Hyper Converged Infrastructure Market

Hyper Converged Infrastructure Market - Global Industry Assessment & Forecast

Segments Covered

By Component Hardware, Software

By Application Remote Office/Branch Office, Virtualization Desktop Infrastructure (VDI), Data Center Consolidation, Backup/Recovery/Disaster Recovery, Virtualizing Critical Applications

By End User Cloud Providers, Colocation Providers, Enterprises

By Organization Size Large Enterprises, Small & Medium-sized Enterprises (SMEs)

By Enterprise Banking Financial Services & Insurance (BFSI), IT & Telecom, Government, Healthcare, Manufacturing, Energy, Education, Other Enterprises

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2023 | |

| 2024 - 2032 | |

| 2018 - 2022 | |

| USD 16.2 Billion | |

| USD 155.7 Billion | |

| 28.6% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

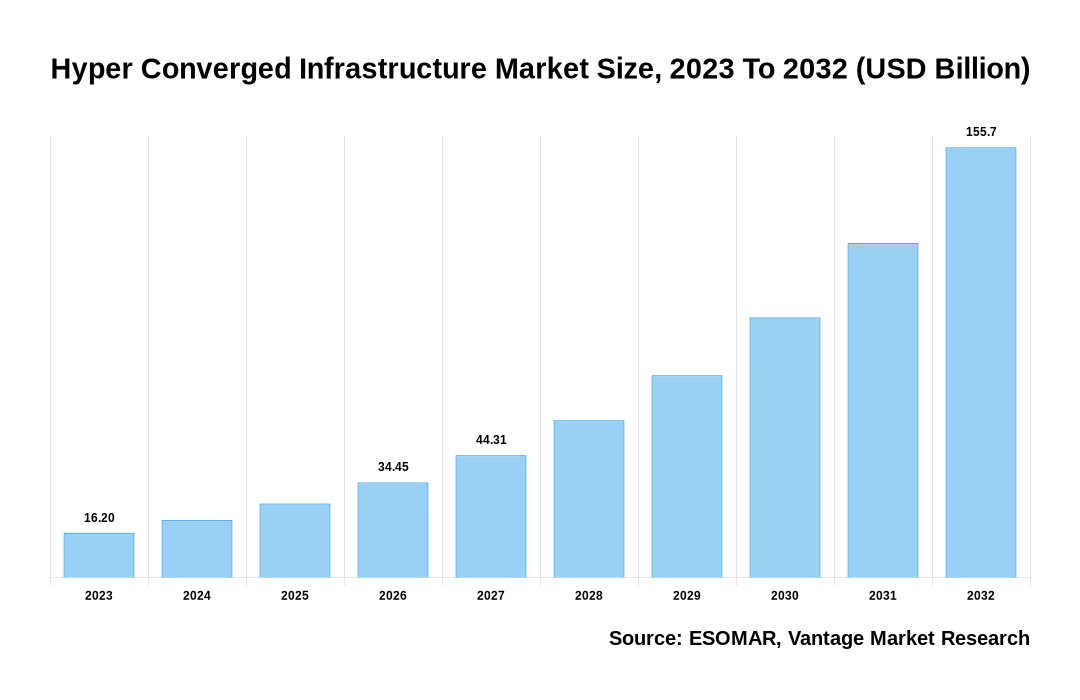

The global Hyper Converged Infrastructure Market is valued at USD 16.2 Billion in 2023 and is projected to reach a value of USD 155.7 Billion by 2032 at a CAGR (Compound Annual Growth Rate) of 28.6% between 2024 and 2032.

Key highlights

- North America dominated the market in 2023, obtaining the largest revenue share of 41.3%

- The Asia Pacific is expected witness fastest growth during the forecast period

- In 2023, the hardware segment dominated the market with revenue share of 72.4%

- The data center consolidation segment captured the largest revenue share of 28.9% in 2023

Hyper Converged Infrastructure Market Size, 2023 To 2032 (USD Billion)

AI (GPT) is here !!! Ask questions about Hyper Converged Infrastructure Market

Regional Overview

North America accounted for largest revenue share of 41.3% in 2023. The expansion of hyper-scale cloud service providers in the region contributes significantly to the growth. Additionally, both wholesale and retail sectors of colocation services have experienced significant growth. The demand for infrastructure to support virtual desktops has surged due to the increasing usage of mobile data and the implementation of bring-your-own-device (BYOD) regulations. In addition, substantial investments made by various data center companies is accelerating the growth of the overall market. For example, Equinix has planned to develop 32 hyperscale data centers in major global markets. With an investment exceeding USD 6.9 billion and a total capacity of 600 megawatts, the company expand their presence and supporting the growing hyper-scale data center landscape.

U.S. Market Overview

The U.S. market, valued at USD 22.3 Billion in 2023 to USD 32.85 Billion in 2032, is anticipated to grow at a CAGR of 4.4% from 2024 to 2032. The popularity of consuming infrastructure-as-a-service solutions, the increasing demand across applications along with the need to enhance IT operational efficiency, improve data protection, reduce IT costs, and streamline system deployments are some major factors propelling the growth. Various companies are collaborating to develop advance technologies which boost the market prospects in United States. For instance, Kyndryl and Lenovo, prominent players in the IT infrastructure services and PC/storage/server industries, announced an expansion of their global partnership. This expansion aimed to deliver comprehensive solutions for customers across Hyper Converged Infrastructure (HCI), hybrid cloud, and edge computing applications.

Component Overview

In 2023, Hardware segment generated a significant revenue share of 72.4%. The Component segment is divided into Hardware and Software. The hardware segment is expected to have the largest market share in the Hyper Converged Infrastructure (HCI) market due to the increasing development of small hardware systems by top manufacturers. For instance, Dell Technologies introduced managed storage, server, and HCI hardware solutions in May 2023, which can be used for data center consolidation at the edge. These solutions are used to store cloud services and streamline management. In addition, the emerging trends, such as Bring Your Device (BYOD) and surge in work from home from remote locations are augmenting the segmental growth of the market. According to Cisco Systems Survey, 59% of the employees in the IT sector across the U.S. have adopted BYOD during the COVID-19 pandemic. Virtual desktop infrastructure is the centralized system used to manage remote employees’ devices.

Application Overview

The Data Center Consolidation segment held a significant revenue share of 28.9% in 2023. The Application segment covers Remote Office/Branch Office, Virtualization Desktop Infrastructure (VDI), Data Center Consolidation, Backup/Recovery/Disaster Recovery, and Virtualizing Critical Applications. The integration of HCI infrastructure approach such as, computing, storage, and networking into a single system can be managed through a unified interface, which in turn, is augmenting the overall market growth in the near future.

Key Trends

- The increasing adoption of hybrid cloud strategies which is being increasingly integrated with hybrid cloud management platforms to provide seamless management and scalability across different environments is aiding the markt growth. For Example, Nutanix offers a comprehensive HCI solution with native integration to public cloud services like AWS, Azure, and Google Cloud Platform (GCP). This allows organizations to easily extend their HCI deployments to the cloud and manage their hybrid infrastructure from a single pane of glass.

- The increasing adoption of IoT technologies in order to provide local processing power and reduce latency for edge workloads is gaining traction in the market. For example, VMware's vSAN Edge solution is designed specifically for edge computing environments. It enables organizations to deploy HCI clusters in remote locations with limited space and resources, providing compute and storage capabilities at the edge.

- The incorporation of software-defined networking technologies which provides greater flexibility and agility in network configuration and management is a revolutionizing trend in the growth of the Hyper Converged Infrastructure Market. For example, Cisco's HyperFlex HCI platform integrates with Cisco's software-defined networking solution, Cisco ACI (Application Centric Infrastructure), to provide automated, policy-driven network provisioning and management for HCI deployments.

- Increasing focus on security features by various organization such as encryption, data-at-rest protection, and integrated threat detection is accelerating the demand for enhanced infrastructure. For example, HPE SimpliVity HCI solution includes built-in data encryption and data deduplication features to ensure data security and reduce storage costs.

Premium Insights

The integration of on-premises and cloud resources in HCI solutions is providing the scalability, cost-effectiveness, and flexibility. This strategy enables dynamic workload management and hybrid cloud deployments which support both private and public clouds to optimize their IT operations. For instance, Kyndryl and Lenovo, key players in IT infrastructure services and the PC/storage/server sectors, revealed an expansion of their global partnership. This expansion is designed to provide customers with holistic solutions spanning its applications.

Report Coverage & Deliverables

Get Access Now

Track market trends LIVE & outsmart rivals with our Premium Data Intel Tool: Vantage Point

Market Dynamics

Integration of cloud computing services

HCI presents enhanced data security and scalability when compared to traditional storage solutions. With the proliferation of connected devices and the Internet of Things (IoT), HCI's capability to collect and store analytics within a centralized management framework becomes increasingly valuable. This feature aligns seamlessly with the trajectory of 5G networks, where HCI's unified interface for data visualization proves advantageous. Optimized for virtual workloads akin to public cloud-based services, HCI offers flexible, consumption-based infrastructure economics. The integration of HCI solutions in various applications can expand business demand and enhancing IT service flexibility. Thus, the integration essential cloud computing services such as centralized administration, storage, computation, and data security is providing the comprehensive solution in the growth of the Hyper Converged Infrastructure Market.

Integration of AI and Machine Learning

The incorporation of advanced technologies, such as machine learning (ML) and artificial intelligence(AI) in order to enhance the overall efficiency and infrastructural administration of the organizations. For instance, Huawei has introduced its strategy to expand the digital transformation of organizations through the deployment of advance technologies such as, big data, artificial intelligence, edge computing, and intelligent manufacturing. Within this framework, the infrastructure setup is undergoing rapid evolution, transitioning from conventional data centers to the edge, from structured to unstructured data, and from single general-purpose computing power to diversified computing capabilities.

Competitive Landscape

Hyper Converged Infrastructure is undergoing rapid evolution, transitioning from conventional data centers to the edge, from structured to unstructured data, and from single general-purpose computing power to diversified computing capabilities. This evolution has emerged as one of the primary methods for constructing modern data centers. In February 2023, Huawei has unveiled its strategy to expedite the digital transformation of enterprises through the deployment of cutting-edge technologies including big data, artificial intelligence, edge computing, and intelligent manufacturing. Likewise, in April 2022, Equinix and Dell broadened their collaboration to offer hyper-converged data center solutions. As a component of this expansion, Equinix extended its Equinix Metal range of bare metal appliances.

The key players in the global Hyper Converged Infrastructure market include - Nutanix Inc. (U.S.), Dell Inc. (U.S.), VMware Inc. (U.S.), Hewlett Packard Enterprise Development LP (U.S.), Cisco System Inc. (U.S.), Oracle Corp. (U.S.), Microsoft Corp. (U.S.), NetApp Inc. (U.S.), IBM Corp. (U.S.), Huawei Technologies Co. Ltd. (China), StarWind Software Inc. (U.S.), Datacore Software Corp. (U.S.), Maxta Inc. (U.S.), Pivot3 Inc. (U.S.) among others.

Key Market Developments

- In February 2024, Huawei launched the Net5.5G-oriented products and solutions, covering mobile backhaul, enterprise campus, converged transport, and data center network, to fully support carriers' business success.

- In October 2023, Cisco and Nutanix have introduced Cisco Compute Hyperconverged, marking Cisco's shift towards hybrid multi-cloud computing following the announcement of the end-of-life for HyperFlex, utilizing their recently formed alliance.

- In September 2023, Cisco has committed to providing five years of support and service for existing HyperFlex installations, with orders being accepted until March 2024.

- In August 2023, The Data Center Intelligence Group (DCIG), a prominent global technology analyst firm, has chosen Huawei FusionCube as one of the premier enterprises (HCI) providers worldwide in their DCIG 2023-24 Top 5 report.

The global Hyper Converged Infrastructure market can be categorized as Component, Application, Organization Size, Enterprise, End User and Region.

| Parameter | Details |

|---|---|

| Segments Covered |

By Component

By Application

By End User

By Organization Size

By Enterprise

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

Vantage Market

Research | 04-Jun-2024

Vantage Market

Research | 04-Jun-2024

FAQ

Frequently Asked Question

What is the global demand for Hyper Converged Infrastructure in terms of revenue?

-

The global Hyper Converged Infrastructure valued at USD 16.2 Billion in 2023 and is expected to reach USD 155.7 Billion in 2032 growing at a CAGR of 28.6%.

Which are the prominent players in the market?

-

The prominent players in the market are Nutanix Inc. (U.S.), Dell Inc. (U.S.), VMware Inc. (U.S.), Hewlett Packard Enterprise Development LP (U.S.), Cisco System Inc. (U.S.), Oracle Corp. (U.S.), Microsoft Corp. (U.S.), NetApp Inc. (U.S.), IBM Corp. (U.S.), Huawei Technologies Co. Ltd. (China), StarWind Software Inc. (U.S.), Datacore Software Corp. (U.S.), Maxta Inc. (U.S.), Pivot3 Inc. (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 28.6% between 2024 and 2032.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Hyper Converged Infrastructure include

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Hyper Converged Infrastructure in 2023.