Heart Valve Devices Market

Heart Valve Devices Market - Global Industry Assessment & Forecast

Segments Covered

By Product Type Mechanical Heart Valves, Biological Heart Valves, Transcatheter Valves

By Treatment Open Surgery, Minimally Invasive Surgery

By End User Hospital & Clinics, Ambulatory Surgical Centers, Cardiac Centers, Research Centers, Other End Users

By Distribution Channel Directa Tender, Third Party Distributors

By Region North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Snapshot

| 2022 | |

| 2023 - 2030 | |

| 2017 - 2021 | |

| USD 8.9 Billion | |

| USD 25.9 Billion | |

| 14.3% | |

| Asia Pacific | |

| North America |

Customization Offered

Cross-segment Market Size and Analysis for Mentioned Segments

Additional Company Profiles (Upto 5 With No Cost)

Additional Countries (Apart From Mentioned Countries)

Country/Region-specific Report

Go To Market Strategy

Region Specific Market Dynamics

Region Level Market Share

Import Export Analysis

Production Analysis

Others Request Customization Speak To Analyst

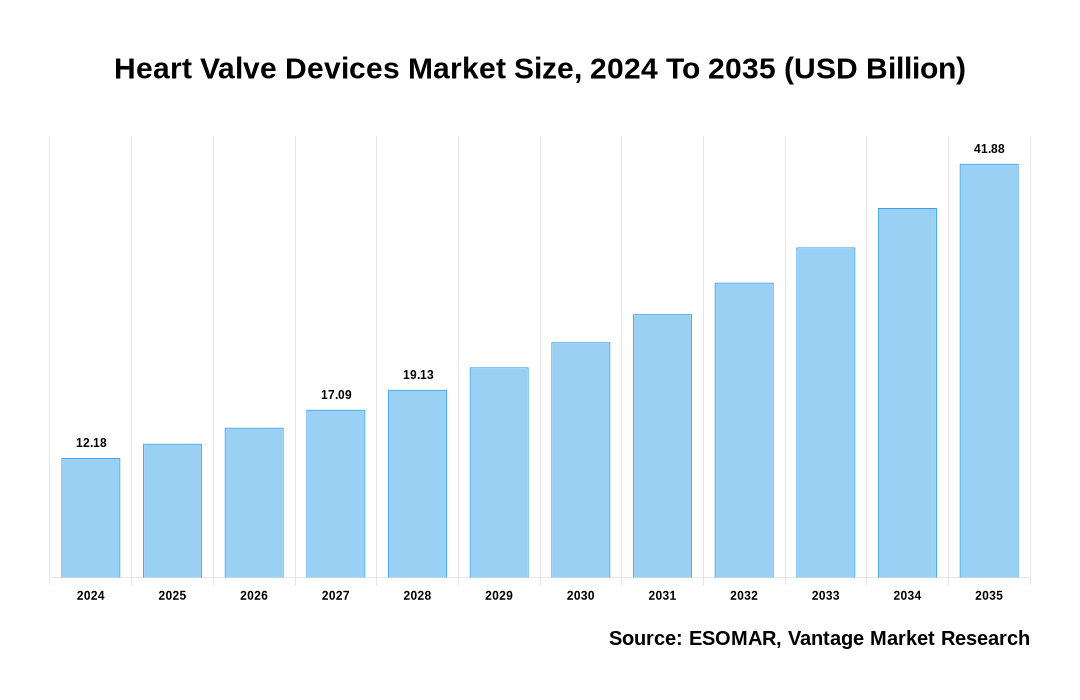

The global Heart Valve Devices Market is valued at USD 8.9 Billion in 2022 and is projected to reach a value of USD 25.9 Billion by 2030 at a CAGR (Compound Annual Growth Rate) of 14.3% between 2023 and 2030.

Premium Insights

Nearly five million people are thought to be affected by valvular heart disease worldwide. Each year, 850,000 of these patients' cases necessitate surgical intervention. The management of this large patient population involves the use of Heart Valve Devices very heavily. According to statistical studies, the 5-year survival rate for aortic valve replacement (AVR) surgery is 94%. Therefore, 94 out of 100 patients who underwent AVR surgery could survive for at least five years. Heart Valve Devices are medical devices used to replace or repair dysfunctional heart valves. Different types of Heart Valve Devices are available, including Mechanical Heart Valves, Biological Heart Valves, Transcatheter Heart Valves, Annuloplasty Rings, and Balloon Valvuloplasty Devices. Among all these types, there are two main types of Heart Valve Devices: mechanical and biological. Mechanical valves are long-lasting and made of materials like titanium or carbon. However, they require lifelong anticoagulation therapy due to the possibility of blood clot formation. However, even though they do not require long-term anticoagulation, biological valves made from animal tissues or synthetic materials may eventually need to be replaced. A medical professional will recommend Heart Valve Devices after assessing the patient's health and the necessary valve replacement or repair. The patient's age, general health, type of valve dysfunction, and any underlying medical conditions play a role in the device selection.

Heart Valve Devices Market Size, 2022 To 2030 (USD Billion)

AI (GPT) is here !!! Ask questions about Heart Valve Devices Market

Transcatheter aortic valve replacement (TAVR) is a prime illustration of a heart valve device. This minimally invasive procedure inserts a collapsible valve into the heart through a small incision, typically in the groin. Particularly for elderly patients or those deemed high-risk for open heart surgery, TAVR has revolutionized the treatment of heart valves. While reducing recovery time and complications, this novel approach has significantly increased patient access to life-saving interventions. These devices must adhere to strict regulations to guarantee their effectiveness and safety. The Food and Drug Administration (FDA) in the US oversees the use of Heart Valve Devices, monitoring their effectiveness and safety through clinical trials. The European Medicines Agency (EMA) is in charge of managing the approval procedure in Europe. The Edwards Lifesciences SAPIEN valve is one illustrative example of a heart valve device. It is an aortic valve stenosis treatment tool known as a transcatheter aortic valve replacement (TAVR). Numerous patients have benefited from the SAPIEN valve, particularly those regarded as high-risk surgical candidates. In conclusion, Heart Valve Devices have transformed how heart valve diseases are treated, providing patients with a higher quality of life and better results.

Key Takeaways

- The Transcatheter Valve segment is gaining traction and is expected to grow at a CAGR of roughly 11% throughout the projected period of 2023-2030.

- Hospitals held the largest share of over 65% in 2022.

- North America held the largest share, with 42% of the overall market in 2022.

Top Market Trends

- The Heart Valve Devices market is witnessing significant technological advancements, leading to the development of minimally invasive and transcatheter-based therapies. Compared to conventional open-heart surgeries, these cutting-edge devices offer better patient outcomes, lower risks, and faster recovery times.

- Tissue heart valves, made from porcine or bovine tissue, have recently gained demand due to their durability and reduced need for long-term anticoagulant therapy. These valves have a longer lifespan than mechanical heart valves, resulting in a growing demand for tissue heart valves.

- Transcatheter aortic valve replacement (TAVR) has emerged as an alternative to surgical valve replacement for high-risk and inoperable patients. TAVR is less invasive, reduces hospital stays, and offers faster recovery. The TAVR devices are anticipated to advance rapidly due to the increasing adoption of this procedure.

Report Coverage & Deliverables

Get Access Now

Economic Insights

The COVID-19 pandemic-related global recession has reduced healthcare spending and delayed non-urgent medical procedures like heart valve surgeries. Additionally, the market's expansion has been constrained by the rising price of Heart Valve Devices and the absence of insurance coverage for these devices in some areas. The market's growth has also been constrained by a lack of qualified healthcare workers and restricted access to healthcare facilities in developing economies.

Market Segmentation

The global Heart Valve Devices market can be categorized on the following:

The global Heart Valve Devices market can be categorized into Product Type, Treatment, End User, Distribution Channel, Region. The Heart Valve Devices market can be categorized into Mechanical Heart Valves, Biological Heart Valves, Transcatheter Valves based on Product Type. The Heart Valve Devices market can be categorized into Open Surgery, Minimally Invasive Surgery based on Treatment. The Heart Valve Devices market can be categorized into Hospital & Clinics, Ambulatory Surgical Centers, Cardiac Centers, Research Centers, Other End Users based on End User. The Heart Valve Devices market can be categorized into Directa Tender, Third Party Distributors based on Distribution Channel. The Heart Valve Devices market can be categorized into North America, Europe, Asia Pacific, Latin America, Middle East & Africa based on Region.

Based on Product Type

The Transcatheter Valves Category Dominates the Market; these Valves Offer Minimally Invasive Procedures for Patients Suffering from Heart Valve Diseases

Due to several factors, the Transcatheter Valves category controls the market for Heart Valve Devices in the product type segment. First, compared to conventional open-heart surgeries, these valves offer minimally invasive procedures for patients with heart valve diseases, resulting in a safer and quicker recovery. Developing better transcatheter valve systems, like the Sapien 3 Ultra valve, which offers improved sealing and decreased paravalvular leakage, is another result of technological advancements. These elements help explain why the Transcatheter Valves category dominates the market for Heart Valve Devices. Chest pain, shortness of breath, fainting, and fatigue are signs and symptoms of aortic valve stenosis that can be lessened with TAVR. For those who run the risk of complications from open-heart surgery for surgical aortic valve replacement, TAVR may be an option. After consulting with a group of heart and heart surgery specialists to determine the best course of action for you, the decision to treat aortic stenosis with TAVR is made.

Based on the End-User

Hospitals Dominate the End-User Segment for the Heart Valve Devices Market

Hospitals dominate the End-User segment of the market for Heart Valve Devices for several reasons. First, hospitals have operating rooms and intensive care facilities for heart valve procedures. Additionally, they have a knowledgeable workforce trained to handle such procedures, including cardiac surgeons and specialized nursing staff. Furthermore, hospitals frequently have access to cutting-edge medical tools and technology, ensuring that patients get the best possible care. Additionally, hospitals frequently collaborate with medical device producers to carry out clinical trials and research projects that advance heart valve technology. For instance, the SAPIEN transcatheter heart valve was developed and tested in partnership between the Cleveland Clinic and Edwards Lifesciences.

Based on Region

North America Boasts Advanced Healthcare Infrastructure, Cutting-Edge Technologies, and a High Level of Healthcare Expenditure

North America occupies the prominent position as the largest region in the Heart Valve Devices market growth for several key reasons. Firstly, the region boasts advanced healthcare infrastructure, cutting-edge technologies, and a high level of healthcare expenditure, all contributing to developing and adopting innovative Heart Valve Devices. Moreover, the increasing prevalence of chronic cardiovascular diseases, such as valvular disorders and coronary artery diseases, among the aging population drives the demand for these devices. The American Heart Association estimates that 5 million people in the United States receive a heart valve disease diagnosis yearly. Heart Valve Devices have emerged as a common and successful treatment for many patients. These devices have significantly enhanced patient outcomes and quality of life thanks to technological and surgical advancements. Additionally, favorable reimbursement policies, robust research and development initiatives, and a strong presence of leading medical device manufacturers further fuel market growth. For instance, prominent companies like Edwards Lifesciences and Medtronic operate extensively in the region, offering a wide range of heart valve solutions.

Competitive Landscape

The market is fiercely competitive, with many major players vying for a bigger piece of the action. Edwards Lifesciences Corporation, Medtronic PLC, Abbott Laboratories, LivaNova PLC, and Boston Scientific Corporation are a few of the leading businesses in this industry. These businesses spend a lot of money on research and development to bring new products to market, like tissue and transcatheter heart valves, which improve patient outcomes. In addition, market participants frequently pursue partnerships, collaborations, mergers, and acquisitions to bolster their presence and broaden their product portfolios. Edwards Lifesciences, for instance, acquired CardiAQ Valve Technologies to expand its transcatheter mitral valve technologies portfolio. Overall, the market for Heart Valve Devices is driven by this competitive environment to continue improving and providing better patient care.

The key players in the global Heart Valve Devices market include - Abbott Laboratories (U.S.), Boston Scientific Corporation (U.S.), Artivion Inc. (U.S.), Edwards Lifesciences Corporation (U.S.), Medtronic PLC (U.S.), LivaNova PLC (UK), Micro Interventional Devices Incorporated (U.S.), Braile Biomedica (Brazil), TTK Healthcare Limited (India), JenaValve Technology Inc. (U.S.) among others.

Recent Market Developments

- On June 8, 2023, the FDA recently approved the Wattson Temporary Pacing Guidewire, according to a recent announcement from Teleflex Inc. From June 7–10 in Phoenix, the business will highlight Wattson at TVT The Structural Heart Summit. With the first commercially available bipolar temporary pacing guidewire created specifically for use during transcatheter aortic valve replacement (TAVR) and balloon aortic valvuloplasty (BAV), the most recent development will broaden the company's Structural Heart Portfolio.

- On March 7, 2023, MitraClip's long-term benefits for patients with heart failure were recently highlighted by Abbott Laboratories, Inc. (ABT), which recently presented late-breaking data from the Landmark COAPT trial. The information was presented at the World Congress of Cardiology and the American College of Cardiology's 72nd Annual Scientific Session, which took place in New Orleans from March 4–6, 2023.

- On December 6, 2022, Abbott, a global healthcare company, announced that it has launched its latest generation transcatheter aortic valve implantation (TAVI) system, Navitor, making the minimally invasive device available for people in India with severe aortic stenosis who are at high or extreme surgical risk.

Segmentation of the Global Heart Valve Devices Market

| Parameter | Details |

|---|---|

| Segments Covered |

By Product Type

By Treatment

By End User

By Distribution Channel

By Region

|

| Regions & Countries Covered |

|

| Companies Covered |

|

| Report Coverage | Market growth drivers, restraints, opportunities, Porter’s five forces analysis, PEST analysis, value chain analysis, regulatory landscape, technology landscape, patent analysis, market attractiveness analysis by segments and North America, company market share analysis, and COVID-19 impact analysis |

| Pricing and purchase options | Avail of customized purchase options to meet your exact research needs. Explore purchase options |

FAQ

Frequently Asked Question

What is the global demand for Heart Valve Devices in terms of revenue?

-

The global Heart Valve Devices valued at USD 8.9 Billion in 2022 and is expected to reach USD 25.9 Billion in 2030 growing at a CAGR of 14.3%.

Which are the prominent players in the market?

-

The prominent players in the market are Abbott Laboratories (U.S.), Boston Scientific Corporation (U.S.), Artivion Inc. (U.S.), Edwards Lifesciences Corporation (U.S.), Medtronic PLC (U.S.), LivaNova PLC (UK), Micro Interventional Devices Incorporated (U.S.), Braile Biomedica (Brazil), TTK Healthcare Limited (India), JenaValve Technology Inc. (U.S.).

At what CAGR is the market projected to grow within the forecast period?

-

The market is project to grow at a CAGR of 14.3% between 2023 and 2030.

What are the driving factors fueling the growth of the market.

-

The driving factors of the Heart Valve Devices include

- Innovations in heart valve devices offer improved clinical outcome.

Which region accounted for the largest share in the market?

-

North America was the leading regional segment of the Heart Valve Devices in 2022.