnel Tracking will dominate the market during Forecast Period

The Asset & Personnel Tracking category accounts for most of the market share. This is because asset tracking is becoming more popular in manufacturing, healthcare, and retail areas. Asset monitoring enables businesses to trace the movement of assets in real-time, improving efficiency and security.

Based on Component

Hardware will make significant revenue

The hardware category accounts for significant revenue. This is because hardware components like beacons, sensors, and receivers are required to operate Indoor Positioning and Navigation System.

Based on the End User

Retail accounts for the majority of the market

The retail segment accounts for the majority of the market share in the industry because the demand for Indoor Positioning and Navigation System in retail businesses is expanding. Indoor positioning systems can assist stores in improving the customer experience, increasing sales, and reducing inventory loss.

Based on Region

North America will lead the market

With the increasing adoption of smartphones and other mobile devices, growing demand for asset tracking and location-based services, and the presence of many major players in the market, North America is expected to dominate the indoor positioning and indoor navigation systems market in the coming years. The increasing popularity of smartphones in North America, in particular, is driving market expansion. Smartphones and other mobile devices have built-in sensors that can establish the user's location, which can be utilized to provide indoor navigation services.

Competitive Landscape

The global Indoor Positioning and Navigation System market is highly competitive, with multiple players; a few prominent companies dominate the landscape due to their established expertise and technological capabilities. Also, A diverse range of smaller players, startups, and specialized providers offer unique solutions and technologies for specific use cases. Several notable players and businesses control a large amount of the market. These firms frequently have significant resources, cutting-edge technology, established systems, technology companies, and specialized integrators. For instance, Apple Business Connect was announced in January 2023. Apple Maps now has a new feature. Apple Business Connect: Business owners will now be able to update and manage their information on the platform, including vital details such as business hours and location, photographs, logos, special offers and promotions, and more.

The players in the global Indoor Positioning and Indoor Navigation market include Senion AB, Nextome, Steerpath, Spreo, HERE Technologies, AIRFINDER, Sensewhere, IndoorAtlas, POINTR, INDOO.RS, among others.

Recent Market Developments

- January 2023: Apple Business Connect was announced in January. Apple Maps now has a new feature. Apple Business Connect: Business owners will now be able to update and manage their information on the platform, including vital details such as business hours and location, photographs, logos, special offers and promotions, and more.

- April 2022: Google teamed with Orient to build a joint product for in-store navigation and proximity marketing.

- January 2022: Cisco purchased Opsani, so the acquisition will allow Cisco AppDynamics to expand its product and engineering teams, as well as the capabilities of its platform.

- January 2022: Indoor Map as a Service was announced by HERE as a one-stop shop for indoor mapping solutions, including indoor map data, routing, and location, accessible via the HERE SDK and seamlessly linked with the company's base map.

Segmentation of the Global Indoor Positioning and Navigation System Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Technology

By Application

By Component

By End user

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Indoor Positioning and Navigation System in terms of revenue?

-

The global Indoor Positioning and Navigation System valued at USD 10.2 Billion in 2022 and is expected to reach USD 90.2 Billion in 2030 growing at a CAGR of 31.6%.

Which are the prominent players in the market?

-

The prominent players in the market are Senion AB, Nextome, Steerpath, Spreo, HERE Technologies, AIRFINDER, Sensewhere, IndoorAtlas, POINTR, INDOO.RS.

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 31.6% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Indoor Positioning and Navigation System include

- Bluetooth beacons are becoming more popular

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Indoor Positioning and Navigation System in 2022.