India Inorganic Chemicals Market

India Inorganic Chemicals Market - Global Industry Assessment & Forecast

Segments Covered

By Type of Chemical Compound Acids, Bases, Salts, Oxides, Others

By Production Process Solids, Liquids, Gases, Others

By Application Water Treatment, Fertilizers & Agrochemicals, Catalysts & Chemical Synthesis, Construction Materials, Industrial Processing, Electronics Manufacturing, Others

By End-Use Industry Chemicals & Petrochemicals, Construction & Infrastructure, Agriculture, Electronics, Automotive, Pharmaceuticals, Others

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 40.92 Billion | |

| USD 69.23 Billion | |

| 6.01% | |

| XX | |

| XX |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

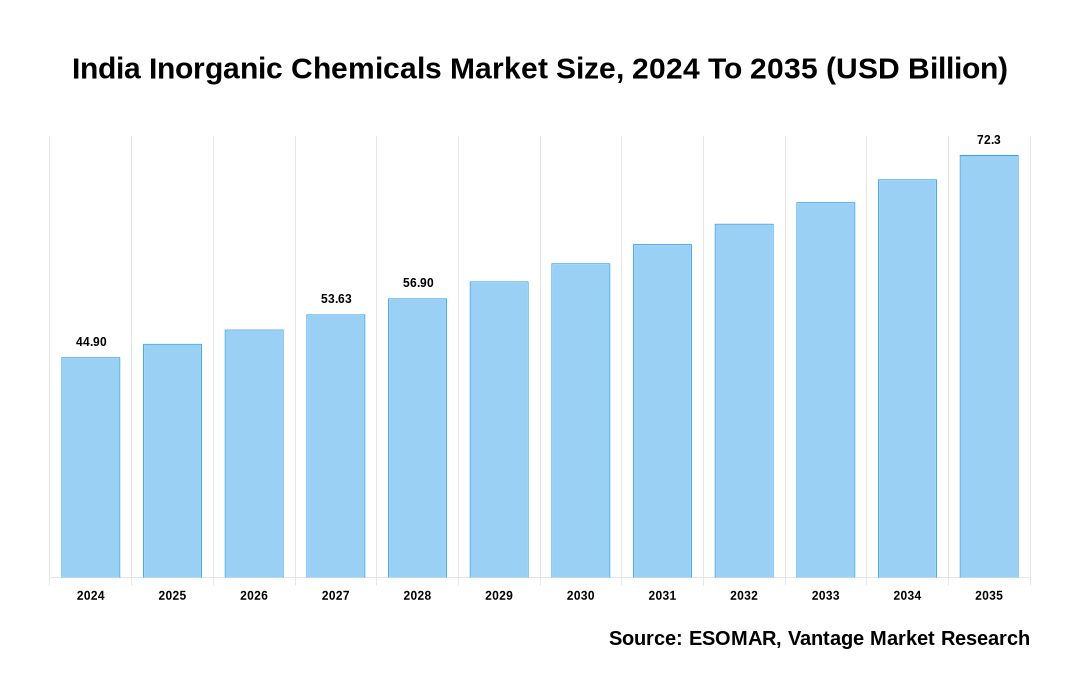

The India Inorganic Chemicals Market is valued at USD 40.92 Billion in 2023 and is projected to reach a value of USD 69.23 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 6.01% between 2024 and 2032 driven by the innovation in manufacturing technologies and processes enhance the efficiency and application of inorganic chemicals, leading to increased adoption across various industries.

Key Highlights

- India ranks as the 6th largest chemical producer globally and the 3rd in Asia, contributing 7% to the nation's GDP

- The growing demand from end-user industries such as Chemicals & Petrochemicals, Construction & Infrastructure, Agriculture, Electronics, Automotive, Pharmaceuticals is driving the expansion of India Inorganic Chemicals market

Major objectives of India Inorganic Chemicals Market Study

- To gain a comprehensive understanding of the India Inorganic Chemicals market by identifying its key segments and subsegments

- To provide an in-depth analysis of the factors driving or hindering market growth, including emerging opportunities and challenges specific to the industry

- To analyze individual market segments for growth trends, future prospects, and their impact on the overall market

- To explore potential opportunities for stakeholders in the India Inorganic Chemicals market and to map out the competitive landscape of leading players

- To profile major companies within the market, evaluating their market share, strengths, and competitive advantages

India Inorganic Chemicals Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about India Inorganic Chemicals Market

India Inorganic Chemicals Market Government Initiatives

- The Dahej PCPIR project in Bharuch has attracted an investment of approximately Rs. 1 lakh crore (around US$ 12 billion) and is projected to create 32,000 jobs

- The government introduced PLI schemes with a budget of Rs. 1,629 crore (US$ 213.81 million) to encourage the development of Bulk Drug Parks

- In the Interim Union Budget for 2024-25, Rs. 192.21 crore (US$ 23.13 million) was allocated to the Department of Chemicals and Petrochemicals

- The Petroleum, Chemicals, and Petrochemicals Investment Region (PCPIR) at Paradip has secured investments totaling US$ 8.84 billion (Rs. 73,518 crore), generating approximately 40,000 jobs

- The government plans to establish 25,000 Jan Aushadhi Kendras to provide affordable medicines

- Foreign Direct Investment (FDI) in the chemicals sector (excluding fertilizers) reached US$ 22.146 billion between April 2000 and March 2024

- An estimated investment of Rs. 8 lakh crore (US$ 107.38 billion) is anticipated in the Indian chemicals and petrochemicals sector by 2025

- On September 14, 2023, Prime Minister Narendra Modi inaugurated development projects worth over Rs. 50,700 crore (US$ 6.11 billion)

Type of Chemical Compound Overview

The Type of Chemical Compound segment is divided into Acids, Bases, Salts, Oxides, Others.

Acids: Inorganic acids, such as sulfuric acid, hydrochloric acid and nitric acid are extensively utilized across multiple industries for purposes like chemical synthesis, pH regulation, and metal cleaning. Infrastructure development and industrial expansion, notably in the chemical and manufacturing industries drives demand for inorganic acids.

Bases: Inorganic bases, including sodium hydroxide and potassium hydroxide, are crucial for applications in manufacturing, wastewater treatment, and pharmaceuticals. The expansion of industrial activities and increased focus on water treatment are key factors contributing to the growth of bases.

Salts: Essential inorganic salts like sodium chloride, calcium chloride and potassium nitrate are utilized in various sectors, including food processing, pharmaceuticals, and agriculture. The market is experiencing growth due to increasing demand for processed foods and agricultural chemicals.

Oxides: Inorganic oxides, such as titanium dioxide and iron oxide, sodium oxide are important for their roles as pigments, catalysts, and additives in diverse industries. The need for these oxides is being driven by the expansion of the automotive and construction industries, especially in the manufacture of paints, coatings, and construction materials.

Others: This segment covers a variety of inorganic compounds, including sulfates, carbonates, and silicates, with applications in textiles, ceramics, and electronics. The market is witnessing innovations in specialty chemicals and niche segments, addressing specific industrial needs and new emerging applications.

Application Overview

The Application segment is divided into Water Treatment, Fertilizers & Agrochemicals, Catalysts & Chemical Synthesis, Construction Materials, Industrial Processing, Electronics Manufacturing, Others.

Water Treatment: Inorganic chemicals such as alum, chlorine, and lime are essential for water treatment, serving purposes like disinfection, purification, and pH adjustment to ensure safe drinking water. The increasing use of advanced treatment technologies, including membrane filtration and ultraviolet disinfection, to comply with rigorous water quality regulations.

Fertilizers & Agrochemicals: Inorganic chemicals such as nitrogen, phosphorus, and potassium are crucial for the production of fertilizers and agrochemicals, which enhance soil fertility and promote crop growth. The increasing need for higher agricultural productivity and the rise in global food demand are major factors boosting this segment.

Catalysts & Chemical Synthesis: Inorganic chemicals play a significant role as catalysts in various chemical reactions, including industrial processes and chemical synthesis. Some catalysts like zeolites, alumina, and transition metal plays important role in chemical synthesis. They are used to accelerate reactions and improve efficiency in manufacturing processes.

Construction Materials: This segment includes inorganic chemicals used in the production of construction materials such as cement, concrete, and plaster. Growth in infrastructure development and construction activities fuels the demand for this segment.

Industrial Processing: Inorganic chemicals are used in various industrial processing applications, including metal treatment, surface finishing, and pulp and paper production. Their role in improving efficiency and product quality in industrial operations drives demand in this sector.

Electronics Manufacturing: This segment involves the use of inorganic chemicals like silicon, gallium, and indium in the production of electronic components and devices, including semiconductors and display materials. The expanding electronics industry and technological advancements contribute to market growth.

Others: This category includes a diverse range of applications for inorganic chemicals that do not fall into the above segments. It covers uses in areas such as textiles, ceramics, and pharmaceuticals. Innovation and niche applications drive the growth of this segment, addressing specific industry needs.

Premium Insights

The India Inorganic Chemicals Market is driven by the increasing demand across various industries such as agriculture, pharmaceuticals, and manufacturing. The expanding agricultural sector, in particular, contributes to the market's growth as inorganic fertilizers are essential for enhancing soil fertility and crop yields. The need for high-purity inorganic chemicals by the pharmaceutical industry for the formulation and manufacture of drugs drives market expansion. Government's emphasis on industrialization and infrastructure development through initiatives like "Make in India" increases demand for inorganic chemicals used in manufacturing and construction. Additionally, the growing emphasis on renewable energy and sustainable practices opens new avenues for inorganic chemicals in green technologies and environmental applications.

India Inorganic Chemicals Market Export and Import Overview

In 2022, India was a prominent player in the global market, exporting 3.2 billion worth of these chemicals, making it the 19th largest exporter worldwide and ranking 27th among its export products. Key export destinations included the United Arab Emirates, which received 364 million, the United States with 315 million, China with 129 million, and Saudi Arabia each with 139 million, and Vietnam at 120 million. Notably, between 2023 and 2022, the United States, Russia, and Oman were the fastest-growing markets for Indian inorganic chemicals, showing significant increases in export values.

India was the 5th largest global importer of inorganic chemicals, bringing in .4 billion worth of these products. This substantial import volume underscores India's critical role in the global supply chain for inorganic chemicals, reflecting both its import needs and its active participation in international trade.

Based on the provided market data, Vantage Market Research offers customizations in the reports to meet the specific needs of clients.

Key Trends

- Expansion of Industrial Applications: Inorganic chemicals are increasingly being used across diverse industries such as agriculture, water treatment, construction, and electronics.

- Advancements in Manufacturing Technologies: The adoption of advanced manufacturing technologies, including automation and process optimization, is enhancing production efficiency and product quality.

- Rising Demand for Specialty Inorganic Chemicals: The demand for high-performance and specialty inorganic chemicals used in electronics and pharmaceuticals is on the rise as they play critical for advanced applications and market growth.

- Government Initiatives and Policies: The Indian government's support for the chemical industry through favorable policies, incentives, and investments in infrastructure is fostering market growth.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Definition

Inorganic chemicals are derived from mineral sources, encompass a wide range of substances such as metals, salts, acids, bases, and oxides. These chemicals play a fundamental role in various industrial applications, including manufacturing, agriculture, water treatment, construction, and pharmaceuticals. In India, the inorganic chemicals market is diverse and vital, featuring products like sulfuric acid, hydrochloric acid, sodium hydroxide, ammonium nitrate, chlorine, and calcium carbonate. These chemicals are essential for producing fertilizers, glass, ceramics, and other key materials, significantly contributing to the country's industrial growth.

Market Dynamics

Increasing demand for specialty chemicals drives the India Inorganic Chemicals market

High-performance chemicals have extensive use in a various industry, such as electronics, water treatment, and pharmaceuticals. Coagulants and flocculants are inorganic chemicals used in water treatment that are essential for purifying water, particularly in industrial and municipal settings. Specialty chemicals are essential in the electronics industry to manufacture semiconductors and other electronic components, as purity and efficiency are essential components. The use of inorganic compounds as drug formulation intermediates in the pharmaceutical industry is fueling the industry's rising demand. Market expansion is driven by the need for increasingly specialized and high-performance chemicals as industries continue to grow and innovate.

The volatility of raw material prices restraints the market growth

Inorganic chemicals are often derived from minerals, ores, and other natural resources, the prices of which can fluctuate due to factors such as geopolitical tensions, supply chain disruptions, and changes in global demand. These fluctuations can lead to unpredictable production costs, squeezing profit margins for manufacturers. Additionally, any sudden increase in raw material costs may not be easily passed on to consumers, leading to potential market instability.

Technological advancements in manufacturing and automation creates significant opportunities

Businesses can increase product quality, decrease waste, and increase production efficiency by investing in modern technologies. Maintaining consistency and boosting production to meet rising demand are additional advantages of automation in manufacturing processes. Furthermore, process optimization using AI and machine learning can lower operating costs even further and make Indian producers of inorganic chemicals more competitive globally.

Competitive Landscape

The competitive landscape of the India Inorganic Chemicals market is characterized by the presence of numerous established players, including both domestic and international companies. Major players in the market focus on expanding their production capacities, enhancing product quality, and adopting advanced technologies to gain a competitive edge. The market is also witnessing increased investments in R&D to develop innovative and sustainable chemical solutions. Companies are leveraging strategic partnerships, mergers, and acquisitions to strengthen their market position and expand their product portfolios. Additionally, government initiatives promoting the chemical industry are further intensifying competition among key players in the market.

The key players in the global India Inorganic Chemicals market include - Indian Farmers Fertiliser Cooperative Limited (IFFCO), National Fertilizers Limited (NFL), Deepak Fertilisers and Petrochemicals Corporation Limited (DFPCL), Rashtriya Chemicals & Fertilizers Ltd (RCF), Chemplast Sanmar Limited, Paradeep Phosphates Limited, Solar Industries India Limited, Deepak Nitrite Limited, Gujarat State Fertilizers & Chemicals Limited (GSFC), Gujarat State Fertilizer Corporation (GSFC), Indo Gulf Fertilisers Limited, Tata Chemicals Limited, Gujarat Alkalies and Chemicals Limited, Grasim Industries Limited, Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC). among others.

Recent Market Developments

Vishnu Chemicals Limited Acquires Jayansree Pharma for ₹52 Crore to Expand Pharmaceutical Market Presence

- In August 2024, Vishnu Chemicals Limited, a leading producer of high-performance specialty chemicals, has further strengthened its market presence by acquiring Jayansree Pharma for ₹52 crore. This strategic acquisition is expected to enhance Vishnu Chemicals' product portfolio and expand its footprint in the pharmaceutical sector.

The global India Inorganic Chemicals market can be categorized as Type of Chemical Compound, Production Process, Application, End-Use Industry and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Type of Chemical Compound

By Production Process

By Application

By End-Use Industry

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 09-Sep-2024

Vantage Market

Research | 09-Sep-2024

FAQ

Frequently Asked Question

What is the global demand for India Inorganic Chemicals in terms of revenue?

-

The global India Inorganic Chemicals valued at USD 40.92 Billion in 2023 and is expected to reach USD 69.23 Billion in 2032 growing at a CAGR of 6.01%.

Which are the prominent players in the market?

-

The prominent players in the market are Indian Farmers Fertiliser Cooperative Limited (IFFCO), National Fertilizers Limited (NFL), Deepak Fertilisers and Petrochemicals Corporation Limited (DFPCL), Rashtriya Chemicals & Fertilizers Ltd (RCF), Chemplast Sanmar Limited, Paradeep Phosphates Limited, Solar Industries India Limited, Deepak Nitrite Limited, Gujarat State Fertilizers & Chemicals Limited (GSFC), Gujarat State Fertilizer Corporation (GSFC), Indo Gulf Fertilisers Limited, Tata Chemicals Limited, Gujarat Alkalies and Chemicals Limited, Grasim Industries Limited, Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC)..

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 6.01% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the India Inorganic Chemicals include

Which region accounted for the largest share in the market?

-

XX was the leading regional segment of the India Inorganic Chemicals in 2023.